Wall Street has experienced volatility a number of times since March 2020. COVID-19, GameStop’s activist short squeeze, and the Suez Canal blockage all shook up worldwide commerce. Investment firm Archegos Capital Management could be the next major story. The fund’s multi-billion dollar overleveraged bets on media companies like ViacomCBS and Discovery have come crashing down, throwing Wall Street into disarray. Though the dust has yet to settle, the firm’s founder, Bill Hwang, may have gone from billionaire to broke.

It is rare for a person who has reached the status of billionaire to ever lose it — but it is not unheard of. Most people with the business savvy to amass billions of dollars also know how to maintain their fortune. Occasionally, however, someone who was at one time worth billions sees their net worth drop to near zero.

24/7 Wall St. researched reports of wealthy individuals who lost their fortune. We found more than a dozen billionaires who have gone broke.

Typically, the billionaires on this list lost their money either because of bad investments or criminal activity. Several are notorious scammers who raked in billions of dollars by lying to investors or cooking the books to make their business appear more successful.

Other people on this list gained their billions through divorce but were unable to maintain their wealth, either because of bad investments or lavish spending.

The ultra wealthy can generally stay rich by diversifying their holdings to protect themselves from economic turmoil as well as by hiring the top money managers that can help shield them from recessions. Throughout the COVID-19 pandemic and resulting financial fallout, the net worth of America’s 614 billionaires grew by over $900 billion, collectively. These are the American billionaires that got richer during COVID.

Click here to see billionaires that have gone broke.

1. Elizabeth Holmes

Elizabeth Holmes was once on the cover of Forbes for founding a revolutionary startup worth an estimated $9 billion. She was recently convicted of criminal fraud. Holmes claimed her company, Theranos, was developing a revolutionary blood test that could test for hundreds of diseases and conditions with just a few drops of blood. In reality, the company was nowhere close to delivering this technology. Holmes is awaiting sentencing and faces up to 20 years in prison.

[in-text-ad]

2. Bernie Madoff

Bernie Madoff will go down as one of the most infamous scammers in history. Madoff ran the largest Ponzi scheme of all time, swindling an estimated $17.5 billion from investors. Trustees have reportedly recovered $13 billion of the stolen money. Madoff is currently serving a 150-year federal prison sentence. In early 2020, he asked for a compassionate release, claiming he had less than two years to live due to kidney failure. His request was denied.

