In August 2018, 154 chief executives at American companies left their job — the most of any month on record, according to management consulting firm Challenger, Gray, & Christmas. While many departed on good terms, leaving for another company or retiring, others stepped down amid scandals or were forced out by their board of directors on a no-confidence vote. The record-high CEO turnover rate is partially a reflection of the pressures that come with the top job: in good times and bad, the buck often stops at the CEO.

The specific responsibilities of a CEO vary from company to company. Still, as the highest-ranking managers, the decisions CEOs make can have serious consequences, affecting the lives of thousands of employees, investors, and even consumers.

This year, there were many high-profile chief executives who stood out. Many of them, like Amazon’s Jeff Bezos or Dollar General’s Todd Vasos, took their companies to new heights, often bucking market trends.

In other cases, CEOs were in the spotlight for poor leadership, ethically questionable business decisions, or morally ambiguous, sometimes reprehensible, personal actions. Often, these mistakes resulted in sales declines, share price drops, and even bankruptcy.

24/7 Wall St. reviewed a number of measures related to corporate performance in addition to media reports to identify America’s biggest CEO winners and losers of 2018. We only considered CEOs of highly visible companies.

Click here to see the worst CEOs of 2018.

Click here to see the best CEOs of 2018.

The Worst

1. Steve Ells

> Company: Chipotle Mexican Grill

> Tenure: July 2003 – Mar. 2018

> Annual compensation: $11.1 million

> YTD stock price change: +62.4% (NYSE: CMG)

The founder of fast casual restaurant Chipotle Mexican Grill, Steve Ells took an $85,000 loan to open the first restaurant in Denver, expanding it to a nationwide chain with 2,400 locations. Earlier this year, however, Ells stepped down as the company’s chief executive. The company has faced widespread criticism in the wake of E-coli outbreaks traced back to several Chipotle locations in late 2015. Company leadership said they would investigate the issue and make necessary changes, but problems persisted. Additionally, after much anticipation, the company introduced queso to its menu, but the new ingredient did not take off as expected. Chipotle’s sales dipped 13% in 2016 and have yet to return to 2015 levels.

After Ells departure was announced in November 2017, Chipotle stock surged 12%. Ells handed the company over to former Taco Bell CEO Brian Niccol in March of this year.

[in-text-ad]

2. John Flannery

> Company: General Electric

> Tenure: Aug. 2017 – Oct. 2018

> Annual compensation: $5.8 million

> YTD stock price change: -57.5% (NYSE: GE)

GE share price rose more than 7% after John Flannery was removed as CEO in October. Before he was ousted, company shares were their lowest point in nine years. Reportedly, Flannery was ousted because he did not facilitate GE’s turnaround quickly enough, though Jim Cramer speculated that it had more to do with Flannery’s failure to anticipate the high costs of running the company’s energy and insurance businesses.

GE’s board did act quickly, though. Flannery was ousted after just 14 months at the helm. Additionally, he may leave with far less compensation than many CEOs get on their way out, as GE’s board has considerable flexibility in determining severance.

3. Carlos Ghosn

> Company: Renault-Nissan-Mitsubishi Alliance

> Tenure: 2001 – present

> Annual compensation: N/A

> YTD stock price change: N/A

Carlos Ghosn, CEO of the Renault-Nissan-Mitsubishi Alliance, one of the largest automotive groups in the world, is currently sitting in a Tokyo jail cell. Ghosn made a name for himself in the 1990s by bringing Japanese automaker Nissan back from the brink of bankruptcy. Though he has not been officially charged, he is being held as a flight risk under suspicion that he underreported his income by tens of millions for dollars over the years since 2010. Though Ghosn denies any wrongdoing, his has been removed from his position as chairman of Nissan.

