The Biggest Corporate Scandals of the Decade

December 20, 2019 by Evan ComenCorporate scandals seem to have dominated the news cycle more than ever over the past 10 years. Amid widening income inequality and the aftermath of the Great Recession, many of the past decade’s major corporate scandals also seem to expose deeper, more widespread problems — the decade’s major sexual harassment, product recall, corporate negligence, and fraud cases were rarely isolated incidents.

And while instances similar to some of the biggest corporate scandals of the decade can be found throughout the past century, others would be difficult to conceive of until fairly recently.

In the 2010s, technology and data mining has evolved to such a degree that software could allow cars to cheat on emissions tests, and an app that could harvest data to form an accurate picture of the voting public and potentially help tip an election. With technology continuing to improve, Americans are faced with new legal and ethical questions about the use of technology.

As 2019 comes to a close, 24/7 Wall St. identified the biggest corporate scandals of the decade. We considered events covered widely in news reports since 2010 in which a corporation was responsible for unethical or illegal activities. To measure the size of the scandal, we used our editorial discretion to highlight cases that involved catastrophic damage, deaths, or otherwise had a large impact on the general public.

For more on companies, see the biggest product flops of the year, the worst product flops of all time, and brands that will disappear in 2020.

Click here to see the biggest corporate scandals of the decade

1. BP Deepwater Horizon oil spill

> Date: April 2010

Oil and gas giant BP kicked off the decade with one of the worst environmental disasters in history. In April 2010, the BP-licensed oil drilling rig Deepwater Horizon exploded, killing 11 workers. The rig sank into the Gulf of Mexico, breaking the well open and spilling oil. In what is now estimated to be the largest marine oil spill in history, between 2.5 and 4.2 million barrels of oil flowed into the ocean over an 87-day period before the well was capped, forming an oil slick thousands of square miles wide.

The spill had catastrophic economic and environmental impacts, from reduced beach tourism to an estimated fish and wildlife death toll in the hundreds of thousands. Total costs stood at $65 billion as of the end of last year. The incident ultimately led to a temporary moratorium on offshore drilling.

[in-text-ad]

2. Foxconn suicides

> Date: 2010

In 2010, there were 14 confirmed suicides at the flagship plant of Foxconn, a Chinese company that manufactures an estimated 40% of the world’s consumer electronics, including components for the iPhone, PlayStation 4, and Xbox One.

The suicides garnered substantial press in the United States and drew attention to the poor labor conditions at the factory. Interviews with Foxconn employees and other investigations revealed that the average worker works in 12-hour-long shifts and receives a cafeteria meal allowance worth just 65 cents, and that many of the suicides were committed in protest of the work conditions.

The scandal threatened to tarnish the reputations of some of Foxconn’s U.S. customers, including Apple and Hewlett-Packard, who conducted audits of the factory’s labor conditions in March 2010. Since 2010, at least eight additional suicides at the factory have been reported.

3. Libor scandal

> Date: June 2012

With the financial crisis still fresh and banks’ reputations still in tatters, yet another financial scandal hit the headlines. The U.S. Commodity Futures Trading Commission released in June 2012 the results of an investigation that revealed an international scheme in which several major banks — including Deutsche Bank, Barclays, and UBS — colluded to illegally manipulate interest rates for profit. Specifically, the banks rigged the Libor, which is an average interest rate that is calculated based on estimates submitted from a panel of global banks and used as the main benchmark for global lending rates. As of 2018, it was still used for over $370 trillion loans worldwide. It is the main benchmark for global lending rates. In conspiring to set the Libor artificially high or low, banks had the power to raise the value of their investments by millions of dollars with just an email or two.

The fallout from the scandal, including total costs to states, cities, and other municipalities as high as $6 billion, led to massive fines for the banks involved and substantial reform of how the Libor is determined. Regulators fined the banks more than $9 billion, and administration of the Libor was shifted to the ICE Benchmark Administration. Several bankers involved have been arrested and sentenced to prison, while other cases are ongoing.