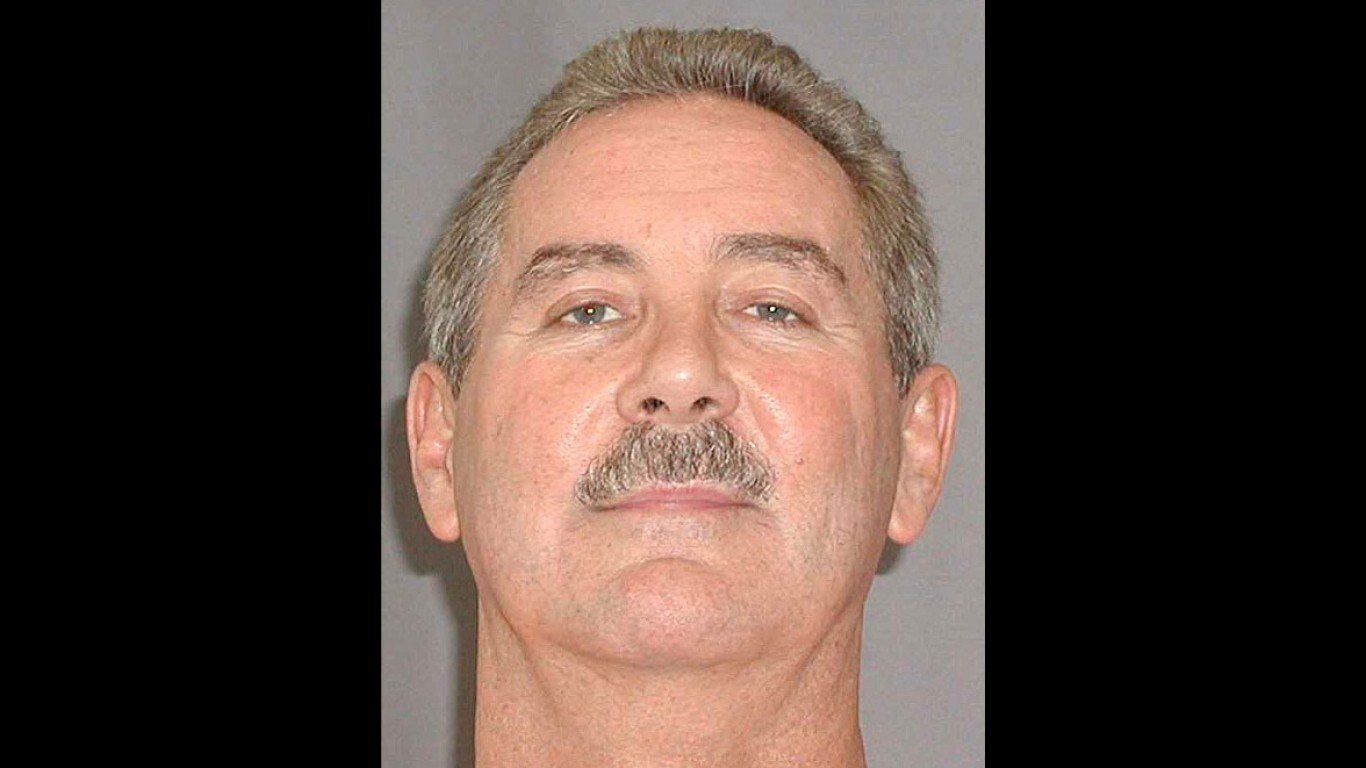

3. Allen Stanford

Though Allen Stanford is not as well known as Bernie Madoff, he gained and lost his fortune the same way — a Ponzi scheme. He defrauded about 18,000 people, many of them retirees, out of their savings. His scheme reportedly took in over $7 billion. After his scheme was uncovered, Stanford’s net worth dropped to zero. He was sentenced to 110 years in prison for his role in the scheme. Unlike with Madoff, however, few of Stanford’s victims have recovered their money.

4. Eike Batista

Once the world’s seventh richest person, oil billionaire Eike Batista was the face of Brazil’s booming economy in 2012. Bastista’s business affairs began to unravel when his oil company, OGX, could not keep up with promised production, and investors pulled their money. After his fortunes further declined when Brazil’s economy went into a tailspin, Batista filed for bankruptcy.

Investigators eventually discovered that Batista was involved in a kickback scandal that took down many of Brazil’s most prominent politicians, and he was charged with money laundering. He was sentenced to 30 years in prison for corruption and money laundering and received an additional eight year sentence in 2019 for market manipulation.

[in-text-ad-2]

5. Sean Quinn

Sean Quinn was once Ireland’s richest man, with an estimated net worth of over 3 billion euro. He grew his family quarry and diversified into different businesses like manufacturing, real estate, power plants, and more. Quinn lost control of his business empire after a bad investment in the Anglo Irish Bank. He tried to salvage the bank’s fortune by taking money out of his insurance company, but bank shares were in freefall. The bank had to be bailed out by taxpayers, and the government assumed control. In 2011, Quinn claimed that his assets were worth less than £50,000 and filed for bankruptcy.

