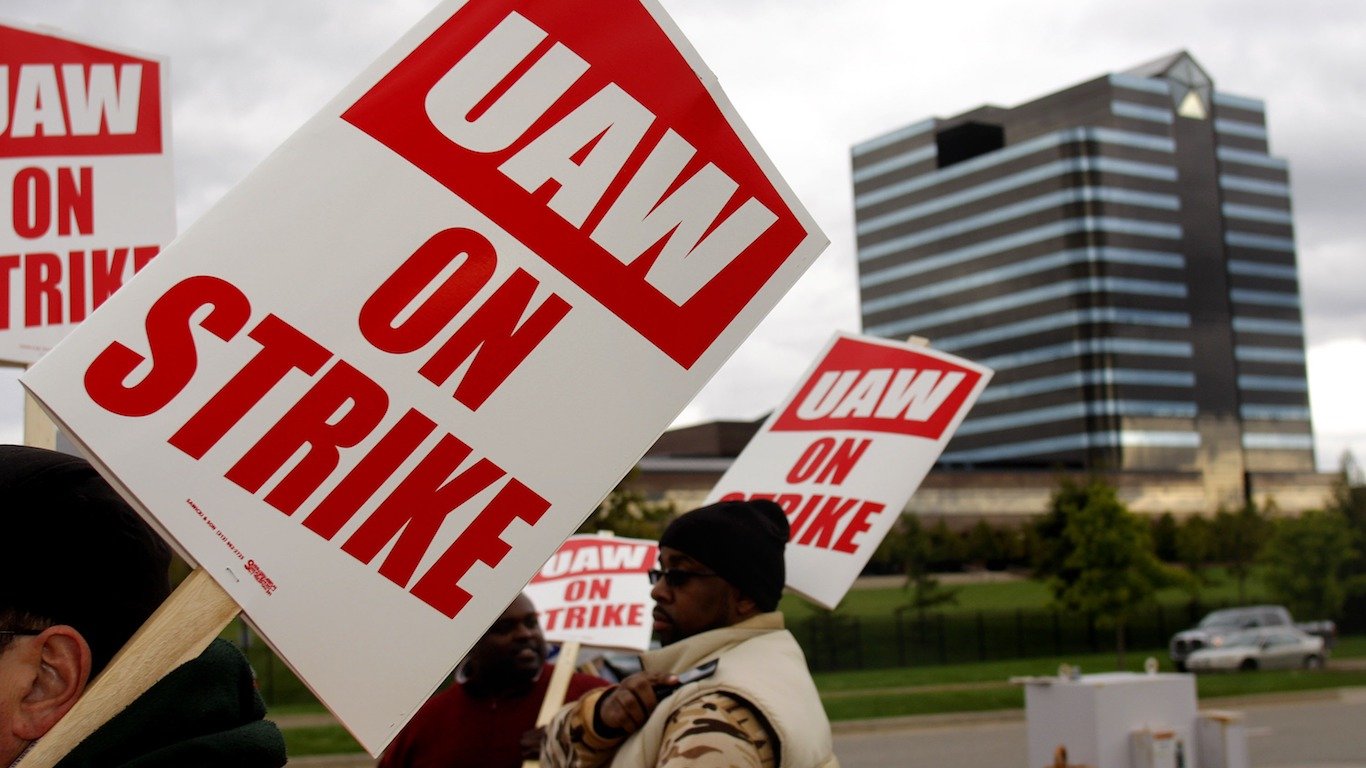

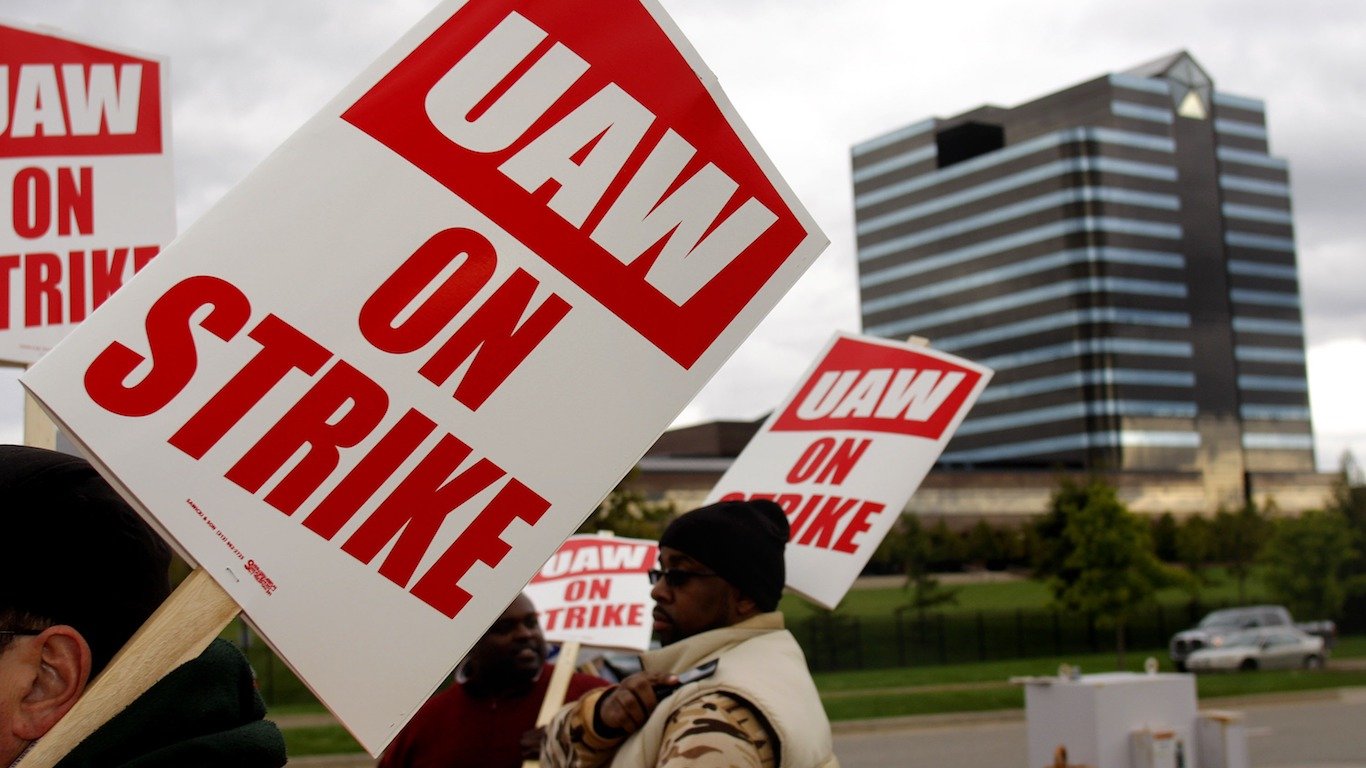

General Motors Co. (NYSE: GM) reportedly has finalized a settlement to end a multiweek strike by the United Auto Workers (UAW) union. As of midday on October 17, neither a press release nor a U.S. Securities and Exchange Commission filing has confirmed that a settlement is finalized. With earnings season kicking off, there will be more of a focus on what the strike’s price tag in dollars and cents will tally up to for GM.

According to Merrill Lynch’s John Murphy, GM’s third-quarter earnings report, due on October 29, will be weighed down by the UAW strike. The Merrill team has come up with a projected cost of roughly $750 million to GM’s EBIT results in the third quarter alone. The larger hit is an expected $2.5 billion hit in the fourth quarter and a greater cash flow hit. The firm’s view is that much of the investor focus will be around the UAW strike and the ultimate contract’s financial implications into 2020 and beyond.

What matters about the Merrill view is that the firm has a Buy rating and still has a $55 per share price objective. That compares with a $36.65 prior close, and GM shares have taken close to a 10% slide since the recent peak prior to the strike. The two weeks of lost production are projected to have just under 100,000 units of lost production in the third quarter, while a hit of around 250,000 units is expected for the four weeks of lost production in the fourth quarter.

Murphy’s report said:

As we have noted previously, the cash flow hit will be greater than the EBIT hit due to the negative working capital unwind with production downtime. We are assuming roughly half (but certainly not all) of this lost production, particularly on the new K2XX/T1XX program, will be recovered in 2020, although we still maintain our broader cycle downturn view for that year, which should continue to pressure volumes.

As far as what to expect from the coming earnings report, the Refinitiv consensus estimates call for $1.36 in earnings per share on $34.1 billion in revenues during the third quarter. Fourth-quarter estimates are $1.44 per share and $30.9 billion. That fourth-quarter hit is substantial as it would be only one cent higher in earnings per share from a year earlier, but the annualized revenue drop would be close to 20%.

It’s important to consider that GM’s shares rallied late in September on reports that GM and the UAW were close to an agreement to end the strike. Nearly three weeks later the same reports are out but with more specifics. Other analysts have chimed in as well in recent days and weeks.

On October 15, Buckingham Research maintained its Neutral rating but lowered its target to $32 from $35.

Barclays chimed in on October 2, maintaining its Overweight rating but lowering its price target to $48 from $51.

GM’s stock traded down 0.5% at $36.46 on Thursday, in a 52-week trading range of $30.56 to $41.90. Its consensus price target was $47.44.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.

24/7 Wall St.

24/7 Wall St.