Last Summer, U.S. gas prices exceeded $5 for the first time in history. The causes included the end of the pandemic leading to an increase in demand, and the Russian invasion of Ukraine, resulting in Western embargoes on Russian oil. This includes a total ban by the U.S. last March. The spike in gas prices was one of the main drivers of inflation this past year. (Here’s a list of the countries that have Sanctioned Russia.)

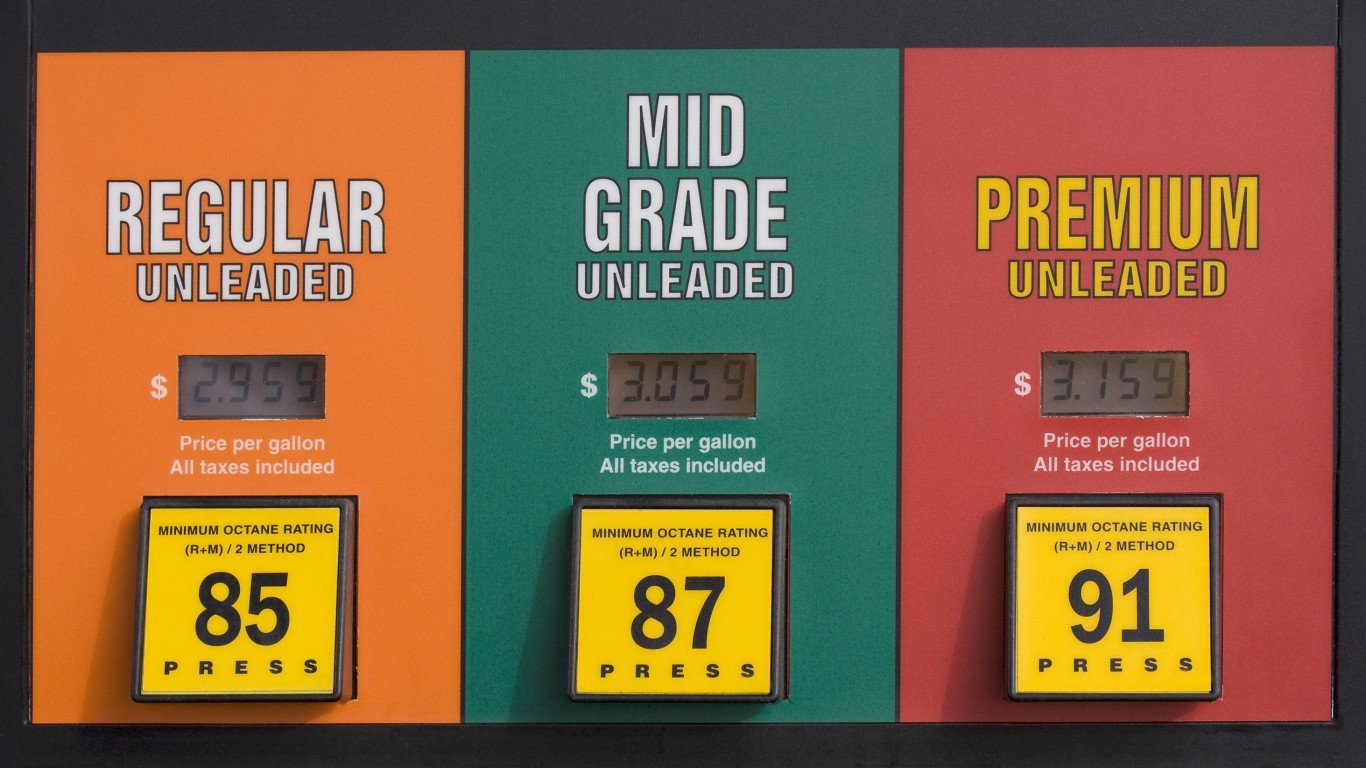

Since then, gas prices have fallen back to an average of $3.60 per gallon, $1.40 below the June 2022 high but still well above any pre-pandemic monthly average going back more than five years. While $3.60 per gallon is the current national average price, what Americans are paying at the pump varies from a little over $3 to nearly $5. That variance is largely the result of different transportation and refining costs and, of course, taxes. (See also: the price of gasoline the year you were born.)

