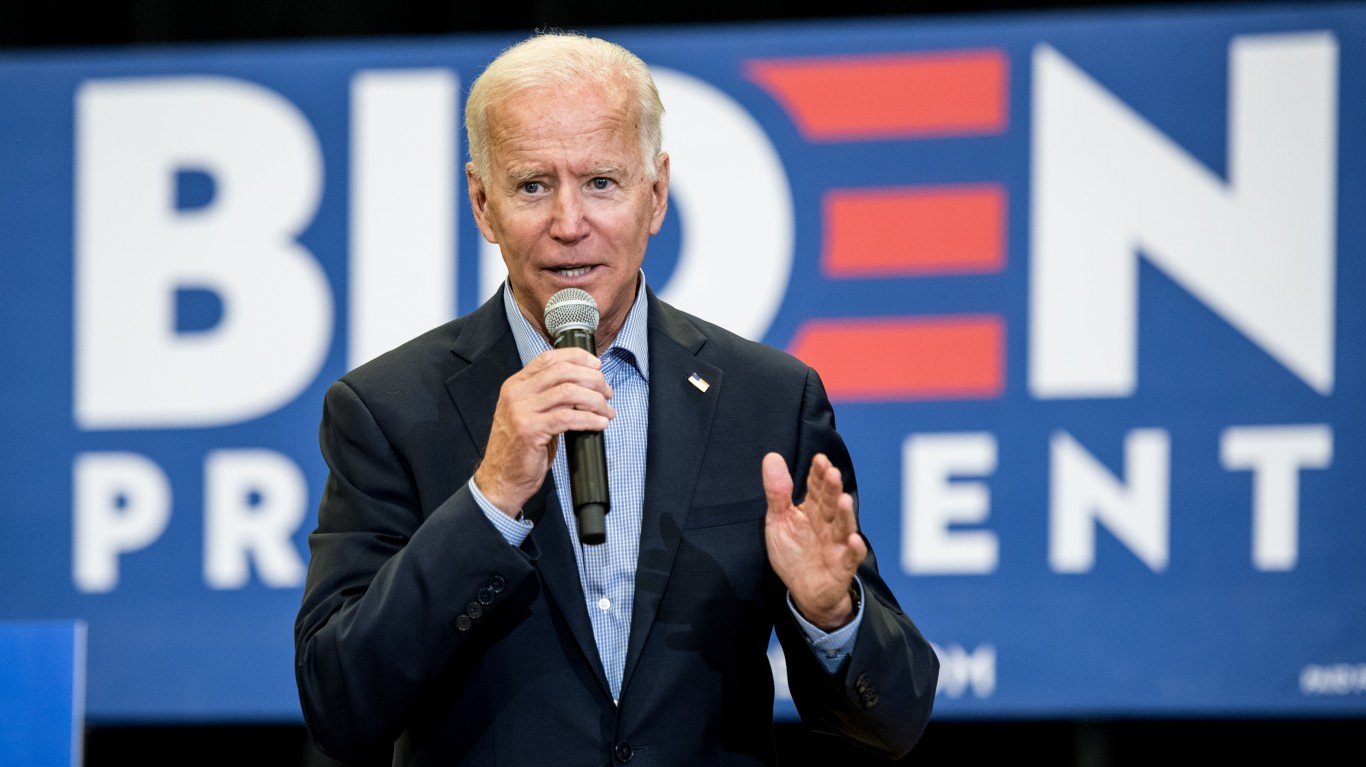

One thing we learned well in 2016 is not to trust the polls. Even a week before the election Hillary Clinton was considered a lock to win the presidency, but she ended up losing the electoral vote by a wide margin. The early handicapping has former Vice President Joe Biden with a sizable lead over President Trump, but given the shaky work of polls, and the history of four years ago, plus the possibility of a massive “silent majority” vote, Trump could hold the office for another four-year term.

[in-text-ad]

A new and outstanding UBS report handicaps every angle of this year’s races for president and Congress. They show the results of a blue wave with the Democrats regaining the presidency and the Senate, and they also show a red wave where Trump is reelected and the Republicans take back the house. Plus, they show the scenario if things remain the same as they are now.

To avoid a problem that we have encountered more and more in media and reporting these days, the UBS team said this as a forward to the report:

This report focuses exclusively on the investment aspect of the upcoming election. The authors are citizens and residents of the United States and, like all people around the world, hold a range of opinions and concerns about the issues of the day. You will not find those opinions in this report. Our jobs require us to be impartial observers, to view the world as it is, not as we think it should be. In line with that perspective, the objective of this report is straightforward. We aim to help investors prepare, as effectively as possible, for the upcoming US presidential election, which will be held on 3 November 2020.

Here we focus on the stocks the UBS team likes for investors to own for a Trump victory. While 28 stocks made the list, we selected 10 in various sectors with solid upside potential. It is important to remember that no single analyst report should be used as a sole basis for any buying or selling decision.

Citigroup

Shares of this top bank are trading at the lowest levels since 2018. Citigroup Inc. (NYSE: C) has approximately 200 million customer accounts and does business in more than 160 countries and jurisdictions. It also had one of the 50 highest-paid CEOs last year.

It provides consumers, corporations, governments and institutions with a broad range of financial products and services, including consumer banking and credit, corporate and investment banking, securities brokerage, transaction services and wealth management.

Trading at a still very cheap 8.4 times estimated 2021 earnings, this company posted solid second-quarter results this week that topped the analysts’ expectations on both the top and bottom lines.

Investors receive a sizable 3.91% dividend. The Wall Street consensus price objective is $69.29, and Citigroup stock closed Wednesday trading at $51.84. That was a gain of more than 3% on the day.

Concho Resources

In 2018, this company bought RSP Permian for $9.5 billion, and most on Wall Street continue to love the deal. Concho Resources Inc. (NYSE: CXO) is an independent company engaged in the acquisition, development and exploration of oil and natural gas properties.

It offers investors a unique combination of investment themes, including valuation, rate-of-change and resource expansion themes. The company is the largest acreage holder of the publicly traded Permian large-caps and provides investors peer-leading exposure to three of the most impactful catalysts across the Delaware Basin, including the Wolfcamp XY, Wolfcamp D and Bone Spring Shale.

Owning Concho Resources stock comes with a 1.54% dividend. The posted consensus price objective is $73.53. The shares closed trading on Wednesday at $52.05 apiece.

Crown Castle International

This top cell tower company offers incredible growth and income possibilities. Crown Castle International Corp. (NYSE: CCI) is one of the largest U.S. wireless tower companies, with over 40,000 towers across the country. Its core business is leasing space on its wireless towers primarily to wireless carriers, government agencies and broadband data providers.

Crown Castle is one of the best stocks in the group for more conservative investors as the high-yield distribution and low volatility make it a good holding for accounts seeking growth and income with less risk.

Investors receive a very solid 2.86% distribution. The consensus price objective is $171.43. Crown Castle International stock closed most recently at $168.00 per share.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.

24/7 Wall St.

24/7 Wall St.