4. FIFA corruption scandal

> Date: May 2015

The U.S. Department of Justice indicted on May 27, 2015, 14 Fédération Internationale de Football Association (FIFA) executives and officials on charges of racketeering, wire fraud, and money laundering conspiracy. The DOJ’s 164-page indictment to the public details over $150 million in bribes taken by FIFA executives for providing advertisers with marketing rights over a period dating as far back as 1991.

Switzerland opened parallel probes around the same time, including one investigation that confirmed FIFA executives enriched each other with as much as $80 million. While FIFA President Sepp Blatter was not charged in the indictment, he resigned on June 2, 2015. Due in part to the legal costs and loss of sponsors incurred in the wake of the scandal, FIFA reported net losses of $122.4 million in 2015, $368.8 million in 2016, and $191.5 million in 2017.

[in-text-ad-2]

5. Volkswagen emissions scandal

> Date: September 2015

News of one of the largest corporate scandals of the decade broke on Sept. 18, 2015, when the Environmental Protection Agency ordered Volkswagen to recall some 482,000 diesel passenger cars sold in the United States. The notice of violation came after researchers discovered that a number of Volkswagen models were emitting illegally high levels of poisonous nitrogen oxides, and that the polluting vehicles contained illegal software that could detect when the cars were being tested and change the performance to pass the emissions tests. It has since been revealed that 11 million vehicles contain the software.

VW was ordered to pay more than $25 billion in fines in the United States and reported an operating loss of $1.77 billion in 2015. According to a study published in Environmental Research Letters, 59 premature deaths will result from the excess pollution of illegal VW cars in the United States alone.

6. Turing Pharmaceuticals HIV drug price gouging

> Date: September 2015

Former Turing Pharmaceuticals CEO Martin Shkreli in 2015 increased the cost of the life saving drug Daraprim by 5,000%, driving the price of the drug from $13.50 to $750 per pill. Daraprim, which costs less than a dollar to manufacture, is a medicine for toxoplasmosis, which can lead to deadly infections in people with HIV and affects about 2,000 Americans per year. The price hike caused widespread outrage. Shkreli was required to testify in front of Congress over the company’s pricing tactics and was eventually convicted in an unrelated case of securities fraud for which he is currently serving a seven-year prison sentence.

The Martin Shkreli scandal was big news on its own but was by no means an isolated problems throughout the decade. To give just one example, it was just one year later that pharmaceutical company Mylan boosted prices by 400% for its EpiPen auto injector, a life saving medicine for cases of severe allergic reactions.

[in-text-ad]