While the federal government levies a tax of 18.4 cents on every gallon of gas sold in the United States, each state adds on its own excise tax on top of that. State-imposed gas taxes and fees can account for anywhere from 2.3% of the total cost of gas to 16.5%, depending on where you live.

To determine the highest and lowest gas taxes in every state, 24/7 Wall St. reviewed data on average state gas taxes as of spring 2023 from business tax compliance platform IGEN. State gas taxes do not include the federal gas tax. Data on gas prices by state came from AAA and is current as of April 11, 2023. Data on motor fuel consumption and the number of licensed drivers by state came from the Federal Highway Administration and is for 2021. The gas tax rate ranges at the state level from $0.09 to $0.61 per gallon.

Generally speaking, states with higher gas taxes have higher relative gas prices overall. California and Pennsylvania, the only two states that levy more than a $0.50 tax per gallon of gas, both rank in the top 10 for overall gas prices.

At the other end of the list, the relationship is more complicated. Very low gas tax states like Mississippi and Oklahoma also have very low gas prices. But of the seven states that levy less than 20 cents per gallon gas tax, five are in the top 20 for gas prices, including three – Alaska, Hawaii, and Arizona – in the top 10. (More globally, here are the countries with the lowest gas prices in the world at the start of 2023.)

In fact, Alaska and Hawaii have the third and second-highest gas prices among states, respectively. The high gas prices in Hawaii are largely due to the cost of transportation – shipping gas from refineries on the mainland. In Alaska, the high gas prices are partially tied to issues related to the West Coast’s current tight supply of gas due to refineries in California and Washington undergoing maintenance.

It might be expected that higher taxes (and the occasionally resulting higher gas prices overall) would cause Americans to drive less, and on the whole, that appears to be true. Using figures published by the FHA, the average registered driver used 795 gallons of gasoline in 2021. In the eight states where drivers consumed on average 1,100 gallons of gas or more in 2021, gas taxes were less than a quarter per gallon in six.

Click here to see states with the lowest and highest gas tax.

Click here to see our detailed methodology.

50. Alaska

> Avg. state gas tax: $0.09 per gallon

> Avg. gas price, April 11, 2023: $3.85 per gallon (8th highest)

> State taxes as pct. of gas price: 2.3% (the lowest)

> 2021 motor fuel consumption: 396,608,000 gallons (2nd fewest)

> 2021 motor fuel consumption per licensed driver: 763.8 gal/driver (20th fewest)

> 2021 licensed drivers: 519,288 (3rd fewest)

[in-text-ad]

49. Hawaii

> Avg. state gas tax: $0.16 per gallon

> Avg. gas price, April 11, 2023: $4.78 per gallon (2nd highest)

> State taxes as pct. of gas price: 3.3% (2nd lowest)

> 2021 motor fuel consumption: 469,593,000 gallons (4th fewest)

> 2021 motor fuel consumption per licensed driver: 511.8 gal/driver (the fewest)

> 2021 licensed drivers: 917,464 (9th fewest)

48. New Mexico

> Avg. state gas tax: $0.17 per gallon

> Avg. gas price, April 11, 2023: $3.55 per gallon (17th highest)

> State taxes as pct. of gas price: 4.8% (4th lowest)

> 2021 motor fuel consumption: 1,773,707,000 gallons (17th fewest)

> 2021 motor fuel consumption per licensed driver: 1,200.7 gal/driver (4th most)

> 2021 licensed drivers: 1,477,213 (15th fewest)

47. Arizona

> Avg. state gas tax: $0.18 per gallon– tied

> Avg. gas price, April 11, 2023: $4.42 per gallon (3rd highest)

