emerging markets

China's Shanghai exchange fell into bear territory Tuesday, another signal that the government's efforts to manage the economy are not having their intended effect. Can China withstand an all-out...

Published:

Last Updated:

India's great long-term growth opportunities have not translated into gains for investors so far in 2018. But Goldman Sachs feels that India likely will benefit from demographic trends, reforms and...

Published:

Last Updated:

As US Enters Formal Stock Market Correction, Global Stock Exchanges Follow Suit (and Some Are Worse)

It's official: The U.S. stock market has entered correction territory. While drops of 10% sound atrocious, there are a few things to keep in mind.

Published:

Last Updated:

One strategy that investors can use to be defensive without taking the extremely low return of bonds is with stocks characterized as low-volatility ones.

Published:

Last Updated:

Everyone knows that investors will pay up to chase growth, and it is quite possible that India might be one of the best growth stories in the world for 2018 and beyond.

Published:

Last Updated:

Direxion has been the key firm behind the triple-leverage ETF model. Now Direxion is entering the emerging market bonds.

Published:

Last Updated:

Extreme poverty remains a worldwide social and economic scourge. According to a report from the World Bank and UNICEF, 767 million people around the world live on less than $1.90 per day — a...

Published:

Last Updated:

Inflation has not been a concern for quite some time. Perhaps too long. Now that some inflation has started to look a bit more close, and with the Federal Reserve presidents continuing to jawbone...

Published:

Last Updated:

Brazil's problems spread beyond a terrible management of the Olympics. Brazil's economy is sliding toward disaster.

Published:

Last Updated:

When told of a failed coup and a round of thousands of arrests of military, government and civilian people, most investors might just assume that the local stock market would be crushed.

Published:

Last Updated:

24/7 Wall St. has decided to track seven funds, all either closed-end funds or exchange-traded funds (ETFs), that offer yields of 10% or more.

Published:

Last Updated:

Fitch Ratings has issued its latest Global Economic Outlook. Unfortunately, that outlook is calling weaker growth in gross domestic product (GDP) for the United States in 2016.

Published:

Last Updated:

Merrill Lynch now believes that the time has come to move back into emerging markets from developed markets.

Published:

Last Updated:

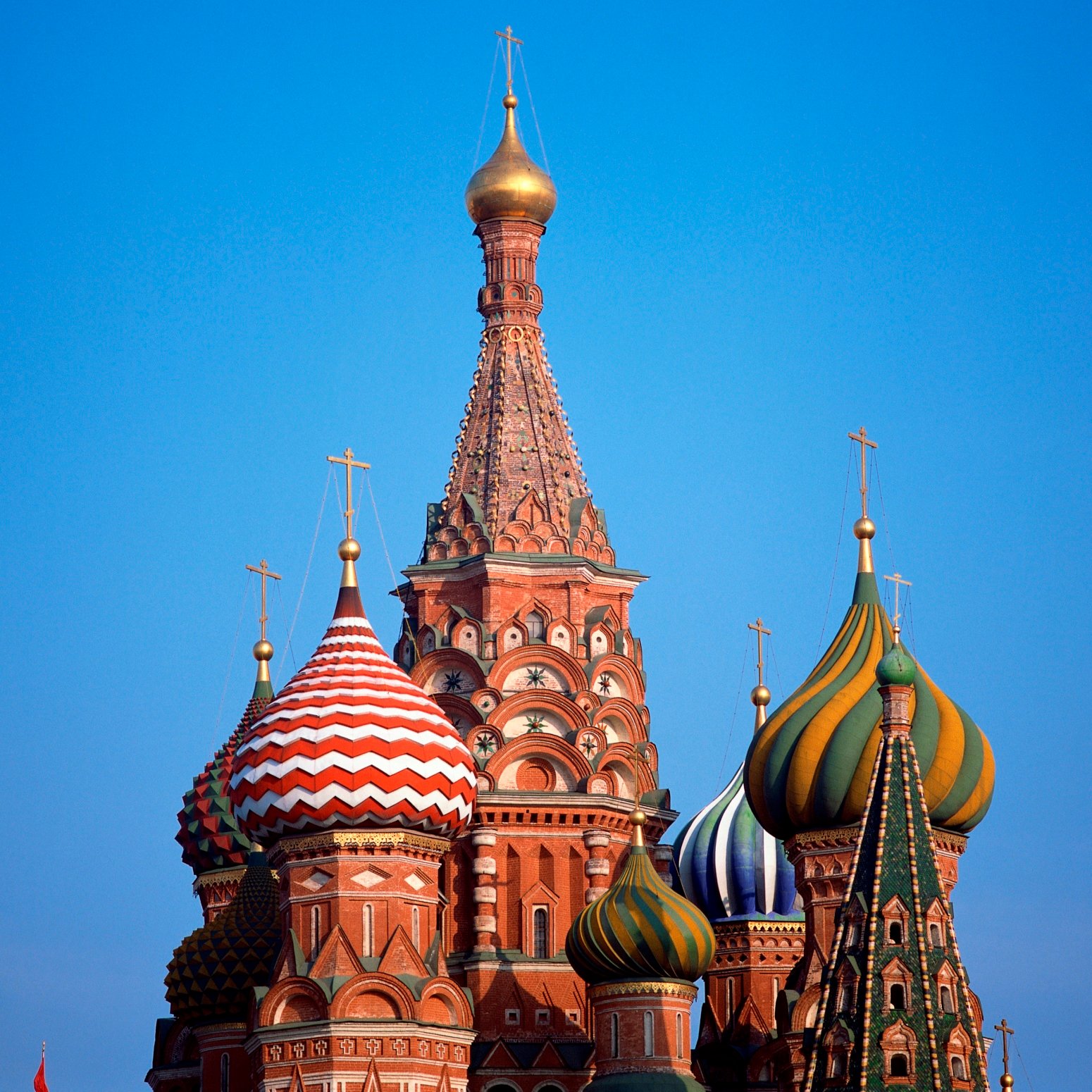

On top of news that money outflows out of Russia have slowed in 2016, Credit Suisse's emerging markets investing team has lifted its weighting for Russia.

Published:

Last Updated:

The latest OECD Interim Economic Outlook sees only a modest recovery in advanced economies and slower activity in emerging markets.

Published:

Last Updated: