The bull market has now reached the ripe age of seven and a half years old. Stocks are valued high, at more than 18 times forward 12-month earnings for the S&P 500, and it is an election year with slow global growth. The Federal Reserve even keeps saying that it wants to raise interest rates. That may sound like a time that investors would show some pause or concern, but those same investors keep proving over and over that they want to buy stocks.

24/7 Wall St. has seen many warnings that the market seems to be overlooking, but pure technicians and chartists do not look at the same thing that fundamental investors care about. Some stocks have continued to surge day in and day out, and now their charts have been so strong that they might garner attention for a closer look.

Does it matter that these stocks are all valued with what might be nose-bleed valuations? Does it matter that these are almost all trading above the consensus analyst price targets from Thomson Reuters? Does it matter that some are currently losing money from operations? Again, fundamentals generally do not matter much (or at all) to pure technicians. P/E ratios, EBITDA growth, debt-to-equity, dividend coverage and other ratios that traditional investors are largely ignored by technicians.

24/7 Wall St. has tracked six key stocks that are all well-known companies and which have just managed to defy gravity. Not all of them are at all-time highs, but they have all seen more than impressive gains.

As a reminder, for a stock to be strong it means that many of the percentage gains have already been seen. That might not continue, and the fundamentals might scare traditional investors. Technicians only follow trends until those trends no longer work, and then they rapidly move on to something else. Another issue to consider is that by the time many charts get written about, the moves may be closer to an end rather than the start of something new.

Avon Products

Avon Products Inc. (NYSE: AVP) was so down and out that many investors forgot about it (or wish they did). That was then, with shares having recovered a whopping 170% from their lows of the last year. After a private equity deal there are hopes that this turnaround will finally have the runway and focus it needs. The issue is that selling its North American operations to Cerberus alleviated the cash worries, and Avon even recently had a $500 million debt offering. Jefferies started Avon as Buy with a $7 target this summer, back when shares were closer to $4.00 each.

Avon shares were up 46% so far in 2016, and 16% of that net gain has been in the past month alone. Some investors might care about the $20 share price as recently as 2013, but that feels like a long time ago and the NewCo Avon is much different from the OldCo Avon.

Avon’s shares were last seen trading at $5.95 on Wednesday, and the new 52-week high is $5.96. Its consensus analyst price target was at $5.39, and its 52-week low is $2.21. Avon’s market cap is $2.6 billion, and it is valued at more than 40 times expected 2016 earnings.

Chesapeake Energy

Though it is one of the top players in the energy sector, Chesapeake Energy Corp. (NYSE: CHK) also in the unloved natural gas segment. The company recently increased the aggregate purchase price offered for debt (notes) in a tender offer from $500 million up to $750 million. Chesapeake shares were trading strong at $6.66 last week, but now the shares have hit $6.90.

Chesapeake shares are still up 51% so far in 2015, but that is down 6.5% from this time a year ago. Just keep in mind that 39 of those 51 percentage points were from the past month alone. Chesapeake now loses money, and the consensus estimates from Thomson Reuters expect a loss in 2016 and then see earnings magically recovering to $0.84 per share in 2017.

The consensus price target is $5.37. and Chesapeake has a 52-week trading range of $1.50 to $9.55. Its market cap is $5.24 billion, but keep in mind this stock price is a fraction of its glory day highs under Aubrey McClendon.

GrubHub

Despite being weak on Wednesday after seeing a 1% drop, GrubHub Inc. (NYSE: GRUB) was up almost 20% in just the past three weeks alone. It is also now up almost 150% from its 52-week low. The stock was featured earlier in 2016, at far lower share prices, as a stock that wins from the rising tide of the millennials.

GrubHub shares are up a whopping 77% year to date, with seven of those percentage points in the past week and 10 of them in the past month. GrubHub’s valuation is also a high-beta level, valued at close to 50 times expected 2016 earnings per share.

Shares of GrubHub were last seen at $42.50, and the stock hit a new 52-week high of $42.97 just a day ago. The 52-week low is $17.77. The consensus price target is $42.38.

Petrobras

Petróleo Brasileiro S.A. (NYSE: PBR) has been a massive recovery machine. Much of the hope here was after anti-corruption efforts in Brazil might take the socialists out of power and that might get Brazil back on its recovery track. Petrobras recently said that its voluntary layoffs reached such high acceptance levels that it ended the program.

Investors need to keep in mind that Petrobras is not a normal oil company, and it is fully under the dominance and control of non-investor entities like the government and its union. Petrobras may be forced to operate at a loss, regardless of where the price of oil goes. Its shares are up 131% so far in 2016, and almost 20 points of the percentage gain is from the past month. Investors cannot use traditional earnings valuations on Petrobras.

Shares of Petrobras hit a new high of $10.04 on Wednesday, but they were already pulling back sharply. Its consensus price target is down all the way at $7.42, and its 52-week low is $2.71.

