Income inequality is a growing problem in the United States. Perhaps more evident now than in any time in recent memory, conspicuous consumption is juxtaposed with abject poverty in cities and towns across the country. While the rich and poor often live side by side, in some American towns, serious financial hardship is a daily reality for most who live there.

In every state, there are towns where the median household income falls well below the state and national median incomes. In over a dozen states, there are towns in which the typical household earns less than half the income that a typical household statewide earns.

24/7 Wall St. reviewed the median annual household income in every American town to identify the poorest town in each state. Even in wealthy states like Maryland and New Jersey there are towns that rank among the poorest in the country. For comparison purposes, census designated places, boroughs, cities, towns, and villages were all considered.

Click here to see the poorest town in every state.

Click here to see our detailed findings and methodology.

1. Selma, Alabama

> Town median household income: $23,283

> State median household income: $44,758

> Town poverty rate: 41.4%

> Town population: 19,650

The poorest town in Alabama, Selma also ranks among the 10 poorest towns in the United States. The typical household in the town earns just $23,283 annually, about half the income a typical household in the state as a whole earns. Some 41.4% of Selma’s 20,000 residents live below the poverty line, more than double the statewide poverty rate of 18.4% and the U.S. rate of 15.1%.

2. Ketchikan City, Alaska

> Town median household income: $53,937

> State median household income: $74,444

> Town poverty rate: 13.6%

> Town population: 8,189

With a median annual household income of $74,444 — nearly $20,000 more than the median income nationwide — Alaska is a relatively wealthy state. Even in the state’s poorest town, Ketchikan, the typical household earns $53,937 a year, in line with the typical American household income. Ketchikan’s 13.6% poverty rate is below the 15.1% U.S. poverty rate.

[in-text-ad]

3. South Tucson, Arizona

> Town median household income: $20,241

> State median household income: $51,340

> Town poverty rate: 48.9%

> Town population: 5,627

South Tucson is the poorest town in Arizona and the fifth poorest town in the United States. The typical household in the town earns $20,241 a year, and nearly half of all town residents live in poverty. The town is one of only three in the United States in which over half of all households receive government assistance to afford groceries in the form of SNAP benefits.

4. Camden, Arkansas

> Town median household income: $25,581

> State median household income: $42,336

> Town poverty rate: 34%

> Town population: 11,515

The typical household in Camden earns $25,581 a year, the least of any town in Arkansas. Property values in an area often reflect incomes, and the median home value in Camden is just $70,900. In comparison, the typical American home is worth $184,700, and the median home across Arkansas is valued at $114,700.

5. Clearlake, California

> Town median household income: $25,426

> State median household income: $63,783

> Town poverty rate: 38.1%

> Town population: 15,070

With a median annual household income of $25,426, Clearlake is the poorest town in California. Higher education can open doors to higher paying jobs, and areas with fewer college-educated adults often have lower income levels. Just 9.1% of adults in Clearlake have a four-year college degree, less than a third of the statewide bachelor’s degree attainment rate of 32.9%.

6. Sterling, Colorado

> Town median household income: $36,282

> State median household income: $62,520

> Town poverty rate: 20.4%

> Town population: 13,976

In Sterling, the poorest town in Colorado, about one in every five residents live in poverty, nearly double the statewide poverty rate of 11.0%. The typical household in the town earns just $36,282 a year, or about $26,000 less than the typical Colorado household and $19,000 less than the typical American household.

Income levels track closely with education levels. Just 15.5% of adults in Sterling have a bachelor’s degree, less than half the comparable shares nationwide and statewide.

7. Willimantic, Connecticut

> Town median household income: $34,211

> State median household income: $71,755

> Town poverty rate: 29.7%

> Town population: 17,339

The median household income in Connecticut is $71,755 a year, well above the income the typical American household earns. Not every town in the state is high earning, however. In Willimantic, the typical household earns just $34,211 a year, less than half the statewide median. With a large low-income population, a disproportionate share of Willimantic residents rely on government assistance to afford groceries. Over a third of Willimantic households receive SNAP benefits, well above the recipiency rates for the nation and every other town in Connecticut.

