The cost of higher education in the United States has been growing at such an alarming rate that total student loan debt in the country hit $1.7 trillion this year after topping $1 trillion just nine years ago, putting this trend well on the path to topping $2 trillion by the time current college freshmen completes a four-year degree path.

Tuition for full-time students at an in-state public university hit an average of $10,560 for the 2020-2021 academic cycle, doubled in price compared to 2000-2001, according to the College Board. This means the average total tuition for the most affordable bachelor’s degree in the U.S. easily tops $40,000, and that’s before the costs of room and board, books and supplies, and other expenses. Going to an out-of-state college or a private university can more than double or triple the cost. Here’s the most expensive college in every state.

Considering that a college education can cost way more than the annual median wage of a full-time worker in their early 20s, it should be no surprise that so many Americans start their careers already weighted down with yoke of higher-education debt that follows them for years, longer still if the type of education doesn’t lead to significant higher earnings quickly after graduation. Here’s a list of the 20 best colleges in America.

A 2019 report from New York Life found that taking on too much student loan debt was a top financial regret among the survey’s 2,200 adults who reported taking an average of 18-and-a-half years to pay down the debt.

The ability to pay down student loan debt depends on a lot of factors, notably whether or not the degree you borrowed against led to a good job in your present location. A graduate with a coveted diploma in a large city with many job opportunities may have an easier time paying off the debt than the graduate living in a less-populated area with fewer plum career opportunities.

With so much student debt sloshing around the country, many Americans find themselves defaulting on student loan payments.

Here’s a list of counties with the most student loan debt in collections

To identify the counties with the most student loan debt in collections, 24/7 Wall St. reviewed the median student loan debt in collections among those residents in every state with student loan debt in collections from non-profit think tank Urban Institute‘s Debt in America 2021 report. The Urban Institute used credit bureau data from 2020.

The share of student debt in collections, also from the Urban Institute, is the percentage of total individuals with any form of student debt that is open, deferred, and sent out to a collection agency. Educational attainment comes from the American Community Survey 2019 5-year estimates.

50. Suffolk County, New York

> Median student debt in default: $15,105

> Student loan holders with student debt in default: 5.8% — #2,479 out of 2,934 counties

> Adults with at least a bachelor’s degree as of 2019: 36.3% — #257 out of 3,136 counties

[in-text-ad]

49. Santa Clara County, California

> Median student debt in default: $15,110

> Student loan holders with student debt in default: 7.6% — #2,174 out of 2,934 counties

> Adults with at least a bachelor’s degree as of 2019: 52.4% — #45 out of 3,136 counties

48. Polk County, Iowa

> Median student debt in default: $15,127

> Student loan holders with student debt in default: 9.1% — #1,820 out of 2,934 counties

> Adults with at least a bachelor’s degree as of 2019: 36.7% — #245 out of 3,136 counties

47. Fairfield County, Connecticut

> Median student debt in default: $15,171

> Student loan holders with student debt in default: 7.1% — #2,279 out of 2,934 counties

> Adults with at least a bachelor’s degree as of 2019: 47.9% — #78 out of 3,136 counties

[in-text-ad-2]

46. Kitsap County, Washington

> Median student debt in default: $15,173

> Student loan holders with student debt in default: 9.4% — #1,774 out of 2,934 counties

> Adults with at least a bachelor’s degree as of 2019: 33.2% — #377 out of 3,136 counties

45. San Mateo County, California

> Median student debt in default: $15,270

> Student loan holders with student debt in default: 5.7% — #2,493 out of 2,934 counties

> Adults with at least a bachelor’s degree as of 2019: 51.0% — #53 out of 3,136 counties

[in-text-ad]

44. Henry County, Georgia

> Median student debt in default: $15,316

> Student loan holders with student debt in default: 11.4% — #1,304 out of 2,934 counties

> Adults with at least a bachelor’s degree as of 2019: 28.5% — #628 out of 3,136 counties

43. Adams County, Colorado

> Median student debt in default: $15,325

> Student loan holders with student debt in default: 11.3% — #1,324 out of 2,934 counties

> Adults with at least a bachelor’s degree as of 2019: 24.3% — #940 out of 3,136 counties

42. Cherokee County, Georgia

> Median student debt in default: $15,341

> Student loan holders with student debt in default: 8.5% — #1,967 out of 2,934 counties

> Adults with at least a bachelor’s degree as of 2019: 38.2% — #217 out of 3,136 counties

[in-text-ad-2]

41. Lane County, Oregon

> Median student debt in default: $15,351

> Student loan holders with student debt in default: 12.5% — #1,049 out of 2,934 counties