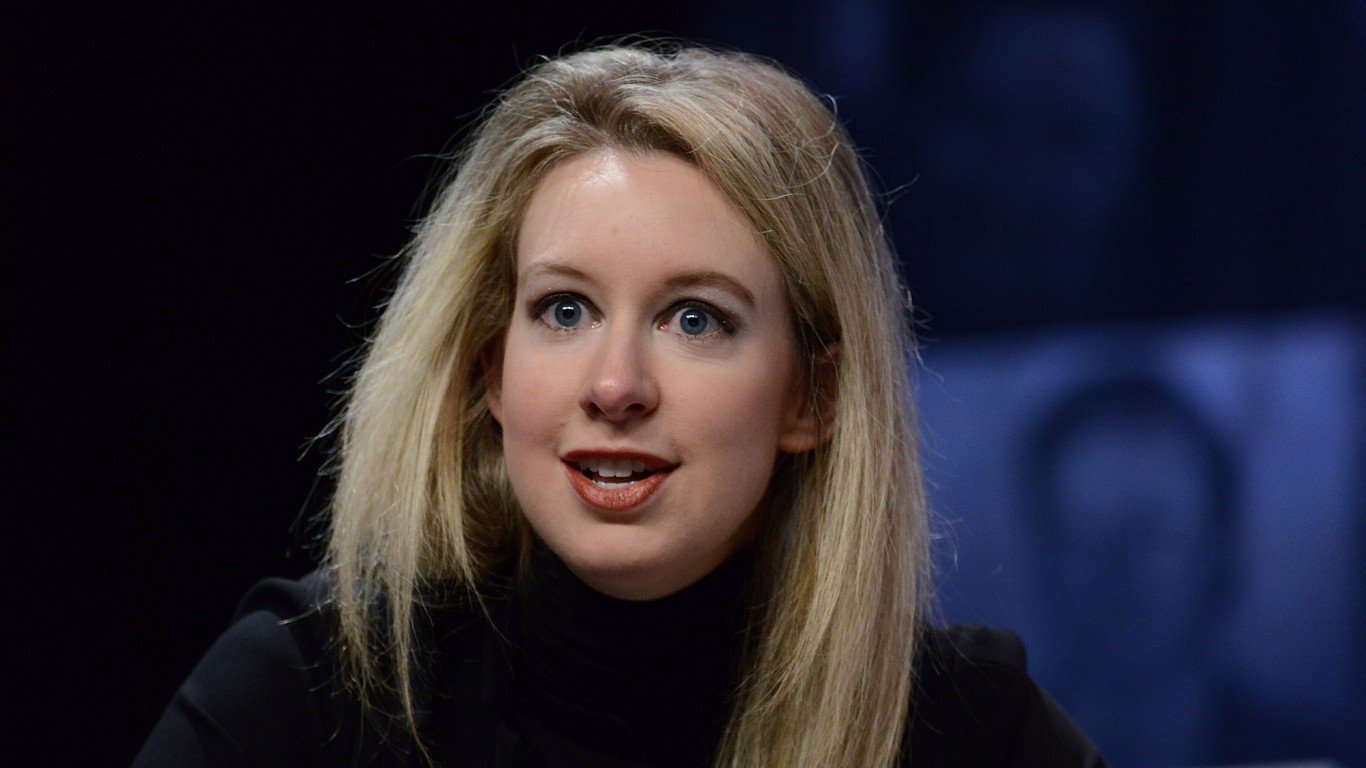

7. Theranos

> Date: October 2015

In the approximately 15 years Theranos was in operation, the health technology company was able to raise more than $700 million in venture capital and reach a peak valuation of $10 billion without publishing a single scientific research paper. The company was led by founder Elizabeth Holmes, who started Theranos at age 19 and was a frequent subject of praise by media outlets like The New Yorker, Forbes, and Fortune.

The company touted technology that could perform a wide range of lab tests with a single drop of blood, but an October 2015 expose in The Wall Street Journal claimed Theranos had deceived the public. This opened the company to further scrutiny. The fallout began shortly thereafter, and Holmes was charged with massive fraud in March 2018. The former wunderkind is currently set to stand trial in federal court in 2020 and will face penalties of up to 20 years in prison and tens of millions of dollars in fines.

8. Fyre Festival

> Date: April 2017

Hundreds of festival goers arrived on April 27, 2017, to the Bahamian island of Grand Exuma to attend the much-hyped Fyre Festival. The event, which was promoted by some of the world’s biggest supermodels, advertised a music festival with top-tier musical talent, drinks on a white sand beach, gourmet food, and luxury villas. Guests, however, arrived to find that the festival site was an unbuilt housing development; dinner consisted of a slice of bread, two slices of cheese, and salad; and many of the shelters were half-built FEMA disaster relief tents.

The scandal was broadcast to the world in real time. Festival guests tweeted images of a free-for-all grab and dash for shelter, outbound attendees locked in Exuma International Airport with no food, water, or air conditioning, and other footage of the bedlam that quickly unfolded. In the fallout from the festival, organizer Billy McFarland was sentenced to six years in prison on two counts of wire fraud and ordered to pay $26 million in restitution. He is also currently facing several class action lawsuits. While some attendees may have received refunds through their credit card company, as of the beginning of this year, no one at the festival had been refunded.

9. Mossack Fonseca and the Panama Papers

> Date: April 2016

In April 2016, an anonymous whistleblower leaked 11.5 million documents from Panamanian law firm Mossack Fonseca to German newspaper Süddeutsche Zeitung. The 2.6 TB trove of files — now known as the Panama Papers — revealed a global network of offshore bank accounts and shell companies used by the world’s elite to conceal wealth and avoid taxes. The Panama Papers shed light on the inner workings and massive scale of offshore tax havens — researchers using data from the leak estimated that tax havens hold 10% of world GDP. These revelations led to Iceland’s Prime Minister Sigmundur DavÃð Gunnlaugsson’s resignation from office. They also caused Pakistani Prime Minister Nawaz Sharif to be removed from office and sentenced to 10 years in prison.