[in-text-ad]

8. Smyrna, Delaware

> Town median household income: $53,941

> State median household income: $61,017

> Town poverty rate: 8.3%

> Town population: 11,081

The typical household in Smyrna earns $53,941 a year, the lowest median income of any town in Delaware. Despite ranking as the poorest town in the state, Smyrna’s income levels are comparable with the U.S. as a whole in terms of income. The median annual household income in the town is only about $600 less than the median income nationwide of $53,322.

Compared the poorest town in most states, a smaller than typical share of Smyrna residents live in poverty. Smyrna’s 8.3% poverty rate is below the 15.1% poverty rate across Delaware.

9. Brownsville, Florida

> Town median household income: $19,796

> State median household income: $48,900

> Town poverty rate: 42.4%

> Town population: 15,860

The typical annual household in Brownsville, Florida, which is located within the Miami metro area, is just $19,796, or less than half the comparable median income of $48,900 across the state as a whole. Likely because of the low incomes, a relatively large share of area residents rely on government assistance to buy groceries. An estimated 48% of households in Brownsville received SNAP benefits last year, more than double the 14.8% of Florida households.

10. Cordele, Georgia

> Town median household income: $23,294

> State median household income: $51,037

> Town poverty rate: 49.6%

> Town population: 11,015

In Cordele, the poorest town in Georgia, the typical household earns just $23,294 a year, or less than half the statewide median income of $51,037. With the lowest income in the state, Cordele also has the highest poverty rate. About half of the town’s 11,015 residents live below the poverty line, well more than double the comparable 17.8% poverty rate across Georgia.

As in many low-income regions, a relatively low proportion of adults in Cordele have a college degree. An estimated 11.5% of adults in the area have a bachelor’s degree or higher. In comparison, 29.4% of adults in Georgia and 30.3% of American adults nationwide have a bachelor’s degree.

11. Wahiawa, Hawaii

> Town median household income: $55,744

> State median household income: $71,977

> Town poverty rate: 15.4%

> Town population: 17,696

Hawaii is one of only half a dozen states where the typical household earns over $70,000 a year. Even in Wahiawa, the lowest income town in the state, the median household income is $55,744 a year, which is slightly higher than the $55,322 the typical American household earns annually.

The high incomes across the state are partially offset by a high cost of living. Goods and services in Hawaii are about 19% more expensive on average than they are nationwide.

12. Rupert, Idaho

> Town median household income: $35,011

> State median household income: $49,174

> Town poverty rate: 27.4%

> Town population: 5,702

The median household income in Rupert of $35,011 a year is about $14,000 less than the median income across Idaho as a whole. Less education in Rupert partially explains the town’s low incomes. Fewer than 75% of area adults have a high school diploma, and just 11% have a bachelor’s degree. In comparison, 90% of adults across the state have a high school diploma, and 26.2% have a four-year college degree.

[in-text-ad]

13. Centreville, Illinois

> Town median household income: $16,715

> State median household income: $59,196

> Town poverty rate: 50.1%

> Town population: 5,127

With a median annual household income of $16,715, Centreville is not only the poorest town in Illinois, but also the poorest in the United States. The median household income in both Illinois and the United States as a whole is more than three times the median income in Centreville. The town is also one of only four nationwide where more than half of the population lives below the poverty line.

14. Brazil, Indiana

> Town median household income: $29,531

> State median household income: $50,433

> Town poverty rate: 31.6%

> Town population: 8,105

Brazil has the lowest median household income of any town in Indiana. The typical household earns less than $30,000 a year. Likely due to the area’s low incomes the population is relatively dependent on government assistance. About 31% of the town’s households receives SNAP benefits, well above the 12.2% statewide recipiency rate.

15. Lamoni, Iowa

> Town median household income: $33,393

> State median household income: $54,570

> Town poverty rate: 26.1%

> Town population: 2,616

The median household income in Lamoni is $33,393 a year, the least of any town in Iowa. Lamoni is also one of only two towns in Iowa in which more than one in every four residents are below the poverty line.

In most poor towns across the United States the share of adults with a college education is relatively small, but Lamoni is a notable exception. Some 32.9% of adults in the town have a bachelor’s degree, a larger share than the national college attainment rate of 30.3% and the statewide rate of 27.2%.

