The COVID-19 pandemic sped up a transition in global payment types. With stay-home restrictions and general caution on the part of consumers, point-of-sale (POS) cash transactions fell by 32% globally in 2020 to just over 20% of all global POS sales. Much of that share was taken by digital (or mobile) wallets.

According to a new report from FIS Worldpay, a division of Fidelity National Information Services (FIS), mobile wallet payments rose by nearly 20% last year and represented more than 25% of global POS transactions last year. Mobile wallet payments also exceeded global POS payments by credit card (22.4% globally) and debit cards (22.3%).

By 2024, FIS Worldpay forecasts mobile wallet POS payments will rise to more than a third of all such payments, while credit card payments will rise to 22.8% and debit card payments will rise to 22.4%. Cash payments will continue falling, reaching 12.7% in 2024.

What are the top investments in mobile wallets? Before teasing out more from the FIS Wordplay study, here’s our quick look at four exchange-traded funds (ETFs) that focus on the financial services or financial technology (fintech) sectors.

Ark Invest’s Fintech Innovation ETF (NYSEARCA: ARKF) had nearly $2 billion in assets under management at the end of December and had more than doubled its net asset value over the course of 2020. Since its inception in February 2019, the fund has returned 62.2%. As of last Friday, net assets in the fund totaled $2.72 billion. Square accounts for 9.71% of its holdings, and PayPal accounts for 5.45% of the fund’s investments. Other fintech firms among its top 10 holdings are Zillow, Pinterest, Shopify and Sea.

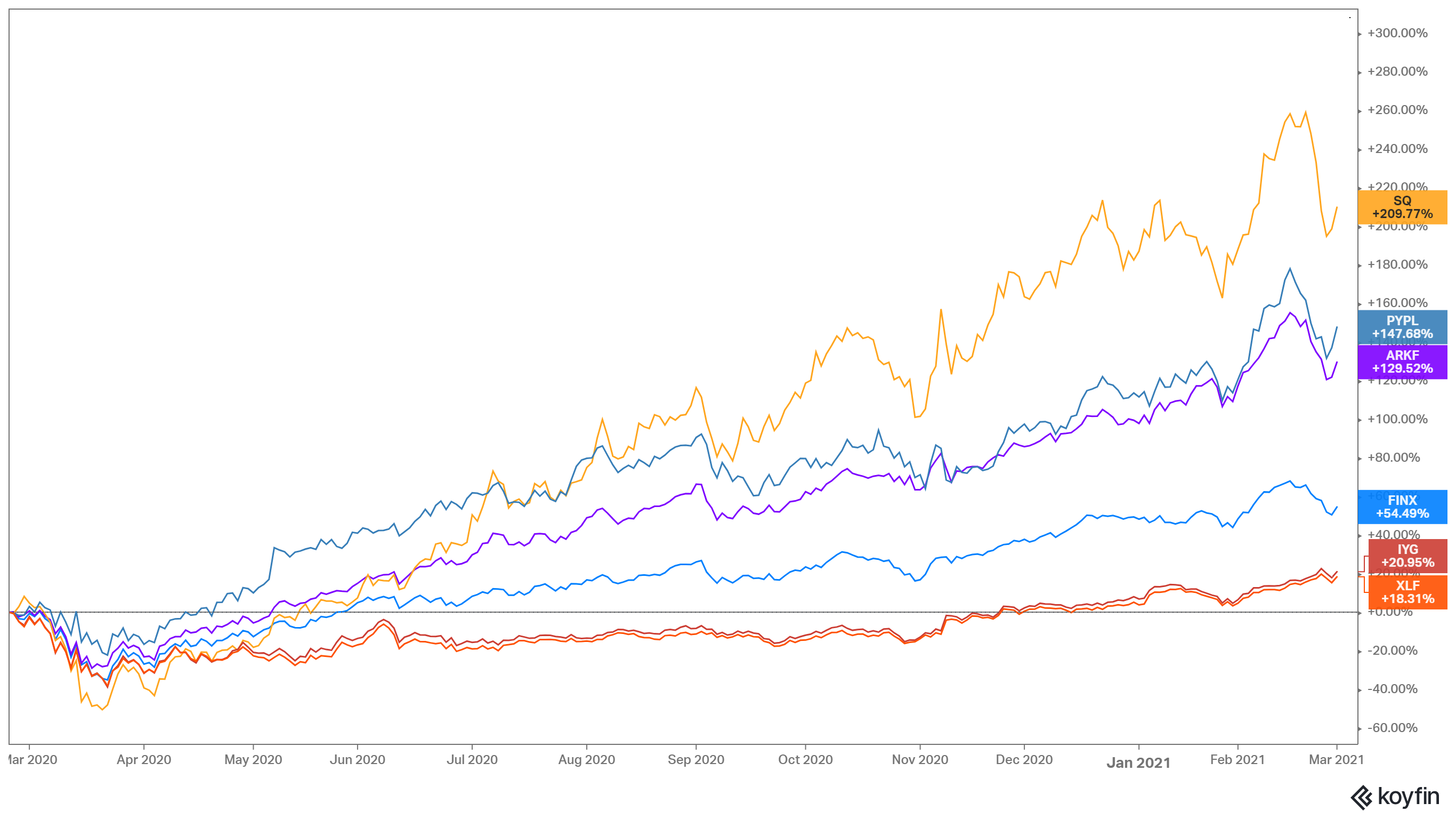

The fund’s top holding is Square, whose digital payment and stock trading Cash App, has contributed to sending the company’s shares up more than 200% over the past 12 months. The ETF’s second-largest holding is PayPal, the payments processor and owner of the Venmo mobile wallet, which has added about 145% over the past 12 months.