> State taxes as pct. of gas price: 4.1% (3rd lowest)

> 2021 motor fuel consumption: 4,104,309,000 gallons (17th most)

> 2021 motor fuel consumption per licensed driver: 708.2 gal/driver (17th fewest)

> 2021 licensed drivers: 5,795,216 (14th most)

[in-text-ad-2]

46. Mississippi

> Avg. state gas tax: $0.18 per gallon– tied

> Avg. gas price, April 11, 2023: $3.14 per gallon (the lowest)

> State taxes as pct. of gas price: 5.7% (7th lowest)

> 2021 motor fuel consumption: 2,490,902,000 gallons (23rd fewest)

> 2021 motor fuel consumption per licensed driver: 1,225.4 gal/driver (3rd most)

> 2021 licensed drivers: 2,032,775 (16th fewest)

45. New York

> Avg. state gas tax: $0.18 per gallon– tied

> Avg. gas price, April 11, 2023: $3.56 per gallon (16th highest)

> State taxes as pct. of gas price: 5.1% (5th lowest)

> 2021 motor fuel consumption: 6,811,989,000 gallons (4th most)

> 2021 motor fuel consumption per licensed driver: 573.4 gal/driver (2nd fewest)

> 2021 licensed drivers: 11,879,057 (4th most)

[in-text-ad]

44. Oklahoma

> Avg. state gas tax: $0.19 per gallon

> Avg. gas price, April 11, 2023: $3.28 per gallon (7th lowest)

> State taxes as pct. of gas price: 5.8% (8th lowest)

> 2021 motor fuel consumption: 2,917,947,000 gallons (24th fewest)

> 2021 motor fuel consumption per licensed driver: 1,123.4 gal/driver (7th most)

> 2021 licensed drivers: 2,597,441 (22nd fewest)

43. Connecticut

> Avg. state gas tax: $0.20 per gallon– tied

> Avg. gas price, April 11, 2023: $3.43 per gallon (25th lowest)

> State taxes as pct. of gas price: 5.8% (9th lowest)

> 2021 motor fuel consumption: 1,701,906,000 gallons (16th fewest)

> 2021 motor fuel consumption per licensed driver: 653.0 gal/driver (7th fewest)

> 2021 licensed drivers: 2,606,396 (23rd fewest)

42. Louisiana

> Avg. state gas tax: $0.20 per gallon– tied

> Avg. gas price, April 11, 2023: $3.28 per gallon (7th lowest)

> State taxes as pct. of gas price: 6.1% (10th lowest)

> 2021 motor fuel consumption: 3,032,119,000 gallons (25th most)

> 2021 motor fuel consumption per licensed driver: 882.0 gal/driver (21st most)

> 2021 licensed drivers: 3,437,733 (25th most)

[in-text-ad-2]

41. Texas

> Avg. state gas tax: $0.20 per gallon– tied

> Avg. gas price, April 11, 2023: $3.26 per gallon (4th lowest)

> State taxes as pct. of gas price: 6.1% (11th lowest)

> 2021 motor fuel consumption: 20,332,802,000 gallons (the most)

> 2021 motor fuel consumption per licensed driver: 1,111.2 gal/driver (8th most)

> 2021 licensed drivers: 18,297,900 (2nd most)

40. Colorado

> Avg. state gas tax: $0.22 per gallon– tied

> Avg. gas price, April 11, 2023: $3.50 per gallon (20th highest)

> State taxes as pct. of gas price: 6.3% (12th lowest)

> 2021 motor fuel consumption: 3,053,136,000 gallons (24th most)

> 2021 motor fuel consumption per licensed driver: 692.1 gal/driver (13th fewest)

> 2021 licensed drivers: 4,411,587 (19th most)

[in-text-ad]

39. Missouri

> Avg. state gas tax: $0.22 per gallon– tied

> Avg. gas price, April 11, 2023: $3.26 per gallon (5th lowest)

> State taxes as pct. of gas price: 6.7% (15th lowest)

