After the Supreme Court overturned the landmark abortion case of Roe v. Wade in June, Green Day lead singer Billie Joe Armstrong told London concertgoers that he was going to renounce his U.S. citizenship and move to England.

Armstrong is just the latest example of famous Americans who declare that they are leaving the United States for political reasons. Though most get over their pique and stay here, some famous Americans have abandoned their citizenship, for a variety of reasons. (One might be simply that the U.S. is not considered to be among the countries with the most valuable passports.)

24/7 Tempo has compiled a list of famous people who have renounced their American citizenship by reviewing sources including Tax-Expatriation, Britannica, and PBS.

After a record 6,705 Americans renounced their citizenship in 2020, the number dropped to 2,426 last year, though the lower number might be attributed to U.S. embassy closures amid the pandemic. According to a survey of U.S. expatriates in 121 countries from Greenback Expat Tax Services, about one in four American expats is “seriously considering” or “planning” to repudiate their U.S. citizenship. Critics of American tax law say U.S. global income tax compliance and disclosure laws are excessive and oppressive. (These are the countries with the most American expats.)

Renunciation is time-consuming and expensive. In September 2015, the U.S. State Department raised the fee to renounce U.S. citizenship to $2,350 from $450 to try and deter Americans overseas from rejecting citizenship.

Click here to see famous Americans who gave up their citizenship

Tax avoidance is the main reason actor Yul Brynner, entrepreneur Eduardo Saverin, and inventor Earl Tupper abandoned U.S. citizenship. Author Henry James, film director John Huston, and Eugene O’Neill’s daughter, Oona, stood on political principles to turn down U.S. citizenship. Ascension to a royal title triggered the renouncement of U.S. citizenship for Prince Albert II of Monaco and socialite Betty Hutton. Dancer Josephine Baker so disdained racism in the U.S. that she became a French citizen.

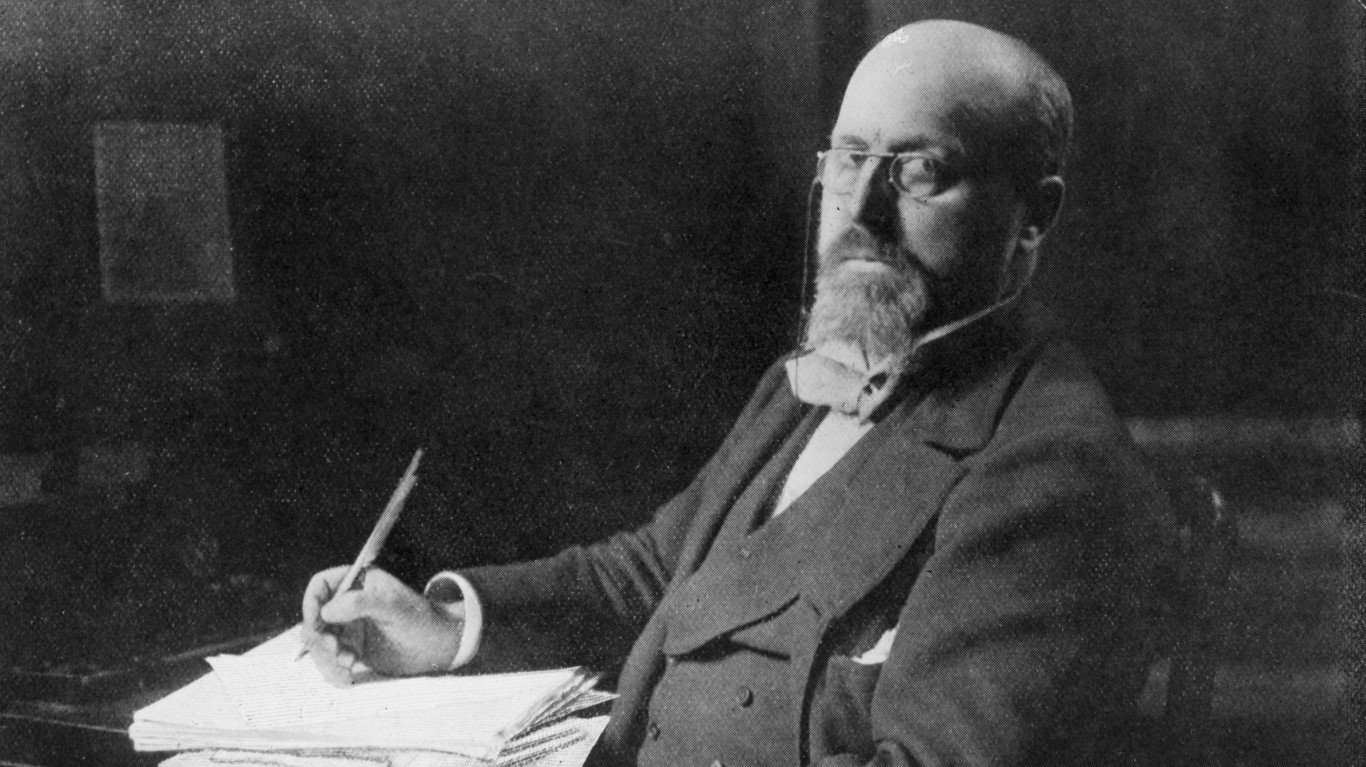

Henry James (1843-1916)

> Occupation: Writer

> Year citizenship renounced: 1915

Famed author Henry James, who wrote more than 20 novels (“The American,” “Daisy Miller,” “The Europeans”) and many short stories and novellas, shuttled between Europe and the United States during the 19th century. He was troubled by the materialism of his native country and eventually settled in England in 1876. James renounced U.S. citizenship in 1915 and became a British subject to protest American neutrality in WWI.

[in-text-ad]

T.S. Eliot (1888-1965)

> Occupation: Poet and playwright

> Year citizenship renounced: 1927

T.S. Eliot was one of the major poets and playwrights of the 20th century, with landmark works such as “The Love Song of J. Alfred Prufrock,” “The Wasteland,” and “Murder in the Cathedral.” The St. Louis-born Eliot moved to England in 1914 to study at Oxford University and focused on poetry and writing plays. He eventually renounced his American citizenship in 1927. Eliot decided to become a British subject because he was spending so much time in England and didn’t “like being a squatter.”

Josephine Baker (1906-1975)

> Occupation: Dancer

> Year citizenship renounced: 1937

Dancer Josephine Baker fled to Europe in the 1920s to escape racism in America. She became a sensation in Paris, performing as a member of an all-black revue at the Folies Bergère in 1925. She renounced her U.S. citizenship in 1937 out of her disgust for America’s treatment of African-Americans. Baker helped French Resistance efforts in WWII and later became involved in the American civil rights movement.

Barbara Hutton (1912-1979)

> Occupation: Socialite/philanthropist

> Year citizenship renounced: 1937

Barbara Hutton was a socialite and heiress, dubbed “Poor Little Rich Girl” in the press for her lavish debutante ball and her oftentimes loveless personal life (she was married seven times). The New York City native moved to Denmark in 1935 when she married Count Kurt von Haugwitz-Reventlow, and two years later renounced her U.S. citizenship to take the Danish citizenship of her husband.

[in-text-ad-2]

Oona O’Neill (1925-1991)

> Occupation: Actor

> Year citizenship renounced: 1954

Daughter of playwright Eugene O’Neill, Oona O’Neill married motion-picture icon Charlie Chaplin in 1943 when she was 18 and he was 54. In 1954, she renounced her U.S. citizenship and became a British subject after Chaplin had been denied re-entry to the United States two years earlier because he would not answer accusations of communist sympathies. O’Neill and Chaplin returned to the U.S. in 1972 when Chaplin accepted an honorary Academy Award.

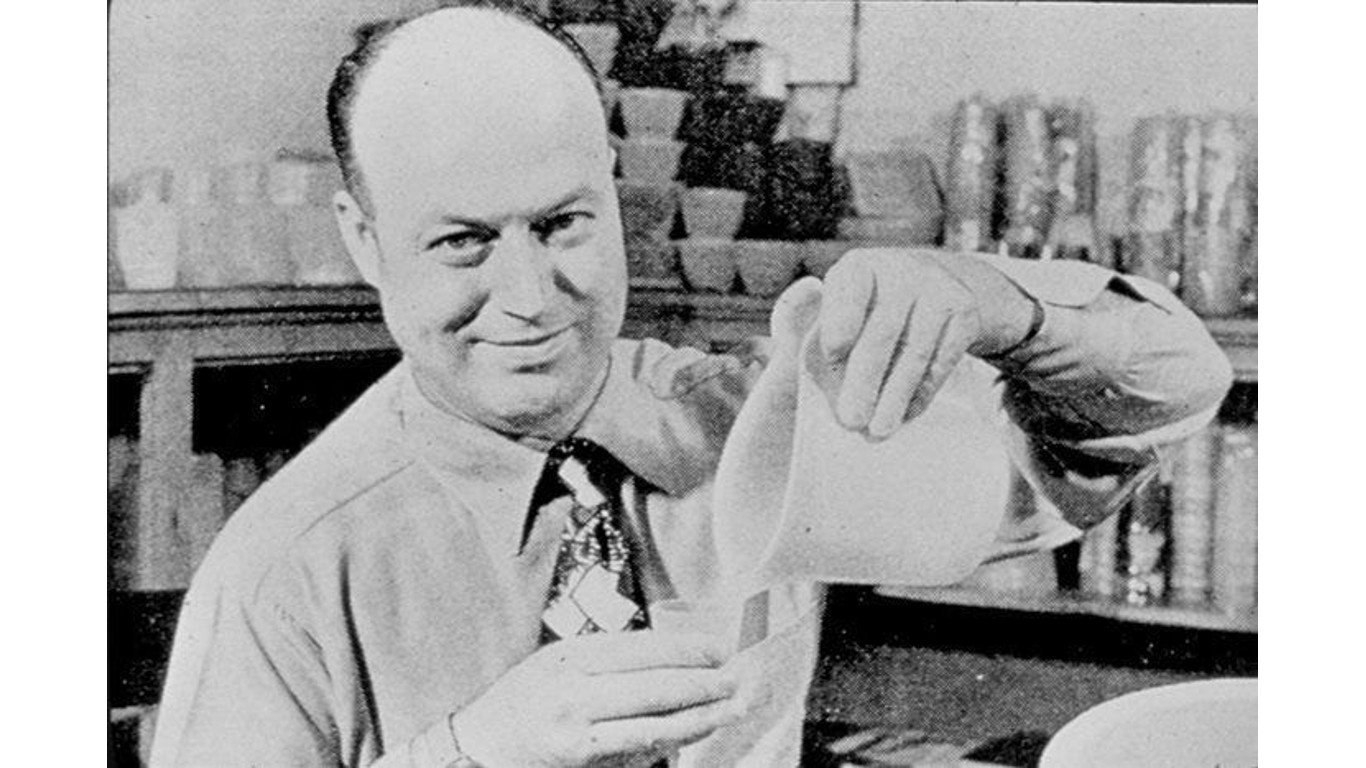

Earl Tupper (1907-1983)

> Occupation: Inventor

> Year citizenship renounced: Early 1960s

Those plastic containers of last night’s spaghetti and last week’s fajitas are the brainchild of Earl Tupper, the inventor of Tupperware. He came up with the idea for the airtight plastic containers during WWII, using a block of polyethylene provided by DuPont. Tupper called his creation the “wonderbowl.” In 1958, he sold the company to Justin Dart of the Rexall Drug Company for $16 million. Tupper eventually moved to Costa Rica and renounced his U.S. citizenship to avoid taxes.

[in-text-ad]

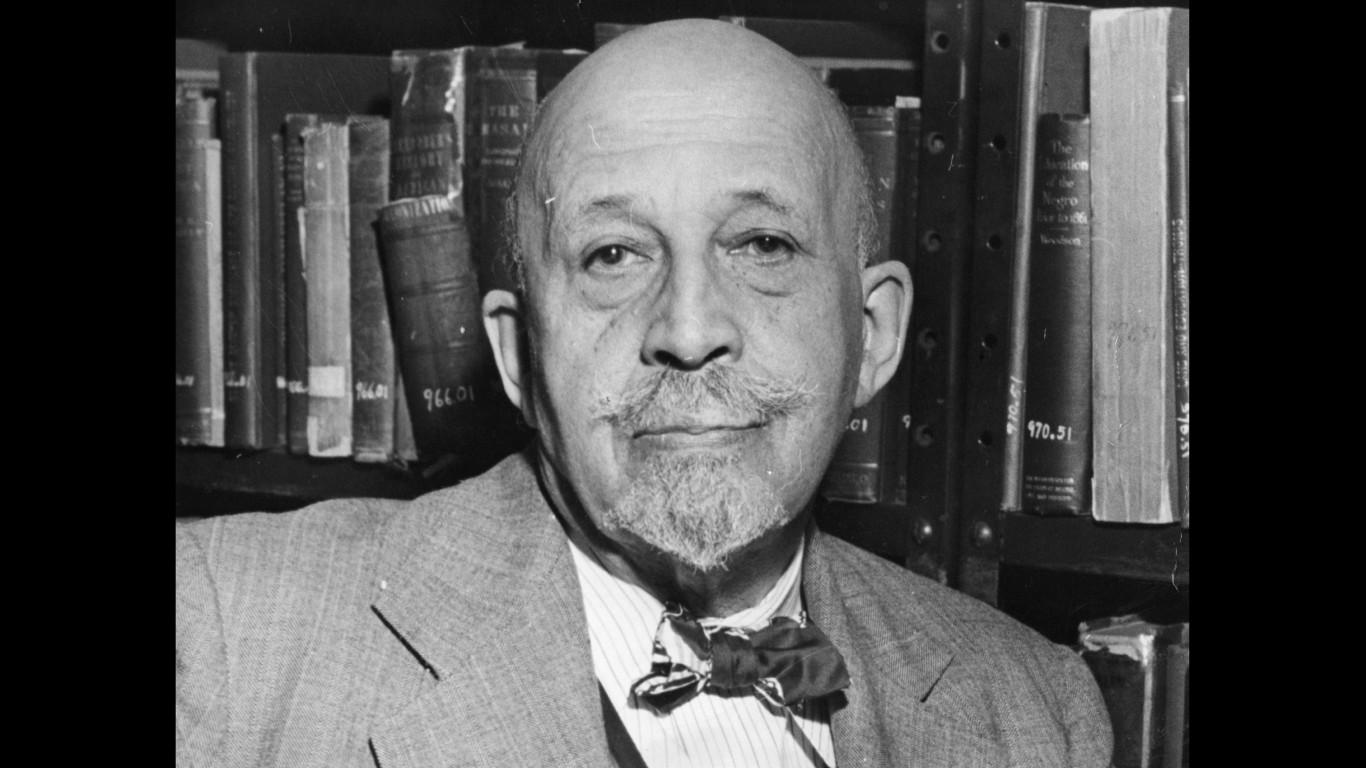

W.E.B. Du Bois (1868-1963)

> Occupation: Writer/civil rights activist

> Year citizenship renounced: 1963

W.E.B. Du Bois, an African-American sociologist, author,, and civil rights activist who espoused Pan-Africanism, moved to Ghana in 1961 at age 93 to manage the Encyclopedia Africana project. The U.S. State Department refused to renew his passport while he was living there, so Du Bois chose to naturalize as a citizen of Ghana in 1963. He died on Aug. 27, 1963, and his passing was noted the next day when Martin Luther King Jr. delivered his history-making “I Have a Dream” speech.

