When Boeing Co. (NYSE: BA) rolls out its first 737 Max on Tuesday, the occasion will be marked by … not much.

Perhaps that’s because the new plane is still about two years away from first delivery to customers, and given Boeing’s recent performance with the 787 Dreamliner, a little less hubbub and a lot more attention to detail may help calm skittish investors. Recent stories related to airlines looking at leasing older planes rather than placing orders for new ones have introduced a note of caution into bragging about the huge backlogs at Boeing and Airbus, its main rival.

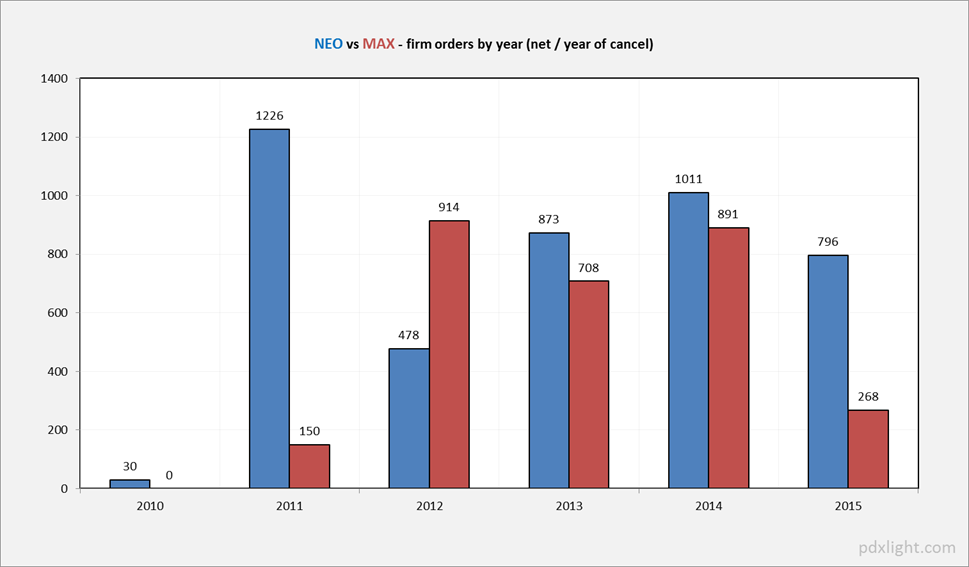

Boeing’s order book shows 2,955 of the 737 Max planes in the backlog. Airbus, which launched its A320neo program several months before Boeing launched the 737 Max, has firm orders for around 4,400 A320neo jets at the end of November, according to aircraft tracking website pdxlight.

The following chart tells the story:

Worse, for Boeing, is that so far in 2015 the company has taken net new orders totaling 568 aircraft. The company plans to sell around 755 aircraft this year. That means unless Boeing has a spectacular December, the company’s book-to-bill ratio will be less than one.

Total firm orders for both single-aisle, narrow-body jets is 7,345, of which Airbus has nabbed 60% to Boeing’s 40%. Not a particular surprise because Airbus has held the lead in narrow-body sales for years now while Boeing’s advantage has come in the wide-body market.

Airbus has just announced a production increase to 60 planes a month in 2019, and Boeing is currently mulling whether to match that. Boeing has said it will boost 737 production to 52 by 2018.

And then there’s the leasing story. With fuel prices at multiyear lows, more airlines may choose to lease and refurbish older planes rather than buy new ones. The new narrow-bodies from Boeing and Airbus have both been designed and built to be more fuel efficient. Since then, however, fuel costs have been halved and the calculus for buying new, more economical planes has changed.

In an article at Leeham News, Aengus Kelly, CEO of AerCap Holdings N.V. (NYSE: AER), noted airlines saw an annual savings of about $1 million a year on an Airbus 320neo when fuel prices were double what they are now. But that’s not what aircraft buyers primarily look at:

[W]hen the airlines are looking out 12, 14 years, which is what they do when they take new aircraft, where fuel is today is not something they look at. … [A]irlines can’t hedge themselves [and] of course no bank will write a derivative for the long-term for an airline to hedge fuel. The only way to do it ultimately is have the most fuel efficient assets out there.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.