For the first time in history, the world spent more than $2 trillion on its militaries in 2021. Most of that came from the $801 billion the United States spent on defense, more than the $777 billion spent by the next nine countries combined.

With such a massive budget, the U.S. also has the world’s largest domestic defense industry, which includes large, well-established names such as Lockheed Martin, Raytheon Technologies, Boeing, Northrop Grumman, General Dynamics, and many more. But what about the rest of the world’s largest weapons makers and military services providers? (These are the companies profiting the most from war.)

To determine the 25 largest arms-producing and military services companies outside of the U.S., 24/7 Wall St. reviewed data from the report “The SIPRI Top 100 Arms-producing and Military Services Companies, 2021,” published by the Stockholm International Peace Research Institute. Defense contractors headquartered outside of the U.S. were ranked based on arms-related revenue in 2021. Data on total revenue also came from SIPRI. All of these companies also generate revenue from non-military enterprises.

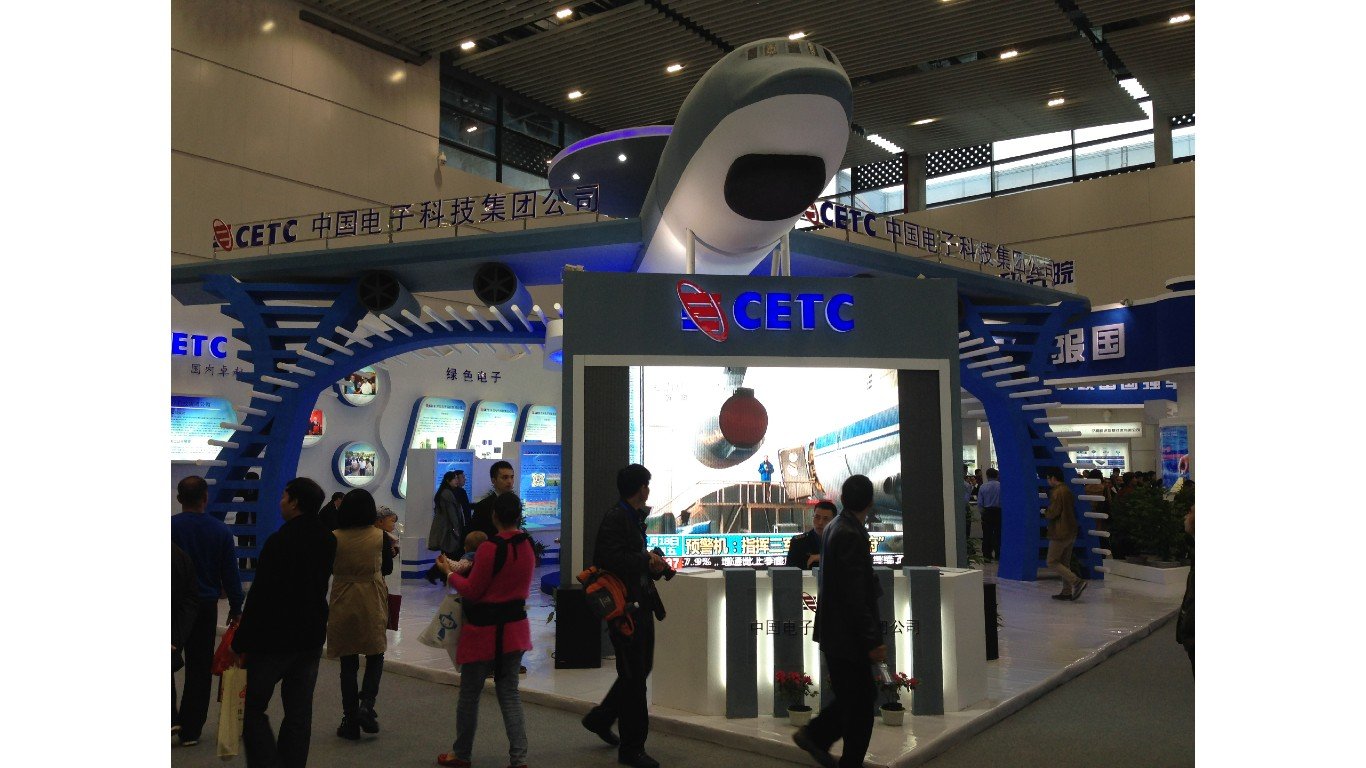

Out of the 25 companies on the list, seven are Chinese state-owned enterprises. They include the China State Shipbuilding Corporation and China Electronics Technology Group Corporation, which provides IT infrastructure and electronic hardware to civilian and military enterprises. CETC was among several Chinese companies the U.S. sanctioned in 2020 for its involvement in building artificial islands in the South China Sea as part of China’s efforts to assert military maritime dominance in the region.

