Broadcom, Maybe Saved by Apple, Still Among the Best Values in Chip Stocks

September 20, 2013 by Jon C. Ogg

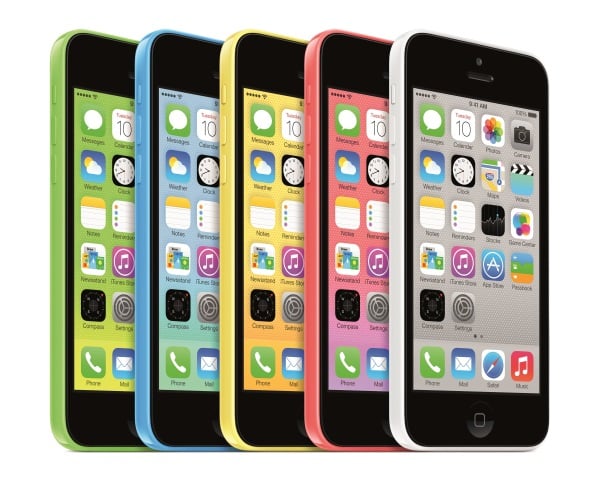

The boost on Friday is on reports of Apple Inc. (NASDAQ: AAPL) using Broadcom’s processing chips in the new iPhone 5 refresh cycle. The note signals a possible end to worries that Apple may in-house all of its chip efforts. It also comes after Broadcom made an acquisition and gave guidance that frankly sent its shares into a “value analysis” category. Growth investors almost never want to see their stocks there. After all, growth investors want growth, rather than battered stocks that look cheap because their growth metrics have petered out.

As far as Broadcom’s new valuations, the consensus estimates from Thomson Reuters are $2.65 earnings per share (EPS) and $8.36 billion in sales in 2013. That puts the stock at less than 11 times earnings and less than two times revenue. For 2014, those consensus estimates are $2.73 EPS and $9.01 billion in sales, which still signals growth. It implies 10 times next year’s earnings and only 1.8 times next year’s sales.

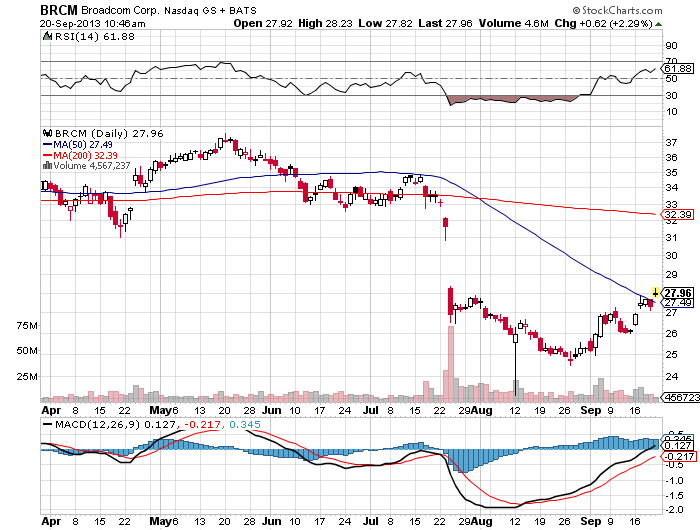

In mid-morning trading, Broadcom shares were up 2.3% at $27.95, and the 52-week range is $23.25 to $37.85. Broadcom has a market cap of $16.2 billion, and the consensus price target from Wall Street analysts is $33.15.

There is still growth and value to be had in Broadcom, but investors are fickle here because of bad misses in the recent past driving its growth rates and stock price lower.

Broadcom’s turnaround might just be getting started. We have included a chart below showing its 50-day and 200-day moving average from Stockcharts.com for your review. Stay tuned.

Essential Tips for Investing: Sponsored

A financial advisor can help you understand the advantages and disadvantages of investment properties. Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

Investing in real estate can diversify your portfolio. But expanding your horizons may add additional costs. If you’re an investor looking to minimize expenses, consider checking out online brokerages. They often offer low investment fees, helping you maximize your profit.