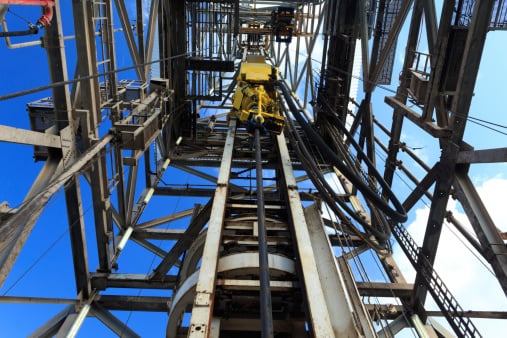

Source: Thinkstock

Nomura lowered its 2016 and 2017 pricing assumptions and reduced its 2018 marginal pricing targets. The firm also notes one factor that is often overlooked:

Lower prices are driving demand above expectations and, subsequently, driving capital out of both non-OPEC/non-U.S. upstream and onshore U.S. shale investment.

In other words, the cost of capital is rising for U.S. E&P companies, and that is before the Federal Reserve boosts its funds rate. The main implication, as Nomura points out, is that companies are going to have to do all they can to live within their cash flows because not only will borrowing cost more, lenders will not be leaping at the chance to fund expensive projects with an uncertain — but certainly longer than desired — payback period.

Here is a quick look at Nomura’s top six picks, with more detail following after.

Concho Resources Inc. (NYSE: CXO) is a Permian Basin pure-play with a market cap at Wednesday’s mid-morning share price of around $12.7 billion.

Newfield Exploration Co. (NYSE: NFX) operates in several oil-rich regions, but its Anadarko Basin properties are the company’s bread and butter. The company’s market cap is about $5.7 billion.

Pioneer Natural Resources Co. (NYSE: PXD) operates in the Midland basin of the Permian. The company’s market cap is about $18.2 billion.

Anadarko Petroleum Corp. (NYSE: APC) is a diversified global E&P company with assets resembling its much larger integrated peers like Exxon Mobil and Chevron. The company’s market cap is about $35.4 billion.

EOG Resources Inc. (NYSE: EOG) has solid positions in the Eagle Ford, Bakken and Permian Basin regions. The company’s market cap is around $43.1 billion.

Suncor Energy Inc. (NYSE: SU) was also listed as a top pick because, like Anadarko, it compares well with the global integrated firms like Exxon and Chevron. Suncor’s market cap is about $38.9 billion.

ALSO READ: 7 Energy Stocks Analysts Want You to Buy Now

In Nomura’s view, the next wave of technology will disproportionately benefit companies with core acreage in the major U.S. shale plays. Capital productivity continues to improve across North America, and the firm remains strongly behind core Midland, Delaware, Anadarko and Marcellus properties over the next 18 months, and it also expects improvements in the Bakken, Eagle Ford and Niobrara plays.

Nomura now estimates benchmark West Texas Intermediate (WTI) crude oil to fetch $50.39 a barrel at the end of third-quarter 2015 and $47.13 at the end of the fourth quarter. Those estimates are unchanged. However, the firm had been estimating a per-barrel price of $62 in 2016 and $74 in 2017 and has now revised those to a 2016 average of $50 a barrel and a 2017 average of $56 a barrel. Not until 2018 does the price rise to an average of $67 a barrel. Nomura’s estimates are below the consensus for all three years and below the latest strip for 2016 and 2017, but 11.1% higher for 2018.

In general, Nomura values its coverage using detailed corporate modeling and relative valuation to growth multiples — i.e., enterprise value/debt-adjusted cash flow (EV/DACF) relative to debt-adjusted cash flow per share (DACFPS). The firm then folds in distributable cash flows (DCFs) and/or net asset value (NAV) work and back-tests these valuations against more traditional price to forward cash flow multiples and their historical ranges to arrive at its relative ratings and target prices. The analysts also consider factors such as changes in debt-adjusted cash flow per share (CFPS) growth, resource inventory and balance sheet risk.

ALSO READ: Warren Buffett Clarifies Buying More IBM and Phillips 66 Shares

When Nomura cites commodity price risk in its evaluations, the firm means any material difference in commodity prices (upward or downward) or regional differentials versus the firm’s forecasts that would affect estimates for profitability and future cash flow and could affect longer-term production growth rates.