The papers have incited anger and inspired a global effort to reshore international money. According to the International Consortium of Investigative Journalists, $1.3 billion in offshore money has been recouped by world governments since the papers leaked.

[in-text-ad-2]

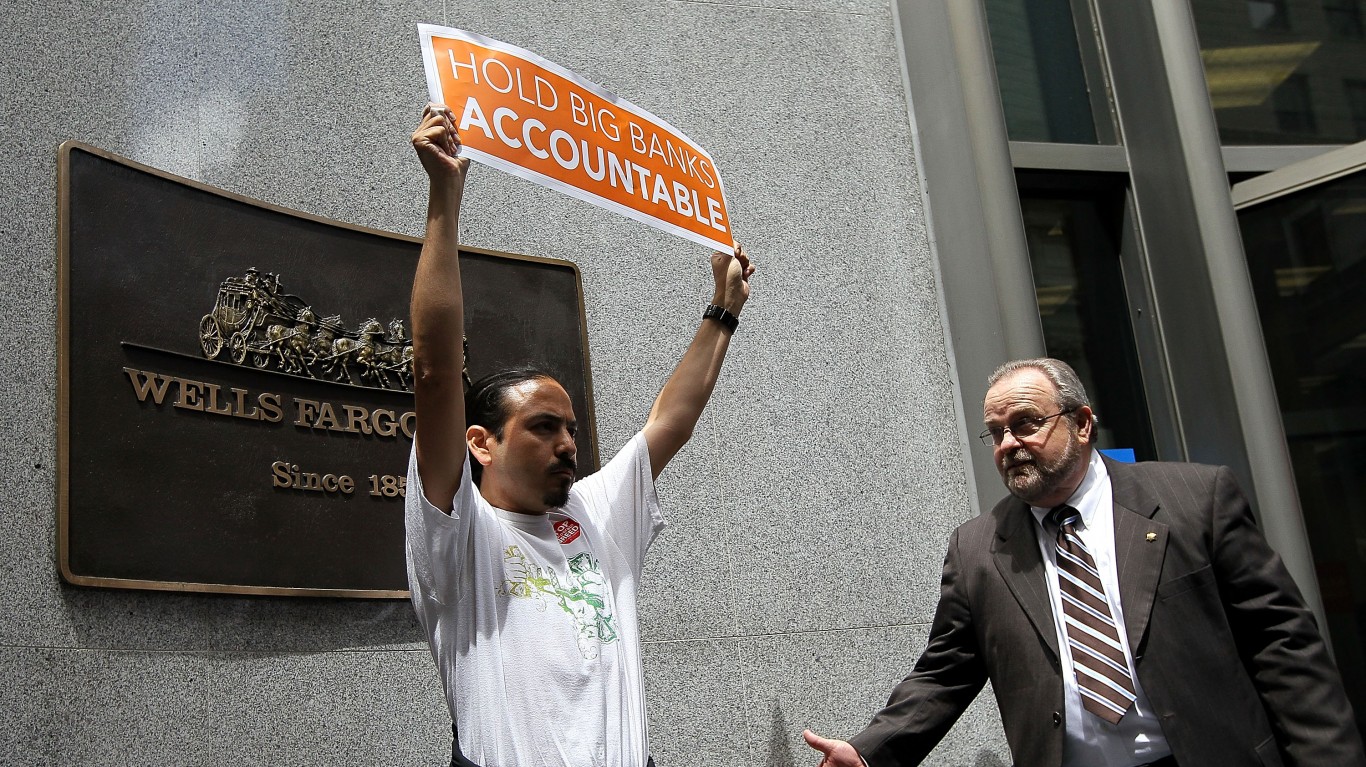

10. Wells Fargo account fraud

> Date: September 2016

The Consumer Financial Protection Bureau revealed on Sept. 8, 2016, that Wells Fargo employees had opened more than 2 million unauthorized deposit and credit card accounts. In order to reach sales targets and other incentives, thousands of employees had opened accounts without customer consent. They also transferred funds from authorized accounts into the unauthorized accounts, which racked up fees and other charges for the unsuspecting customers.

