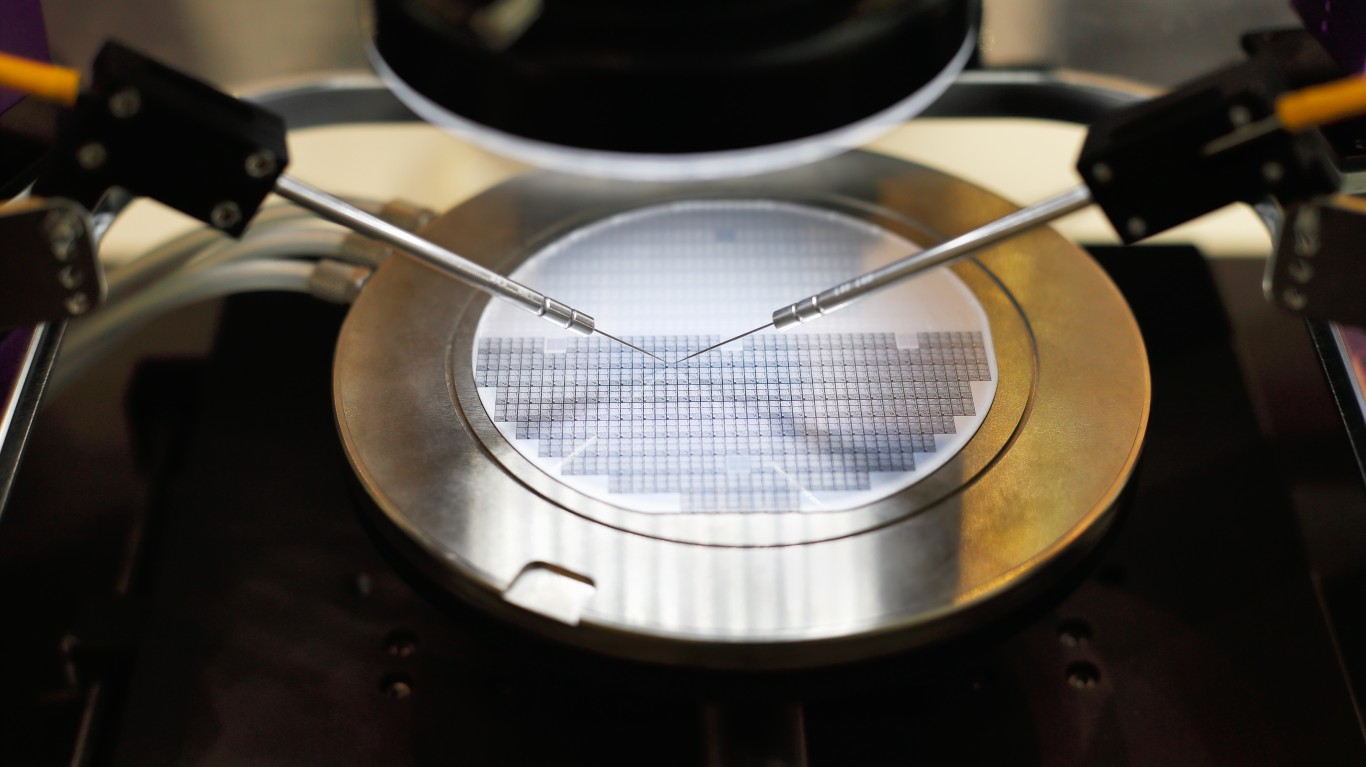

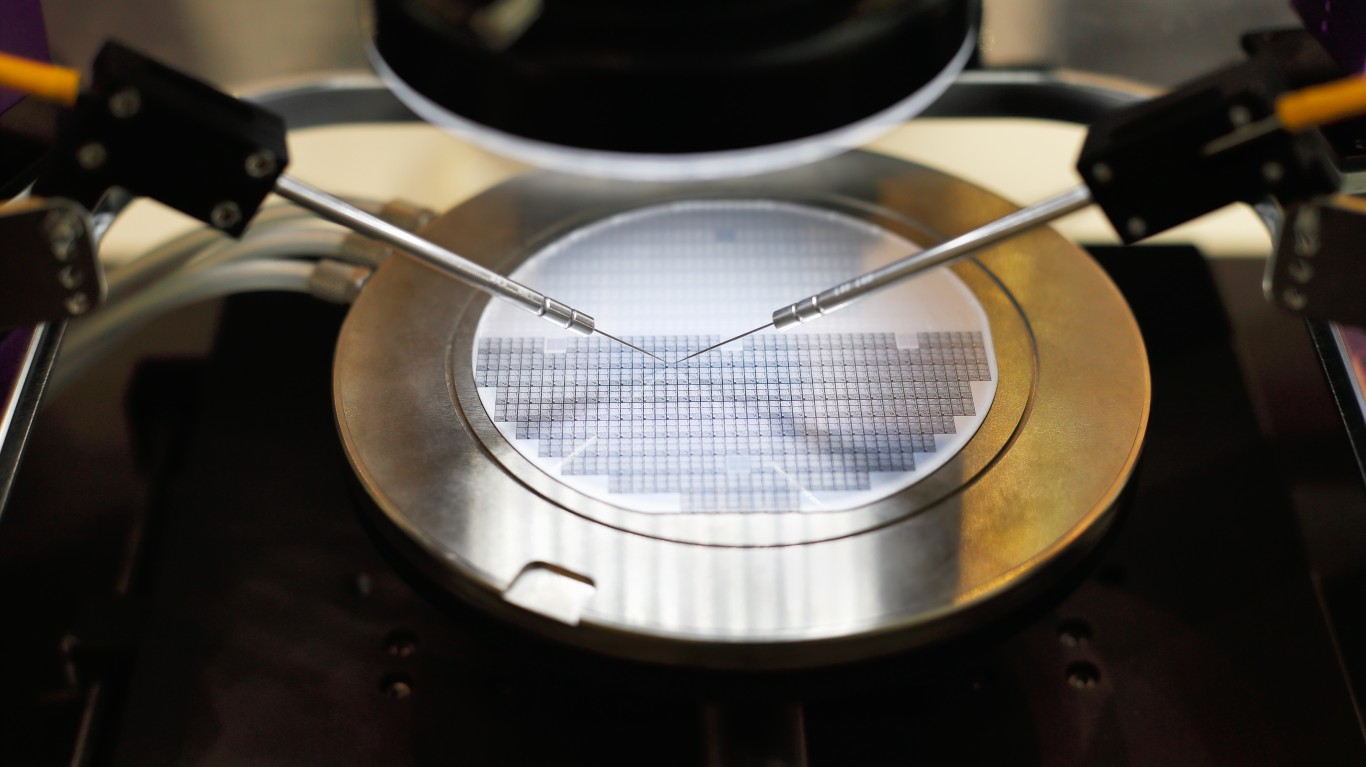

Tightness in the supply of semiconductors and recurring coronavirus outbreaks in China have affected the supply of everything from automobiles to smartphones. Now, the impact of inflation may reduce demand among consumers for semiconductors, while new lockdowns in China and the macroeconomic picture colored by the Russian invasion of Ukraine are expected to ratchet up pressure on the industry.

None of that means that there are no opportunities in the semiconductor industry, either among firms that design the chips, make the chips, or manufacture the machines that fabricate the chips.

[in-text-ad]

In a research note published Wednesday, analyst Mark Lipacis and his team identified seven semiconductor stocks trading at a sharp discount (18%) to the S&P 500 index and that also trade similarly to where semiconductor stocks were trading at their last two mid-cycle corrections. According to the Jefferies analysts, the mid-cycle correction pattern and the discount levels to the S&P 500 (SPX) are strong buying signals:

The Pattern Says Buy. In 2015 and 2018, relative to the SPX, the SOX (PHLX Semiconductor Index) ultimately bottomed close to the respective mid-cycle correction level. The SOX is currently trading at the May mid-cycle correction recently, suggesting limited relative downside from current levels.

The Level Says Buy. In 2015 and 2018, the SOX ultimately bottomed at a 21-23% P/ E discount to the SPX. The median semiconductor stock is currently trading at an 18% discount, [with four semiconductor stocks ] trading at a 25-30% discount.

The analysts go on to say that stocks that were the worst performers in the previous downturns were the best performers in the following upturn. Added to that are Wall Street estimates that set low bars for revenue and earnings growth in the first half of this year.

Here are seven stocks that Lipacis and his team believe are top buys.

AMD

Advanced Micro Devices Inc. (NASDAQ: AMD) is a leading chip designer and producer for the personal computer, server and graphics markets. Jefferies rates the stock a Buy and has a price target of $155 on the shares. At a share price of around $93.40, the upside potential based on Jefferies’ price is 66%. The consensus price target on the stock is $150. Wall Street is estimating 2022 EPS at $4.01 and 2023 EPS at $4.68, while Jefferies has estimates of $4.04 and $4.64 for 2022 and 2023, respectively. In 2021, AMD posted EPS of $2.79.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.

24/7 Wall St.

24/7 Wall St.