CEOs of companies listed on the S&P 500 earned an average of $18.8 million last year, up about 21% from the previous year, Times recently reported. This jump in executive pay came despite an 18% drop in the market index in 2022.

Many of these CEOs were gifted generous stock options by their boards as a reward for steering their companies through the challenges of the coronavirus pandemic. But the ratio of CEO pay to the typical earnings of company employees has been trending upwards for decades, due largely to an increase in the use of stock-based compensation.

According to an analysis last year by the Economic Policy Institute, the heads of the top 350 publicly traded companies earned annual incomes that were on average 399 times greater than a typical worker in 2021, up from 59-to-1 in 1989. This means that some executives’ pay is significantly greater than 399 times their employee’s pay. In fact, the heads of 22 S&P 500 companies earn at least 1,000 times more than what their typical workers take home. (See if some of these companies are also among the companies planning the biggest mass layoffs this year.)

To find the CEOs that are paid at least 1,000 times more than their employees, 24/7 Wall St. reviewed the American Federation of Labor and Congress of Industrial Organizations (AFL-CIO) list of Company Pay Ratios among companies in the S&P 500 index. Only companies headquartered in the U.S. were considered. Information on industry, 12-months trailing revenue, and number of full-time employees came from Yahoo! Finance.

Take for example Walmart Inc. CEO C. McMillon, who earned $25.7 million in 2022, or 1,013 times the $25,335 median income of a Walmart employee. The world’s largest retailer, which was founded in 1945 and employs 2.1 million workers, has the lowest CEO-to-worker pay ratio of these 22 companies. (Also see, these companies control over 50% of their industry.)

Amazon.com CEO Andrew Jassy tops this list, by a long shot. Jassy collected $212.7 million in 2021, nearly 6,500 times greater than the typical Amazon employee pay of $32,855. To put it another way, Jassy makes in one hour more than three times the annual income of a typical Amazon employee (Jassy’s equivalent hourly pay is $102,260 based on a 40-hour work week).

The median CEO-to-worker pay ratio of these 22 companies is 1,687-to-1. The median annual revenue among these companies is $29.9 million

Annual CEO pay on this list starts at $10.6 million for tobacco company Philip Morris International CEO Jacek Olczak, who in 2021 earned 1,055 times the median pay of $18,196 for Philip Morris’ 79,800 employees. The highest CEO pay, at $296.2 million, went to Peter Kern, head of online travel services provider Expedia.com, who in 2021 earned 2,897 times the median income of $102,270 of the 16,500 Expedia employees.

Here are the U.S. S&P 500 CEOs who are paid at least 1,000 more than their employees.

22. C. McMillon, Walmart Inc.

> CEO pay to employee pay ratio: 1,013:1

> Compensation, 2022: $25,670,673 (or $12,342 per working hour)

> Median annual worker pay: $25,335

> Industry: Discount stores

> Revenue (12-month trailing): $611.29 billion

> Full-time employees: 2,100,000

[in-text-ad]

21. Frank Rio, Norwegian Cruise Line Holdings Ltd.

> CEO pay to employee pay ratio: 1,018:1

> Compensation, 2021: $19,668,768 (or $9,456 per working hour)

> Median annual worker pay: $19,319

> Industry: Travel services

> Revenue (12-month trailing): $4.84 billion

> Full-time employees: 38,900

20. Jacek Olczak, Philip Morris International Inc.

> CEO pay to employee pay ratio: 1,055:1

> Compensation, 2021: $10,557,568 (or $5,076 per working hour)

> Median annual worker pay: $18,196

> Industry: Tobacco

> Revenue (12-month trailing): $31.76 billion

> Full-time employees: 79,800

19. Richard Fain, Royal Caribbean Group

> CEO pay to employee pay ratio: 1,075:1

> Compensation, 2021: $15,812,027 (or $7,602 per working hour)

> Median annual worker pay: $14,706

> Industry: Travel services

> Revenue (12-month trailing): $8.84 billion

> Full-time employees: 102,400

[in-text-ad-2]

18. Brian Niccol, Chipotle Mexican Grill, Inc.

> CEO pay to employee pay ratio: 1,131:1

> Compensation, 2021: $17,880,580 (or $8,596 per working hour)

> Median annual worker pay: $15,811

> Industry: Restaurants

> Revenue (12-month trailing): $8.63 billion

> Full-time employees: 104,958

17. Ronald Clarke, FLEETCOR Technologies, Inc.

> CEO pay to employee pay ratio: 1,404:1

> Compensation, 2021: $57,923,473 (or $27,848 per working hour)

> Median annual worker pay: $41,265

> Industry: Software – infrastructure

> Revenue (12-month trailing): $3.43 billion

> Full-time employees: 9,900

[in-text-ad]

16. Timothy Cook, Apple Inc.

> CEO pay to employee pay ratio: 1,447:1

> Compensation, 2021: $98,734,394 (or $47,468 per working hour)

> Median annual worker pay: $68,254

> Industry: Consumer electronics

> Revenue (12-month trailing): $387.54 billion

> Full-time employees: 164,000

15. Barbara Rentler, Ross Stores, Inc.

> CEO pay to employee pay ratio: 1,480:1

> Compensation, 2022: $15,989,635 (or $7,687 per working hour)

> Median annual worker pay: $10,806

> Industry: Apparel retail

> Revenue (12-month trailing): $18.70 billion

> Full-time employees: 101,000

14. Kevin Johnson, Starbucks Corporation

> CEO pay to employee pay ratio: 1,579:1

> Compensation, 2021: $20,425,162 (or $9,820 per working hour)

> Median annual worker pay: $12,935

> Industry: Restaurants

> Revenue (12-month trailing): $32.91 billion

> Full-time employees: 402,000

[in-text-ad-2]

13. Joseph Hogan, Align Technology, Inc.

> CEO pay to employee pay ratio: 1,659:1

> Compensation, 2021: $21,591,400 (or $10,380 per working hour)

> Median annual worker pay: $13,011

> Industry: Medical devices

> Revenue (12-month trailing): $3.73 billion

> Full-time employees: 23,165

12. Andrew Meslow, Bath & Body Works, Inc.

> CEO pay to employee pay ratio: 1,662:1

> Compensation, 2022: $17,668,627 (or $8,495 per working hour)

> Median annual worker pay: $10,632

> Industry: Specialty retail

> Revenue (12-month trailing): $7.56 billion

> Full-time employees: 8,800

[in-text-ad]

11. Patrick Gelsinger, Intel Corporation

> CEO pay to employee pay ratio: 1,711:1

> Compensation, 2021: $178,590,400 (or $85,861 per working hour)

> Median annual worker pay: $104,400

> Industry: Semiconductors

> Revenue (12-month trailing): $63.05 billion

> Full-time employees: 131,900

10. Arnold Donald, Carnival Corporation

> CEO pay to employee pay ratio: 1,740:1

> Compensation, 2021: $15,063,788 (or $7,242 per working hour)

> Median annual worker pay: $8,658

> Industry: Travel services

> Revenue (12-month trailing): $14.98 billion

> Full-time employees: 87,000

9. James Quincey, The Coca-Cola Company

> CEO pay to employee pay ratio: 1,791:1

> Compensation, 2021: $24,883,878 (or $11,963 per working hour)

> Median annual worker pay: $13,894

> Industry: Beverages – non-alcoholic

> Revenue (12-month trailing): $43.00 billion

> Full-time employees: 82,500

[in-text-ad-2]