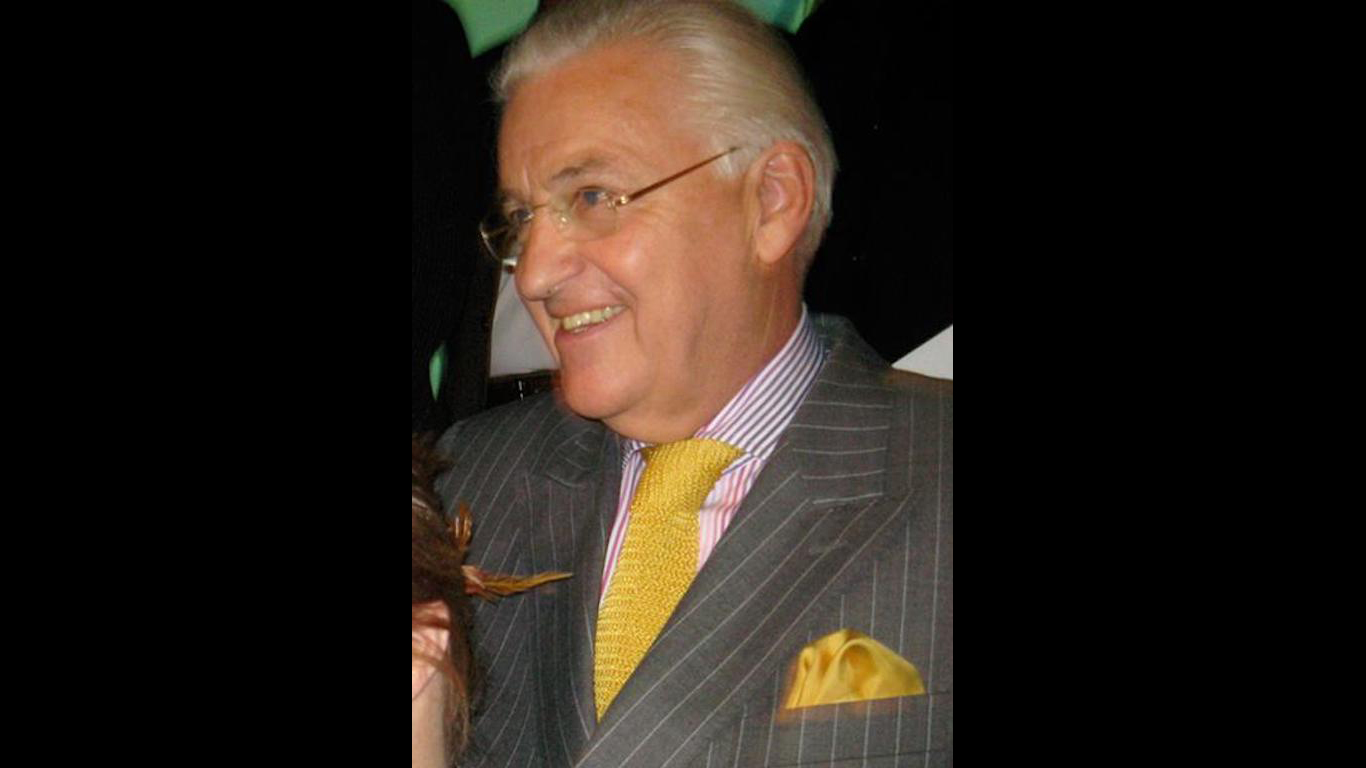

6. Björgólfur Gudmundsson

Björgólfur Gudmundsson was in 2008 the chairman and primary owner of the second largest bank in Iceland. But that year’s financial crisis took its toll on banking systems worldwide, and Gudmundsson’s bank collapsed. The was taken over by the Icelandic government, wiping out all of Gudmundsson’s fortune. He declared bankruptcy, admitting he was hundreds of millions of pounds in debt. Gudmundsson had to sell London’s West Ham United Football Club, the Premier League soccer team he owned.

[in-text-ad]

7. Aubrey McClendon

Aubrey McClendon was reportedly worth $1.2 billion as the co-founder of major oil and gas company Chesapeake Energy. He may not, however, have earned his fortune honestly. In 2016, he was indicted on federal conspiracy charges. The government accused McClendon of unfairly manipulating bids for drilling rights. The day after he was charged, McClendon died in a car accident, which some have speculated was a suicide. Though McClendon appeared to be wealthy before his death, creditors claimed he borrowed $465 million for business ventures in 2013 and sought payment from his estate. Because of outstanding debts, McClendon may have had a net worth close to zero when he died.