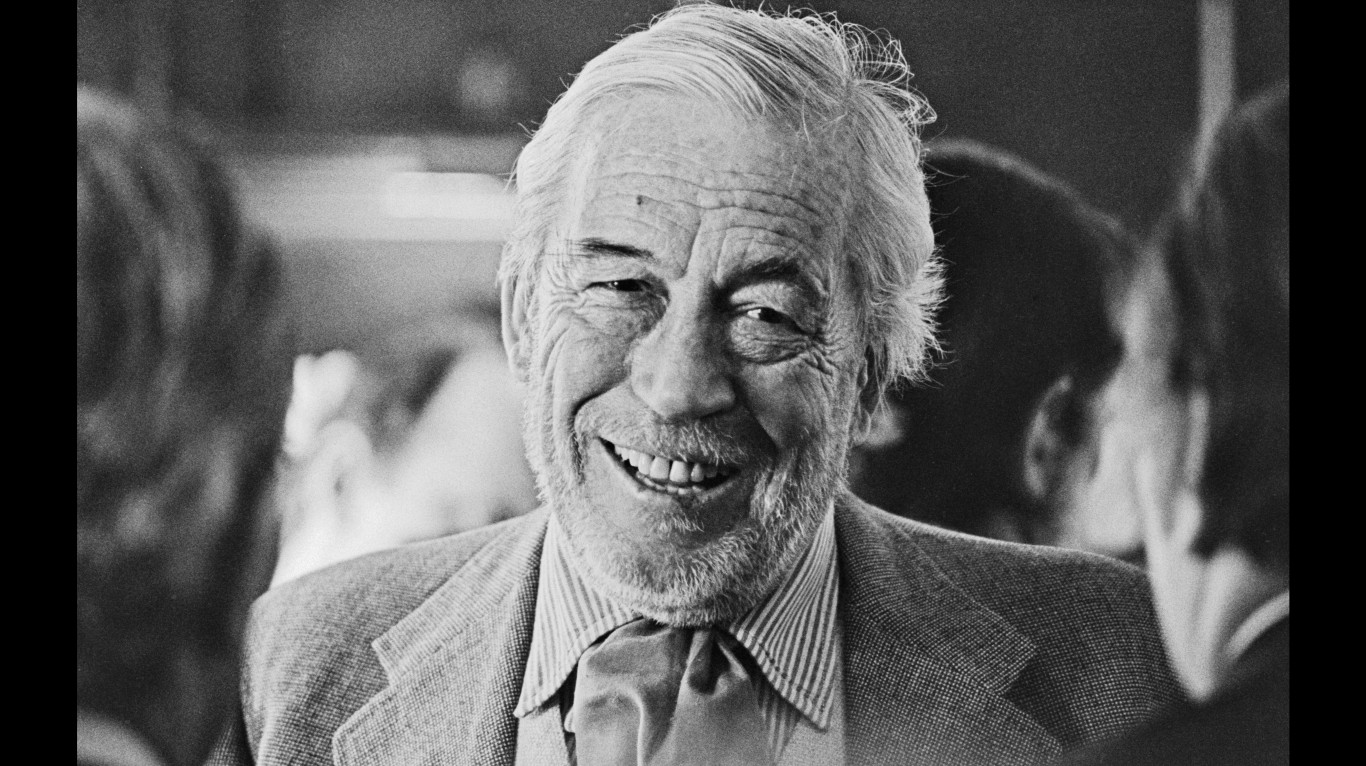

John Huston (1906-1987)

> Occupation: Filmmaker

> Year citizenship renounced: 1964

John Huston, the Academy Award-winning director (“The Treasure of Sierra Madre”) whose notable films include “The Maltese Falcon” “Key Largo,” and “The Asphalt Jungle,” emigrated to Ireland in 1952 in protest over the activities of the House Committee on Un-American Activities. He renounced his U.S. citizenship in 1964 to become an Irish citizen.