Concho Resources carries a $131 target price from Nomura, based on an 8.5-times CFPS multiple applied to its averaged 2017 and 2018 CFPS estimates ($15.37). Downside risks to Nomura’s financial outlook and, therefore, to Concho Resources achieving its target price include: 1) commodity price risk and 2) production risk — the company is well regarded by analysts and investors, and, as such, any disappointments on the production and growth could lead to outsized volatility. Concho traded late Wednesday morning at $103.96, in a 52-week range of $77.22 to $136.10.

Newfield Exploration has a $45 target price, based on a 5.3-times CFPS multiple applied to Nomura’s averaged 2017 and 2018 CFPS estimates ($8.58). Downside risks to Nomura’s financial outlook and, therefore, to Newfield achieving its target price include: 1) commodity price risk and 2) operations risk — Newfield is focusing on its best areas and high-grading operations — subpar geologic results, particularly in the emerging South-Central Oklahoma Oil Province (SCOOP) and Sooner Trend, Anadarko, Canadian and Kingfisher (STACK) plays, could present risks to production growth forecasts. Newfield traded at $34.48, in a 52-week range of $22.31 to $40.27.

ALSO READ: UBS Dividend Ruler Stocks to Buy This Fall

Nomura puts a $174 price target on Pioneer Natural Resources, based on a 10.0-times CFPS multiple applied to the firm’s averaged 2017 and 2018 CFPS estimates ($17.45). Downside risks to Nomura’s financial outlook and, therefore, to Pioneer achieving its target price include: 1) commodity price risk and 2) operational risk — Pioneer has chosen to focus on its best areas and high-grading operations, and subpar geologic results, particularly in the Midland Basin, could present risks to production growth forecasts. Pioneer traded at $120.10 Wednesday morning, in a 52-week range of $105.83 to $209.25.

Regarding Anadarko, Nomura has a price target of $86, based on a 7.0-times CFPS multiple applied to its averaged 2017 and 2018 CFPS estimates ($12.35). Downside risks to Nomura’s financial outlook and, therefore, to Anadarko achieving its target price include: 1) commodity price risk; 2) inventory risk — while Nomura believes that Anadarko’s adept portfolio management and technology will add to medium- to long-term resource inventory, investors will closely monitor type curve sustainability and resource potential to gauge reserve life/future growth, particularly in areas such as the Delaware Basin; 3) exploration risk — the success or failure of exploration wells could change investors’ valuation views; and 4) litigation risk — Anadarko had a working interest in the Macondo well, and ongoing litigation could expose the company to additional liability. Anadarko recently traded at $68.61, in a 52-week range of $58.10 to 108.14.

EOG Resources gets a $93 price target from Nomura, based on a 8.5-times CFPS multiple applied to its averaged 2017 and 2018 CFPS estimates ($10.93). Downside risks to Nomura’s financial outlook and, therefore, to EOG achieving the target price include: 1) commodity price risk and 2) inventory risk — while Nomura believes that EOG’s technology will add to medium- to long-term resource inventory, investors closely monitor type curve sustainability and resource potential to gauge EOG’s reserve life and future growth. EOG shares traded at $78.28, in a 52-week range of $68.15 to $106.09.

ALSO READ: 4 Top Jefferies Growth Stock Picks to Buy Now

Suncor has a CDN$43 price target, based on a 6.6-times CFPS multiple applied to its averaged 2017 and 2018 CFPS estimates (CDN$6.47). Downside risks to Nomura’s financial outlook and, therefore, to Suncor achieving its target price include: 1) commodity price risk; 2) operations risk — there are timing and cost overrun risks with building out and streaming incremental larger projects (Hebron) and oil sands (Ft. Hills) facilities — to date, Suncor is largely on time and on budget, but delays could negatively affect valuation; 3) downtime risk — given the concentrated nature of Suncor’s oil sands and refining assets, unexpected facility downtime can affect production and cash flows; 4) environmental risk — the oil sands are subject to significant environmental scrutiny, whereby changes in policies and/or rulings can adversely affect oil sands companies; and 5) political risk, given the Alberta government’s current review of its royalty regime. Suncor traded Wednesday morning at $26.74, in a 52-week range of $24.20 to $39.88.

Sponsored: Find a Qualified Financial Advisor

Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to 3 fiduciary financial advisors in your area in 5 minutes. Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests. If you’re ready to be matched with local advisors that can help you achieve your financial goals, get started now.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.