Amazon is considered one of the best-run companies in the world with an all-encompassing business model, but it did not get there without a few missteps along the way. Originally the brainchild of Jeff Bezos, Amazon got its start in 1995 selling books online and later expanded into selling CDs and videos. With time, all of these mediums have found technologically superior substitutes, and Amazon has pivoted with the market as well.

If Amazon would have stuck with just selling books, CDs, and videos online, the company would now be defunct, or at least in a perilous circumstance. However, Bezos saw new products and trends in the market and incorporated them into Amazon’s business model. Perhaps one of the best pivots and investments Amazon has ever made was in 2006 with Amazon Web Services, which is now one of the largest cloud-computing services in the world. (These companies control over 50% of their industry.)

Of course, not every investment Amazon made panned out as well as AWS. There were in fact some big losers in the process. To find the biggest investments/acquisitions/business decisions blunders that Amazon made over the last decade, 24/7 Wall St. reviewed several media sources, including Business Insider, Failory, and GoBankingRates. This list, which is ordered by the date a service or company was shuttered, is far from comprehensive.

One of the biggest industry disruptors over the last decade has come in the form of electric vehicles. Other industries that have been changing have been health care, gaming, and more. Amazon has reached into these markets to varying degrees, but the results have not always been as expected.

In fact, Amazon’s most recently reported annual loss of $2.7 billion – its first unprofitable year since 2014 and a record annual loss for the company – came after Amazon bought a sizable stake in Rivian. The past year, the EV maker has consistently struggled with production, parts, and supply chain problems, resulting in Rivian’s stock price plummeting. With Amazon owning about 17% of Rivian, the investment cost the company $2.3 billion in the most recent quarter. (These are 13 biggest electric vehicle business failures in American history.)

Click here to see the worst investments made by Amazon.

Amazon WebPay

> Years operating: 2009-2014

> Business: finances

Amazon introduced its WebPay to compete with services like Venmo, allowing individuals to exchange funds. It was shuttered in October 2014 in the wake of poor adoption. The service would eventually be retooled and rebranded as Amazon Pay.

[in-text-ad]

Amazon Wallet

> Years operating: 2014-2015

> Business: digital wallet

In 2014, Amazon introduced Wallet as a point-of-sale platform. It didn’t even last a full year. Among the app’s flaws were its reliance on QR codes and the fact that it did not hold credit or debit cards, only gift cards.

Fire phone

> Years operating: 2014-2015

> Business: phone

Amazon’s fire phone was released to much fanfare, intended to take a bite out of Apple’s domination of the smart tablet market. It was an unequivocal failure, dinged by reviewers for its high price and lack of apps. It was discontinued less than two years after its launch, and in Amazon’s next financial statement, the company reported an $170 million writedown, citing the Fire phone’s sales as a primary reason.

Amazon Destination

> Years operating: 2015-2015

> Business: travel agency

The tech giant’s 2015 venture into hotel booking, Amazon Destination was short-lived, lasting less than seven months. At the time of taking the site down, Amazon did not give a reason for abandoning the project.

[in-text-ad-2]

Amazon Local

> Years operating: 2011-2015

> Business: daily deals

Some failed Amazon investments involve trying to venture into a market in which it was unable to knock out competitors that had already established a foothold or investing in shrinking markets. Amazon Local is one such example, where the company simply got involved in an industry that was on the way out already. Local was a daily deals app meant to compete with companies like Groupon and LivingSocial, both of which have also shrunk to a fraction of their former glory.

LivingSocial

> Years operating: 2010-2017

> Business: daily deals

Speaking of, Amazon invested $175 million in LivingSocial in 2010. But that company, like Amazon Local, fell precipitously from its brief period of wild success. In the third quarter of 2012, the company posted a net loss of $0.37 per share, with the primary culprit being a $169 million loss from its LivingSocial investment.

[in-text-ad]

Amazon Local Register

> Years operating: 2014-2016

> Business: finances

Amazon Local Register, introduced in 2014, was the company’s attempt to compete with properties like Apple Pay and Square, providing a $10 smartphone dongle to read credit cards. However, it failed to catch on and the company stopped selling it in 2015 and discontinued support the following year.

Quidsi

> Years operating: 2005-2017

> Business: e-commerce

In 2010, Amazon bought Quidsi, parent of a number of specialized retail websites, including diapers.com, beautybar.com, and yoyo.com. The $545 million investment proved to be for naught: Amazon shut the company down in 2017, citing a failure to make the company profitable.