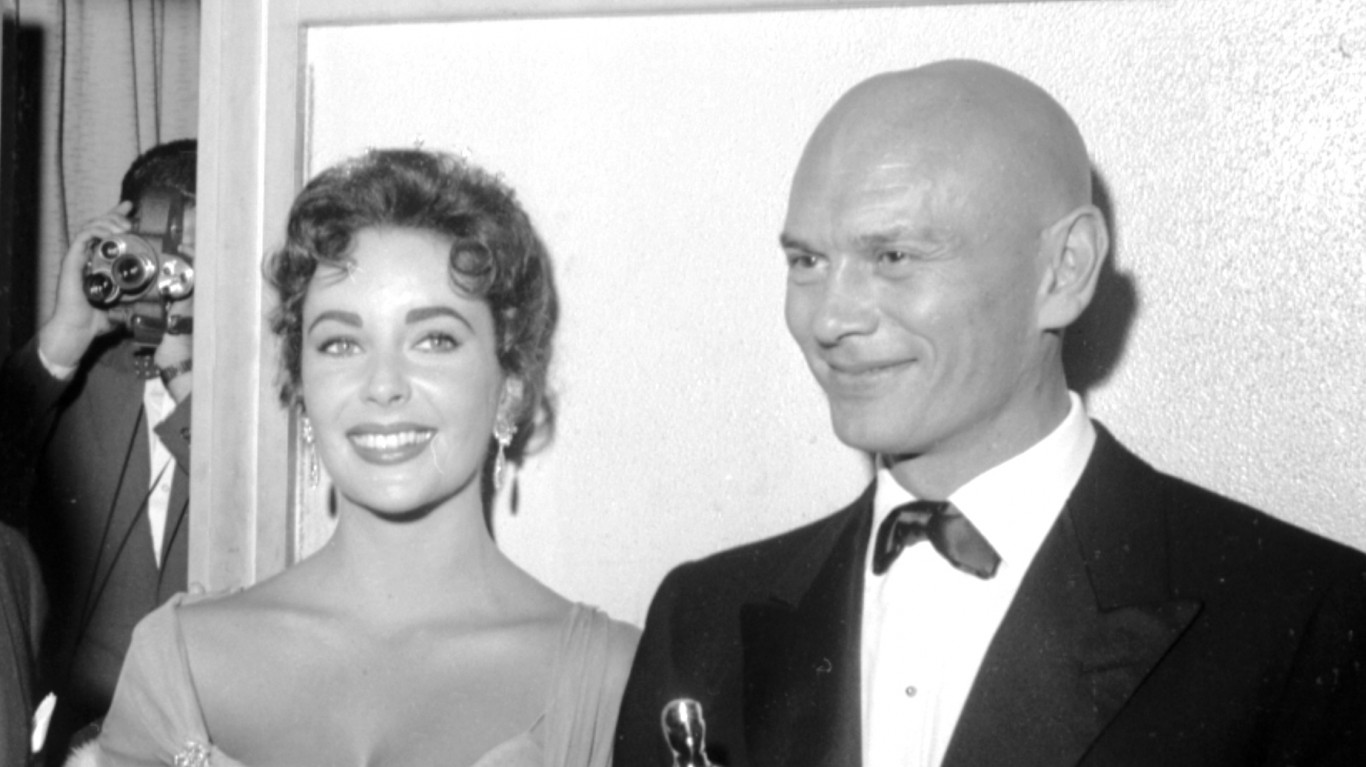

Yul Brynner (1920-1985)

> Occupation: Actor

> Year citizenship renounced: 1965

Russian-born Yul Brynner, famed for his roles as the Siamese monarch in “The King and I,” and the vengeful pharaoh in “The Ten Commandments,” was a dual citizen of Switzerland and the United States, though he lived outside the U.S. for most of his adult life. Brynner claimed tax-exempt status in the U.S. by working on short projects that didn’t subject him to American tax law. The U.S. government disagreed and wanted to impose penalties that probably would have bankrupted him. To avoid the tax hit, he renounced his U.S. citizenship.

[in-text-ad-2]

Maria Callas (1923-1977)

> Occupation: Opera singer

> Year citizenship renounced: 1966

Opera diva Maria Callas, who was a naturalized American citizen, chose to renounce her U.S. citizenship to resume her ancestral Greek citizenship. She chose to do so in part to get out of her marriage to Italian industrialist Gianni Meneghini. News reports at the time said Callas had tried to obtain a divorce for seven years. It was during that period that she was having an affair with Greek shipping tycoon Aristotle Onassis. Callas said that according to her lawyers, by taking Greek nationality, her marriage would become “non-existent” everywhere, except in Italy.

Elizabeth Taylor (1932-2011)

> Occupation: Actor

> Year citizenship renounced: 1966

The story of Elizabeth Taylor’s American citizenship has lots of twists and turns. She was born in the United Kingdom to American parents, both art dealers, and received derivative U.S. citizenship through them. The family returned to the U.S. at the start of WWII and settled in Los Angeles, where Taylor began her storied career that would lead to two Academy Awards. For unknown reasons, she tried to renounce her citizenship in the mid-1960s. She failed in her first attempt before succeeding in 1966. Eleven years later, Taylor reportedly reacquired her U.S. citizenship while she was married to politician John Warner, the seventh of her eight husbands.

[in-text-ad]

