Health and Healthcare

Merrill Lynch Bullish on Deep Value Pharmaceuticals: 5 Stocks to Buy for 2018

Published:

Last Updated:

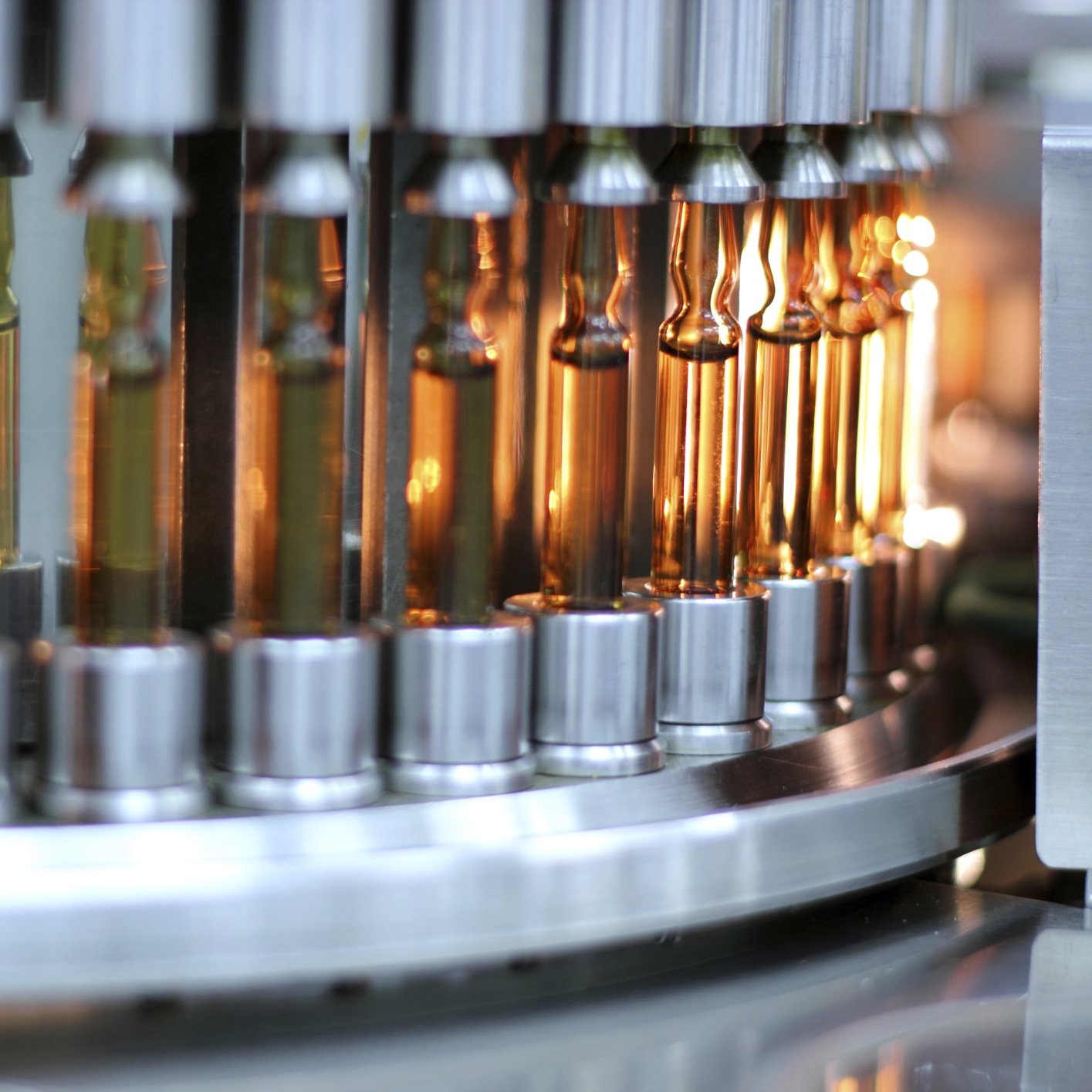

With the market looking ready to continue running to all-time highs despite yesterday’s selling, many pundits feel this late stage part of the rally is more people trying to get on board for fear of missing out than actually true investment dollars coming in. The only problem with that is the economy, and the macro picture, need to stay almost perfect. If the tax reform doesn’t pass, or a war breaks out in the Middle East or Korea, all bets are off. Source: Thinkstock

Source: Thinkstock

One good area to look at in this overbought and pricey market is the big and specialty pharmaceuticals, and the analysts at Merrill Lynch are out with reinstated coverage on 10 companies, including five that are rated Buy that they consider to be “deep value” plays now.

This is one of the top pharmaceutical stocks picks across Wall Street. AbbVie Inc. (NYSE: ABBV) is a global, research-based biopharmaceutical company formed in 2013 following separation from Abbott Laboratories. The company develops and markets drugs in areas such as immunology, virology, renal disease, dyslipidemia, and neuroscience.

One of the biggest concerns with AbbVie is what might eventually happen with anti-inflammatory therapy Humira, which has some of the largest sales for a drug ever recorded. Last year the patent board instituted Coherus’s Inter Partes Review against the Humira ‘135 patent. The problem with Humira is that biosimilars and generics are itching to enter the market.