16. Belleville, Kansas

> Town median household income: $31,885

> State median household income: $53,571

> Town poverty rate: 13.9%

> Town population: 1,831

The typical household in Belleville earns just $31,885 a year, the least of any town in Kansas. Despite the low incomes, relatively few residents earn poverty wages or depend on government assistance for basic necessities. Just 13.9% of area residents live below the poverty line, compared with the 13.3% state poverty rate and the 15.1% U.S. poverty rate. Similarly, the 9.2% SNAP benefit recipiency rate in Belleville is in line with the 9.1% statewide rate and below the 13.0% national recipiency rate.

17. Glasgow, Kentucky

> Town median household income: $28,362

> State median household income: $44,811

> Town poverty rate: 26.9%

> Town population: 14,338

Glasgow is the only town in Kentucky where the typical household earns less than $30,000 a year. Glasgow’s 26.9% poverty rate is also higher than any other town in the state and well above the 18.8% poverty rate statewide — itself one of the higher poverty levels compared with other states.

A high school diploma is a prerequisite for almost any job. In Glasgow, 78.2% of the adult population have a high school diploma, compared to 84.6% of adults statewide.

[in-text-ad]

18. Ville Platte, Louisiana

> Town median household income: $18,679

> State median household income: $45,652

> Town poverty rate: 38.4%

> Town population: 7,338

Several towns in Louisiana have a low enough median household income to qualify as the poorest town in most other states. Ville Platte is the only town in Louisiana where the typical household earns less than $20,000 a year. The town’s median household income is nearly a third of the national median income of $55,322, and less than half the statewide median income of $45,652.

19. Eastport, Maine

> Town median household income: $33,836

> State median household income: $50,826

> Town poverty rate: 18.8%

> Town population: 1,390

Eastport is the poorest town in Maine and the third poorest town in all of New England. The typical area household earns just $33,836 a year, or about $17,000 less than the median across Maine as a whole.

As is the case in most poor American towns, a relatively large share of Eastport residents depend on government assistance to afford food. Some 23.5% of the town’s population receives SNAP benefits compared to 16.3% of people in Maine as a whole.

20. Cumberland, Maryland

> Town median household income: $31,855

> State median household income: $76,067

> Town poverty rate: 24%

> Town population: 20,290

With a median annual household income of $76,067, Maryland is the wealthiest state in the country. However, not all parts of the state are high income. In Cumberland, the typical household earns $31,855 a year — less than half the statewide median income and well below the $55,322 the typical American household earns.

The area’s low incomes are reflected in low property values. The typical home in Cumberland is worth $87,700, or less than a third the median home value of $290,400 across Maryland.

21. Webster, Massachusetts

> Town median household income: $44,846

> State median household income: $70,954

> Town poverty rate: 16.8%

> Town population: 12,122

With a median annual household income of nearly $71,000, Massachusetts is a relatively wealthy state. Compared to most towns on this list, Webster is not especially poor. The typical Webster household earns $44,846 a year, or about $10,500 less than the typical American household. Additionally, the town’s 16.8% poverty rate — while considerably higher than the 11.4% statewide rate — is only slightly higher than the 15.1% poverty rate nationwide.

22. Hamtramck, Michigan

> Town median household income: $23,609

> State median household income: $50,803

> Town poverty rate: 49.7%

> Town population: 21,985

In Hamtramck, the poorest town in Michigan, about half of the population lives below the poverty line. Hamtramck is also the only town in the state where most households earn less than $25,000 a year. Due to low incomes in the area, a relatively large share of residents rely on government assistance to afford food. Some 44.0% of area households receive SNAP benefits, the largest share of any town in the state and more than double the comparable 15.9% recipiency rate across Michigan.

[in-text-ad]

