This week’s earnings dump from retailers continued Wednesday morning, with reports from Target, TJX and Lowe’s. All three beat estimates on both the top and bottom lines, and two of the three saw shares rise early Wednesday. Target appeared to do everything right, but shares traded down about 5%.

[in-text-ad]

After markets close Wednesday, tech giants Cisco Systems and Nvidia will be reporting quarterly results. And before markets open on Thursday, Alibaba, Kohl’s and Macy’s will share their results.

Here’s a look at four companies set to report results either late Thursday or early Friday.

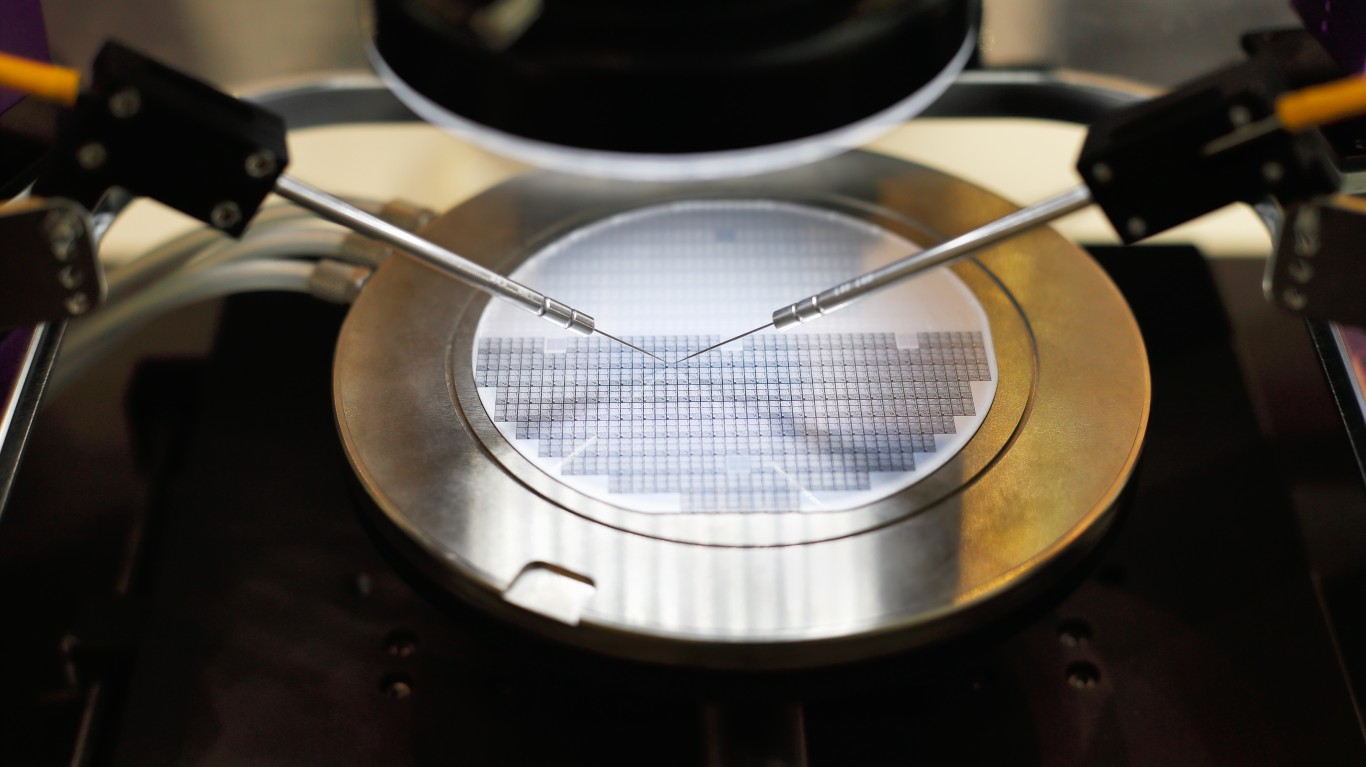

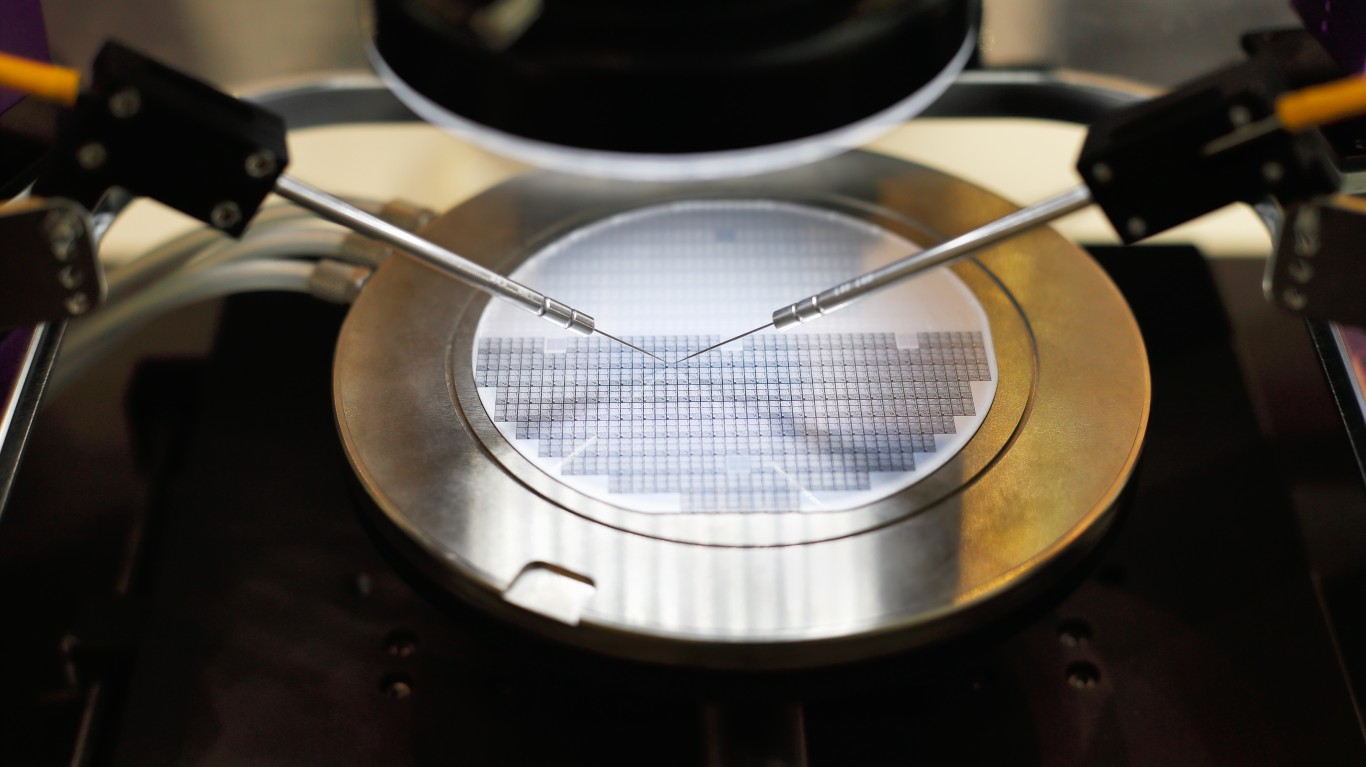

Applied Materials

Shares of semiconductor equipment maker Applied Materials Inc. (NASDAQ: AMAT) have more than doubled in the past 12 months. Year to date, the stock is up about 84%. Global demand for more chips has pushed the stock to a string of all-time highs that began in October 2020. The largest U.S.-based maker of the machines used to make chips and other high-tech components, Applied Materials is almost required to blow past expectations when it reports results after markets close Thursday.

Of 31 analysts covering the stock, 23 have Buy or Strong Buy ratings on the shares and the other eight have Hold ratings. At a recent price of around $158, the upside potential based on a median price target of $162 is 2.5%. At the high target of $195, the upside potential is 23.4%.

For the company’s fourth quarter of fiscal 2021, analysts are expecting revenue of $6.34 billion, which would be up 2.4% sequentially and 35% higher year over year. Adjusted earnings per share (EPS) are forecast at $1.96, up 3% sequentially and 57% year over year. For the full fiscal year, analysts are looking for EPS of $6.87, up nearly 65%, on sales of $23.32 billion, up 35.6%.

Applied Materials’ share price to earnings multiple for the 2021 fiscal year is 23.0. For fiscal 2022, the multiple to estimated EPS of $8.02 is 19.7, and for 2024, it is 19.0 times estimated EPS of $8.32. The stock’s 52-week range is $74.51 to $159.00. Applied Materials pays an annual dividend of $0.96 (yield of 0.61%). The one-year total return to shareholders is around 114.4%.

Foot Locker

In mid-May, shares of Foot Locker Inc. (NYSE: FL) reached their 12-month peak gain of nearly 67%. Since then, shares plunged by about 30% before recovering to post a gain of about 42% for the 12-month period. The shoe and apparel retailer has a gross margin of more than 33% for the past 12 months, total free cash flow of $695 million and free cash flow per share of $6.70. When the company reports third-quarter results before markets open on Friday, investors will be looking for the company to improve on those already-impressive numbers.

