Chinese Automaker Nio Looks to Intel for Self-Driving Cars Push

November 5, 2019 by Paul AusickChipmaker Intel Inc. (NASDAQ: INTC) and Chinese automaker Nio Inc. (NYSE: NIO) have announced an agreement to join in a “strategic collaboration” to develop highly automated and autonomous vehicles (AV) for consumer markets in China and other major markets.

Under the agreement, Nio will mass-produce Intel’s Mobileye Level 4 AV kit and integrate the technology into Mobileye’s electric consumer vehicle lines and driverless ride-hailing service. Intel paid $15.3 billion in 2017 to acquire Israel-based Mobileye.

Nio is the first large-scale automaker supplying vehicles to Mobileye as it builds out is commercial fleet of robotaxis. Nio seeks to maintain its position in the premium electric car market. In October, Nio sold 2,526 vehicles in China, including 2,220 of its new all-electric ES6 5-passenger sedan. Sales of its ES8 sport utility vehicle fell 83% to just 306 units.

Nio founder, board chair and chief executive, William Li, commented:

NIO aspires to be the next-generation car company and a user enterprise. We see electric vehicles as the starting point and the fabric that connects and strengthens communities. Working with Mobileye to enhance the safety and capabilities of our vehicles is in line with our vision to offer premium smart electric vehicles and shape a joyful lifestyle.

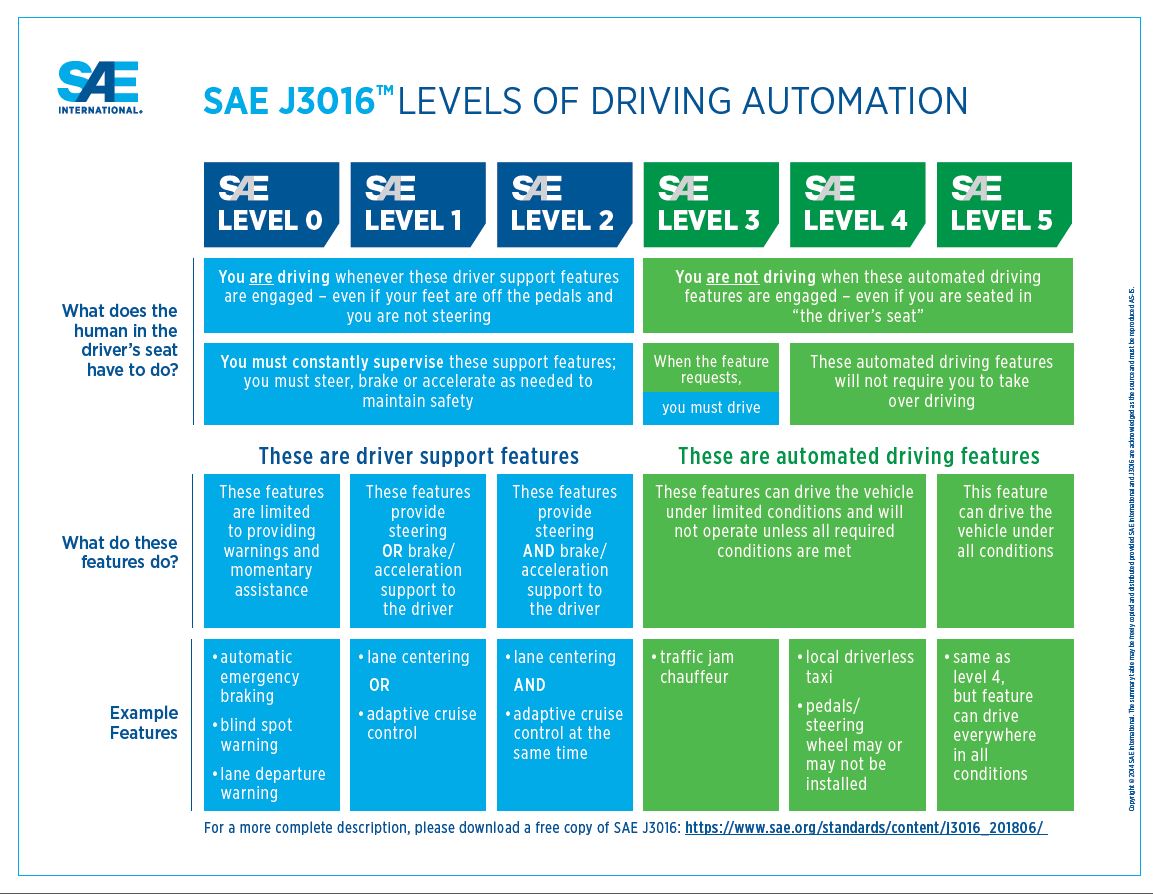

Mobileye’s AV Series systems include cameras, radars, lidars, cables, modem, GPS and other mechanical components powered by the firm’s fifth-generation EyeQ system-on-a-chip processor. A Level 4 AV system does not rely on a human driver to take over control of the vehicle at any time and can control the vehicle in “limited” conditions but will not operate unless all the conditions are met. It is the minimum level for robotaxis.

Virtually every major automaker either is developing or is a party to an agreement with a company working to develop AV capabilities. Mobileye’s chief competitor is probably Alphabet Inc. (NASDAQ: GOOGL), which spun off its Waymo autonomous driving activities in 2016 into a separate subsidiary. Waymo has been testing its driverless technology in Phoenix since late in 2017 with a selected group of handpicked riders. In December 2018, another 1,000 invitees began testing the driverless ride-hailing service.

Nio’s chief competitor in the electric car market is Tesla Inc. (NASDAQ: TSLA), which sold an estimated 6,400 vehicles in China in the third quarter, most of which were the company’s Model 3 sedan. Tesla recently fired up its Shanghai Gigafactory and has begun producing low volumes of the Model 3 in China. By the end of the year, Tesla hopes to be building 1,000 Model 3 sedans a week in China.

Tesla’s entry-level Model X SUV sells for around $89,500, compared to around $67,000 for the ES8. Nio began delivering the ES6 sedan in June at a price before incentives of around $52,000.

Tesla and Mobileye ended their collaboration in 2016, shortly after Intel acquired the Israeli company. It’s not clear which company initiated the break, but there were recriminations enough to go around. The split followed the May crash of a Tesla Model S that was operating semi-autonomously and that killed the driver of the car. To some degree, Tesla faulted Mobileye and Mobileye faulted Tesla. In any event, the relationship ended. Since then, Tesla has developed its own camera-based AV system.

Nio’s shares traded up about 28% in the noon hour Tuesday, at $2.19 in a 52-week range of $1.19 to $10.64. The 12-month consensus price target on the stock is $3.40.

The following chart from the Society of Automotive Engineers specifies the six levels of driving automation.