Wells Fargo has been hit with over $2 billion in penalties related to the phony accounts since the scandal broke. Over 5,000 employees were fired in connection with the fake accounts, and CEO John Stumpf was forced to retire. Credit card applications plummeted in October 2016, and the Better Business Bureau revoked its accreditation of the bank.

11. Equifax data breach

> Date: September 2017

Credit reporting agency Equifax announced on Sept. 7, 2017, that an unauthorized third party had gained access to the information of up to 143 million Americans — roughly half the U.S. population. According to a report published in Vice, Equifax may have known about the vulnerability from a security researcher’s warning, but failed to act on it. Information contained in the files accessed by hackers included names, dates of birth, Social Security numbers, addresses, and, in about 209,000 cases, credit card numbers.

While the breach led to widespread public outrage, consumers were further incensed by the poor response to the incident. Equifax provided little explanation of the breach, and cybersecurity experts noted that the website Equifax directed customers to learn if their information was compromised was itself a security risk. The site also contained terms of use that, according to some lawyers, may have waived the customer’s right to a class action lawsuit.

[in-text-ad]

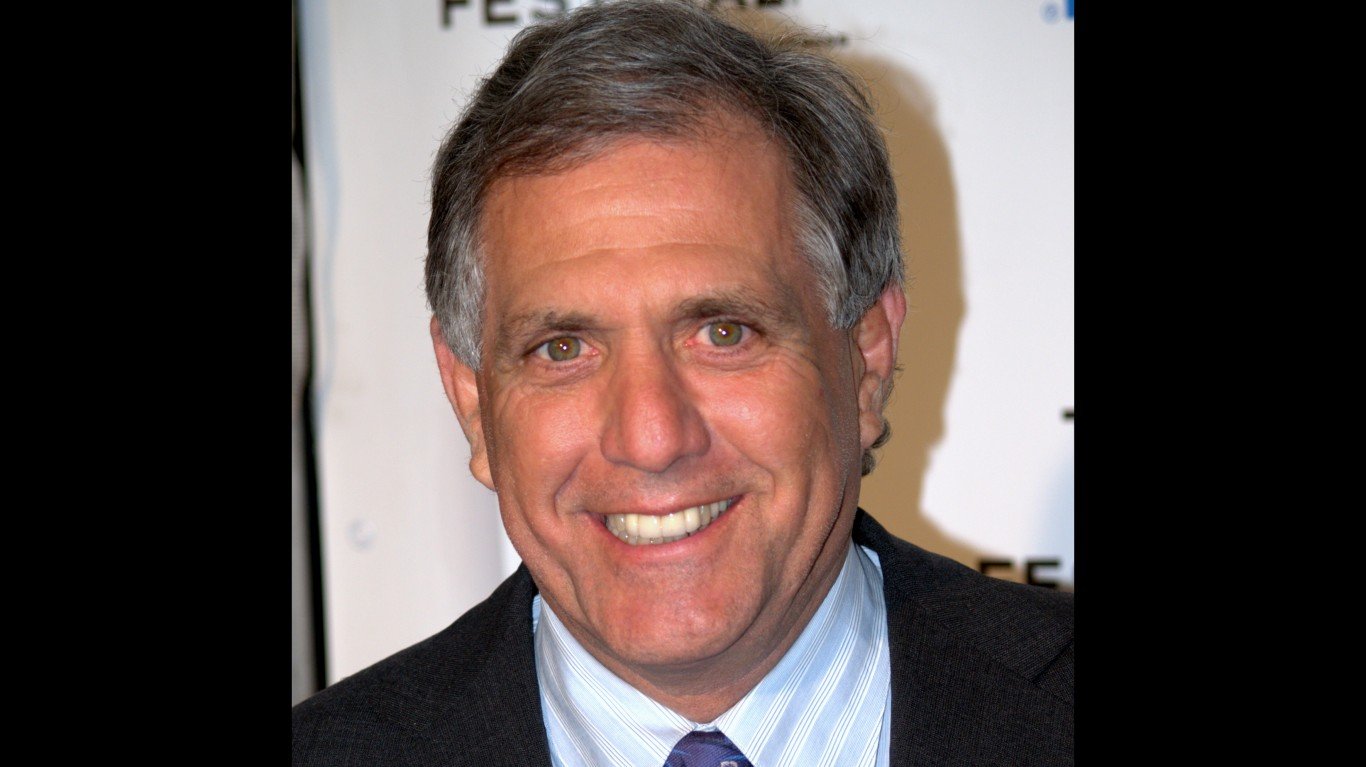

12. CBS sexual harassment scandal

> Date: November 2017-September 2018

One of the defining cultural trends of the 2010s was the widespread organization and empowerment of victims of sexual harassment and assault. Under the banner of the #MeToo movement, millions of victims have broken the silence on their stories of abuse, leading to the ouster of some of the most powerful men in politics and industry, and a measurable improvement in sexual harassment awareness.

One of the largest institutions that faced widespread accusations of sexual misconduct was CBS. Major figures — CEO Les Moonves, longtime anchor Charlie Rose, and executive producer Jeff Fager — lost their jobs after being accused of sexual misconduct, and a number of employees have spoken out about the company’s hostile culture.

13. Facebook-Cambridge Analytica data scandal

> Date: March 2018

Facebook was often making headlines this decade, and mostly not with positive news. On March 17, 2018, The Guardian and The New York Times simultaneously published exposés alleging that data harvested from over 50 million Facebook profiles by political consulting firm Cambridge Analytica were used to help the 2016 Trump presidential campaign. The firm used the data to identify the personalities of American voters and better target them with digital ads. The data were harvested as early as June 2014 through an app developed by a researcher who worked with Cambridge Analytica and who was originally granted access to user information by Facebook for academic purposes.