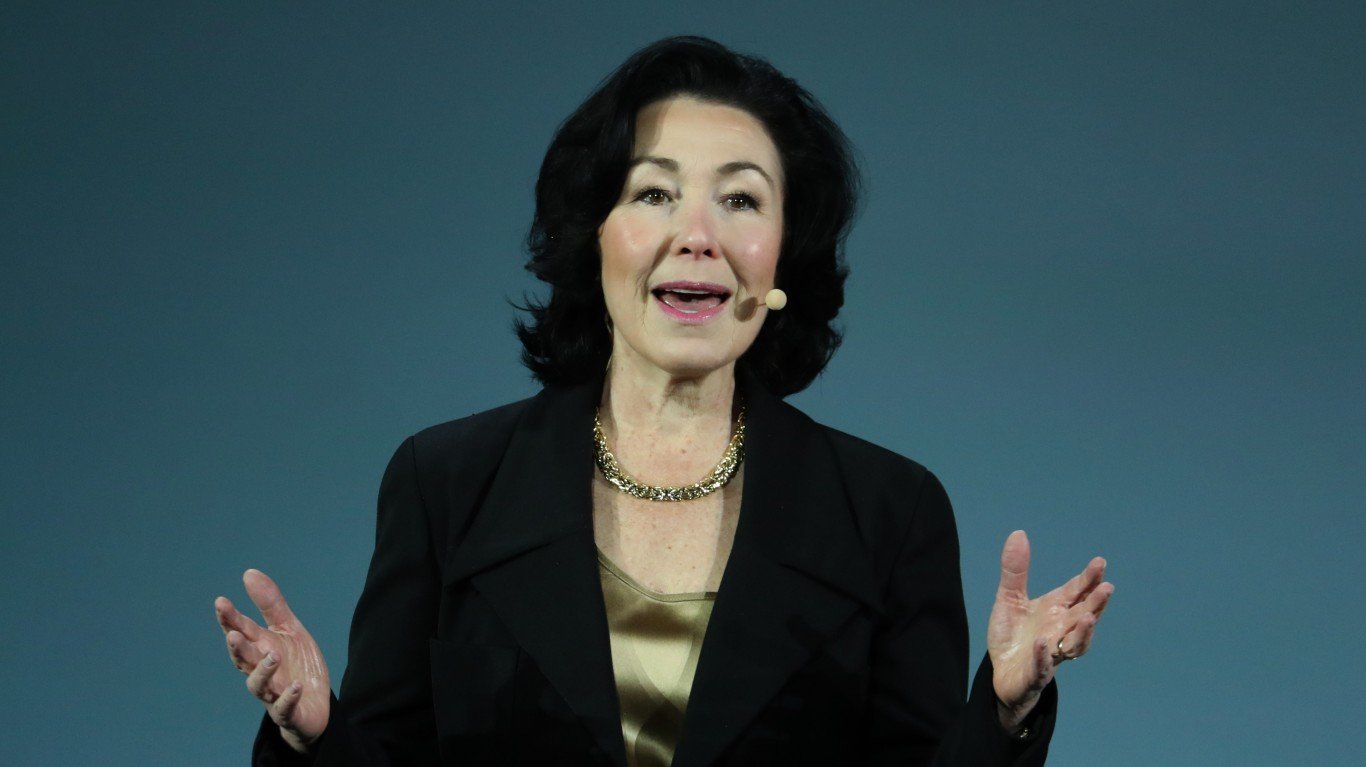

8. Safra Catz, Oracle Corporation

> CEO pay to employee pay ratio: 1,842:1

> Compensation, 2022: $138,192,032 (or $66,438 per working hour)

> Median annual worker pay: $75,043

> Industry: Software – infrastructure

> Revenue (12-month trailing): $47.96 billion

> Full-time employees: 143,000

7. David Gibbs, Yum! Brands, Inc.

> CEO pay to employee pay ratio: 2,108:1

> Compensation, 2021: $27,578,659 (or $13,259 per working hour)

> Median annual worker pay: $13,082

> Industry: Restaurants

> Revenue (12-month trailing): $6.84 billion

> Full-time employees: 36,000

[in-text-ad]

6. Ernie Herrman, The TJX Companies, Inc.

> CEO pay to employee pay ratio: 2,249:1

> Compensation, 2022: $31,802,000 (or $15,289 per working hour)

> Median annual worker pay: $14,139

> Industry: Apparel retail

> Revenue (12-month trailing): $49.94 billion

> Full-time employees: 329,000

5. Christopher Kempczinski, McDonald’s Corporation

> CEO pay to employee pay ratio: 2,251:1

> Compensation, 2021: $20,028,132 (or $9,629 per working hour)

> Median annual worker pay: $8,897

> Industry: Restaurants

> Revenue (12-month trailing): $23.18 billion

> Full-time employees: 100,000

4. Peter Kern, Expedia Group, Inc.

> CEO pay to employee pay ratio: 2,897:1

> Compensation, 2021: $296,247,749 (or $142,427 per working hour)

> Median annual worker pay: $102,270

> Industry: Travel services

> Revenue (12-month trailing): $11.67 billion

> Full-time employees: 16,500

[in-text-ad-2]

3. David Zaslav, Warner Bros. Discovery, Inc.

> CEO pay to employee pay ratio: 2,972:1

> Compensation, 2021: $246,573,481 (or $118,545 per working hour)

> Median annual worker pay: $82,964

> Industry: Entertainment

> Revenue (12-month trailing): $33.82 billion

> Full-time employees: 37,500

2. David Goeckeler, Western Digital Corporation

> CEO pay to employee pay ratio: 3,332:1

> Compensation, 2022: $32,137,338 (or $15,451 per working hour)

> Median annual worker pay: $9,644

> Industry: Computer hardware

> Revenue (12-month trailing): $15.75 billion

> Full-time employees: 65,000

[in-text-ad]

1. Andrew Jassy, Amazon.com, Inc.

> CEO pay to employee pay ratio: 6,474:1

> Compensation, 2021: $212,701,169 (or $102,260 per working hour)

> Median annual worker pay: $32,855

> Industry: Internet retail

> Revenue (12-month trailing): $513.98 billion

> Full-time employees: 1,541,000

Take This Retirement Quiz To Get Matched With A Financial Advisor (Sponsored)

Take the quiz below to get matched with a financial advisor today.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

Here’s how it works:

1. Answer SmartAsset advisor match quiz

2. Review your pre-screened matches at your leisure. Check out the

advisors’ profiles.

3. Speak with advisors at no cost to you. Have an introductory call on the phone or introduction in person and choose whom to work with in the future

Take the retirement quiz right here.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.

24/7 Wall St.

24/7 Wall St. 24/7 Wall St.

24/7 Wall St. 24/7 Wall St.

24/7 Wall St.