> Adults with at least a bachelor’s degree as of 2019: 30.5% — #514 out of 3,136 counties

40. St. Louis County, Minnesota

> Median student debt in default: $15,393

> Student loan holders with student debt in default: 10.5% — #1,511 out of 2,934 counties

> Adults with at least a bachelor’s degree as of 2019: 29.3% — #571 out of 3,136 counties

[in-text-ad]

39. Trumbull County, Ohio

> Median student debt in default: $15,440

> Student loan holders with student debt in default: 14.5% — #722 out of 2,934 counties

> Adults with at least a bachelor’s degree as of 2019: 18.7% — #1,722 out of 3,136 counties

38. Contra Costa County, California

> Median student debt in default: $15,492

> Student loan holders with student debt in default: 8.9% — #1,876 out of 2,934 counties

> Adults with at least a bachelor’s degree as of 2019: 42.4% — #140 out of 3,136 counties

37. Denton County, Texas

> Median student debt in default: $15,529

> Student loan holders with student debt in default: 8.2% — #2,045 out of 2,934 counties

> Adults with at least a bachelor’s degree as of 2019: 45.1% — #108 out of 3,136 counties

[in-text-ad-2]

36. Stark County, Ohio

> Median student debt in default: $15,559

> Student loan holders with student debt in default: 12.7% — #1,021 out of 2,934 counties

> Adults with at least a bachelor’s degree as of 2019: 22.8% — #1,113 out of 3,136 counties

35. Chester County, Pennsylvania

> Median student debt in default: $15,600

> Student loan holders with student debt in default: 6.2% — #2,419 out of 2,934 counties

> Adults with at least a bachelor’s degree as of 2019: 53.0% — #38 out of 3,136 counties

[in-text-ad]

34. Solano County, California

> Median student debt in default: $15,608

> Student loan holders with student debt in default: 9.3% — #1,791 out of 2,934 counties

> Adults with at least a bachelor’s degree as of 2019: 26.9% — #718 out of 3,136 counties

33. Jackson County, Missouri

> Median student debt in default: $15,609

> Student loan holders with student debt in default: 10.3% — #1,547 out of 2,934 counties

> Adults with at least a bachelor’s degree as of 2019: 31.6% — #452 out of 3,136 counties

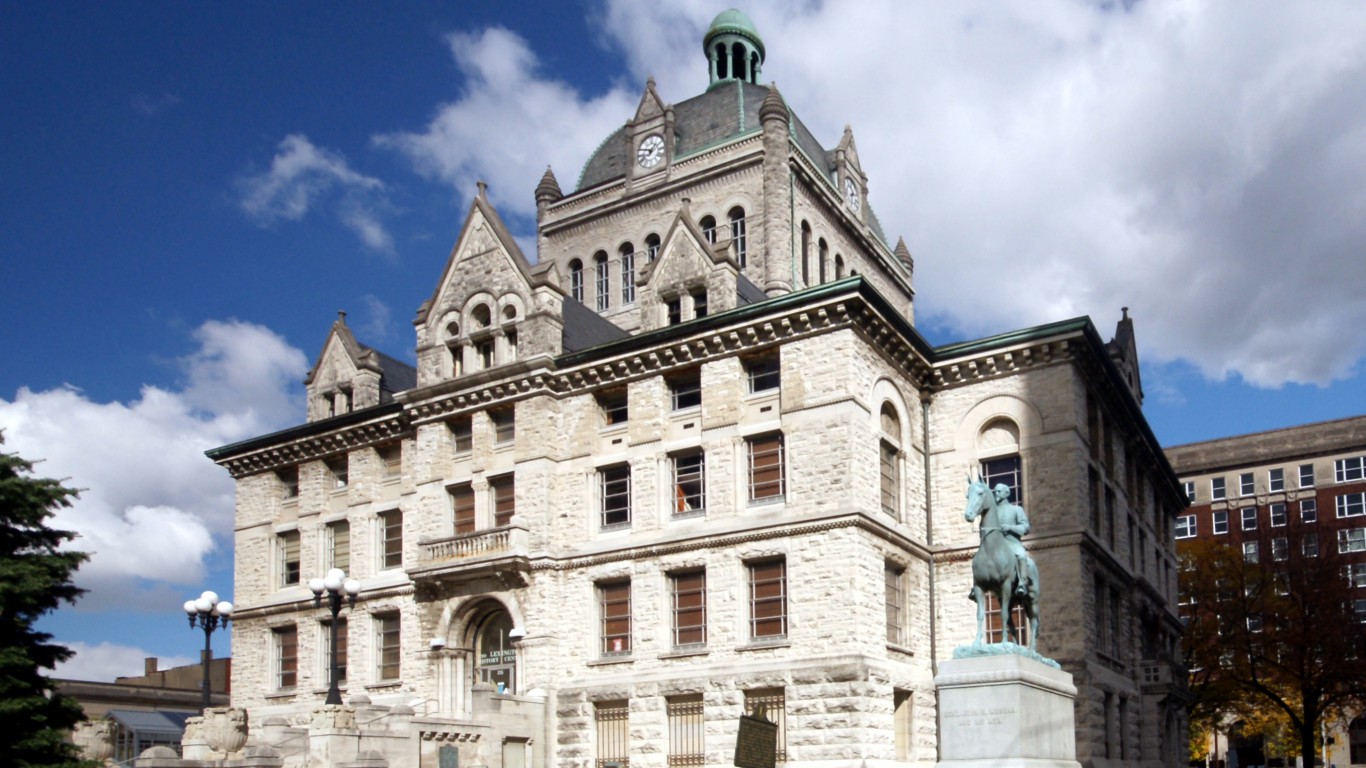

32. Fayette County, Kentucky

> Median student debt in default: $15,669

> Student loan holders with student debt in default: 9.8% — #1,674 out of 2,934 counties

> Adults with at least a bachelor’s degree as of 2019: 43.6% — #123 out of 3,136 counties

[in-text-ad-2]

31. Forsyth County, North Carolina

> Median student debt in default: $15,746

> Student loan holders with student debt in default: 9.2% — #1,807 out of 2,934 counties

> Adults with at least a bachelor’s degree as of 2019: 34.0% — #339 out of 3,136 counties

30. Burlington County, New Jersey

> Median student debt in default: $15,764

> Student loan holders with student debt in default: 7.0% — #2,289 out of 2,934 counties

> Adults with at least a bachelor’s degree as of 2019: 38.0% — #222 out of 3,136 counties

[in-text-ad]

29. Osceola County, Florida

> Median student debt in default: $15,891

> Student loan holders with student debt in default: 11.0% — #1,431 out of 2,934 counties

> Adults with at least a bachelor’s degree as of 2019: 21.8% — #1,242 out of 3,136 counties

28. Hillsborough County, New Hampshire

> Median student debt in default: $15,914

> Student loan holders with student debt in default: 6.6% — #2,352 out of 2,934 counties

> Adults with at least a bachelor’s degree as of 2019: 38.1% — #220 out of 3,136 counties

26. Mecklenburg County, North Carolina

> Median student debt in default: $15,991

> Student loan holders with student debt in default: 9.6% — #1,731 out of 2,934 counties

> Adults with at least a bachelor’s degree as of 2019: 45.4% — #105 out of 3,136 counties

[in-text-ad-2]

26. Suffolk County, Massachusetts

> Median student debt in default: $15,991

> Student loan holders with student debt in default: 8.0% — #2,087 out of 2,934 counties

> Adults with at least a bachelor’s degree as of 2019: 46.1% — #94 out of 3,136 counties

25. Morris County, New Jersey

> Median student debt in default: $16,034

> Student loan holders with student debt in default: 4.2% — #2,650 out of 2,934 counties

> Adults with at least a bachelor’s degree as of 2019: 54.1% — #34 out of 3,136 counties

[in-text-ad]

24. Cabarrus County, North Carolina

> Median student debt in default: $16,051

> Student loan holders with student debt in default: 9.3% — #1,785 out of 2,934 counties

> Adults with at least a bachelor’s degree as of 2019: 32.3% — #419 out of 3,136 counties

23. Delaware County, Indiana

> Median student debt in default: $16,096

> Student loan holders with student debt in default: 16.9% — #455 out of 2,934 counties

> Adults with at least a bachelor’s degree as of 2019: 23.7% — #996 out of 3,136 counties

22. Pueblo County, Colorado

> Median student debt in default: $16,143

> Student loan holders with student debt in default: 12.4% — #1,121 out of 2,934 counties

> Adults with at least a bachelor’s degree as of 2019: 21.8% — #1,252 out of 3,136 counties

[in-text-ad-2]

21. St. Louis city, Missouri

> Median student debt in default: $16,204

> Student loan holders with student debt in default: 14.5% — #732 out of 2,934 counties

> Adults with at least a bachelor’s degree as of 2019: 36.3% — #258 out of 3,136 counties

20. DeKalb County, Georgia

> Median student debt in default: $16,316

> Student loan holders with student debt in default: 13.4% — #906 out of 2,934 counties

> Adults with at least a bachelor’s degree as of 2019: 44.2% — #120 out of 3,136 counties