Of 20 analysts covering the company, 12 have a Buy or Strong Buy rating on the stock, with another seven rating the stock at Hold. At a share price of around $55.90, the upside potential based on a median price target of $74 is 32.4%. At the high price target of $91, the upside potential is almost 63%.

Fiscal 2022 third-quarter revenue for Foot Locker is forecast at $2.14 billion, down 6.1% sequentially but up 1.4% year over year. Adjusted EPS are forecast at $1.37, down 38% sequentially and up 13.2% year over year. For the fiscal year ending in January, Foot Locker currently is expected to report EPS of $7.01, up 150%, on revenue of $8.85 billion, up 17.3%.

Foot Locker’s share price to earnings multiple for the 2022 fiscal year is 8.5. For fiscal 2023, the multiple to estimated EPS of $7.37 is 8.5, and for 2024, it is 8.3 times estimated EPS of $8.00. The stock’s 52-week range is $36.94 to $66.71. Foot Locker pays an annual dividend of $1.20 (yield of 2.16%). The one-year total return to shareholders is around 41.7%.

[in-text-ad]

Ross Stores

The past 12 months have been a bit rocky for apparel retailer Ross Stores Inc. (NASDAQ: ROST). In early May, shares were up about 20%, before plunging to a 12-month low of down 4% in mid-October. For the entire 12-month period, the stock is up about 8.3%. Free cash flow for the past 12 months totals just over $3 billion, and free cash flow per show is $8.46. Half that free cash flow total came in the third quarter of last year. That could be a key metric for investors when Ross reports results after markets close Thursday.

Analysts are mostly bullish on the stock, with 17 of 24 putting ratings of Buy or Strong Buy on the shares, and the rest giving the stock a rating of Hold. At a share price of around $119.20, the upside potential based on a median price target of $139 is 16.6%. At the high price target of $153, the upside potential is more than 28%.

For the third quarter of fiscal 2022, analysts expect Ross to report revenue of $4.35 billion, down 9.5% sequentially and up 16% year over year. Adjusted EPS are forecast at $0.77, down 44.6% sequentially and 24.5% lower year over year. For the full fiscal year, analysts are forecasting EPS of $4.50, up 474%, on sales of $18.64 billion, up nearly 49%.

Ross Stores’ share price to earnings multiple for the 2022 fiscal year is 26.4. For the 2023 fiscal year, the multiple to estimated EPS of $5.30 is 22.4, and for 2024, it is 20.2 times estimated EPS of $5.87. The stock’s 52-week range is $104.92 to $134.22. Ross pays an annual dividend of $1.14 (yield of 0.99%). Total shareholder return for the past year is about 8.4%.

Workday

Workday Inc. (NASDAQ: WDAY) saw its share price rise by about a third over the past 12 months. The company develops enterprise-level software applications for cloud-based computing. UBS recently upgraded the stock from Neutral to Buy and boosted the price target to $370, based on increased demand for Workday’s back-office human resources applications. Continuing growth in revenue and earnings will be key to investor reaction to Thursday afternoon’s report. If the company boosts its guidance, that could be a real plus.

Analysts are solidly bullish on Workday. Of 35 brokerages covering the stock, 29 rate the shares a Buy or Strong Buy, and five more rate the stock at Hold. At a share price of around $300.30, the upside potential based on a median price target of $310 is 3.2%. At the high target of $370, the upside potential is 13.2%.

Revenue for the company’s third quarter of fiscal 2022 is pegged at $1.32 billion, which would be 4.8% higher sequentially and up nearly 19% year over year. Adjusted EPS are forecast at $0.85, down nearly 31% sequentially and a penny lower year over year. For the fiscal year ending in January, analysts currently expect Workday to report EPS of $3.66, up 25%, on sales of $5.11 billion, up 18.2%.

Workday’s share price to earnings multiple for the 2022 fiscal year is 26.4. For the 2023 fiscal year, the multiple to estimated EPS of $3.52 is 85.3, and for 2024, it is 67.5 times estimated EPS of $4.46. The stock’s 52-week range is $204.86 to $307.80, and the high was posted earlier in the morning. Workday does not pay a dividend. Total shareholder return for the past year is about 32.7%.

Take This Retirement Quiz To Get Matched With An Advisor Now (Sponsored)

Are you ready for retirement? Planning for retirement can be overwhelming, that’s why it could be a good idea to speak to a fiduciary financial advisor about your goals today.

Start by taking this retirement quiz right here from SmartAsset that will match you with up to 3 financial advisors that serve your area and beyond in 5 minutes. Smart Asset is now matching over 50,000 people a month.

Click here now to get started.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.