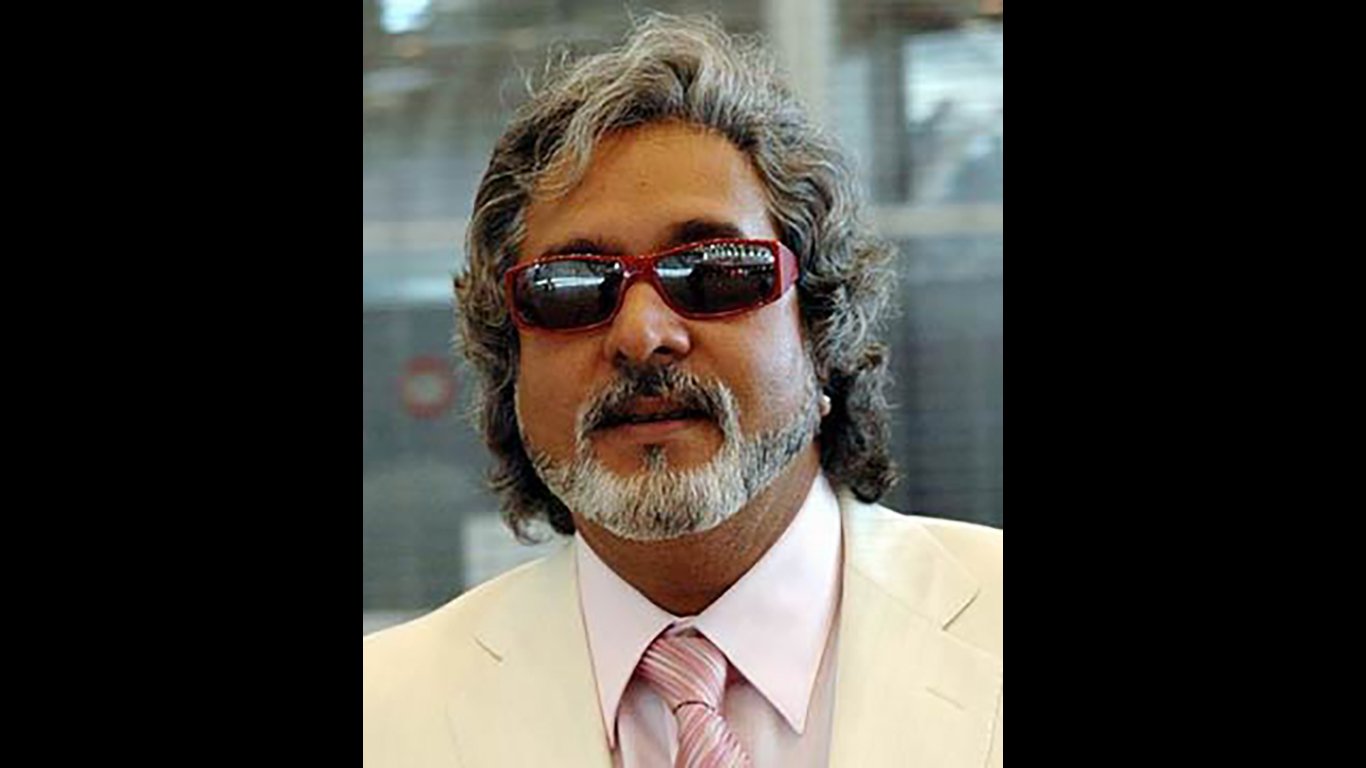

8. Vijay Mallya

Indian businessman Vijay Mallya took over his father’s liquor business at 28 and turned it into a massive company, amassing a net worth of $1.5 billion. He later took over Kingfisher Airlines but accumulated massive amounts of debt to try to support the business. Beginning in 2012, he was accused of money laundering and fraud, to the tune of $1.3 billion. Pursued by creditors, Mallya fled India for the U.K in 2016. Since 2018, he has fought in British courts against extradition. The U.K. Ministry of External Affairs told the Indian government in October 2020 that Mallya would not be taken back to India until a “confidential legal matter” was taken care of.

