The futures were higher across the board on Thursday, after the markets tried hard Wednesday for a follow-through rally. While the Dow Jones industrials were up big on the back of some of the strongest numbers from IBM in years, the Nasdaq was crushed, with the guilty party being a 36% collapse in Netflix stock price after the company reported losing 200,000 subscribers. That also had other streaming companies, like Disney, down big as well. The S&P 500 ended trading with a small loss, and the Russell 2000 closed the day with modest gains, while the surprise winner was the utility stock index, which printed a 52-week high.

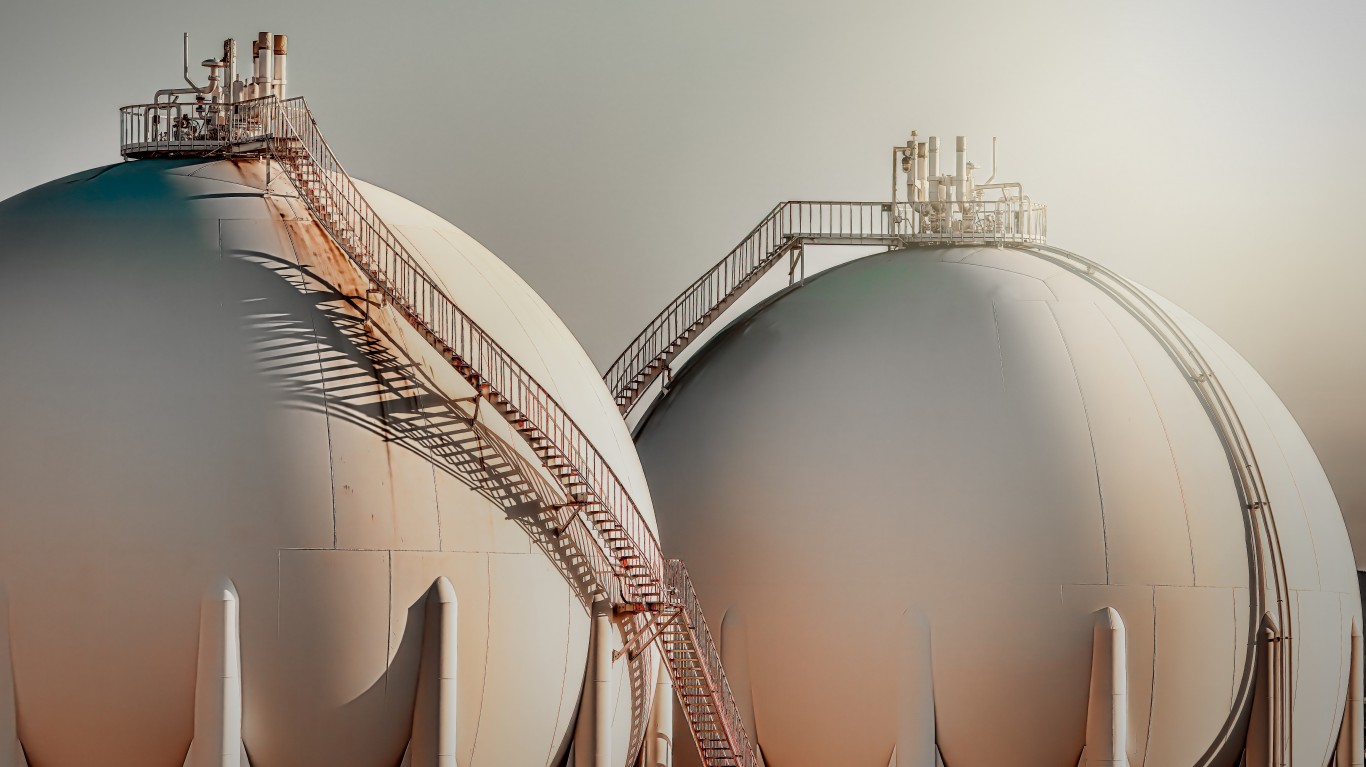

The Treasury market saw buyers return in a big way across the curve, after yields this week hit the highest levels in years. The 30-year bond, which printed over 3% on Tuesday, closed Wednesday at a 2.88% yield, down 11 basis points. Brent and West Texas Intermediate crude were flat, while natural gas took another hit, down over 3%, and gold closed modestly higher.

24/7 Wall St. reviews dozens of analyst research reports each day of the week with a goal of finding fresh ideas for investors and traders alike. Some of these daily analyst calls cover stocks to buy. Other calls cover stocks to sell or avoid. Remember that no single analyst call should ever be used as a basis to buy or sell a stock. Consensus analyst target data is from Refinitiv.

These are the top analyst upgrades, downgrades and initiations seen on Thursday, April 21, 2022.

Alkermes PLC (NASDAQ: ALKS): Goldman Sachs started coverage with a Buy rating and a $35 price target. The consensus target is $28.33. The last trade on Wednesday came in at $29.45, which was up over 3% for the day.

Bed Bath & Beyond Inc. (NASDAQ: BBBY) This struggling retailer is the Zacks the Bear of the Day. The analyst suggests that the “rebuild hit a supply chain speed bump.” The stock has traded as high as $44.51 in the past year but closed most recently at $16.38 a share. That is down almost 26% in the past month.

Block Inc. (NYSE: SQ): Baird kept a Neutral rating on the shares in front of first-quarter results, and it has a $128 target price. The consensus target is up at $179.45. The last trade on Wednesday came in at $114.52, down almost 9% on the day.

Citizens Financial Group Inc. (NYSE: CFG): Baird maintained an Outperform rating with a $58 price target. The consensus target is $54.72. The last trade on Wednesday was reported at $44.32.