[in-text-ad]

19. Berrien County, Michigan

> Median student debt in default: $16,556

> Student loan holders with student debt in default: 12.4% — #1,117 out of 2,934 counties

> Adults with at least a bachelor’s degree as of 2019: 27.8% — #677 out of 3,136 counties

18. Placer County, California

> Median student debt in default: $16,608

> Student loan holders with student debt in default: 7.6% — #2,176 out of 2,934 counties

> Adults with at least a bachelor’s degree as of 2019: 39.7% — #191 out of 3,136 counties

17. Houston County, Georgia

> Median student debt in default: $16,742

> Student loan holders with student debt in default: 10.3% — #1,563 out of 2,934 counties

> Adults with at least a bachelor’s degree as of 2019: 28.3% — #639 out of 3,136 counties

[in-text-ad-2]

16. Westchester County, New York

> Median student debt in default: $17,061

> Student loan holders with student debt in default: 6.6% — #2,345 out of 2,934 counties

> Adults with at least a bachelor’s degree as of 2019: 48.9% — #72 out of 3,136 counties

15. Hays County, Texas

> Median student debt in default: $17,187

> Student loan holders with student debt in default: 10.8% — #1,452 out of 2,934 counties

> Adults with at least a bachelor’s degree as of 2019: 37.2% — #238 out of 3,136 counties

[in-text-ad]

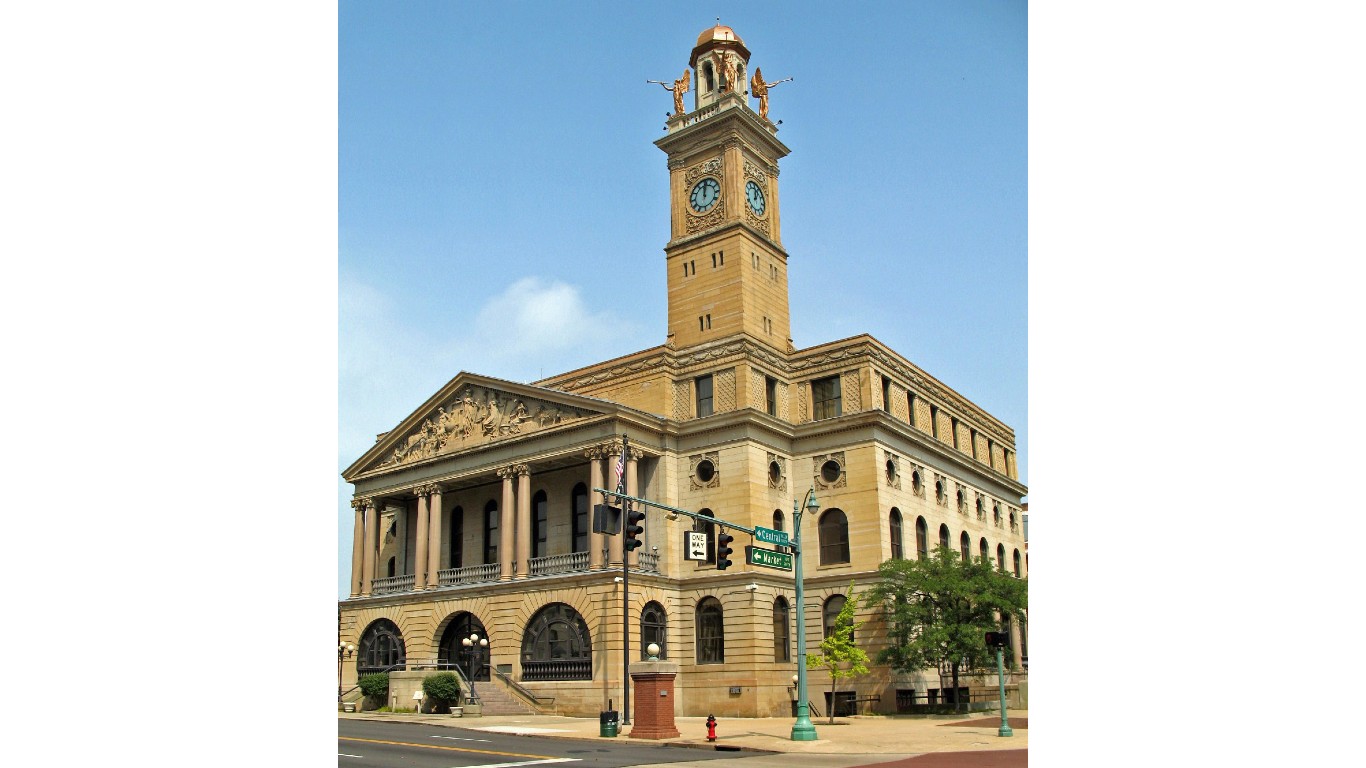

14. Mahoning County, Ohio

> Median student debt in default: $17,562

> Student loan holders with student debt in default: 13.0% — #986 out of 2,934 counties