Within 10 days of the news reports, the Federal Trade Commission launched an investigation into Facebook’s data practices, CEO Mark Zuckerberg was called to testify in front of Congress, and the price of Facebook stock fell 16%. The breach was one of several major scandals that befell Facebook in the 2010s, sowing distrust in the company — 44% of Americans today believe Facebook fosters division in society, according to a recent national survey by Consumer Reports — and furthering the public conversation on data privacy.

14. Boeing 737 MAX back-to-back plane crashes

> Date: October 2018-March 2019

On Oct. 29, 2018, a Lion Air flight departing from Indonesia crashed into the sea just moments after takeoff, killing all 189 people on board. Several months later, on March 10, 2019, an Ethiopian Airlines flight crashed shortly after takeoff, killing all 157 people on board. The planes involved in both accidents were Boeing 737 Max jets.

Shortly after the second crash, aviation authorities around the world grounded the 737 Max jet. Boeing ceased production of the aircraft, and is now the subject of several federal investigations and lawsuits. The lawsuit alleges Boeing had foreknowledge of the issue, which was partly what prompted the investigation and contributed to the public outrage. As of December 2019, Boeing has paid more than $9 billion in customer compensation costs related to the halted production. In the second quarter of 2019, Boeing posted a net loss of $2.9 billion, the largest quarterly loss in the company’s history, as the company took a $4.9 billion related to the jet.

[in-text-ad-2]

15. College admissions scandal

> Date: March 2019

With such developments over the decade as rising pay for university presidents, which now often exceeds $1 million, labor strikes by workers building university campuses overseas, and declines in government funding of higher education, it seems higher education in the United States has increasingly become big business.

The college admissions scandal of 2019 might be considered a corporate scandal in light of these trends. Unsealed court documents filed by FBI agents investigating corporate fraud implicated 32 individuals, including officials at eight elite universities: Georgetown, the University of Southern California, Stanford, Yale, and Wake Forest University. The scandal also involved 52 people accused of bribing or cheating their children into college. As of October, seven individuals had received jail sentences of weeks or months.

While the admissions process at universities, particularly elite institutions, has always been partly governed by special favors, the public spotlight and penalties associated with this scandal were unprecedented.