> 2021 motor fuel consumption: 4,334,417,000 gallons (15th most)

> 2021 motor fuel consumption per licensed driver: 1,013.8 gal/driver (13th most)

> 2021 licensed drivers: 4,275,228 (21st most)

38. New Hampshire

> Avg. state gas tax: $0.22 per gallon– tied

> Avg. gas price, April 11, 2023: $3.30 per gallon (9th lowest)

> State taxes as pct. of gas price: 6.7% (14th lowest)

> 2021 motor fuel consumption: 821,482,000 gallons (9th fewest)

> 2021 motor fuel consumption per licensed driver: 699.2 gal/driver (15th fewest)

> 2021 licensed drivers: 1,174,826 (12th fewest)

37. Delaware

> Avg. state gas tax: $0.23 per gallon– tied

> Avg. gas price, April 11, 2023: $3.48 per gallon (21st highest)

> State taxes as pct. of gas price: 6.6% (13th lowest)

> 2021 motor fuel consumption: 582,188,000 gallons (5th fewest)

> 2021 motor fuel consumption per licensed driver: 686.1 gal/driver (9th fewest)

> 2021 licensed drivers: 848,504 (7th fewest)

[in-text-ad-2]

36. Nevada

> Avg. state gas tax: $0.23 per gallon– tied

> Avg. gas price, April 11, 2023: $4.24 per gallon (5th highest)

> State taxes as pct. of gas price: 5.4% (6th lowest)

> 2021 motor fuel consumption: 1,643,840,000 gallons (15th fewest)

> 2021 motor fuel consumption per licensed driver: 764.3 gal/driver (21st fewest)

> 2021 licensed drivers: 2,150,707 (18th fewest)

35. North Dakota

> Avg. state gas tax: $0.23 per gallon– tied

> Avg. gas price, April 11, 2023: $3.38 per gallon (17th lowest)

> State taxes as pct. of gas price: 6.8% (16th lowest)

> 2021 motor fuel consumption: 701,995,000 gallons (6th fewest)

> 2021 motor fuel consumption per licensed driver: 1,277.0 gal/driver (2nd most)

> 2021 licensed drivers: 549,721 (4th fewest)

[in-text-ad]

34. Kansas

> Avg. state gas tax: $0.24 per gallon– tied

> Avg. gas price, April 11, 2023: $3.23 per gallon (3rd lowest)

> State taxes as pct. of gas price: 7.4% (19th lowest)

> 2021 motor fuel consumption: 1,835,639,000 gallons (19th fewest)

> 2021 motor fuel consumption per licensed driver: 878.4 gal/driver (22nd most)

> 2021 licensed drivers: 2,089,707 (17th fewest)

33. Massachusetts

> Avg. state gas tax: $0.24 per gallon– tied

> Avg. gas price, April 11, 2023: $3.35 per gallon (14th lowest)

> State taxes as pct. of gas price: 7.2% (17th lowest)

> 2021 motor fuel consumption: 2,978,745,000 gallons (25th fewest)

> 2021 motor fuel consumption per licensed driver: 607.9 gal/driver (5th fewest)

> 2021 licensed drivers: 4,899,931 (16th most)

32. Wyoming

> Avg. state gas tax: $0.24 per gallon– tied

> Avg. gas price, April 11, 2023: $3.34 per gallon (13th lowest)

> State taxes as pct. of gas price: 7.2% (18th lowest)

> 2021 motor fuel consumption: 737,024,000 gallons (7th fewest)

> 2021 motor fuel consumption per licensed driver: 1,712.1 gal/driver (the most)

> 2021 licensed drivers: 430,472 (the fewest)

[in-text-ad-2]

31. Arkansas

> Avg. state gas tax: $0.25 per gallon

> Avg. gas price, April 11, 2023: $3.19 per gallon (2nd lowest)

> State taxes as pct. of gas price: 7.7% (20th lowest)