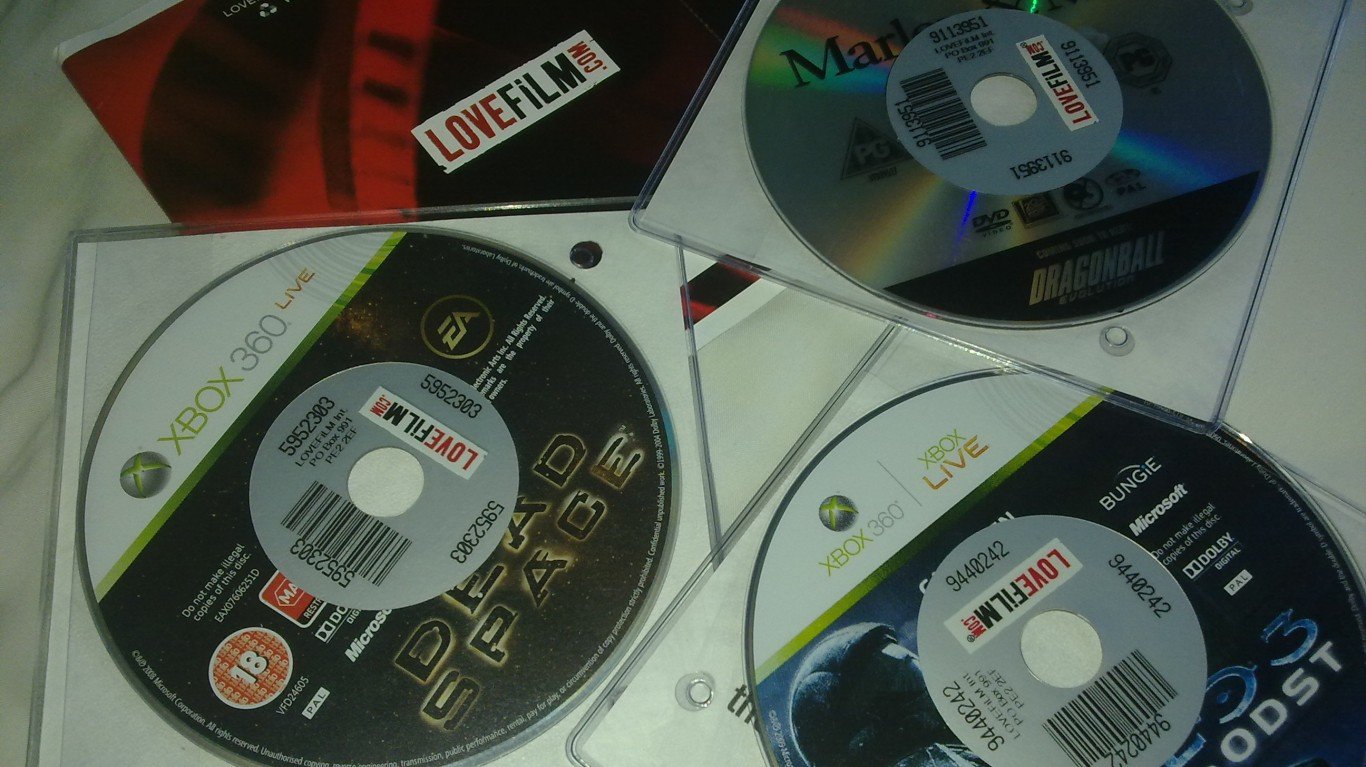

LoveFilm

> Years operating: 2003-2017

> Business: entertainment

Amazon’s LoveFilm was the European equivalent of Netflix, not as it is now as a content streaming platform, but the by-mail DVD rental business of the early 2000s. LoveFilm, a British company, was founded in 2003. Amazon took stake in the company in 2008 and acquired it in its entirety in 2011 for about $200 million. In 2017, the company announced it would end LoveFilm services entirely.

[in-text-ad-2]

Junglee

> Years operating: 1998-2017

> Business: e-commerce

Junglee was a silicon valley-founded comparison shopping service, used in India. Founded in 1998, Amazon bought the site in 2012. But soon Junglee began to be decimated by the success of its own parent company, and in November 2017, the company rolled the company’s operations into Amazon.in.

Liquavista

> Years operating: 2006-2018

> Business: video screens

In 2013, Amazon bought LiquaVista, a liquid display company for devices with screens, from Samsung. Amazon acquired the company to help furnish its Kindle e-readers with displays that would preserve battery life. However, new screen tech developed in the following years rendered the Liquavista “electrowetting” tech obsolete. In 2018, Amazon shuttered the company.

[in-text-ad]

Amazon Tickets

> Years operating: 2015-2018

> Business: event ticket sales

Amazon started Tickets in 2015, with its mission statement at the time being “disrupting the entire live entertainment experience.” The U.K.-based company was pegged to be a competitor to major players like Ticketmaster. The company gave up its attempt to unseat those established ticketing giants in 2018.