9. Adolf Merckle

Adolf Merckle grew his small family business in Germany into a vast corporate empire with more than 100 companies and 100,000 employees. In the process, his net worth grew to over $9 billion. But his investment company fell billions of euros into debt, and Merckle personally lost hundreds of millions of euros shorting Volkswagen shares. That, along with a global recession in 2008, forced Merckle to consider bankruptcy. Merckle took his own life in 2009. At the time, his investment company VEM owed banks billions of euros.

[in-text-ad-2]

10. Patricia Kluge

In the 1980s, heiress and socialite Patricia Kluge was married to the richest man in America — media mogul John Kluge. They divorced in 1990, and Patricia’s settlement included Albemarle, a Virginia estate and winery. She founded Kluge Estate Winery and Vineyard and saw success. She also developed a luxury subdivision with multimillion-dollar homes near Albemarle. When the housing crisis hit, however, everything came to a halt. The houses were unfilled, and Kluge was forced to sell her estate for a fraction of the asking price to pay her debts. It was purchased by future President Donald Trump in 2011.

11. Bernie Ebbers

WorldCom appeared to be a thriving telecom company in the late 1990s, and the company’s CEO, Bernie Ebbers, was worth as much as $1.4 billion — but much of that success had been a sham. Billions in WorldCom’s profits were improperly recorded for the wrong year, and billions in expenses were classified as investments, grossly inflating the company’s profits. All in all, WorldCom’s books were off by $11 billion. The company is now defunct, and Ebbers was sentenced to 25 years in prison. He was released in late 2019 after his lawyers said his health was in decline. Ebbers died in February 2020.

[in-text-ad]

12. Jocelyn Wildenstein

Jocelyn Wildenstein first became a billionaire after receiving an estimated $2.5 billion in a 1999 divorce settlement from her art dealer husband. Wildenstein has been frequently featured in tabloids for her legendary spending habits and her extensive cosmetic surgeries that have netted her the nickname “Catwoman.” She told reporters her net worth dropped after several pieces of art in her trust were found to be forged or worth much less than expected. She has also faced several lawsuits and foreclosures. In 2018, Wildenstein filed for bankruptcy, claiming that she had zero dollars in her bank account.

13. Chuck Feeney

Chuck Feeney is unique on this list of billionaires who went broke because his substantial net worth loss was intentional. Feeney founded Duty Free Shoppers, the airport retailer, then launched private equity firm General Atlantic, accumulating a net worth of around $8 billion. He decided to give virtually all his money away to various domestic and international charities and philanthropic efforts over his last 40 years or so. In September 2020, Feeney closed down his philanthropy company, having given away his wealth, minus retirement savings for him and his wife.

14. Bill Hwang

It appears that Bill Hwang became one of the latest billionaires to lose it all in March 2021, when his overleveraged market bets came crashing down. Hwang’s private investment firm, Archegos Capital Management, reportedly used loans to bet on the stock prices of several media companies, including ViacomCBS and Discovery Inc., which had inflated their perceived value 2021, before declining recently. When the brokers issued margin calls, Archegos defaulted and was forced to liquidate many of its positions, further driving these stock prices down. Brokers like Credit Suisse and Nomura reportedly expect billions of dollars in losses.

It has been difficult to ascertain the extent of the losses Hwang, who pled guilty to insider trading charges in 2012, incurred. Former Goldman Sachs partner Mike Novogratz told Bloomberg it amounts to “one of the single greatest losses of personal wealth in history.” Before these margin calls, some estimates placed Hwang’s personal wealth at around $10 billion and the value of the firm’s positions at around $100 billion.

Sponsored: Attention Savvy Investors: Speak to 3 Financial Experts – FREE

Ever wanted an extra set of eyes on an investment you’re considering? Now you can speak with up to 3 financial experts in your area for FREE. By simply

clicking here you can begin to match with financial professionals who can help guide you through the financial decisions you’re making. And the best part? The first conversation with them is free.

Click here to match with up to 3 financial pros who would be excited to help you make financial decisions.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.

24/7 Wall St.

24/7 Wall St.

24/7 Wall St.

24/7 Wall St.