Industrials

Merrill Lynch Has 3 Industrial Stocks to Buy After Earnings

Published:

Last Updated:

With most of the second-quarter reporting done, and the market now entering the proverbial dog days of the summer, we wanted to find out just who did the best in the second quarter. In a new research report from Merrill Lynch we got the answer — and were somewhat surprised. Source: Thinkstock

Source: Thinkstock

The Merrill Lynch team, which is led by the outstanding Savita Subramanian, crunched the numbers and a somewhat unlikely sector winner came up for the second quarter in terms of beating earnings expectations. An astounding 62% of big cap multinational companies have beaten on earnings per share estimates, 49% have beaten on sales and 36% have beaten on both metrics. The analysts point out this is similar to the first-quarter numbers.

We screened the Merrill Lynch universe of stocks for companies rated Buy that fall into that category.

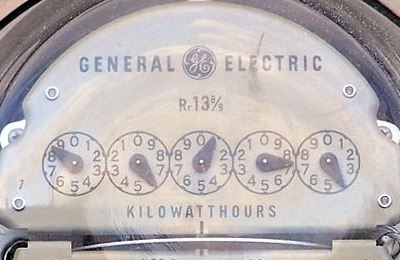

General Electric

This iconic blue chip industrial posted solid second-quarter numbers and may be in the process of a huge turnaround. General Electric Co. (NYSE: GE) is a highly diversified, global industrial corporation. Its businesses are organized broadly under six segments: GE Capital, Energy Infrastructure, Aviation, Healthcare, Transportation and Home & Business Solutions. The company’s products and services include power generation equipment, aircraft engines, locomotives, medical equipment, appliances, commercial leasing and personal finance.

ALSO READ: 4 Top Jefferies US Growth Stocks to Buy Now

The company has begun scaling back many of its operations and is returning capital to shareholders. GE announced earlier this year a restructuring plan that includes buying back up to $50 billion of its shares, selling about $30 billion in real estate assets over the next two years and divesting more GE Capital operations.

The repurchase program, which will be partly funded by $35 billion through money returned from GE Capital, is the second-biggest in history, after Apple’s $90 billion plan. GE, which had 10.06 billion shares outstanding on Jan. 31, said it expected to reduce that by as much as 20% to 8.0 billion to 8.5 billion by 2018.

All these catalysts could lure the fund managers back to the stock, which was a tremendous growth stock for years under Jack Welch.

GE investors are paid a solid 3.58% dividend. The Merrill Lynch price target for the stock is $33, and the Thomson/First Call consensus target is $30.23. Shares closed Monday at $25.87.

Honeywell International

This is another big cap multinational that is rated Buy at Merrill Lynch. Honeywell International Inc. (NYSE: HON) announced last week its largest purchase in more than a decade, when it agreed to buy the utility consumption metering business of Britain’s Melrose Industries for about $5.1 billion. This is the first major deal for Honeywell since it laid out a five-year plan in March 2014 to target at least $10 billion in acquisitions. Wall Street has been very eager to see how industrial companies use their capital as many of the foreign markets struggle for growth.

Honeywell’s operations are organized under three business groups: Aerospace, Automation and Control Solutions, and Performance Materials & Technologies. The company is a premier supplier of avionics, power and control systems for the aerospace industry.

ALSO READ: With Oil and Gas Down Huge This Year, 4 Quality Stocks to Buy Now

Honeywell investors are paid a 2% dividend. The Merrill Lynch price target is posted at $117, and the consensus objective is $116. Shares closed Monday at $104.70.

Raytheon

This company has a diversified mix of business and posted solid second-quarter numbers as well. Raytheon Corp. (NYSE: RTN) is an industry leader in defense, government electronics, space, information technology and technical services. The company operates in four principal business segments: Integrated Defense Systems, Intelligence, Information and Services, Missile Systems, and Space and Airborne Systems.

The company is not only likely to benefit from domestic defense purchasing, but the company has posted large contract sales to the Saudis over the past two years. Last year, Raytheon purchased privately held cybersecurity company Blackbird Technologies for about $420 million. The acquisition will help expand its surveillance and cybersecurity services to clients. Raytheon provides state-of-the-art electronics, mission systems integration and other capabilities in the areas of sensing; effects; and command, control, communications and intelligence systems, as well as cybersecurity and a broad range of mission support services.

Raytheon investors are paid a 2.5% dividend. The Merrill Lynch price target is $120, and the consensus target is $119.50. The shares ended Monday’s trading at $108.90.

ALSO READ: UBS Makes August Changes to Equity Focus List Portfolio

All three stocks are perfect for long-term growth portfolios. They pay solid dividends, are growing their business both organically and through acquisitions, and are returning capital to shareholders. These total return stocks make good sense in an expensive market.

A financial advisor can help you understand the advantages and disadvantages of investment properties. Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

Investing in real estate can diversify your portfolio. But expanding your horizons may add additional costs. If you’re an investor looking to minimize expenses, consider checking out online brokerages. They often offer low investment fees, helping you maximize your profit.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.