The Global X FinTech Thematic ETF (NYSEARCA: FINX) had about $1.26 billion in assets under management as of last Friday. The fund was created in September 2016 and shares have appreciated by around 54% over the past 12 months. The fund’s top holding is Square, and its fifth-largest holding is PayPal, with asset percentages of 8.21% and 5.62%, respectively. Australia-based Afterpay and Netherlands-based payment software provider Ayden are the second- and third-largest holdings in the fund, with investments totaling 7.41% and 6.16% of assets, respectively.

The third financial services ETF we looked at is the iShares U.S. Financial Services ETF (NYSEARCA: IYG). The fund’s top holding is megabank JPMorgan Chase (12.54% of assets), with credit card issuers Visa and Mastercard as the second- and third-largest (89.97% and 8.49%, respectively). Of the top eight holdings, six are the country’s largest banks.

The fund has $1.35 billion in assets under management, and ETF shares have appreciated by about 21% over the past 12 months, less than half as much as shares in Global X FinTech Thematic and about 90% below the growth in the Ark Invest ETF.

The last of the financial services ETFs we looked at was the Financial Select Sector SPDR Fund (NYSEARCA: XLF). With some $34.5 billion in assets under management, this ETF is by far the largest and oldest (inception date of December 1998). The top holding is Warren Buffett’s Berkshire Hathaway (12.87% of assets), and the next six largest holdings are all the biggest U.S. banks.

Over the last 12 months, this fund has returned more than 18% to investors, and its chart path closely matches that of iShares and Global X funds. Here’s a full chart of the four ETFs, along with the performance of Square and PayPal over the same period. Including the fintech stocks and excluding all the big bank stocks made all the difference for the Ark’s fund.

If FIS Worldpay is accurate, fintech will continue to grow and share prices for fintech stocks right along with the technology. For global e-commerce payments, digital/mobile wallets accounted for 44.5% of all payments last year, and FIS Worldpay forecasts that total to rise to 51.7% by 2024. Credit cards accounted for 22.8% of all e-commerce payments last year, but that is forecast to fall to 20.8% and debit card payments are expected to slip from 12.3% to 12.0%. Bank transfer payments accounted for 7.7% of online payments last year, and those are forecast to fall to 5.3% by 2024.

Cui bono? Who benefits? First off, people do. Mobile wallets mean never having to hand a credit or debit card to another person or even having to punch the buttons on the POS gizmo at the checkout line. It may take longer to eliminate the ubiquitous ATM machines, but they’re eventually gone too.

Between early June and mid-August of last year, Australian firms had removed 2,150 ATMs and the country’s top four banks had closed 175 bank branches in an effort to protect people from the spread of the coronavirus. However, the head of the Reserve Bank of Australia’s payments policy, Tony Richards, told Adelaide Now that the central bank “expects the long-term downward trend in the use of cash to continue.”

Businesses benefit from some lessons learned from the pandemic. For example, in 2019, physical checks accounted for 29% of all business-to-business transactions with two-thirds of those checks issued by small and medium-sized businesses. According to the FIS Worldpay report, research firm Juniper Research estimates that the global transaction value of virtual (digital) cards increased by 11% to $1.6 trillion. The researchers expect that total to more than triple by 2025.

The financial services sector benefits in a number of ways. First, digital wallets like Square’s Cash Pay, PayPal’s Venmo and Zelle, owned by a consortium including BofA, Capital One, JPMorgan Chase and Wells Fargo (among others), make it possible to avoid touching filthy lucre at all. The switch to digital wallets also means fewer branches, which means lower costs and higher profits.

Who might benefit? In the first place, people who don’t have bank accounts. According to a report issued last October by the Federal Deposit Insurance Corporation (FDIC), about 5.4% of U.S. households (around 7.1 million) do not have a bank account. One proposed remedy for that is postal banking, offering basic banking services through the 30,000 or so U.S. Post Offices scattered across the country.

If postal banking, along with digital wallets, were available to the so-called unbanked (and everyone else), would that drive the final nail in the coffin of cash payments? The financial services sector will not give in quietly on this subject, however, especially the payday lenders that likely benefit most from Americans who don’t have bank accounts.

Catherine Wood, ARK Invest CEO, is a shareholder of 24/7 Wall St. LLC.

Sponsored: Want to Retire Early? Here’s a Great First Step

Want retirement to come a few years earlier than you’d planned? Or are you ready to retire now, but want an extra set of eyes on your finances?

Now you can speak with up to 3 financial experts in your area for FREE. By simply clicking here you can begin to match with financial professionals who can help you build your plan to retire early. And the best part? The first conversation with them is free.

Click here to match with up to 3 financial pros who would be excited to help you make financial decisions.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.

24/7 Wall St.

24/7 Wall St.