4. Edward Lampert

> Company: Sears

> Tenure: May 2013 – Oct. 2018

> Annual compensation: $4.3 million

> YTD stock price change: -90.3% (NASDAQ: SHLD)

After buying Sears in 2005, many saw Eddie Lampert as the department store chain’s savior. But by now it is apparent Sears is likely a dying brand, having filed for bankruptcy in October. In an attempt to save Sears, Lampert and his own hedge fund made loans to the company. Though Lampert and his company are the owner of much of Sears’ debt and assets, they could benefit from the company’s collapse as much of the debt is backed by hard assets. And though Lampert is also the company’s largest shareholder, he has also bought over the years much of its valuable stores and real estate. Critics have called Lampert’s strategy with Sears a “slow-motion liquidation,” stripping the company’s assets and laying off tens of thousands of workers. Even if Lampert remains financially secure, his name will forever be associated with the death of a well-known brand.

[in-text-ad-2]

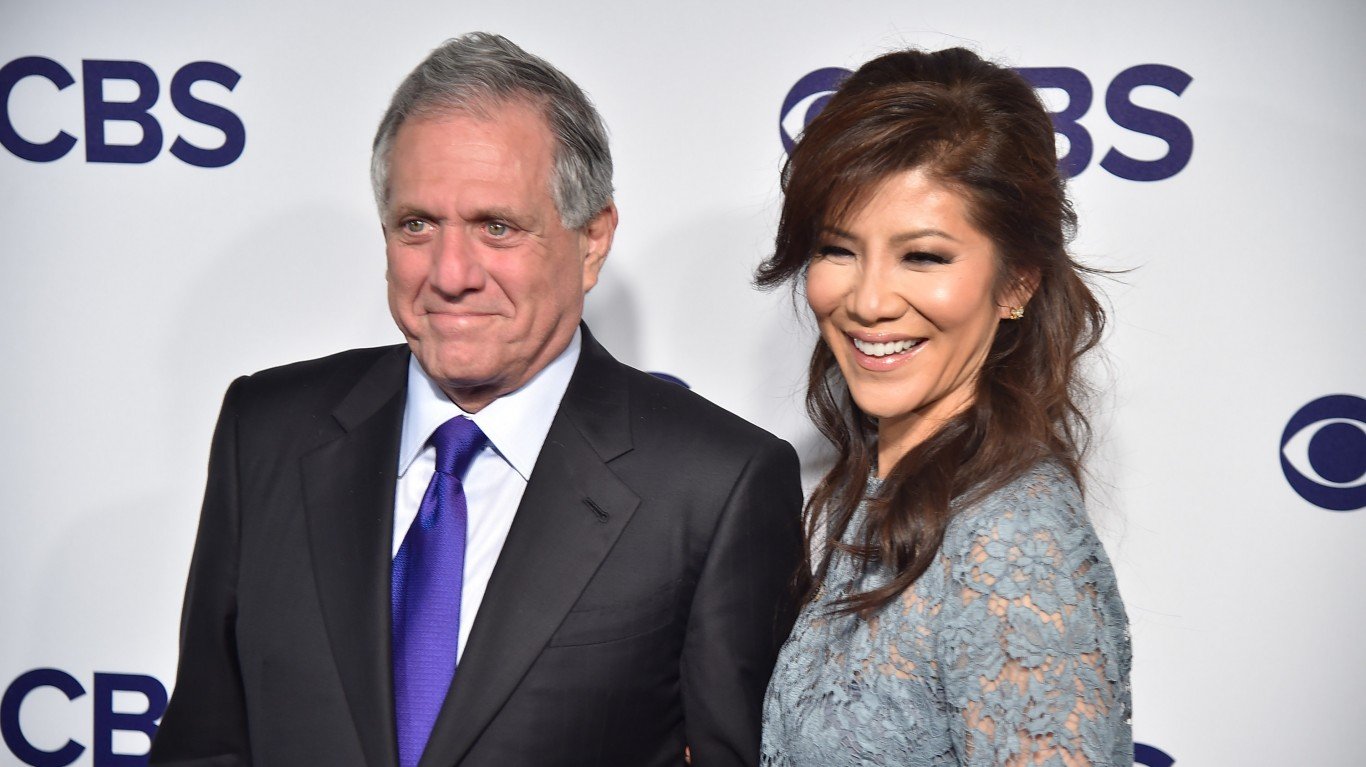

5. Les Moonves

> Company: CBS Corporation

> Tenure: Apr. 2003 – Sept. 2018

> Annual compensation: $69.3 million

> YTD stock price change: -11.9% (NYSE: CBS)