16. WeWork IPO disaster

> Date: August 2019

Office sharing real estate company WeWork filed in August 2019 its highly anticipated S-1 form with the Securities and Exchange Commission in preparation to become a public company. However, a litany of red flags in the document — including massive losses, expensive lease agreements, complex corporate structure, an all-male board of directors, and CEO Adam Neumann’s outsized control of the company — were seen as major risks by investors and invited further scrutiny into the company’s leadership. Examples of Neumann’s lifestyle and idiosyncrasies that came to light as the IPO collapsed added to the scandal. The disgraced CEO was reported to have illegally transported marijuana in his private jet across international borders and promoted excessive alcohol consumption in professional settings. He banned meat at his company, considered running for president of the world, and expressed a desire to become the world’s first trillionaire.

Amid a storm of negative press, WeWork slashed its valuation from $47 billion to $10 billion, ousted its CEO, and laid off 2,400 employees — nearly one-fifth of its workforce. The IPO — which has been delayed indefinitely — ultimately cast a shadow on spendthrift, fast-growth startups and has likely soured the marketplace on future unicorn IPOs.

[in-text-ad]

17. Johnson & Johnson baby powder recall

> Date: October 2019

On Oct. 18, 2019, Johnson & Johnson recalled 33,000 bottles of baby powder after the Food and Drug Administration discovered traces of asbestos in the product. The recall comes after decades of concern — from both the public and from within the company — that the baby powder could contain the cancer-causing mineral.

At the time of the recall, J&J faced more than 15,000 lawsuits from customers who alleged the baby powder caused them to develop cancer. While the company is currently fighting the accusations and has declared the product is completely safe, analysts estimate the lawsuits could cost the company up to $10 billion.

18. TikTok foreign ownership

> Date: November 2019

The Committee on Foreign Investment in the United States opened an investigation into the short-form video-sharing service TikTok, according to a Reuters report from Nov. 1, 2019. Lawmakers who called for the investigation are concerned about TikTok’s connection to China — the service is owned by the Beijing-based ByteDance Technology Co. — and whether it poses a national security risk to the United States. One complaint, from Sen. Marco Rubio, alleges the company removes content critical of the Chinese government. Another complaint, from Sens. Chuck Schumer and Tom Cotton, cites security concerns posed by TikTok’s collection of users’ personal data.

TikTok is one of many companies whose foreign ownership has raised suspicion. Other recent examples include the Chinese-owned dating app Grindr and the Russian-owned FaceApp.

19. Probe on opioid makers

> Date: November 2019

Six pharmaceutical companies are under federal investigation and face potential criminal charges for their role in the opioid crisis. Federal prosecutors are working to determine what, if any, laws were broken in connection with shipments of mass quantities of opioid painkillers. The companies include Teva Pharmaceutical Industries, Mallinckrodt, Johnson & Johnson, Amneal Pharmaceuticals, and distributor McKesson Corp. One company, Ohio-based Miami-Luken Inc, shipped 3.7 million hydrocodone pills between 2008 and 2011 to a pharmacy in a West Virginia town of about 400 people.

Pharmaceutical giant Purdue Pharma reached in September a multibillion-dollar settlement with thousands of cities, counties, and tribes, as well as 23 states for its role in the opioid crisis. The settlement is the first of its kind. Under the deal, the company will file for bankruptcy and restructure with its OxyContin proceeds going to victims of the opioid addiction epidemic.

According to the most recent data from the Centers for Disease Control and Prevention, more than two-thirds of the more than 70,000 drug overdose deaths in 2017 involved an opioid. Such drug-related deaths were six times more common in 2017 than in 1999, according to the CDC.

Take This Retirement Quiz To Get Matched With An Advisor Now (Sponsored)

Are you ready for retirement? Planning for retirement can be overwhelming, that’s why it could be a good idea to speak to a fiduciary financial advisor about your goals today.

Start by taking this retirement quiz right here from SmartAsset that will match you with up to 3 financial advisors that serve your area and beyond in 5 minutes. Smart Asset is now matching over 50,000 people a month.

Click here now to get started.

24/7 Wall St.

24/7 Wall St.