> Adults with at least a bachelor’s degree as of 2019: 24.2% — #949 out of 3,136 counties

13. St. Charles County, Missouri

> Median student debt in default: $17,665

> Student loan holders with student debt in default: 6.6% — #2,353 out of 2,934 counties

> Adults with at least a bachelor’s degree as of 2019: 38.9% — #205 out of 3,136 counties

12. Saratoga County, New York

> Median student debt in default: $17,858

> Student loan holders with student debt in default: 6.8% — #2,316 out of 2,934 counties

> Adults with at least a bachelor’s degree as of 2019: 41.4% — #159 out of 3,136 counties

[in-text-ad-2]

11. Charleston County, South Carolina

> Median student debt in default: $17,999

> Student loan holders with student debt in default: 10.5% — #1,513 out of 2,934 counties

> Adults with at least a bachelor’s degree as of 2019: 43.6% — #125 out of 3,136 counties

10. Dorchester County, South Carolina

> Median student debt in default: $18,075

> Student loan holders with student debt in default: 12.2% — #1,150 out of 2,934 counties

> Adults with at least a bachelor’s degree as of 2019: 28.2% — #648 out of 3,136 counties

[in-text-ad]

9. Jefferson County, Colorado

> Median student debt in default: $18,252

> Student loan holders with student debt in default: 7.9% — #2,117 out of 2,934 counties

> Adults with at least a bachelor’s degree as of 2019: 45.2% — #107 out of 3,136 counties

8. Multnomah County, Oregon

> Median student debt in default: $18,942

> Student loan holders with student debt in default: 10.4% — #1,536 out of 2,934 counties

> Adults with at least a bachelor’s degree as of 2019: 45.9% — #97 out of 3,136 counties

7. Clay County, Missouri

> Median student debt in default: $19,183

> Student loan holders with student debt in default: 10.0% — #1,600 out of 2,934 counties

> Adults with at least a bachelor’s degree as of 2019: 33.2% — #374 out of 3,136 counties

[in-text-ad-2]

6. St. Johns County, Florida

> Median student debt in default: $19,291

> Student loan holders with student debt in default: 8.5% — #1,976 out of 2,934 counties

> Adults with at least a bachelor’s degree as of 2019: 44.7% — #114 out of 3,136 counties

5. Boone County, Missouri

> Median student debt in default: $19,350

> Student loan holders with student debt in default: 8.8% — #1,909 out of 2,934 counties

> Adults with at least a bachelor’s degree as of 2019: 46.1% — #93 out of 3,136 counties

[in-text-ad]

4. Washtenaw County, Michigan

> Median student debt in default: $19,730

> Student loan holders with student debt in default: 10.5% — #1,498 out of 2,934 counties

> Adults with at least a bachelor’s degree as of 2019: 55.9% — #26 out of 3,136 counties

3. Durham County, North Carolina

> Median student debt in default: $20,882

> Student loan holders with student debt in default: 9.4% — #1,783 out of 2,934 counties

> Adults with at least a bachelor’s degree as of 2019: 48.2% — #75 out of 3,136 counties

2. Howard County, Maryland

> Median student debt in default: $22,615

> Student loan holders with student debt in default: 5.9% — #2,469 out of 2,934 counties

> Adults with at least a bachelor’s degree as of 2019: 62.6% — #5 out of 3,136 counties

[in-text-ad-2]

1. York County, South Carolina

> Median student debt in default: $23,965

> Student loan holders with student debt in default: 8.8% — #1,908 out of 2,934 counties

> Adults with at least a bachelor’s degree as of 2019: 33.3% — #372 out of 3,136 counties

Take This Retirement Quiz To Get Matched With An Advisor Now (Sponsored)

Are you ready for retirement? Planning for retirement can be overwhelming, that’s why it could be a good idea to speak to a fiduciary financial advisor about your goals today.

Start by taking this retirement quiz right here from SmartAsset that will match you with up to 3 financial advisors that serve your area and beyond in 5 minutes. Smart Asset is now matching over 50,000 people a month.

Click here now to get started.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.

24/7 Wall St.

24/7 Wall St.

24/7 Wall St.

24/7 Wall St.

24/7 Wall St.

24/7 Wall St.

24/7 Wall St.

24/7 Wall St.