Les Moonves served as chairman and CEO of CBS Corporation from April 2003 to September 2018, when he resigned amidst allegations of sexual misconduct. The allegations, which include accusations from multiple women going as far back as the 1980s and descriptions of abuse from CBS employees, first came to light in a New Yorker profile in July 2018. While Moonves denies the claims, text message correspondences between him and a Hollywood talent manager detailing attempts to find acting work for one of his accusers were reviewed and published in summary by the New York Times in November 2018. The text evidence may threaten Moonves’ $120 million exit package from CBS, which, according to his contract, is voided if the ex-CEO tried to pay off an accuser with job offers.

6. Elon Musk

> Company: Tesla

> Tenure: Oct. 2008 – present

> Annual compensation: $49,920

> YTD stock price change: +16.0% (NASDAQ: TSLA)

In 2018, Elon Musk was involved in a string of public relations incidents that likely reduced investor confidence in Tesla and led to the company’s worst week on Wall Street in several years. Musk drew public ire in July 2018, when he suggested in a tweet that a rescue diver working to save a youth soccer team trapped in a cave in Thailand was a pedophile after the diver criticized Musk’s own plans to design a submarine to rescue the children as a public relation stunt. As the media questioned the Tesla CEO’s mental state, Musk provoked board members further when in August he suggested in another tweet he would take Tesla private at $420 a share.

Musk shared information about his personal struggles and erratic behavior in a New York Times interview later than month and in a podcast appearance in September in which he was filmed smoking pot, raising further questions about his growing instability among the media and investors.

[in-text-ad]

7. Demos Parneros

> Company: Barnes & Noble

> Tenure: May 2017 – July 2018

> Annual compensation: $5.8 million

> YTD stock price change: +4.8% (NYSE: BKS)

Demos Parneros term as CEO of Barnes & Noble was short-lived, from May 2017 to July 2018, when he was fired without severance pay for violating company policy. In response to his firing, Parneros filed a lawsuit against Barnes & Noble, charging the company with defamation and breach of contract. In October, the bookselling company released details of the firing in a court filing, which alleged that Parneros sexually harassed a female employee, bullied staff members, and failed to close a deal to sell the company.

8. Laurent Potdevin

> Company: Lululemon Athletica

> Tenure: Jan. 2014 – Feb. 2018

> Annual compensation: $5.1 million

> YTD stock price change: +70.4% (NASDAQ: LULU)

Laurent Potdevin resigned from his position as CEO of Lululemon Athletica in February after the company said he did not meet the company’s “standards of conduct.” He also resigned from the company’s board. Reports later emerged that Potdevin had an inappropriate relationship with a designer at the company.

Some employees came forward and and said that they believed the designer received preferential treatment. This included extended vacations, first-class accommodations paid for by the company, and an outsized amount of power within Lululemon’s operations. Other employees complained about a toxic work culture, saying Potdevin turned the executive team into a “boy’s club.”