> 2021 motor fuel consumption: 2,298,276,000 gallons (21st fewest)

> 2021 motor fuel consumption per licensed driver: 996.3 gal/driver (15th most)

> 2021 licensed drivers: 2,306,921 (20th fewest)

30. Tennessee

> Avg. state gas tax: $0.26 per gallon

> Avg. gas price, April 11, 2023: $3.31 per gallon (10th lowest)

> State taxes as pct. of gas price: 7.9% (22nd lowest)

> 2021 motor fuel consumption: 4,609,167,000 gallons (12th most)

> 2021 motor fuel consumption per licensed driver: 920.0 gal/driver (19th most)

> 2021 licensed drivers: 5,009,697 (15th most)

[in-text-ad]

29. Kentucky

> Avg. state gas tax: $0.27 per gallon– tied

> Avg. gas price, April 11, 2023: $3.41 per gallon (19th lowest)

> State taxes as pct. of gas price: 7.8% (21st lowest)

> 2021 motor fuel consumption: 3,066,113,000 gallons (23rd most)

> 2021 motor fuel consumption per licensed driver: 1,028.8 gal/driver (12th most)

> 2021 licensed drivers: 2,980,331 (24th fewest)

28. Iowa

> Avg. state gas tax: $0.27 per gallon– tied

> Avg. gas price, April 11, 2023: $3.41 per gallon (20th lowest)

> State taxes as pct. of gas price: 7.9% (23rd lowest)

> 2021 motor fuel consumption: 2,421,751,000 gallons (22nd fewest)

> 2021 motor fuel consumption per licensed driver: 1,032.6 gal/driver (11th most)

> 2021 licensed drivers: 2,345,355 (21st fewest)

27. Alabama

> Avg. state gas tax: $0.28 per gallon– tied

> Avg. gas price, April 11, 2023: $3.28 per gallon (8th lowest)

> State taxes as pct. of gas price: 8.5% (21st highest)

> 2021 motor fuel consumption: 4,320,468,000 gallons (16th most)

> 2021 motor fuel consumption per licensed driver: 1,063.7 gal/driver (9th most)

> 2021 licensed drivers: 4,061,837 (23rd most)

[in-text-ad-2]

26. South Carolina

> Avg. state gas tax: $0.28 per gallon– tied

> Avg. gas price, April 11, 2023: $3.32 per gallon (12th lowest)

> State taxes as pct. of gas price: 8.4% (23rd highest)

> 2021 motor fuel consumption: 3,774,440,000 gallons (18th most)

> 2021 motor fuel consumption per licensed driver: 945.8 gal/driver (18th most)

> 2021 licensed drivers: 3,990,909 (24th most)

25. South Dakota

> Avg. state gas tax: $0.28 per gallon– tied

> Avg. gas price, April 11, 2023: $3.43 per gallon (24th lowest)

> State taxes as pct. of gas price: 8.2% (25th highest)

> 2021 motor fuel consumption: 770,787,000 gallons (8th fewest)

> 2021 motor fuel consumption per licensed driver: 1,148.5 gal/driver (6th most)

> 2021 licensed drivers: 671,149 (5th fewest)

[in-text-ad]

24. Virginia

> Avg. state gas tax: $0.28 per gallon– tied

> Avg. gas price, April 11, 2023: $3.46 per gallon (23rd highest)

> State taxes as pct. of gas price: 8.1% (25th lowest)

> 2021 motor fuel consumption: 5,253,792,000 gallons (11th most)

> 2021 motor fuel consumption per licensed driver: 888.6 gal/driver (20th most)

> 2021 licensed drivers: 5,912,644 (12th most)

23. Minnesota

> Avg. state gas tax: $0.29 per gallon– tied

> Avg. gas price, April 11, 2023: $3.42 per gallon (22nd lowest)

> State taxes as pct. of gas price: 8.3% (24th highest)

> 2021 motor fuel consumption: 3,258,448,000 gallons (21st most)