Dentsply Sirona Inc. (NASDAQ: XRAY): Goldman Sachs lowered the $59 price target on the Neutral-rated shares to $47. The consensus target is $60.75. The final trade on Wednesday came in at $42.89.

DoorDash Inc. (NASDAQ: DASH): Citigroup started coverage with a Buy rating and a $155 target price. The consensus target is $166.30. The close on Wednesday was down almost 6% at $100.14 a share.

Exelon Corp. (NASDAQ: EXC): J.P. Morgan upgraded the stock to Overweight from Neutral and lifted the $47 target to $55. The consensus target is $48.76. The last trade on Wednesday was filled at $50.25.

Exxon Mobil Corp. (NYSE: XOM): RBC Capital Markets raised its Market Perform rating on the integrated energy giant to Outperform and hiked the price objective to $100 from $90. The consensus target is $91.59. The stock closed on Wednesday at $87.96.

Halliburton Co. (NYSE: HAL): BofA Securities reiterated a Buy rating on the oilfield services giant, which is on the firm’s US 1 list of top picks, and it has a $47 target price. Stifel reiterated a Buy rating as well and lifted its target price to $47 from $42. The consensus target is $41.96. The close Wednesday was at $39.60, down over 4% on the day.

Interactive Brokers Group Inc. (NASDAQ: IBKR): Goldman Sachs dropped its $105 price objective to $90 and kept a Neutral rating on the shares. The consensus target is $96.67. The last trade for Wednesday was reported at $66.42.

Karuna Therapeutics Inc. (NASDAQ: KRTX): Jefferies reiterated a Buy rating in front of Phase 3 data that is due out possibly this summer, and the firm has a $183 target price. The consensus target is $178.44. Wednesday’s close was at $132.92.

Kinross Gold Corp. (NYSE: KGC): RBC Capital Markets downgraded the shares from Outperform to Sector Perform with a $6 target price. The consensus target is up at $9.75. The stock closed at $6 on Wednesday.

Lockheed Martin Corp. (NYSE: LMT): Baird reiterated a Neutral rating on the aerospace and defense giant and kept a $513 target price. The consensus target is $466.65. The closing share price on Wednesday was $453.87.

Matador Resources Co. (NYSE: MTDR): Citing rising earnings in the energy sector, Zacks selected this exploration and production company as its Bull of the Day stock. Its shares last closed at $58.13 apiece. The $62.00 consensus price target would be a new 52-week high.

Mosaic Co. (NYSE: MOS): Exane BNP Paribas downgraded the shares of the fertilizer heavyweight from Outperform to Neutral with an $82 target price objective. The consensus target is just $66.84. The shares were last seen on Wednesday trading at $75.77.

PagSeguro Digital Ltd. (NYSE: PAGS): Goldman Sachs slashed the target price to $19 from $27 and maintained a Neutral call. The consensus target is $30.13. The last trade for Wednesday came in at $16.35, which was down almost 7%.

Peloton Interactive Inc. (NASDAQ: PTON): Citigroup upgraded the stock to Buy from Neutral and also raised the $32 target price to $36. The consensus target is $43.43. Wednesday’s final trade was reported at $21.77, down over 11% on the day.

Pinterest Inc. (NASDAQ: PINS): Citigroup resumed coverage with a Neutral rating, and it trimmed its target price to $27 from $28. The consensus target is $38.33. The closed over 7% lower on Wednesday at $21.04.

Silvergate Capital Corp. (NYSE: SI): Goldman Sachs reiterated a Buy rating but slashed the $210 target price to $180. That compares with a $199.25 consensus target and Wednesday’s closing print of $136.07.

Southwestern Energy Co. (NYSE: SWN): Piper Sandler upgraded the stock to Overweight from Neutral and boosted the $4.50 price target to $12. The consensus target is $9.18. The stock closed Wednesday at $8.23.

Spire Global Inc. (NYSE: SPIR): Stifel reiterated a Buy rating with a $6 target price. The consensus target is $5.80. The shares closed on Wednesday at $1.87.

Toast Inc. (NASDAQ: TOST): Baird reiterated an Outperform rating and a $25 target price. The consensus target is $32.39. Wednesday’s close was at $19.71.

Twitter Inc. (NYSE: TWTR): Truist Securities downgraded the stock to Hold from Buy and has a $50 target. The consensus target is $44.61. The shares closed on Wednesday at $46.72.

Yeti Holdings Inc. (NYSE: YETI): Morgan Stanley resumed coverage of the cooler maker with an Equal Weight rating, but it slashed the $97 price objective to $64. The consensus target is $90.88. The stock was last seen on Wednesday at $55.82.

Perhaps the best tactic for investors for the rest of this year is to buy dividend blue chips, hold them and let the stock market find its footing. Five Warren Buffett holdings make sense now for worried growth and income investors.

Wednesday’s top analyst upgrades and downgrades included Airbnb, Amazon.com, Bank of America, Chipotle Mexican Grill, Comcast, Foot Locker, Kimberly-Clark, Meta Platforms, Novavax, Redfin, Synchrony Financial, Snap, Texas Instruments, Twitter, Visa and Walt Disney. Analyst calls seen later in the day were on Alphabet, Avis Budget, Bookings, Haliburton, Netflix, Palantir Technologies, Tripadvisor, Uber Technologies and more.

Take This Retirement Quiz To Get Matched With An Advisor Now (Sponsored)

Are you ready for retirement? Planning for retirement can be overwhelming, that’s why it could be a good idea to speak to a fiduciary financial advisor about your goals today.

Start by taking this retirement quiz right here from SmartAsset that will match you with up to 3 financial advisors that serve your area and beyond in 5 minutes. Smart Asset is now matching over 50,000 people a month.

Click here now to get started.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.

24/7 Wall St.

24/7 Wall St. 24/7 Wall St.

24/7 Wall St.