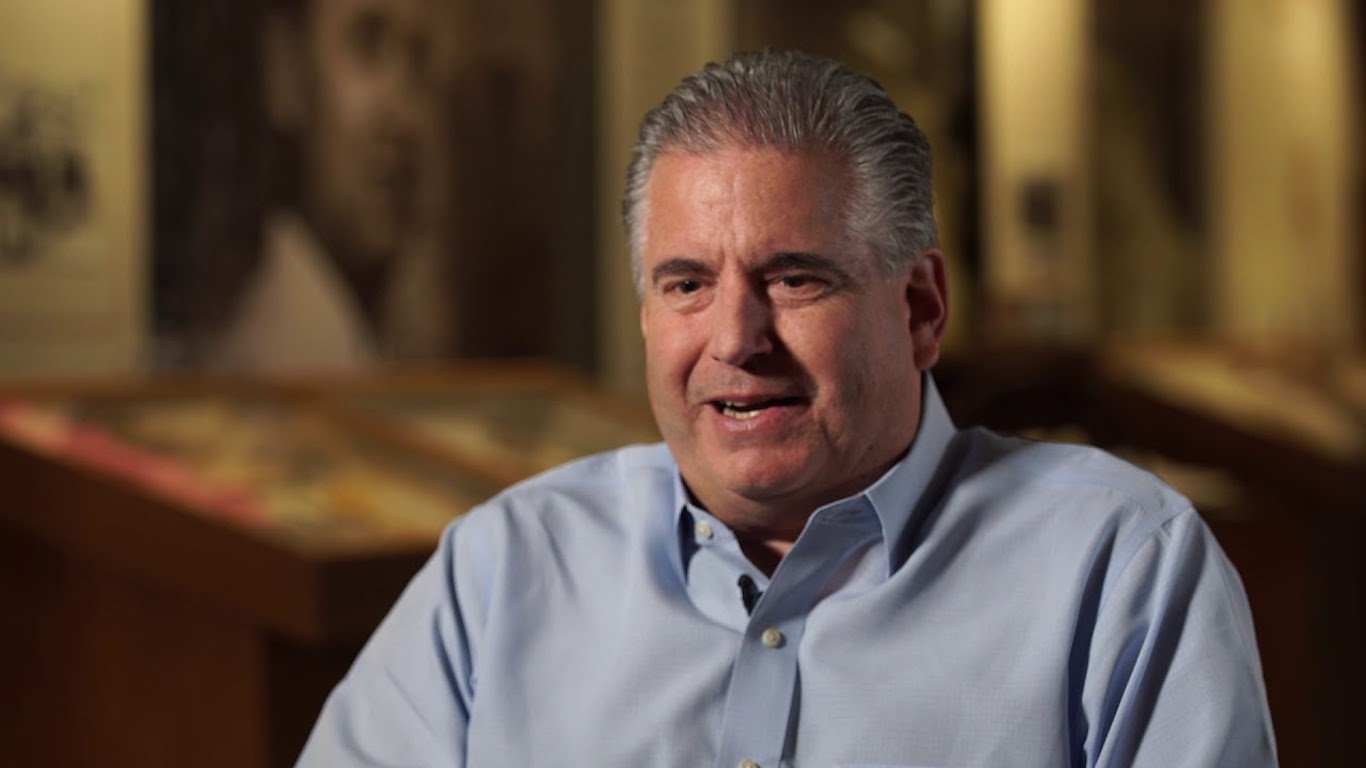

9. John Schnatter

> Company: Papa John’s Pizza

> Tenure: 1984 – Jan. 2018

> Annual compensation: $2.8 million

> YTD stock price change: -18.0% (NASDAQ: PZZA)

After a disappointing third quarter 2017 earnings report, Papa John’s founder John Schnatter blamed much of the company’s struggles on the way the NFL, its close advertising partner, handled the national anthem protest controversy. Papa John’s shares plummeted 11% in less than a day following the remarks, and Schnatter was ousted as CEO. In May 2018, Schnatter used a racial slur on a company conference call. He resigned as chairman and the face of the company shortly after the comments were publicized. Schnatter has continued to be a problem for the company, suing the board over his removal. Papa John’s shares sit more than 22% below where they were a year ago.

[in-text-ad-2]

10. Craig B. Thompson

> Company: Memorial Sloan Kettering

> Tenure: Nov. 2010 – present

> Annual compensation: $2.9 million

> YTD stock price change: N/A

Craig Thompson serves as the CEO of Memorial Sloan Kettering Cancer Center, one of the world’s leading cancer treatment centers. Under Thompson’s watch, Dr. Jose Baselga stepped down as chief medical officer for failing to disclose millions of dollars of payments from drug makers and health care companies.

The conflicts of interest appear to have reached all the way to the top, as Thompson himself served on the board of large pharmaceutical company Merck, receiving as much as $300,000 from the company in 2017 alone. Though Thompson still holds the top job at Sloan Kettering, he has since stepped down from two corporate boards, including Merck.

11. Steve Wynn

> Company: Wynn Resorts

> Tenure: June 2002 – Feb. 2018

> Annual compensation: $20.7 million

> YTD stock price change: -32.4% (NASDAQ: WYNN)

Following a Wall Street Journal investigation into his sexual misconduct, Wynn Resorts founder Steve Wynn was removed from his position as CEO. Dozens of employees alleged a pattern of harassment and assault carried out for decades by Wynn. He denies the allegations, saying his ex-wife spurred on accusers to help get herself a revised divorce agreement. Wynn also resigned as the finance chief with the Republican National Committee.

