Seniors Worried About Social Security Cuts

August 9, 2019 by Paul AusickThe U.S. Social Security system faces two big problems. First, older Americans who have paid into the program for decades worry that it will collapse and that they won’t receive any benefit payments. Second, the younger generation that is just now beginning to pay into the system is even more certain that they’ll get nothing in return when the time comes for them to retire.

In April, the Social Security Administration’s trustees issued their annual report, projecting that the program’s $2.9 trillion trust fund will be exhausted by 2035. That’s not the worst news. Next year, the administration will begin paying out more in benefits than it receives in taxes and interest. The agency will be forced to draw down its trust fund to make full payments and by 2035 the trust fund will be emptied.

The American College of Financial Services surveyed 245 financial advisors who are accredited as Retirement Income Certified Professionals to find out what they and their clients believe about the future of Social Security and how that future will affect their clients.

Fully two-thirds of advisers say their clients are “moderately worried” that Social Security will “drastically cut benefits” in the future. In the trustees’ report last April, they estimated that a 25% reduction in benefits will be required unless Congress raises the Social Security withholding tax.

The economic outlook for seniors varies from state to state, as some places contribute much higher amounts to state and local government pensions. These are the states spending the most to fund their residents retirement.

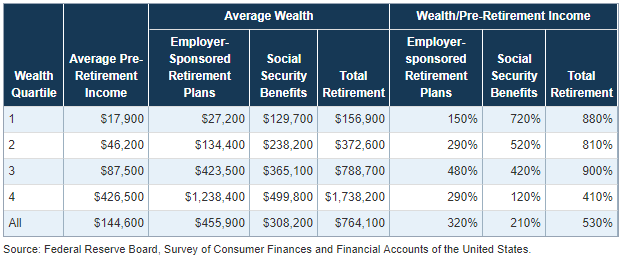

Nearly half (46%) of advisers fear that Social Security benefits for their older clients will be drastically reduced. This situation applies particularly to retirees who are not among the top quarter of earners. Federal Reserve Bank economists have calculated that for retired workers in the lowest quarter of pre-retirement income (average of $17,900), Social Security benefits are 7.2 times more important as sources of retirement wealth than are employer-sponsored retirement plans. In the second quartile (average pre-retirement income of $46,200), retirees are 5.2 times more dependent on Social Security, while in the third quartile ($87,500), Social Security benefits are 4.2% greater than retirement savings. In the top quarter, ($426,500), the ratio of Social Security wealth to pre-retirement income is just 1.2.

More than half (54%) of financial advisers say they are not worried about cuts to Social Security having a drastic effect on their older clients future benefits. That may be due partly to the average wealth of those clients. As the Federal Reserve noted, the Social Security system is designed to be “progressive,” accounting for a larger share of a low-income retiree’s wealth and a smaller share of a high earner’s retirement income.

Finally, 84% of financial advisers say that a 20% cut to Social Security benefits would “drastically alter their clients’ lifestyles.”

Colin Slabach, assistant director of the American College New York Life Center for Retirement Income commented, “The vast majority of [client] misconceptions [about Social Security] fall into one of four categories: spousal benefits, when you have to start taking Social Security, the cost-of-living adjustment, and taxation.”

Here are 11 questions (and answers) related to those and other misconceptions about Social Security.

Sponsored: Find a Qualified Financial Advisor

Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to 3 fiduciary financial advisors in your area in 5 minutes. Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests. If you’re ready to be matched with local advisors that can help you achieve your financial goals, get started now.