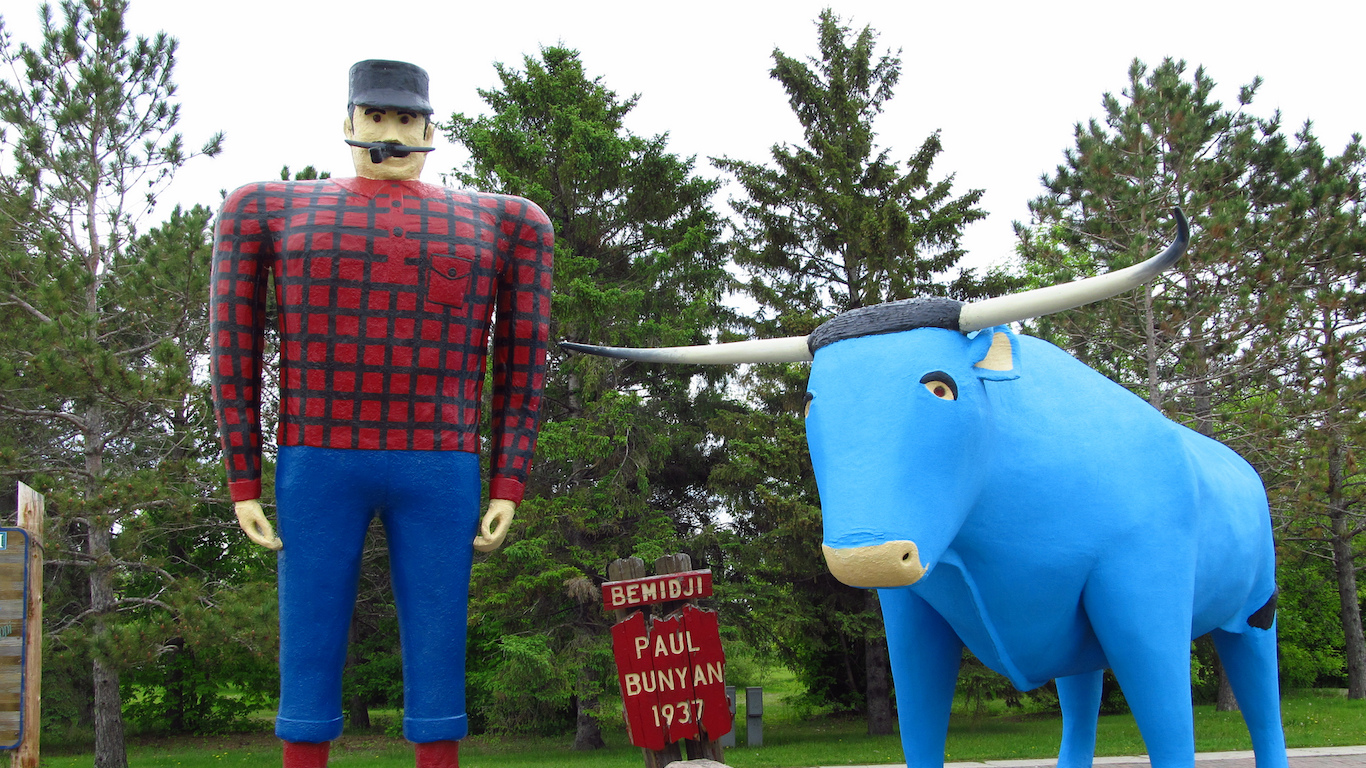

23. Bemidji, Minnesota

> Town median household income: $33,680

> State median household income: $63,217

> Town poverty rate: 24.1%

> Town population: 14,664

With a median household income of $33,680 a year, Bemidji is the poorest town in Minnesota. A disproportionately high 24.1% of area residents live on poverty level income, more than double the statewide poverty rate of 10.8%.

In most of the towns on this list, educational attainment rates are relatively low, but Bemidji is an exception. An estimated 30.2% of adults in the town have a bachelor’s degree, in line with the 30.3% of adults nationwide.

24. Indianola, Mississippi

> Town median household income: $26,479

> State median household income: $40,528

> Town poverty rate: 31.8%

> Town population: 10,047

Indianola, Mississippi, is the poorest town in the poorest state. The typical area household earns just $26,479 a year compared to the median income in Mississippi of $40,528 a year and the median income nationwide of $55,322 a year. Because so many residents live on so little, many depend on government assistance to afford food. Some 32.3% of households in Indianola receive SNAP benefits compared to 18.0% of Mississippi households and 13.0% of American households nationwide.

25. Mountain View, Missouri

> Town median household income: $23,484

> State median household income: $49,593

> Town poverty rate: 26.5%

> Town population: 2,694

More than one in every four residents of Mountain View, Missouri’s poorest town, live below the poverty line — well above the 15.3% statewide poverty rate. Across the United States, poor towns tend to be home to relatively small shares of college educated adults, and Mountain View is no exception. Just 8.9% of adults in the town have a four-year college degree, one of the smallest shares nationwide and less than a third the comparable 27.6% bachelor’s degree attainment rate across Missouri as a whole.