[in-text-ad]

12. Mark Zuckerberg

> Company: Facebook

> Tenure: Feb. 2004 – present

> Annual compensation: $5.8 million

> YTD stock price change: -20.8% (NASDAQ: FB)

Facebook co-founder and CEO Mark Zuckerberg is one of the few executives on this list that still heads the company that he may have jeopardized. Facebook, one of Silicon Valley’s most notable success stories, has been embroiled in controversy since revelations that Russian bots used the social media platform to influence the outcome of the 2016 presidential election. Problems have only escalated in 2018. Early in the year, Zuckerberg made multiple public apologies after it was revealed that Cambridge Analytica, a political marketing firm used by the Trump campaign, accessed data on as many as 87 million people on Facebook.

Most recently, Zuckerberg’s company has been under fire again after the New York Times reported that Facebook’s COO Sheryl Sandberg hired a PR firm to attack philanthropist George Soros after he had been publicly critical of the company. Shares of Facebook are down over 25% year to date.

The Best

1. Marc Benioff

> Company: Salesforce.com

> Tenure: 1999 – present

> Annual compensation: $4.7 million

> YTD stock price change: +38.4% (NYSE: CRM)

Though the market seems to be growing leery of the cloud computing industry, Marc Benioff and Salesforce may be the exception. The company reported a fiscal year 2019 third quarter that surpassed expectations. The company’s revenue grew 26% from the same quarter a year ago, reaching $3.39 billion.

Benioff was named one of the best performing CEOs in the world by Harvard Business Review, as Salesforce regularly reports solid company performance that beat Wall Street expectations. Since the beginning of 2018, Salesforce’s stock price increased by more than 38%, up from $104 per share to over $140.

[in-text-ad]

2. Jeff Bezos

> Company: Amazon

> Tenure: July 1994 – present

> Annual compensation: $1.7 million

> YTD stock price change: +40.3% (NASDAQ: AMZN)

Amazon began as an online book retailer, with Jeff Bezos at the helm it has grown to a tech behemoth. Amazon now sells everything, through multiple pathways, including online commerce and convenience stores. Its cloud service, AWS, is swallowing up more and more market share with a $27 billion run rate. Amazon’s stock is up nearly 40% since the start of 2018, making Bezos the richest person in the world.

Unlike many large companies which seem to inevitably incur the public’s wrath at some point, Amazon is generally well thought of across much of America. Despite recent controversy over its headquarters expansion to New York City and the Washington, D.C. area, Amazon was named America’s most loved company by Morning Consult.

3. Warren Buffet

> Company: Berkshire Hathaway

> Tenure: 1970 – present

> Annual compensation: $100,000

> YTD stock price change: +6.0% (NYSE: BRK-B)

Known as the Oracle of Omaha, Warren Buffet has earned a reputation as one of the greatest investors of all time through years of clear-eyed decision making on Wall Street. This year was no different.

Buffett has had the top job at multinational conglomerate Berkshire Hathaway since 1970. His company beat earnings estimates in each of the three quarters of 2018 so far. As of mid-2018, Buffett’s conglomerate reported strong earnings in nearly every one of is business segments, including manufacturing, retail, and insurance. Over the last year, Berkshire Hathaway Class-B stock rose 7.4%, outperforming the S&P 500 index’s less than 3% return and the Dow Jones Industrial Average’s less than 3.5% increase over the last 12 months, as of the time of this writing.

4. Tricia Griffith

> Company: Progressive Corporation

> Tenure: July 2016 – present

> Annual compensation: $9.3 million

> YTD stock price change: +14.8% (NYSE: PGR)

Tricia Griffith began her career at Progressive Insurance as a claims representative in 1988, rising through a number of leadership positions to Personal Lines Chief Operating Officer in April 2015, ultimately being appointed as chief executive in July 2016. Since becoming CEO, Progressive Insurance one-year and annualized three-year sales growth topped those at both Apple and Microsoft. Profits at the company have risen more than 100% over the past year, and the stock price soared by nearly 50%.