> 2021 motor fuel consumption per licensed driver: 786.4 gal/driver (22nd fewest)

> 2021 licensed drivers: 4,143,272 (22nd most)

22. Michigan

> Avg. state gas tax: $0.29 per gallon– tied

> Avg. gas price, April 11, 2023: $3.61 per gallon (12th highest)

> State taxes as pct. of gas price: 7.9% (24th lowest)

> 2021 motor fuel consumption: 5,542,993,000 gallons (10th most)

> 2021 motor fuel consumption per licensed driver: 694.4 gal/driver (14th fewest)

> 2021 licensed drivers: 7,982,471 (8th most)

[in-text-ad-2]

21. Nebraska

> Avg. state gas tax: $0.29 per gallon– tied

> Avg. gas price, April 11, 2023: $3.42 per gallon (22nd lowest)

> State taxes as pct. of gas price: 8.5% (22nd highest)

> 2021 motor fuel consumption: 1,453,054,000 gallons (14th fewest)

> 2021 motor fuel consumption per licensed driver: 1,009.9 gal/driver (14th most)

> 2021 licensed drivers: 1,438,842 (14th fewest)

20. Maine

> Avg. state gas tax: $0.30 per gallon

> Avg. gas price, April 11, 2023: $3.43 per gallon (23rd lowest)

> State taxes as pct. of gas price: 8.8% (20th highest)

> 2021 motor fuel consumption: 846,830,000 gallons (10th fewest)

> 2021 motor fuel consumption per licensed driver: 801.5 gal/driver (24th fewest)

> 2021 licensed drivers: 1,056,535 (10th fewest)

[in-text-ad]

19. Wisconsin

> Avg. state gas tax: $0.31 per gallon– tied

> Avg. gas price, April 11, 2023: $3.48 per gallon (22nd highest)

> State taxes as pct. of gas price: 8.9% (19th highest)

> 2021 motor fuel consumption: 3,552,277,000 gallons (19th most)

> 2021 motor fuel consumption per licensed driver: 818.3 gal/driver (24th most)

> 2021 licensed drivers: 4,340,851 (20th most)

18. Georgia

> Avg. state gas tax: $0.31 per gallon– tied

> Avg. gas price, April 11, 2023: $3.38 per gallon (16th lowest)

> State taxes as pct. of gas price: 9.2% (16th highest)

> 2021 motor fuel consumption: 6,319,313,000 gallons (6th most)

> 2021 motor fuel consumption per licensed driver: 824.6 gal/driver (23rd most)

> 2021 licensed drivers: 7,663,847 (10th most)

17. Idaho

> Avg. state gas tax: $0.32 per gallon– tied

> Avg. gas price, April 11, 2023: $3.55 per gallon (17th highest)

> State taxes as pct. of gas price: 9.0% (18th highest)

> 2021 motor fuel consumption: 1,272,513,000 gallons (12th fewest)

> 2021 motor fuel consumption per licensed driver: 947.2 gal/driver (17th most)

> 2021 licensed drivers: 1,343,453 (13th fewest)

[in-text-ad-2]

16. Vermont

> Avg. state gas tax: $0.32 per gallon– tied

> Avg. gas price, April 11, 2023: $3.45 per gallon (24th highest)

> State taxes as pct. of gas price: 9.4% (15th highest)

> 2021 motor fuel consumption: 349,078,000 gallons (the fewest)

> 2021 motor fuel consumption per licensed driver: 743.3 gal/driver (19th fewest)

> 2021 licensed drivers: 469,624 (2nd fewest)

15. Indiana

> Avg. state gas tax: $0.33 per gallon– tied

> Avg. gas price, April 11, 2023: $3.59 per gallon (13th highest)

> State taxes as pct. of gas price: 9.2% (17th highest)

> 2021 motor fuel consumption: 4,518,313,000 gallons (13th most)

> 2021 motor fuel consumption per licensed driver: 974.6 gal/driver (16th most)