Six of the top 25 largest defense contractors outside the U.S. are based in France. Two of these companies – European missile manufacturer MBDA and aerospace engine-maker Safran – are also among the world’s fastest growing. Three of the 25 companies on the list are Russian: Tactical Missiles Corporation, United Shipbuilding Corporation, and United Aircraft Corporation. (Here are countries with the strongest military might.)

The share of arms sales to total revenue varies widely. For instance, European aircraft manufacturer Airbus is the world’s ninth-largest defense contractor based on 2021 arms-related revenue of $10.9 billion, but the company generated total revenue of nearly $62 billion that year, mostly from the sale of commercial aircraft. Meanwhile, for six companies on this list, arms-related revenue accounted for at least 90% of total revenue in 2021, including three that generated almost 100% of their 2021 revenue from arms sales.

Three defense contractors raked in more than $20 billion in sales that year: two Chinese-based companies – Aviation Industry Corporation of China and NORINCO – and the U.K.’s BAE Systems.

Here are the largest defense contractors outside of the United States.

25. Hindustan Aeronautics

> Arms-related revenue, 2021: $3.3 billion (95.2% of total revenue)

> Total revenue, 2021: $3.5 billion

> Headquarters: Bangalore, India

[in-text-ad]

24. Israel Aerospace Industries

> Arms-related revenue, 2021: $3.9 billion (86.4% of total revenue)

> Total revenue, 2021: $4.5 billion

> Headquarters: Lod, Israel

23. Tactical Missiles Corporation

> Arms-related revenue, 2021: $4.0 billion (98.0% of total revenue)

> Total revenue, 2021: $4.1 billion

> Headquarters: Korolyov, Russia

22. United Shipbuilding Corporation

> Arms-related revenue, 2021: $4.0 billion (79.0% of total revenue)

> Total revenue, 2021: $5.1 billion

> Headquarters: Moscow, Russia

[in-text-ad-2]

21. Mitsubishi Heavy Industries

> Arms-related revenue, 2021: $4.1 billion (11.5% of total revenue)

> Total revenue, 2021: $35.2 billion

> Headquarters: Tokyo, Japan

20. Saab

> Arms-related revenue, 2021: $4.1 billion (89.6% of total revenue)

> Total revenue, 2021: $4.6 billion

> Headquarters: Trollhättan, Sweden

[in-text-ad]

19. United Aircraft Corporation

> Arms-related revenue, 2021: $4.5 billion (70.0% of total revenue)

> Total revenue, 2021: $6.4 billion

> Headquarters: Moscow, Russia

18. Rheinmetall

> Arms-related revenue, 2021: $4.5 billion (66.5% of total revenue)

> Total revenue, 2021: $6.7 billion

> Headquarters: Düsseldorf, Germany

17. Naval Group

> Arms-related revenue, 2021: $4.7 billion (98.9% of total revenue)

> Total revenue, 2021: $4.8 billion

> Headquarters: Paris, France

[in-text-ad-2]

16. Elbit Systems

> Arms-related revenue, 2021: $4.8 billion (90.0% of total revenue)

> Total revenue, 2021: $5.3 billion

> Headquarters: Haifa, Israel

15. MBDA

> Arms-related revenue, 2021: $5.0 billion (99.1% of total revenue)

> Total revenue, 2021: $5.0 billion

> Headquarters: Paris, France

[in-text-ad]