26. Deer Lodge, Montana

> Town median household income: $37,917

> State median household income: $48,380

> Town poverty rate: 11.4%

> Town population: 3,062

With a median annual household income of $37,917, Deer Lodge is the only town in Montana where the typical household earns over $10,000 less than the typical household in the state. With the state’s lowest median income, Deer Lodge also has the highest SNAP recipiency rate. Some 16.6% of households in the town receive government subsidies to afford food in the form of SNAP benefits. In comparison, 10.6% of households statewide receive SNAP benefits.

27. Red Cloud, Nebraska

> Town median household income: $34,395

> State median household income: $54,384

> Town poverty rate: 15.5%

> Town population: 1,115

The typical household in Red Could earns $34,395 a year, about $20,000 less than the typical household in Nebraska. The area’s low incomes are also reflected in the low property values. The typical home in Red Cloud is worth just $48,500, less than a third of the median home value nationwide of $184,700 and less than half the median home value across the state of $137,300.

[in-text-ad]

28. Laughlin, Nevada

> Town median household income: $32,758

> State median household income: $53,094

> Town poverty rate: 18.8%

> Town population: 7,641

In Laughlin, the poorest town in Nevada, the typical household earns $32,758 a year, more than $20,000 less than the median income across the state. Lower-income towns in the United States tend to be home to relatively small shares of college educated adults, and Laughlin is no different. Less than 15% of adults in Laughlin have a bachelor’s degree or higher, well below the 23.2% of adults with a four-year degree across Nevada as a whole.

29. Berlin, New Hampshire

> Town median household income: $38,863

> State median household income: $68,485

> Town poverty rate: 19%

> Town population: 10,154

The median annual household income in Berlin, New Hampshire is $38,863, nearly $30,000 less than the median income across the state as a whole. The large share of low income households means that a larger share of Berlin households depend on government subsidies to afford food. An estimated 21.1% of households in the town receive SNAP benefits, nearly triple the comparable statewide recipiency rate of 7.8%.

30. Crestwood Village, New Jersey

> Town median household income: $28,282

> State median household income: $73,702

> Town poverty rate: 9.8%

> Town population: 8,135

New Jersey’s median household income of $73,702 is nearly the highest of any state in the country. However, not all corners of the state are high earning. In Crestwood Village, more than half of all households earn less $28,300 a year.

Higher education can open doors to higher paying jobs, and areas with fewer college-educated adults often have lower income levels. Just 13.7% of adults in the town have a bachelor’s degree, well less than half the 37.5% of adults statewide with at least a bachelor’s degree.

31. Deming, New Mexico

> Town median household income: $26,044

> State median household income: $45,674

> Town poverty rate: 32.1%

> Town population: 14,582

The typical household in New Mexico earns just $45,674 a year, nearly $10,000 less than the median household income nationwide. In Deming, the poorest town in New Mexico, the median income is just $26,044 a year. Due to low incomes, a large share of town residents rely on government assistance to afford food. Some 32.8% of households in Deming receive SNAP benefits, well above both the national and statewide recipiency rates of 13.0% and 16.6%, respectively.

32. New Square, New York

> Town median household income: $21,773

> State median household income: $60,741

> Town poverty rate: 70.0%

> Town population: 7,804

New Square is by far the poorest town in New York. The median annual household income of $21,773 in New Square is nearly $5,000 below the that of Kiryas Joel, the next poorest town in the state, and only about a third of the median income across the state as a whole.

Not only is it the poorest town in New York state, but New Square also has the highest poverty and SNAP recipiency rates of any town in the United States. Some 70.0% of New Square residents live in poverty, and 77.1% of area households rely on SNAP benefits to afford food. In comparison, 15.1% of Americans live below the poverty line and 13.0% of households nationwide receive SNAP benefits.