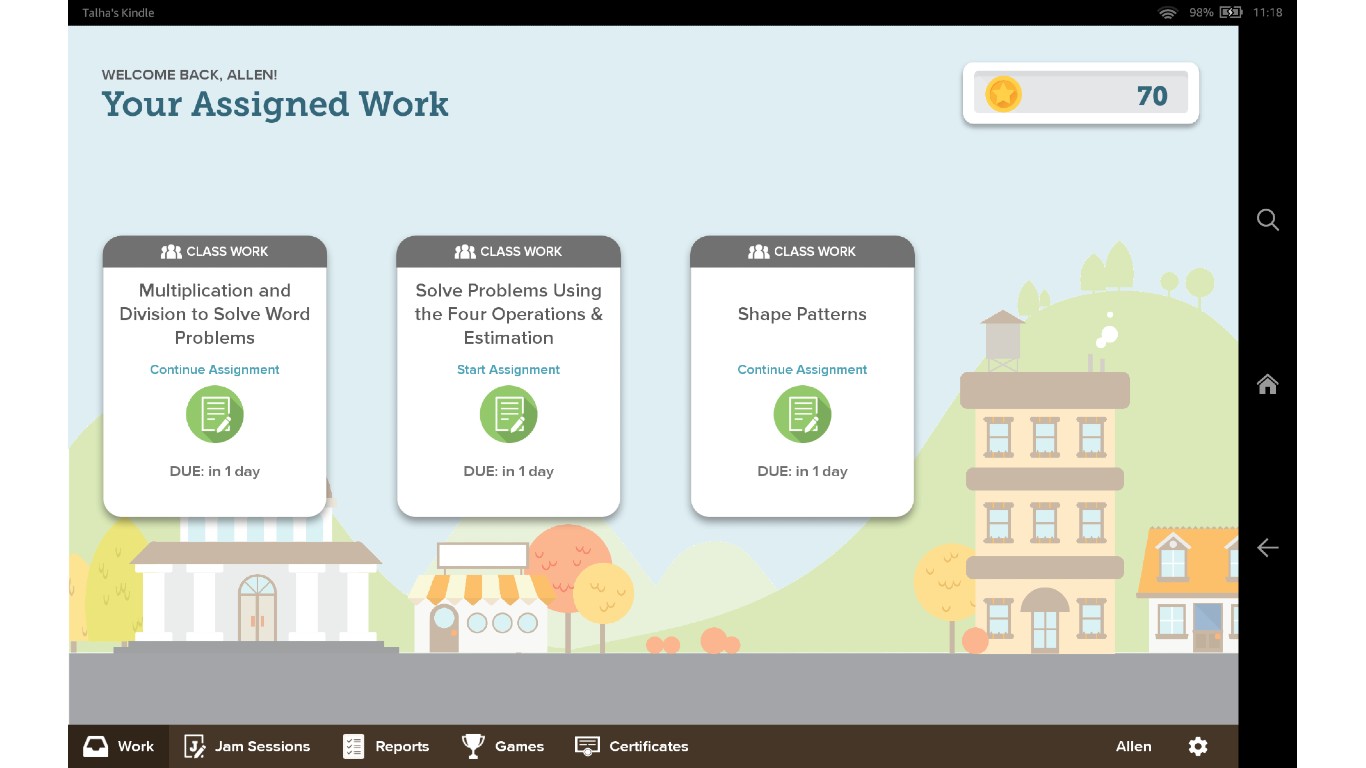

TenMarks Education, Inc

> Years operating: 2009-2019

> Business: education

On October 10, 2013, Amazon bought educational software company TenMarks Education, Inc. Tenmarks had developed a system for K-12 teachers to teach the Common Core standardized curriculum. Amazon shut down TenMarks’ operations at the end of the 2018-2019 school year.

Amazon Spark

> Years operating: 2017-2019

> Business: visual shopping platform

Amazon’s Spark service, started in 2017, was based on the idea that shoppers would be able to peruse a feed of images and be able to buy anything they see, directly competing with Instagram’s model. The platform never caught on and Spark shut down in 2019.

[in-text-ad-2]

Crucible

> Years operating: 2020-2020

> Business: gaming

Crucible, Amazon’s expensive first attempt to enter the increasingly lucrative online gaming market was a dud. The free to play online multiplayer shooter was launched in May 2020, but it was plagued with bugs. The game went back into closed beta the following month for further testing and development, but Amazon ended up pulling the plug in October.

Haven

> Years operating: 2018-2021

> Business: Health care

Amazon, in collaboration with Berkshire Hathaway and JPMorgan Chase, attempted to offer an alternative to the often confusing and inconsistent coverage offered by the various private health insurers in this country. Haven, which was marketed as “simplified, high-quality, and transparent health care at a reasonable cost” did not catch on. A Harvard Business Review report on Haven’s demise points to the timing of the COVID-19 pandemic as a major factor in the health care company’s failure to survive more than three years.

[in-text-ad]

Rivian

> Years operating: 2019-

> Business: EVs

Amazon’s most recent major failed investment, Rivian, is an electric vehicle company. It is also one of the main reasons Amazon reported an annual loss for the first time since 2014. Rivian has consistently struggled with supply chain problems, contributing to the EV maker’s stock price plummeting to a 52-week low earlier this year. With Amazon owning about 17% of Rivian, the investment cost the company $2.3 billion in the most recent quarter.

Sponsored: Attention Savvy Investors: Speak to 3 Financial Experts – FREE

Ever wanted an extra set of eyes on an investment you’re considering? Now you can speak with up to 3 financial experts in your area for FREE. By simply

clicking here you can begin to match with financial professionals who can help guide you through the financial decisions you’re making. And the best part? The first conversation with them is free.

Click here to match with up to 3 financial pros who would be excited to help you make financial decisions.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.

24/7 Wall St.

24/7 Wall St. 24/7 Wall St.

24/7 Wall St.