According to Progressive executives interviewed in a November 2018 profile in Fortune magazine, many of the cultural changes instituted by Griffith as CEO have contributed to the company’s impressive growth. Griffith rose from No. 93 to No. 60 on Glassdoor’s Top CEOs list from 2017 to 2018, the largest increase in rank of any chief executive officer.

[in-text-ad-2]

5. Reed Hastings

> Company: Netflix

> Tenure: 1999 – present

> Annual compensation: $24.4 million

> YTD stock price change: +43.4% (NASDAQ: NFLX)

Reed Hastings is the CEO and founder of Netflix. The company, which started as an online DVD rental store in the 1990s, is now a billion dollar subscription based video streaming business. Hastings clearly anticipated the changes widespread broadband internet would bring to his business, and he adjusted accordingly. Under Hastings, Netflix has grown its user base every quarter so far, from 22.9 million in the third quarter of 2011 to 137.1 million in the third quarter of 2018.

Hastings has also done well by investors. As of the end of the third quarter in 2018, after several stock splits and price surges, Netflix stock has had a return on investment of 31,260% since its 2002 Wall Street debut.

6. Fran Horowitz

> Company: Abercrombie & Fitch

> Tenure: Feb. 2017 – present

> Annual compensation: $10.3 million

> YTD stock price change: +8.3% (NYSE: ANF)

Abercrombie & Fitch CEO Fran Horowitz may have turned her company’s fortunes around with a single bright idea. Horowitz literally turned the lighting up in the formerly dimly lit stores — and changed many other aspects of the company as she implemented her turnaround plan.

Both customers and investors responded well, as did the company’s stock price, not a small feat at a time when many other brick-and -mortar retailers are struggling. Under Horowitz, the company returned to its emphasis on quality in its clothing, helping re-establish the brand’s identity. Horowitz says some of the company’s recent philanthropic efforts have helped build perceptions of the brand.

[in-text-ad]

7. Bob Iger

> Company: The Walt Disney Company

> Tenure: Oct. 2005 – present

> Annual compensation: $36.3 million

> YTD stock price change: +5.0% (NYSE: DIS)

Disney CEO Bob Iger in the midst of the biggest deal of his life — an $85 billion deal to purchase 21st Century Fox’s cable and film assets (and debt). The deal is part of Disney’s strategy to become a premier entertainment company and compete with streaming services like Netflix. The deal has yet to go through, however, though it has cleared considerable hurdles, gaining approval from China and the European Union. Currently, antitrust regulators in Brazil have raised concerns. If the deal goes through, Disney could become a considerable force in cable TV.

