U.S. equity markets got off to a positive start Friday morning, but stocks struggled to stay in the green. There could still be some profit-taking going on (stocks are carrying high valuations, in case you hadn’t noticed), and the economic news is mixed at best. The energy sector has bounced back after a couple of down days, trading up about 2% at noon, with the communications sector up more than 1%, the day’s second-best performer thus far.

Among meme stocks, losers were losing bigger than winners were winning. Losers also outnumbered gainers.

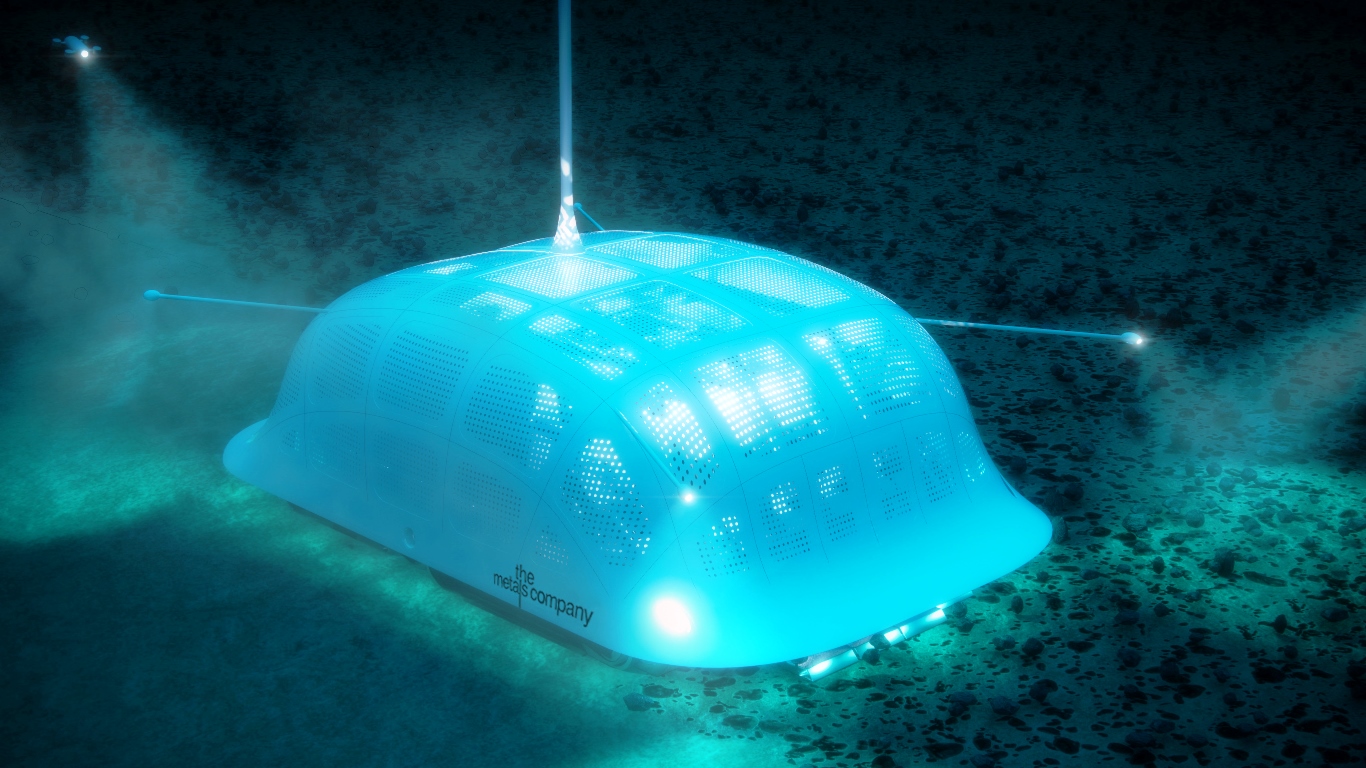

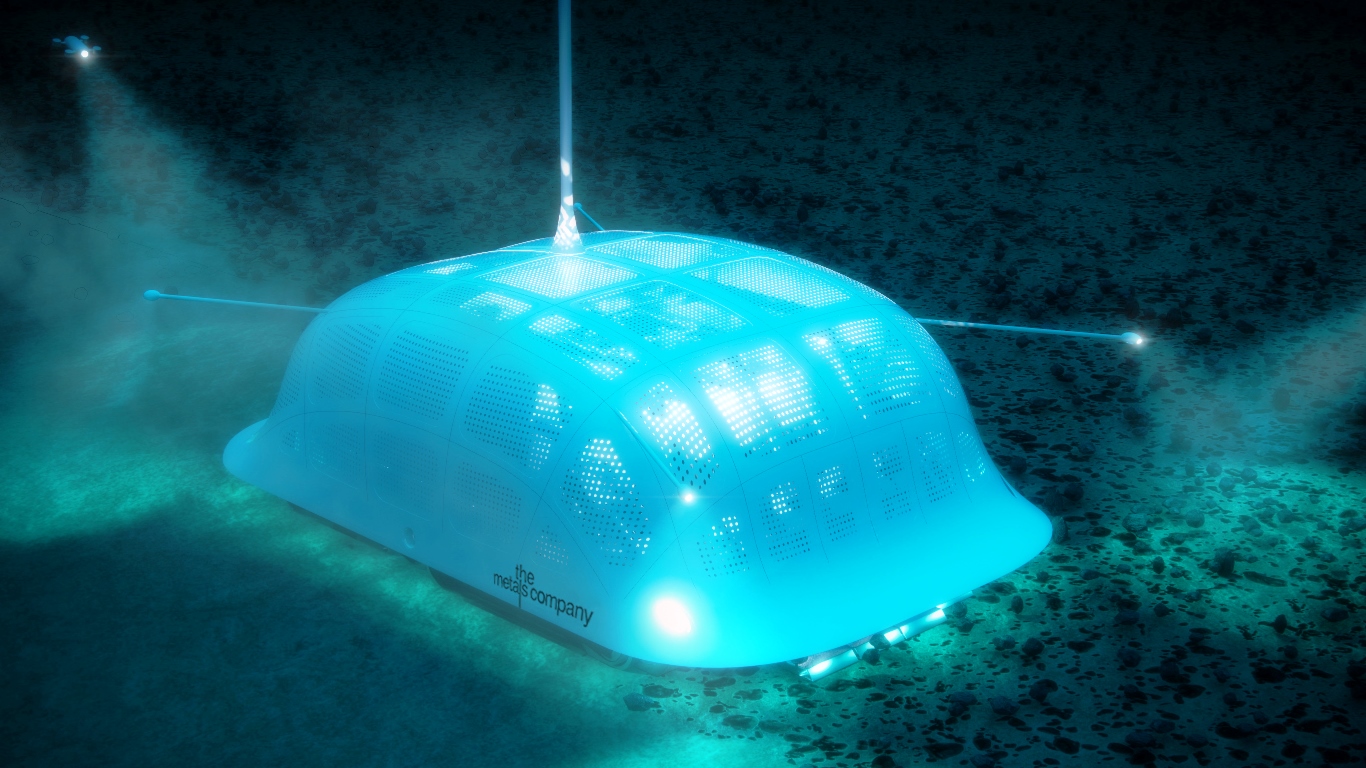

First, the good news. TMC the metals company Inc. (NASDAQ: TMC) was up by double-digits on no specific news. While not a good candidate for a short squeeze (about 2.5% of the float is sold short), the share price has tumbled by more than half in the past two weeks. One of the company’s board members, Andrei Karkar, purchased 2.25 million shares at $4.44 per share in a transaction valued at $10 million. Karkar now owns nearly 42 million shares of the company’s 224.4 million shares outstanding.

On the downside, IronNet Inc. (NYSE: IRNT) traded down more than 22%, at a level below its price exactly one month ago when the runup in the stock price got started. On September 16, the cybersecurity company posted a new 52-week high of $47.50. Shares have plunged since then. Again, not much here to prop up a short squeeze. Of 24 million floated shares, less than 10% (2 million) are sold short.

Camber Energy Inc. (NYSEAMERICAN: CEI) has been on a tear. Shares were up 480% for the month of September but traded down about 15% in the noon hour Friday. The stock had posted gains for six straight trading days, but short sellers apparently were being patient. The stock was one of the most likely to be hit with a short squeeze this week, according to data from Fintel, and it looks like that may have been tried. Traders at Reddit’s WallStreetBets were urging one another to keep calm and hold on.