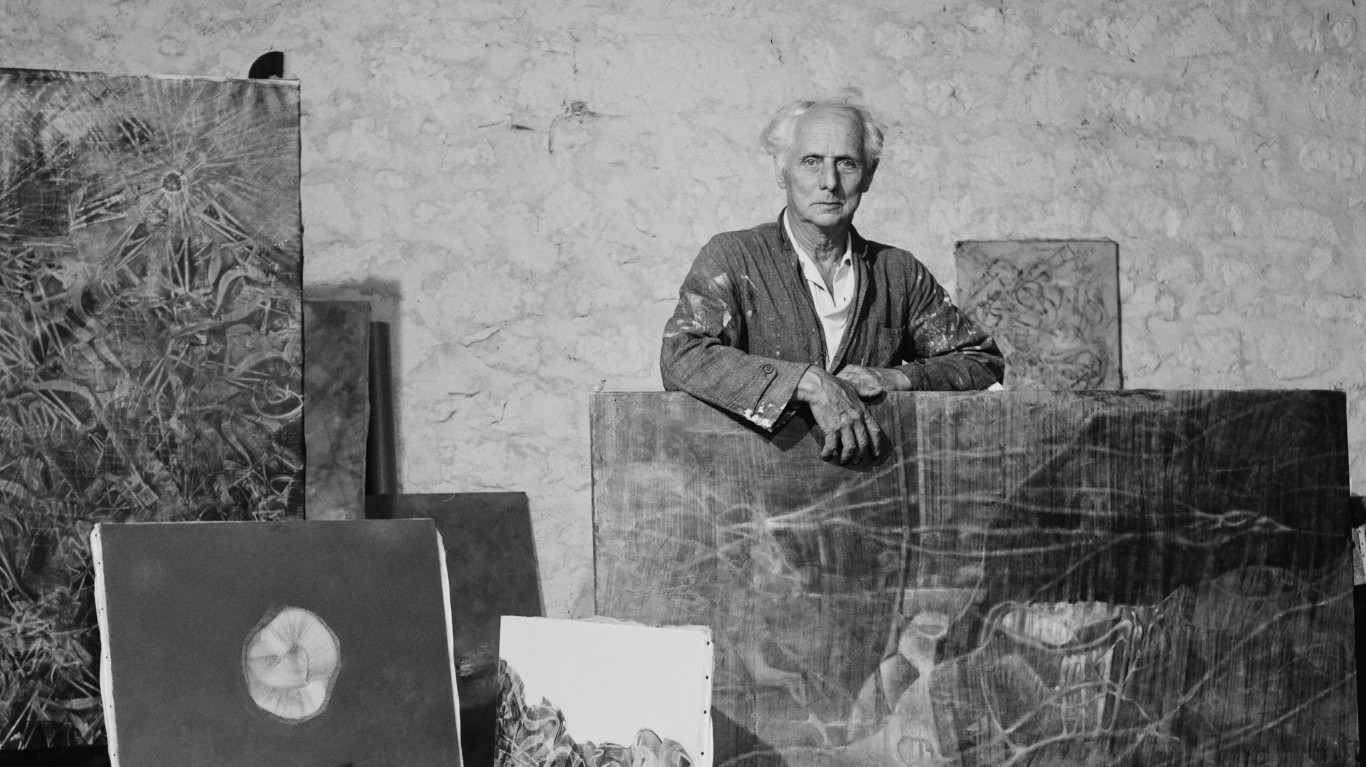

Max Ernst (1891-1976)

> Occupation: Artist

> Year citizenship renounced: 1968

Max Ernst was one of the most influential artists of the 20th century and a founder of the surrealist movement. He was born in Germany and fought in WWI, and the trauma of that conflict greatly influenced his artistic vision. In 1941, Ernst was living in Paris and fled the Nazi occupation of France to came to the U.S. He married gallery owner and socialite Peggy Guggenheim and became a naturalized U.S. citizen. They divorced in 1946, and four years later Ernst returned to France. He gave up his U.S. citizenship in 1958 and became a French citizen.

John Templeton (1912-2008)

> Occupation: Banker/investor

> Year citizenship renounced: 1968

Banker and financier John Templeton founded the Templeton Growth Fund. He was once called by Money magazine “the greatest global stock picker of the century” and was a pioneer in foreign investing. Templeton renounced his U.S. citizenship in 1968, before he sold his company to Franklin Resources, and moved to the Bahamas. He said he emigrated to avoid pressure from Wall Street so he could make clearer investment decisions. Bahamians don’t pay income or investment tax.

Christina Onassis (1950-1988)

> Occupation: Businesswoman

> Year citizenship renounced: 1975

Christina Onassis was the heiress to the Onassis family shipping empire (and the step-daughter of former first lady Jackie Kennedy). She renounced her U.S. citizenship after her father died and donated the American portion of her inheritance to the American Hospital of Paris. After that she was a dual citizen of Greece and Argentina.

[in-text-ad-2]

Albert II, Prince of Monaco (1958-)

> Occupation: Monarch

> Year citizenship renounced: 1979

In 1979, when he was 21, Albert II, Prince of Monaco gave up his American citizenship. He had inherited it from his mother, Hollywood icon Grace Kelly. As a sovereign of another country, he could not hold U.S. citizenship, too.

Ted Arison (1924-1999)

> Occupation: Businessman

> Year citizenship renounced: 1990

Born in Tel Aviv, Israel, Ted Arison moved to the U.S. in the early 1950s and co-founded Carnival Cruises. He moved back to Israel in 1990 and gave up his U.S. citizenship as a way to avoid paying taxes on his estate.

[in-text-ad]

Shere Hite (1942-2020)

> Occupation: Author

> Year citizenship renounced: 1995

Shere Hite was a pioneering sex researcher who was seen as a feminist hero in the 1970s. Because of her research and book, The Hite Report, both seen as controversial at the time, she was a subject of intense criticism and death threats. She moved to Germany and the U.K., eventually renouncing her American citizenship in 1995.

Kenneth Dart (1955-) / Robert Dart (1958-)

> Occupation: Businessmen

> Year citizenship renounced: mid-1990s

Kenneth Dart is an heir to the Dart Container foam cup business. He renounced his American citizenship in 1994 when he obtained citizenship from Belize and later moved to the tax haven of the Cayman Islands. Kenneth’s brother, Robert, holds Belizean and Irish citizenship and lives in London.