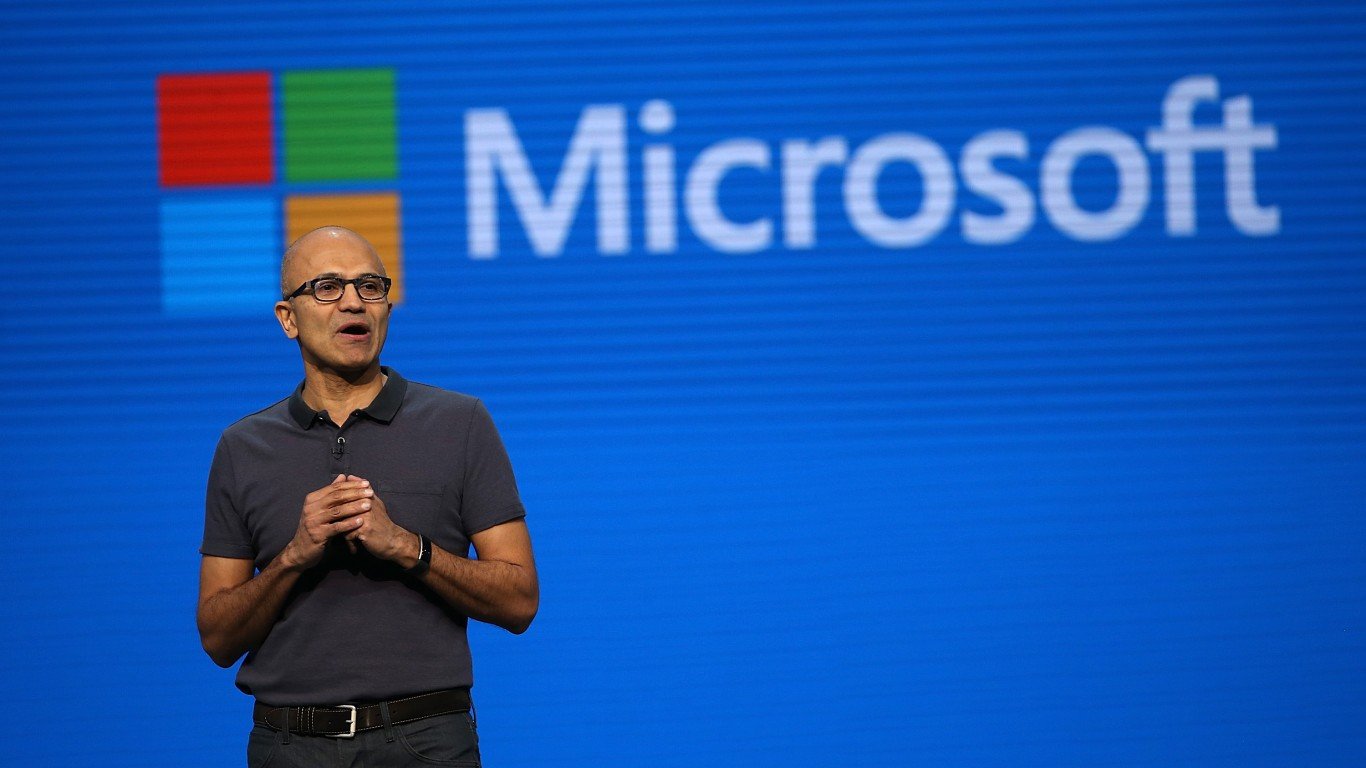

8. Satya Nadella

> Company: Microsoft

> Tenure: Feb. 2014 – present

> Annual compensation: $25.8 million

> YTD stock price change: 26.9% (NASDAQ: MSFT)

Since being appointed CEO of Microsoft in February 2014, Satya Nadella has presided over a period of substantial growth and change at the tech giant. According to an analyst with CNBC, some of Nadella’s more impactful initiatives have been to make some of its software available through open-source licensing, making cloud technology a higher priority for the company, and reducing its reliance on user data collection.

Microsoft stock has consistently outperformed the S&P 500 index throughout 2018, and on Nov. 30 closed the trading day as the world’s most valuable public company, a position it has not held since 2002. Nadella rose from No. 29 to No. 20 on Glassdoor’s Top CEOs list from 2017 to 2018, one of the largest increases in rank of any chief executive officer.