> 2021 licensed drivers: 4,636,114 (17th most)

[in-text-ad]

14. Montana

> Avg. state gas tax: $0.33 per gallon– tied

> Avg. gas price, April 11, 2023: $3.31 per gallon (11th lowest)

> State taxes as pct. of gas price: 10.0% (11th highest)

> 2021 motor fuel consumption: 885,149,000 gallons (11th fewest)

> 2021 motor fuel consumption per licensed driver: 1,033.2 gal/driver (10th most)

> 2021 licensed drivers: 856,696 (8th fewest)

13. Rhode Island

> Avg. state gas tax: $0.34 per gallon

> Avg. gas price, April 11, 2023: $3.36 per gallon (15th lowest)

> State taxes as pct. of gas price: 10.1% (10th highest)

> 2021 motor fuel consumption: 434,036,000 gallons (3rd fewest)

> 2021 motor fuel consumption per licensed driver: 575.3 gal/driver (3rd fewest)

> 2021 licensed drivers: 754,507 (6th fewest)

12. Florida

> Avg. state gas tax: $0.35 per gallon

> Avg. gas price, April 11, 2023: $3.58 per gallon (14th highest)

> State taxes as pct. of gas price: 9.8% (13th highest)

> 2021 motor fuel consumption: 11,153,975,000 gallons (3rd most)

> 2021 motor fuel consumption per licensed driver: 690.9 gal/driver (11th fewest)

> 2021 licensed drivers: 16,144,302 (3rd most)

[in-text-ad-2]

11. Utah

> Avg. state gas tax: $0.36 per gallon

> Avg. gas price, April 11, 2023: $3.67 per gallon (10th highest)

> State taxes as pct. of gas price: 9.9% (12th highest)

> 2021 motor fuel consumption: 1,785,812,000 gallons (18th fewest)

> 2021 motor fuel consumption per licensed driver: 809.1 gal/driver (25th fewest)

> 2021 licensed drivers: 2,207,208 (19th fewest)

10. West Virginia

> Avg. state gas tax: $0.37 per gallon

> Avg. gas price, April 11, 2023: $3.58 per gallon (15th highest)

> State taxes as pct. of gas price: 10.4% (9th highest)

> 2021 motor fuel consumption: 1,323,524,000 gallons (13th fewest)

> 2021 motor fuel consumption per licensed driver: 1,162.7 gal/driver (5th most)

> 2021 licensed drivers: 1,138,290 (11th fewest)

[in-text-ad]

9. Oregon

> Avg. state gas tax: $0.38 per gallon

> Avg. gas price, April 11, 2023: $3.99 per gallon (6th highest)

> State taxes as pct. of gas price: 9.5% (14th highest)

> 2021 motor fuel consumption: 2,192,028,000 gallons (20th fewest)

> 2021 motor fuel consumption per licensed driver: 723.5 gal/driver (18th fewest)

> 2021 licensed drivers: 3,029,912 (25th fewest)

8. Ohio**

> Avg. state gas tax: $0.39 per gallon

> Avg. gas price, April 11, 2023: $3.66 per gallon (11th highest)

> State taxes as pct. of gas price: 10.5% (8th highest)

> 2021 motor fuel consumption: 6,529,011,000 gallons (5th most)

> 2021 motor fuel consumption per licensed driver: 788.2 gal/driver (23rd fewest)

> 2021 licensed drivers: 8,283,546 (7th most)

7. North Carolina

> Avg. state gas tax: $0.41 per gallon

> Avg. gas price, April 11, 2023: $3.44 per gallon (25th highest)

> State taxes as pct. of gas price: 11.8% (4th highest)

> 2021 motor fuel consumption: 6,301,706,000 gallons (7th most)

> 2021 motor fuel consumption per licensed driver: 811.5 gal/driver (25th most)

> 2021 licensed drivers: 7,765,109 (9th most)

[in-text-ad-2]

