Reality Check in Bed Bath & Beyond: Valuation and Chart Adjustment Ahead

January 9, 2014 by Jon C. Ogg

Analysts have chimed in to the downside after the earnings report. The retailer was downgraded to Neutral and the price target was cut to $78 from $85 at Credit Suisse. Canaccord Genuity lowered its price target to $73 from $84 after the earnings report, while Oppenheimer lowered its target to $86. Citigroup dropped its target to $85.

Bed Bath & Beyond reported on Wednesday that its third-quarter earnings came in at $1.12 per share, while revenue was $2.86 billion. We had the consensus at $1.15 in earnings per share and revenue of about $2.88 billion.

Guidance is where things really went off the track. Fourth-quarter earnings guidance was $1.60 to $1.67 per share, down from a prior forecast of $1.70 to $1.77 per share and well under the consensus estimate of $1.79 per share.

Full-year guidance went down to $4.79 to $4.86 in earnings per share, from a prior range of $4.88 to $5.01 per share and short of the consensus estimate of $5.02 per share.

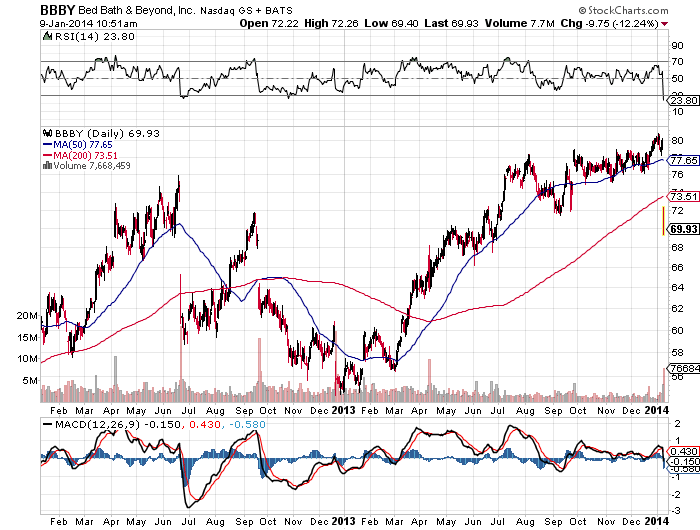

The stock’s chart is where this story becomes very complicated. This marks the fourth major gap down in two years, and the gap takes the stock back to under where the first pre-gap price was. Long-term investors who rode this growth wagon should be paying attention, because this is a chart pattern that is usually very hard to expect any snap-back rally from.

The stock needed to hold above $72, but the late-morning trading on Thursday shows the price down a sharp 12% at $69.80 on about six times normal trading volume of 8.3 million shares. The high for the day was $72.26, implying that the chart failure took place almost immediately after the open. Anything can happen, and many investors have made real money buying the big dips when it comes to Bed Bath & Beyond, but it now seems that investors may need to wait for another big dip before expecting serious gains.

Trading at 14.5 times expected earnings is not exactly an expensive earnings multiple. The problem is that Bed Bath & Beyond is becoming a regular disappointer when it comes to earnings. It cannot command a higher premium with a damaged credibility. This company also still somehow has not paid a dividend to its holders.

What we find even more interesting is that bed Bath & Beyond would have known about weak Black Friday and weaker sales for weeks now. Don’t say you were not warned if this one fails to snap back soon.

Sponsored: Attention Savvy Investors: Speak to 3 Financial Experts – FREE

Ever wanted an extra set of eyes on an investment you’re considering? Now you can speak with up to 3 financial experts in your area for FREE. By simply

clicking here you can begin to match with financial professionals who can help guide you through the financial decisions you’re making. And the best part? The first conversation with them is free.

Click here to match with up to 3 financial pros who would be excited to help you make financial decisions.