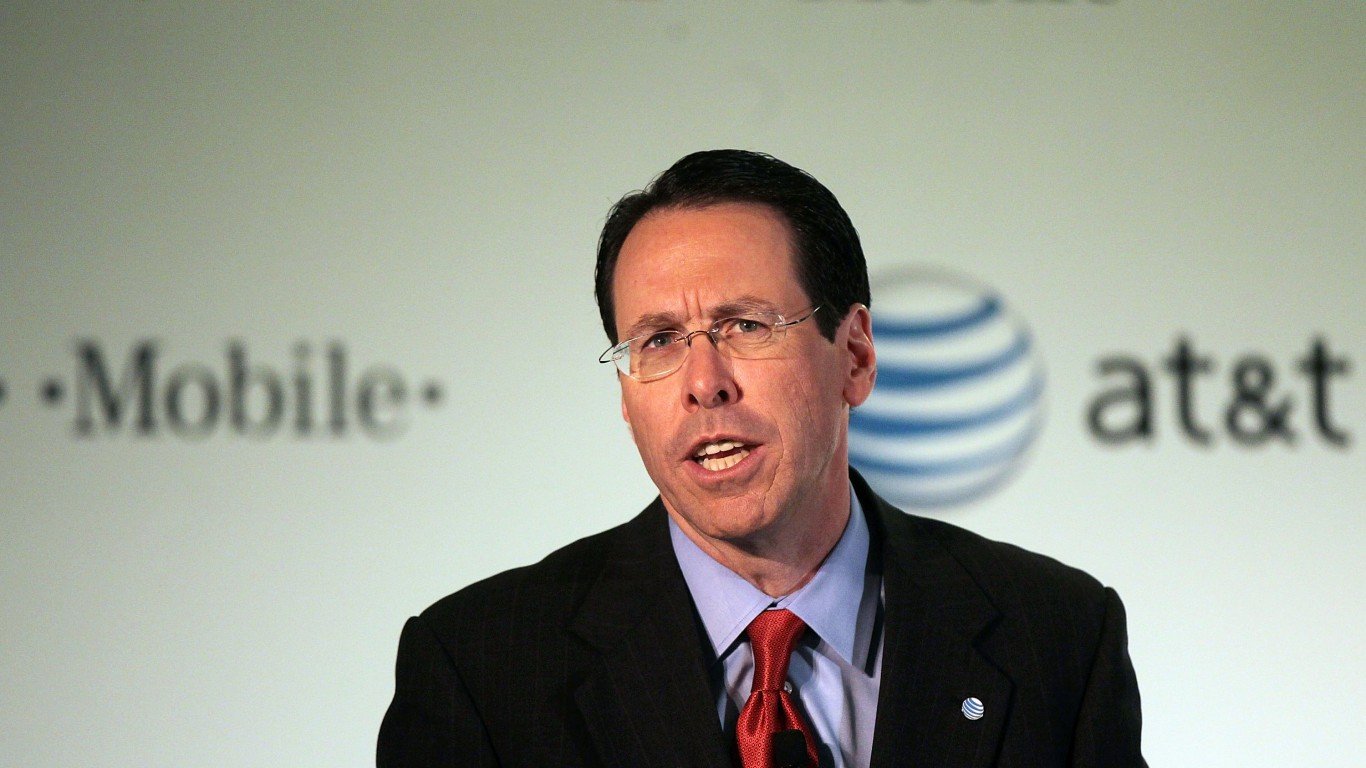

9. Randall Stephenson

> Company: AT&T

> Tenure: June 2007 – present

> Annual compensation: $28.7 million

> YTD stock price change: -21.0% (NYSE: T)

Under CEO Randall Stephenson, AT&T scored a major victory when it was permitted by a district court to acquire Time Warner in June. The deal faced significant opposition from the U.S. Department of Justice, which argued the new media company would have too much power in negotiations and hurt competition, passing higher prices along to consumers.

The DOJ is currently appealing the ruling. Stephenson told Recode that the acquisition will help AT&T get a “direct relationship” with its consumers in the same way that Netflix does. Stephenson has also focused on the relationship AT&T has with its employees. The company invested roughly $1 billion in retraining over 100,000 employees, rather than replacing them.Shares of AT&T are down by 20% on the year.

[in-text-ad-2]

10. Todd Vasos

> Company: Dollar General

> Tenure: June 2015 – present

> Annual compensation: $8.6 million

> YTD stock price change: +11.9% (NYSE: DG)

At a time when brick-and-mortar retail chains are suffering and closing locations, at Dollar General, under CEO Todd Vasos, business is booming. Under Vasos’s leadership, the number of Dollar General locations has jumped from 12,482 in 2015, the year he took the top job, to 14,609 as of March, 2018. This year, the company has plans to open a total of 900 new stores. Net sales at the discount retailer are up 8.7% in the past year, from $5.9 billion in the third quarter of 2017 to $6.4 billion in the third quarter of 2018.

Vasos has also done well by investors. The company’s share price is up from about $78 a share in June 2015, the month Vasos took over, its current price of over $100 a share.

Essential Tips for Investing: Sponsored

A financial advisor can help you understand the advantages and disadvantages of investment properties. Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

Investing in real estate can diversify your portfolio. But expanding your horizons may add additional costs. If you’re an investor looking to minimize expenses, consider checking out online brokerages. They often offer low investment fees, helping you maximize your profit.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.

24/7 Wall St.

24/7 Wall St. 24/7 Wall St.

24/7 Wall St.