6. New Jersey

> Avg. state gas tax: $0.42 per gallon– tied

> Avg. gas price, April 11, 2023: $3.40 per gallon (18th lowest)

> State taxes as pct. of gas price: 12.4% (2nd highest)

> 2021 motor fuel consumption: 4,340,115,000 gallons (14th most)

> 2021 motor fuel consumption per licensed driver: 671.6 gal/driver (8th fewest)

> 2021 licensed drivers: 6,461,950 (11th most)

5. Illinois

> Avg. state gas tax: $0.42 per gallon– tied

> Avg. gas price, April 11, 2023: $3.98 per gallon (7th highest)

> State taxes as pct. of gas price: 10.6% (7th highest)

> 2021 motor fuel consumption: 5,858,870,000 gallons (9th most)

> 2021 motor fuel consumption per licensed driver: 700.4 gal/driver (16th fewest)

> 2021 licensed drivers: 8,364,843 (6th most)

[in-text-ad]

4. Maryland

> Avg. state gas tax: $0.43 per gallon

> Avg. gas price, April 11, 2023: $3.54 per gallon (19th highest)

> State taxes as pct. of gas price: 12.1% (3rd highest)

> 2021 motor fuel consumption: 3,068,881,000 gallons (22nd most)

> 2021 motor fuel consumption per licensed driver: 691.2 gal/driver (12th fewest)

> 2021 licensed drivers: 4,439,757 (18th most)

3. Washington

> Avg. state gas tax: $0.49 per gallon

> Avg. gas price, April 11, 2023: $4.40 per gallon (4th highest)

> State taxes as pct. of gas price: 11.2% (5th highest)

> 2021 motor fuel consumption: 3,379,911,000 gallons (20th most)

> 2021 motor fuel consumption per licensed driver: 575.9 gal/driver (4th fewest)

> 2021 licensed drivers: 5,868,509 (13th most)

2. California

> Avg. state gas tax: $0.54 per gallon

> Avg. gas price, April 11, 2023: $4.89 per gallon (the highest)

> State taxes as pct. of gas price: 11.0% (6th highest)

> 2021 motor fuel consumption: 17,193,411,000 gallons (2nd most)

> 2021 motor fuel consumption per licensed driver: 634.1 gal/driver (6th fewest)

> 2021 licensed drivers: 27,112,595 (the most)

[in-text-ad-2]

1. Pennsylvania

> Avg. state gas tax: $0.61 per gallon

> Avg. gas price, April 11, 2023: $3.70 per gallon (9th highest)

> State taxes as pct. of gas price: 16.5% (the highest)

> 2021 motor fuel consumption: 6,243,385,000 gallons (8th most)

> 2021 motor fuel consumption per licensed driver: 686.2 gal/driver (10th fewest)

> 2021 licensed drivers: 9,098,570 (5th most)

Methodology

To determine the highest and lowest gas taxes in every state, 24/7 Wall St. reviewed data on average state gas taxes as of April 2023 from business tax compliance platform IGEN. State gas taxes do not include the federal gas tax of 18.4 cents per gallon. Supplemental data on the average price of regular gas by state came from AAA and is current as of April 11, 2023. Data on motor fuel consumption and the number of licensed drivers used to calculate annual motor fuel consumption per licensed driver by state came from the Federal Highway Administration and is for 2021.

The gas tax rate ranges at the state level from $0.09 to $0.61 per gallon. It should be noted that in the case of Iowa, due to the variance in local taxes, the effective state tax rate ranges from $0.24 per gallon to $0.30 per gallon. For the purposes of this story, we averaged that range.

Sponsored: Find a Qualified Financial Advisor

Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to 3 fiduciary financial advisors in your area in 5 minutes. Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests. If you’re ready to be matched with local advisors that can help you achieve your financial goals, get started now.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.

24/7 Wall St.

24/7 Wall St. 24/7 Wall St.

24/7 Wall St. 24/7 Wall St.

24/7 Wall St. 24/7 Wall St.

24/7 Wall St.