The Merrill Lynch team feel that based on the strength of Humira formulation patents and patent litigation timelines, they do not expect U.S. biosimilars until 2023. They also note that Abbvie’s next-gen immunology agents should partially mitigate Humira revenue that will be eventually lost to biosimilars.

Shareholders in AbbVie are paid a solid 2.96% dividend. The Merrill Lynch price target for the shares is $103, and the Wall Street consensus target is $98.20. The stock was trading early Thursday at $96.70 per share.

This stock has taken a beating this year and is offering an outstanding entry point for investors. Allergan PLC (NYSE: AGN) is a specialty pharmaceutical company that develops, manufactures and markets branded products. The company’s growth has been driven largely by acquisitions supported by internal growth.

Allergan markets a portfolio of best-in-class products that provide valuable treatments for the central nervous system, eye care, medical aesthetics, gastroenterology, women’s health, urology, cardiovascular and anti-infective therapeutic categories, and it operates the world’s third-largest global generics business, providing patients around the globe with increased access to affordable, high-quality medicines.

Allergan is an industry leader in research and development, with one of the broadest development pipelines in the pharmaceutical industry and a leading position in the submission of generic product applications globally. The Merrill Lynch analysts note the company’s Aesthetics leadership and that the substantial pipeline optionality is not priced in. And with Restasis now a zero, 2018 estimates represent a clean trough multiple year.

Allergan shareholders are paid a 1.6% dividend. Merrill Lynch has a price target of $204 per share, and the posted consensus price objective is $229.70. The shares traded at $175.50 Thursday morning.

This top biotech company is also a new favorite at Merrill Lynch. Jazz Pharmaceuticals PLC (NASDAQ: JAZZ) is a biopharmaceutical company that identifies, develops and commercializes pharmaceutical products for various medical needs in the United States, Europe and elsewhere. The company has a portfolio of products and product candidates with a focus in the areas of sleep and hematology/oncology.

The company’s largest products are Xyrem for narcolepsy (excessive daytime sleepiness), followed by Erwinaze for acute lymphoblastic leukemia (ALL) and Defitelio for veno-occlusive disorder (VOD, blockage of blood vessels in liver).

The analysts see this as a very reasonably priced stock and said this in their report:

Growth opportunity from Vyxeos (expected to become new standard of care in Secondary Acute Myeloid Leukemia) and JZP-110 (greatest upside potential) Potential for Xyrem patent settlements in 2017-2018 estimated, which we would expect to improve the stock sentiment.

Note that the $164 Merrill Lynch price target is less than the consensus estimate of $178.41 a share. The stock was last seen trading at $138.50 a share.

This leading health care company is also expected to partner with Samsung Bioepis, and its stock remains a top pick for conservative investors. Merck & Co. Inc. (NYSE: MRK) offers therapeutic and preventive agents to treat cardiovascular issues, type 2 diabetes, asthma, nasal allergy symptoms, allergic rhinitis, chronic hepatitis C virus, HIV-1 infection, fungal infections, intra-abdominal infections, hypertension, arthritis and pain, inflammatory, osteoporosis, male pattern hair loss and fertility diseases.

The company also provides neuromuscular blocking agents for use in surgery, anti-bacterial products for skin and skin structure infections, cholesterol modifying medicines, non-sedating antihistamine and vaginal contraceptive products.

The Merrill Lynch analysts feel that Merck offers attractive valuation, a good track record of returning cash, diversified revenue and substantial pipeline potential. They also noted that while the shares took a step back on the KN-189 update, they think Keytruda will be able to maintain its solid position in the immuno-oncology market.

Merck shareholders receive an outstanding 3.47% dividend. The Merrill Lynch price target is $64. The consensus price target is $65.36, and the shares were trading at $55.65 apiece.

This top global pharmaceutical company made a gigantic splash last year with a $5.5 billion purchase of Anacor Pharmaceuticals. Pfizer Inc. (NYSE: PFE) is organized into two commercial segments. The Biopharmaceutical segment is focused on discovering, developing and marketing drugs for cardiovascular, metabolic, central nervous system, immunology, pain, infectious diseases, respiratory, oncology and other indications. The Diversified segment includes the consumer products division.

The analysts said this is their report:

We are encouraged by undemanding valuation, EPS growth, leadership in growth categories and sustainable dividend. In the near-term we expect investor focus to be potential post tax reform mergers and acquisitions and strategic review of consumer business.

Investors in Pfizer are paid a very solid 3.53% dividend. Merrill Lynch has set its price objective at $40. That compares with the posted consensus target price of $38.14. The shares were trading at $36.20.

Five top companies to buy that already have long-standing franchises with huge sales and revenues. More conservative accounts may want to buy the pharmaceutical giants, while more aggressive accounts could look to the biotech and specialty pharmaceutical stocks.

Are you ready for retirement? Planning for retirement can be overwhelming, that’s why it could be a good idea to speak to a fiduciary financial advisor about your goals today.

Start by taking this retirement quiz right here from SmartAsset that will match you with up to 3 financial advisors that serve your area and beyond in 5 minutes. Smart Asset is now matching over 50,000 people a month.

Click here now to get started.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.