[in-text-ad]

33. Mount Olive, North Carolina

> Town median household income: $26,099

> State median household income: $48,256

> Town poverty rate: 33.3%

> Town population: 4,734

North Carolina is one of the poorer states in the country. The median annual household income in the state of $48,256 is well below the national median of $55,322. As is the case in most poor states, the poorest town, Mount Olive, is not just the poorest in the state, but also one of the poorest in the entire country. Mount Olive, which is located in the eastern central part of the state, has a median household income of just $26,099 a year, just slightly more than half the national median and lower than the median income in all but 25 of the 2,668 towns considered for this list.

34. Ellendale, North Dakota

> Town median household income: $42,744

> State median household income: $59,114

> Town poverty rate: 12.8%

> Town population: 1,432

There is a great deal of diversity in wealth across towns in North Dakota. The richest town is Williston, with a median household income of over $90,000 per year. At the other end of the state, and the income spectrum, is Ellendale, where the typical household earns $42,744 a year. While the northwest part of the state — which is where Williston is located — benefitted from the shale oil boom that started in the mid 2000s, Ellendale, in the southeast part of the state, largely missed the economic upswing.

35. East Cleveland, Ohio

> Town median household income: $19,953

> State median household income: $50,674

> Town poverty rate: 41.8%

> Town population: 17,413

As the nation’s seventh most populous state, several of the nation’s most populous metro areas are located in Ohio, including Cleveland. As is often the case with major metropolitan areas, Cleveland has areas of both extreme wealth and severe poverty. Hudson, Cleveland’s wealthiest suburb, has a median annual household income of $126,618. Meanwhile, East Cleveland, just a 45 minute drive from Hudson, has a median annual household income of just $19,953, less than one-sixth that of Hudson.

36. Arkoma, Oklahoma

> Town median household income: $26,352

> State median household income: $48,038

> Town poverty rate: 34.1%

> Town population: 1,912

At $48,038, Oklahoma has the 10th lowest median annual household income of any state. To compare, the median household income nationwide is $55,322. The small town of Arkoma is the poorest in Oklahoma, with a median annual household income of $26,352, barely half the state’s figure. More than one-third of the town’s population lives below the poverty line, one of the highest poverty rates not just in the state, but in any American town or city.

37. Reedsport, Oregon

> Town median household income: $32,677

> State median household income: $53,270

> Town poverty rate: 23.9%

> Town population: 4,088

Oregon has one of the widest disparities between the richest and poorest towns of any state. The state’s richest area, the Portland suburb Bethany, has a median annual household income of $117,056, which is nearly $85,000 greater than the median income in the state’s poorest town, Reedsport. The low median income in Reedsport is underscored by the high share of residents receiving financial support. More than one in four households in Reedsport receive SNAP benefits, compared to the national recipiency rate of 13% of households.

[in-text-ad]

38. Johnstown, Pennsylvania

> Town median household income: $24,075

> State median household income: $54,895

> Town poverty rate: 37%

> Town population: 20,169

The typical household in Johnstown earns $24,075 a year, less than half the median income of $54,895 a year across Pennsylvania as a whole. Because so many live on low incomes, a relatively large share of Johnstown residents rely on SNAP benefits. The town’s 38.8% SNAP recipiency rate is nearly three times the statewide rate of 13.0%.

39. Central Falls, Rhode Island

> Town median household income: $28,901

> State median household income: $58,387

> Town poverty rate: 32.7%

> Town population: 19,366

Central Falls is the poorest town in Rhode Island. The $28,901 median annual household income in Central Falls is less than half that of the Newport East area, the state’s next poorest town, where the typical household earns $59,680 a year. Educational attainment across a population can be an indicator of incomes as a college degree tends to lead to better-paying jobs. Just 8.7% of Central Falls’ adults have a bachelor’s degree, compared to 30.3% of the nation’s adults and 32.5% of adults in Rhode Island.

40. Belton, South Carolina

> Town median household income: $29,329

> State median household income: $46,898

> Town poverty rate: 24.3%

> Town population: 4,296

A high school education is often a prerequisite for any full-time job, high paying or otherwise. In Belton, the poorest town in South Carolina, about one in every five adults do not have a high school diploma. Perhaps not surprisingly, Belton. Belton is the only town in the state where over half of all households earn less than $30,000 a year.