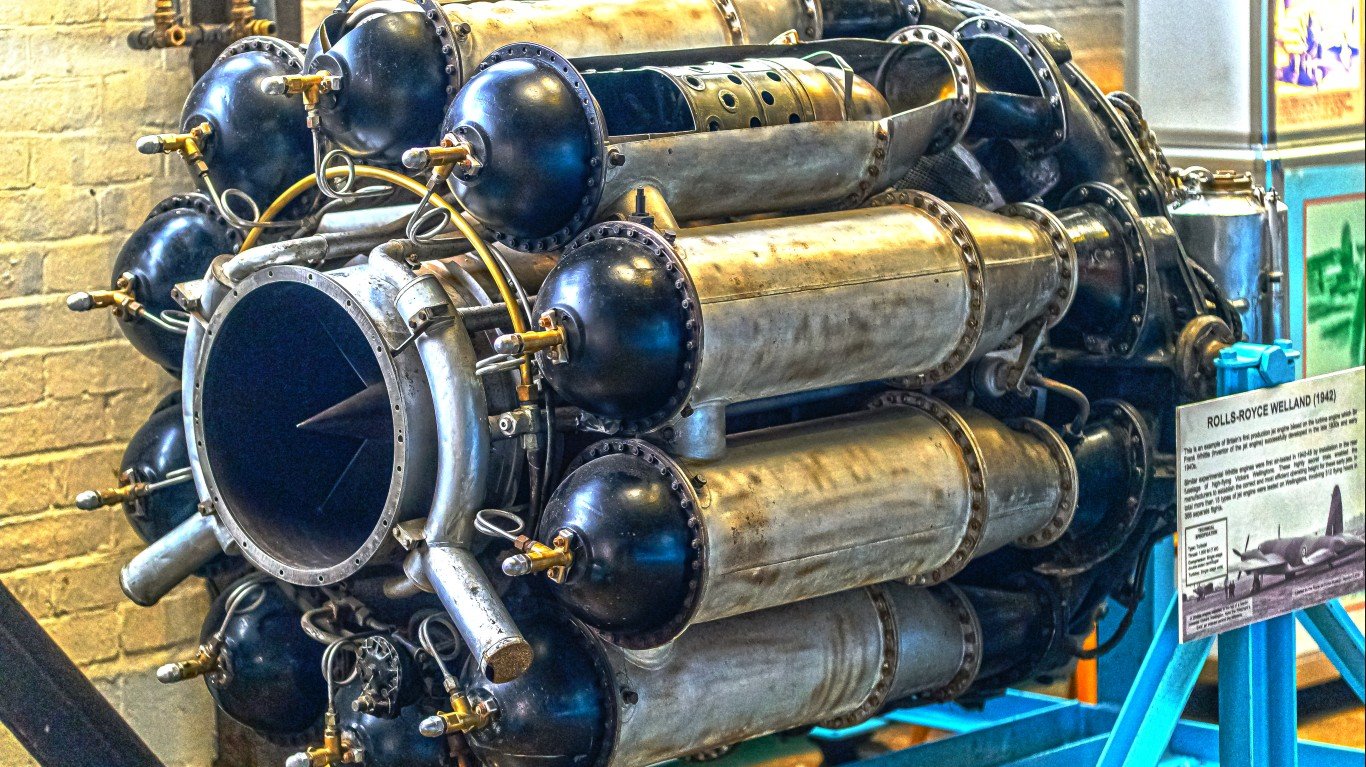

14. Rolls-Royce

> Arms-related revenue, 2021: $5.0 billion (33.0% of total revenue)

> Total revenue, 2021: $15.1 billion

> Headquarters: London, United Kingdom

13. Safran

> Arms-related revenue, 2021: $5.1 billion (28.0% of total revenue)

> Total revenue, 2021: $18.0 billion

> Headquarters: Paris, France

12. China South Industries Group

> Arms-related revenue, 2021: $5.9 billion (13.3% of total revenue)

> Total revenue, 2021: $44.4 billion

> Headquarters: Beijing, China

[in-text-ad-2]

11. Dassault Aviation Group

> Arms-related revenue, 2021: $6.3 billion (73.1% of total revenue)

> Total revenue, 2021: $8.6 billion

> Headquarters: Paris, France

10. Thales

> Arms-related revenue, 2021: $9.8 billion (51.0% of total revenue)

> Total revenue, 2021: $19.1 billion

> Headquarters: Paris, France

[in-text-ad]

9. Airbus

> Arms-related revenue, 2021: $10.9 billion (17.6% of total revenue)

> Total revenue, 2021: $61.7 billion

> Headquarters: Leiden, Netherlands

8. China State Shipbuilding Corporation

> Arms-related revenue, 2021: $11.1 billion (20.9% of total revenue)

> Total revenue, 2021: $53.2 billion

> Headquarters: Shanghai, China

7. Leonardo

> Arms-related revenue, 2021: $13.9 billion (83.0% of total revenue)

> Total revenue, 2021: $16.7 billion

> Headquarters: Rome, Italy

[in-text-ad-2]

6. China Aerospace Science and Industry Corporation

> Arms-related revenue, 2021: $14.5 billion (31.5% of total revenue)

> Total revenue, 2021: $46.1 billion

> Headquarters: Beijing, China

5. China Electronics Technology Group Corporation

> Arms-related revenue, 2021: $15.0 billion (27.0% of total revenue)

> Total revenue, 2021: $55.4 billion

> Headquarters: Beijing, China

[in-text-ad]

4. China Aerospace Science and Technology Corporation

> Arms-related revenue, 2021: $19.1 billion (44.0% of total revenue)

> Total revenue, 2021: $43.4 billion

> Headquarters: Beijing, China

3. Aviation Industry Corporation of China

> Arms-related revenue, 2021: $20.1 billion (25.0% of total revenue)

> Total revenue, 2021: $80.4 billion

> Headquarters: Beijing, China

2. NORINCO

> Arms-related revenue, 2021: $21.6 billion (26.4% of total revenue)

> Total revenue, 2021: $81.6 billion

> Headquarters: Beijing, China

[in-text-ad-2]

1. BAE Systems

> Arms-related revenue, 2021: $26.0 billion (96.9% of total revenue)

> Total revenue, 2021: $26.9 billion

> Headquarters: London, United Kingdom

Essential Tips for Investing: Sponsored

A financial advisor can help you understand the advantages and disadvantages of investment properties. Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

Investing in real estate can diversify your portfolio. But expanding your horizons may add additional costs. If you’re an investor looking to minimize expenses, consider checking out online brokerages. They often offer low investment fees, helping you maximize your profit.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.

24/7 Wall St.

24/7 Wall St.