Terry Gilliam (1940-)

> Occupation: Filmmaker

> Year citizenship renounced: 2006

The esteemed American director, who helped form the legendary group Monty Python, held dual citizenship for three decades after marrying a British citizen. In 2006, he gave up his American citizenship because he doesn’t live in the U.S. anymore and “got tired of [his] taxes paying for exciting little wars around the world.”

[in-text-ad-2]

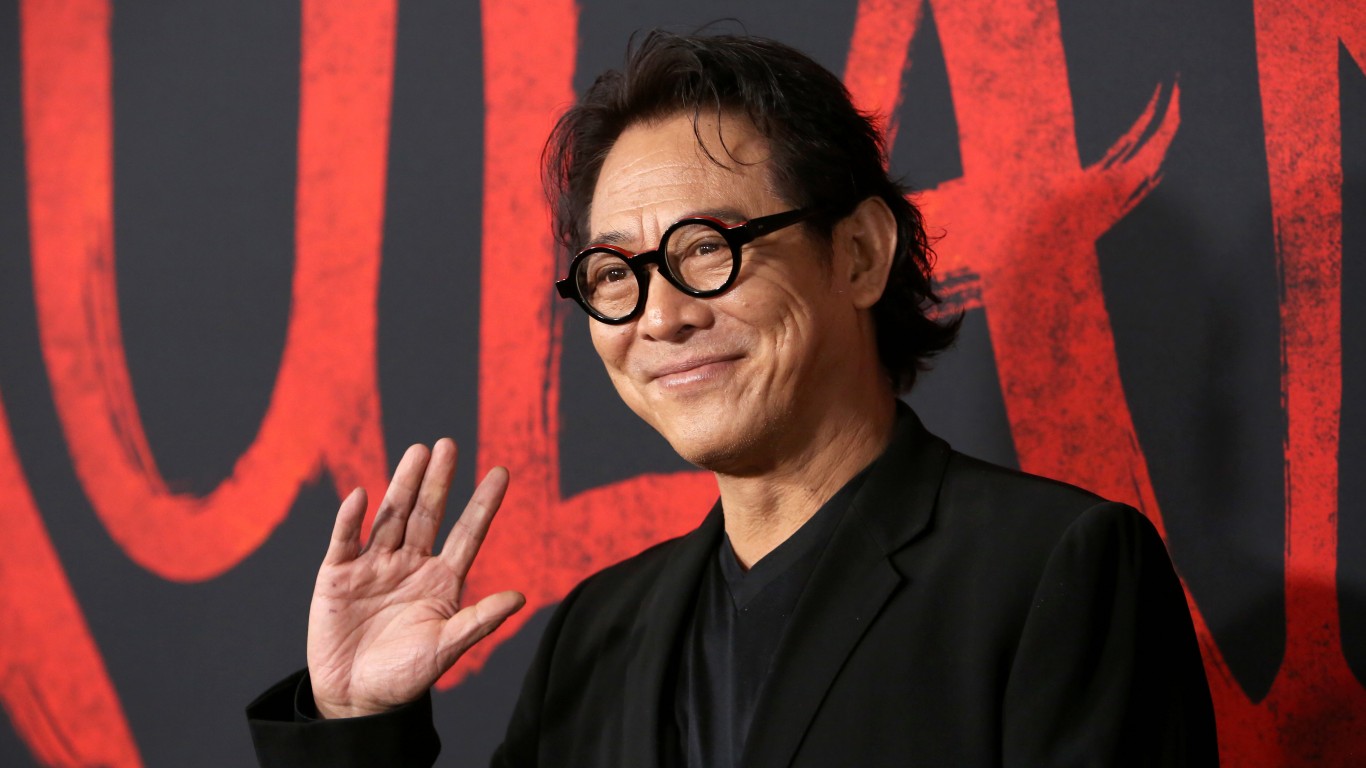

Jet Li (1963-)

> Occupation: Actor

> Year citizenship renounced: 2009

Born in Beijing, the famous action star’s first American movie was “Lethal Weapon 4,” which was released in 1998. Li became a U.S. citizen five years later. In 2009, he became a naturalized citizen of Singapore. He had to renounce his American citizenship because the city-state does not allow dual citizenship. Another reason is Singapore’s school system. Li considered it superior to the American one and wanted his two daughters to grow up bilingual.

Denise Rich (1944-)

> Occupation: Singer

> Year citizenship renounced: 2011

The Grammy-nominated singer, former wife of pardoned billionaire trader Marc Rich, and wealthy socialite gave up his U.S. citizenship in 2011 and has lived in London ever since. The move is largely believed to be to avoid a hefty U.S. tax bill on her estate. She is also a citizen of Austria.

[in-text-ad]

Eduardo Saverin (1982-)

> Occupation: Entrepreneur

> Year citizenship renounced: 2011

Eduardo Saverin, whom people know as the Facebook co-founder who fell out with Mark Zuckerberg, as seen in the movie “The Social Network,” renounced his U.S. citizenship ahead of the company’s IPO launch in 2011. At the time, he owned 4% of the social giant and would have had to pay a lot of money in taxes. Born in Brazil, he is now a resident of Singapore.

Tina Turner (1939-)

> Occupation: Singer

> Year citizenship renounced: 2013

Tina Turner became a Swiss citizen in 2013. The Tennessee native relinquished her American citizenship because, she said at the time, she had lived in Switzerland for 20 years, was happy there, and could not imagine a better place to live.

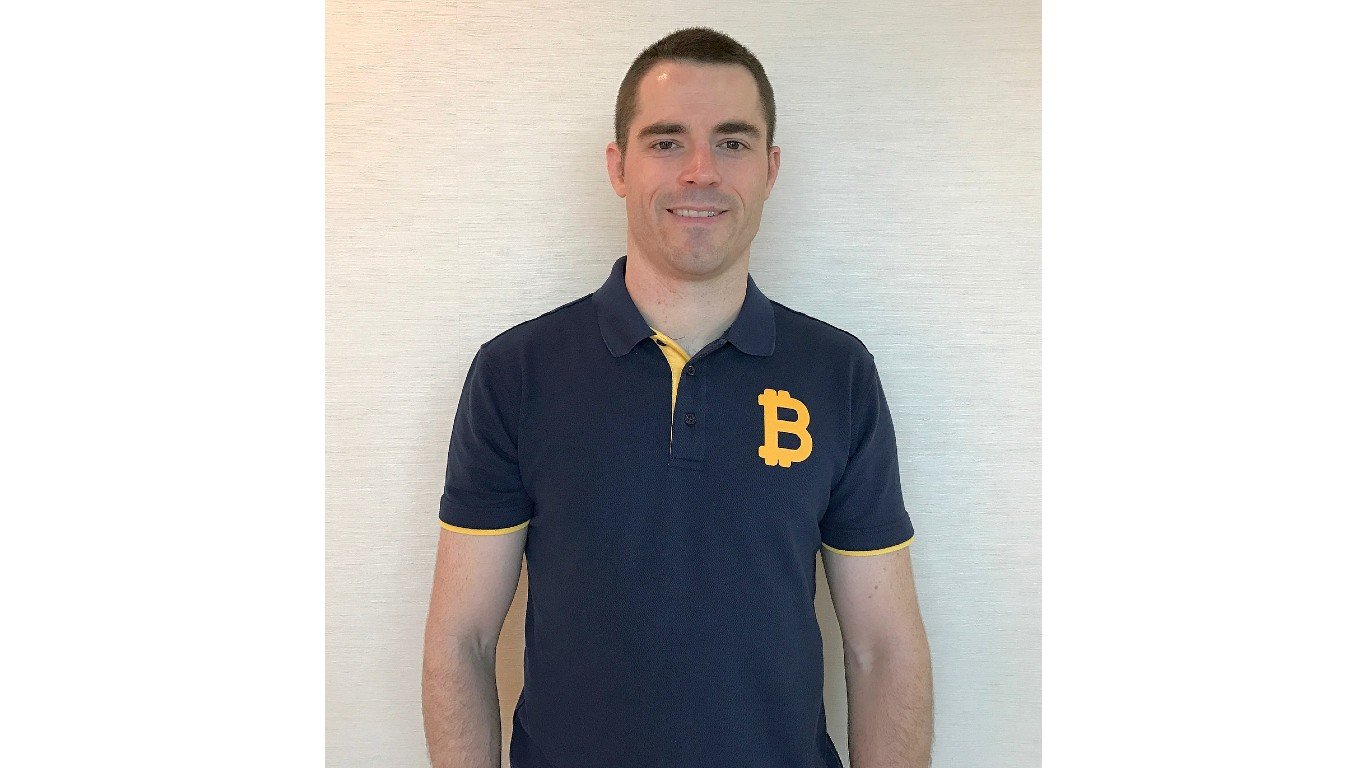

Roger Ver (1979-)

> Occupation: Investor

> Year citizenship renounced: 2014

Bitcoin entrepreneur and activist Roger Ver renounced his citizenship in 2014 for reasons, he said, that have nothing to do with taxes. One reason he does point out is the fact that he went to federal prison. (He served 10 months in prison in 2005 for selling explosives like fireworks on eBay.) He has obtained citizenship of the Caribbean country Saint Kitts and Nevis.

[in-text-ad-2]

Boris Johnson (1964-)

> Occupation: Politician

> Year citizenship renounced: 2016

The current prime minister of Great Britain was born in New York City. His family moved across the pond when he was 5 and he had held dual citizenship since then. In 2016, Johnson gave up his American passport. Though he has not spoken out about the specific reasons for the move, many believe he just didn’t want to pay taxes in the U.S. American citizens and dual citizens are required to pay American taxes on income received anywhere in the world.

Sponsored: Want to Retire Early? Here’s a Great First Step

Want retirement to come a few years earlier than you’d planned? Or are you ready to retire now, but want an extra set of eyes on your finances?

Now you can speak with up to 3 financial experts in your area for FREE. By simply clicking here you can begin to match with financial professionals who can help you build your plan to retire early. And the best part? The first conversation with them is free.

Click here to match with up to 3 financial pros who would be excited to help you make financial decisions.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.

24/7 Wall St.

24/7 Wall St. 24/7 Wall St.

24/7 Wall St.

24/7 Wall St.

24/7 Wall St.