Chinese food producer Farmmi Inc. (NASDAQ: FAMI) traded down nearly 14% in the noon hour Friday, after a day and half that saw the share price jump from around $0.23 to $0.53. The stock traded 1.3 billion shares on Thursday, but that level was probably out of reach Friday. Farmmi’s CEO on Wednesday announced a $10.9 million acquisition and the formation of four new subsidiaries in the health and wellness business. Only about 2.5% of the company’s float is sold short.

TMC’s share price gain had shrunk a bit to around 8%. The stock traded at $4.93, in a 52-week range of $4.09 to $15.39. The average daily trading volume is 15.6 million shares, and about 10.5 million had traded as of Friday’s noon hour.

IronNet continued to trade down about 22%, at $13.36 in a 52-week range of $9.36 to $47.50. Trading volume of around 9.5 million shares was more than double the daily average of 4.6 million.

Camber Energy continues to slide, with shares trading down nearly 18%, at $3.15 in a 52-week range of $0.33 to $4.85. The average daily trading volume is more than 113 million shares, and more than 225 million had traded on the day.

Farmmi stock was down about 17% to $0.38, in a 52-week range of $0.20 to $2.47. The average daily trading volume is around 72 million shares, and more than 325 million had changed hands thus far on Friday.

Take This Retirement Quiz To Get Matched With An Advisor Now (Sponsored)

Are you ready for retirement? Planning for retirement can be overwhelming, that’s why it could be a good idea to speak to a fiduciary financial advisor about your goals today.

Start by taking this retirement quiz right here from SmartAsset that will match you with up to 3 financial advisors that serve your area and beyond in 5 minutes. Smart Asset is now matching over 50,000 people a month.

Click here now to get started.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.