Sprint

Despite a perpetual price war and social media war with T-Mobile, Sprint Corp. (NYSE: S) has done well under the Softbank umbrella. Just do not forget that the Softbank umbrella keeps its shareholders without much real say here. Sprint recently finished third in a review of the top wireless carriers, but it added a record number of subscribers in the second quarter.

Sprint shares are up 75% so far in 2016, but the gains have been more muted of late despite recent highs. Sprint’s stock gains are 2% in the past week and 3% over the past month. Traditional price-to-earnings analysis is impossible to run here, so traditional valuations are elusive.

Sprint shares recently touched a new 52-week high of $6.45 and were as high as $6.43 on Wednesday. It has a consensus price target down at $4.45, and there are nearly four times the number of Hold/Neutral ratings as there are Buy ratings. Its stock is now up almost 200% from the 52-week low of $2.18.

Yelp

Yelp Inc. (NYSE: YELP) is another one of these strong charts that is starting to take a breather after a 1.5% drop on Wednesday. Yelp’s largest run came in August, but shares almost hit a 52-week high all over again the same day. The online reviews site has managed to get past the disappointing earnings waves, and now analysts have been chasing its target prices much higher. Perhaps the move beyond covering restaurants has helped out here.

Yelp’s shares are up 38% so far in 2016, but they are up 88% from this time six months ago. The gain might have only been 4% in the past few days, but that is still up 23% over the past month. Investors might want to keep in mind that Yelp is still expected to lose money in 2016 and is still valued at 100 times expected 2018 earnings.

Shares of Yelp were last trading at $39.20, but the new 52-week high is $39.96. Now consider that Yelp’s 52-week low is $14.53, but also keep in mind that the consensus price target is down at $37.47.

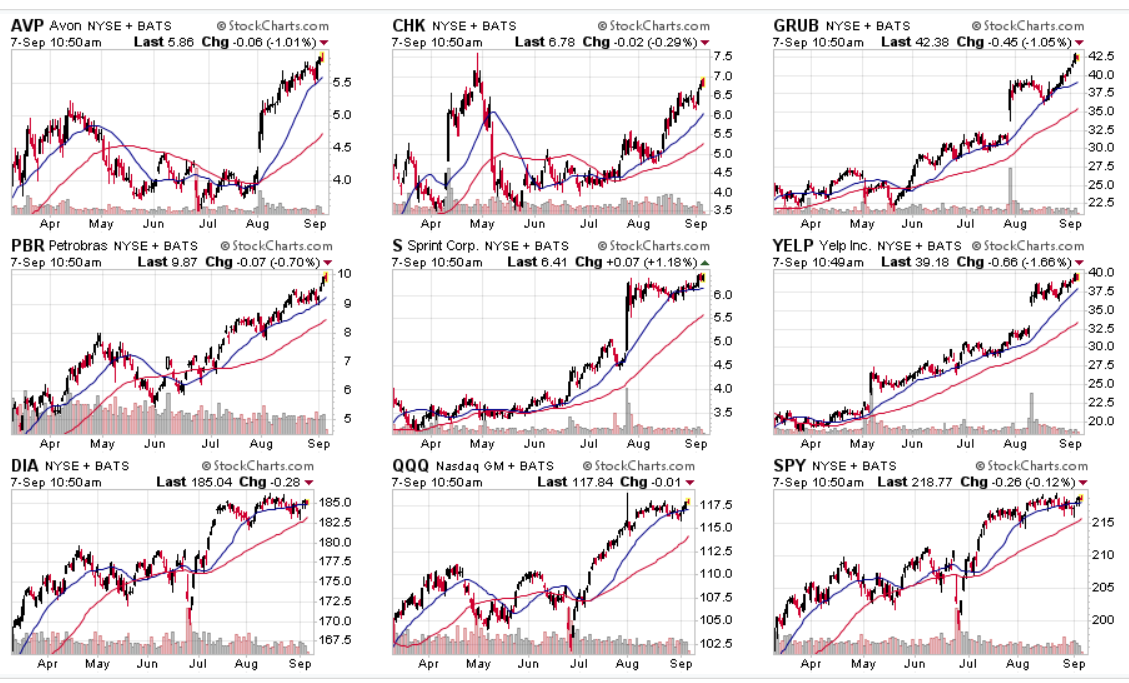

A review of each chart from StockCharts.com (expandable) has been provided below, versus the key exchange traded funds tracking the Dow Jones Industrial Average, Nasdaq 100 and S&P 500.

Essential Tips for Investing: Sponsored

A financial advisor can help you understand the advantages and disadvantages of investment properties. Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

Investing in real estate can diversify your portfolio. But expanding your horizons may add additional costs. If you’re an investor looking to minimize expenses, consider checking out online brokerages. They often offer low investment fees, helping you maximize your profit.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.