41. Vermillion, South Dakota

> Town median household income: $31,155

> State median household income: $52,078

> Town poverty rate: 35.7%

> Town population: 10,778

Of South Dakota’s 18 towns and cities with a population of at least 1,000 residents, 13 have a median annual household income below the national median of $55,322. None, however, has a lower typical household income than Vermillion, where the typical household brings in $31,155 annually. One positive for residents of Vermillion and of South Dakota’s other poor areas: money goes further than it would in most other parts of the country. Goods and services in the South Dakota are the fourth cheapest of all states.

42. Lafayette, Tennessee

> Town median household income: $30,586

> State median household income: $46,574

> Town poverty rate: 16.4%

> Town population: 4,909

Educational attainment among a population is often a good indicator of income levels. Lafayette, Tennessee’s poorest town, has one of the least educated populations in the country. Just 68.8% of Lafayette’s adults have a high school diploma, and only 10.1% have a bachelor’s degree. For context, 86.0% of Tennessee’s adults have a bachelor’s degree, while 25.4% of state adults have a four-year college education.

[in-text-ad]

43. Fabens, Texas

> Town median household income: $24,612

> State median household income: $54,727

> Town poverty rate: 48.8%

> Town population: 7,168

Fabens is the only town in Texas where over half of all households live on less than $25,000 a year. Fabens’ 48.8% poverty rate is also the highest of any town in the state and nearly three times the 16.7% poverty rate across Texas.

The area’s low incomes are reflected in area property values. The typical home in Fabens is worth just $61,600, less than half the median home value in Texas of $142,700 and about a third of the national median home value of $184,700.

44. Brigham City, Utah

> Town median household income: $47,675

> State median household income: $62,518

> Town poverty rate: 9.7%

> Town population: 18,586

Utah is one of the wealthier states in the country. Of the state’s 35 towns and cities with populations between 1,000 and 25,0000, all but four have median annual household incomes higher than the national figure of $55,322. Of those, the median income in most is greater than $75,000. Brigham, one of the state’s few low-income towns, the median income is below the national figure. However, with a median income of $47,675 a year, the city is wealthier than all but four towns on this list as well as wealthier than one-third of the towns and cities with between 1,000 and 25,000 residents.

45. Bellows Falls, Vermont

> Town median household income: $31,963

> State median household income: $56,104

> Town poverty rate: 22.6%

> Town population: 3,032

Vermont’s median annual household income of $56,104 is in line with the median income nationwide of $55,322. However, not all parts of the state are as high earning. In Bellows Falls, the poorest town in the state, the typical household earns just $31,963 a year. Due to low incomes, a relatively large share of households rely on SNAP benefits. The 32.5% SNAP recipiency rate in Bellows Falls is more than double the statewide recipiency rate of 13.6%.

46. Hillsville, Virginia

> Town median household income: $30,943

> State median household income: $66,149

> Town poverty rate: 21.1%

> Town population: 2,683

Virginia is one of 18 states with a town that has a median household income less than half the statewide median income. In Hillsville, the typical household earns just $30,943 a year, while the typical Virginia household earns $66,149 annually. The poorest town in Virginia, Hillsville is also one of only four towns in the state where more than one in every four residents live below the poverty line.

47. Chewelah, Washington

> Town median household income: $30,998

> State median household income: $62,848

> Town poverty rate: 17.6%

> Town population: 2,601

In Chewelah, the poorest town in Washington state, the typical household earns $30,998 a year, less than half the median income across the state as a whole of $62,848 a year. Poor parts of the country tend to have fewer residents with a higher education, and Chewelah is no different. Just 16.1% of adults in Chewelah have a bachelor’s degree or higher, less than half the 33.6% of adults who do statewide.

[in-text-ad]

48. Weston, West Virginia

> Town median household income: $31,739

> State median household income: $42,644

> Town poverty rate: 26.2%

> Town population: 4,085

West Virginia is the third poorest state in the country, with a median household income of $42,644 a year — $12,678 below the national median. Generally, the lowest-income states tend to have the poorest cities in the country, but West Virginia is an exception. The typical household in Weston, the state’s lowest-income town, earns $31,739 each year. While this is certainly low, it is far from the lowest in the country. Well over 100 towns and cities across the country are poorer than Weston.

49. Whitewater, Wisconsin

> Town median household income: $30,934

> State median household income: $54,610

> Town poverty rate: 38.2%

> Town population: 14,840

Whitewater has both the lowest median household income and the highest poverty rate of any town in Wisconsin. The typical Whitewater household earns $30,934 a year, significantly lower than the median income across the state of $54,610. Additionally, 38,2% of Whitewater residents live in poverty compared to 12.7% of Wisconsin residents. Despite the low incomes, a relatively small share of Whitewater residents depend on government assistance to afford food. Just 12.6% of Whitewater households receive SNAP benefits, in line with the 12.7% recipiency rate across the state.

50. Thermopolis, Wyoming

> Town median household income: $45,668

> State median household income: $59,143

> Town poverty rate: 12.7%

> Town population: 2,918

Though it is the poorest town in Wyoming, Thermopolis is not as poor as many other towns on this list. The median annual household income in the area of $45,668 is about $10,000 less than the national median household. That income is more than double that of some of the poorest towns in other states, however. Additionally, just 12.7% of the town population lives below the poverty line, slightly higher than the 11.6% state poverty rate but well below the 15.1% U.S. poverty rate.

Detailed Findings

For every state except Alaska and Hawaii, the Department of Health and Human Services sets the official poverty income at $25,100 a year or less for a family of four. Currently, close to 50 million Americans live below that threshold. Poverty is the most extreme example of financial hardship, and as such, the official poverty rate fails to capture tens of millions of additional Americans who also struggle to make ends meet.

In 45 of the 50 towns on this list, the poverty rate exceeds the poverty rate across the state as a whole. In over half of all towns on this list, more than one in every four residents live in poverty, well above the U.S. poverty rate of 15.1%. In New Square, the poorest town in New York state, 70% of the population lives in poverty, the highest poverty rate of any U.S. town.

Low-income Americans often struggle to afford even the most basic necessities. Partially as a result, the low income towns on this list often also have a high SNAP — formerly known as food stamps — recipiency rates. This rate measures the share of households that receive SNAP benefits. Only three towns on this list have a lower SNAP recipiency rate than their respective state as a whole. In more than a dozen towns on this list, more than one in every three households depend on government support to afford food.

The low incomes in the towns on this list also often are reflected in property values. People live where they can afford housing, and in low income areas homes are often relatively inexpensive. New Square, New York, is the only town on this list with a higher median home value than the state as a whole.

Both on an individual level and across broad populations, income is closely linked to educational attainment. Earning potential tends to increase with education — those with a bachelor’s degree earn considerably more on average than those with just a high school diploma. Additionally, major companies that offer high-skilled, high-paying jobs are more likely to establish a presence in areas with a well-educated labor pool.

Not surprisingly, educational attainment levels are relatively low in the towns on this list. In 46 of the 50 towns, the share of adults with a bachelor’s degree or higher is lower than the corresponding share across the state as a whole. In 22 towns on this list, the share of adults with a four-year degree is less than half the college attainment rate nationwide of 30.3%.

Methodology

To determine the poorest town in each state, 24/7 Wall St. reviewed median household incomes in every town with a population between 1,000 and 25,000 in each state from the U.S. Census Bureau’s American Community Survey. Our list includes Census-designated places, which are unincorporated regions that are treated as towns for statistical purposes. All social and economic figures are based on five-year estimates for the period of 2012-2016. To control for potential data errors that can arise in low population areas, we did not consider towns where the margin of error at 90% confidence was greater than 10% of the point estimate of both median household income and population. We considered the percentage of adults who have at least a bachelor’s degree, the share with a high school diploma, the towns’ poverty rates, SNAP benefit recipiency rates, and median home value — all from the ACS. Regional price parity, or cost of living, by state is for the most recent available year from the Bureau of Economic Analysis.

Sponsored: Want to Retire Early? Here’s a Great First Step

Want retirement to come a few years earlier than you’d planned? Or are you ready to retire now, but want an extra set of eyes on your finances?

Now you can speak with up to 3 financial experts in your area for FREE. By simply clicking here you can begin to match with financial professionals who can help you build your plan to retire early. And the best part? The first conversation with them is free.

Click here to match with up to 3 financial pros who would be excited to help you make financial decisions.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.

24/7 Wall St.

24/7 Wall St. 24/7 Wall St.

24/7 Wall St. 24/7 Wall St.

24/7 Wall St. 24/7 Wall St.

24/7 Wall St. 24/7 Wall St.

24/7 Wall St.