Median rents have hit record highs across the country, thanks to inflation and pandemic-related shortages of housing and building supplies. In many parts of the country, people who choose to rent may find it difficult to meet conventional wisdom’s rule that monthly rent should not exceed 30% of one’s monthly income. While rent prices are prohibitively high across a large part of the country, in the vast majority of states there is at least one metropolitan area where rents fall well below the national average.

To find the metro area with the lowest rent in every state, 24/7 Wall St. reviewed five-year estimates of median gross rent from the U.S. Census Bureau’s 2020 American Community Survey. It is important to note that the figures reflected here are for 2020, the most recent data available through the census. While prices today are much higher across much of the country, the least expensive rental market in each state in 2020 is likely still one of the least expensive markets in 2022. The national 2020 median rent was $1,096. In 44 of the 50 states, there is at least one metro area with a lower 2020 median gross rent.

Housing costs reflect the income levels of the population living there. Costs tend to be more expensive in wealthier communities. The U.S. median household income is $64,996. Of the 50 metros on this list, 40 have lower typical household incomes compared to their home state and 18 have median household incomes of less than $50,000. This is the richest town in every state.

Nationwide, 2020 median gross rent comes to 29.6% of median household income. Even after accounting for the lower incomes in most of these metropolitan areas, rent remains relatively affordable in more than two-thirds of the places on this list. In the Jefferson City, Missouri metropolitan area, median gross rent comes to 23.5% of income. These are the U.S. cities where the most families need food stamps.

Click here to see the big city with the cheapest rent, in every state.

Click here to see our detailed methodology.

Alabama: Decatur

> Median monthly rental price: $666 (Alabama: $811)

> Share of income typically spent on rent: 27.2% (Alabama: 28.8%)

> Rental occupied housing units: 26.5% (Alabama: 30.8%)

> Median home value: $137,600 (Alabama: $149,600)

> No. of metros considered in ranking: 12

[in-text-ad]

Alaska: Anchorage

> Median monthly rental price: $1,277 (Alaska: $1,240)

> Share of income typically spent on rent: 28.7% (Alaska: 27.5%)

> Rental occupied housing units: 34.4% (Alaska: 35.2%)

> Median home value: $301,100 (Alaska: $275,600)

> No. of metros considered in ranking: 2

Arizona: Sierra Vista-Douglas

> Median monthly rental price: $803 (Arizona: $1,097)

> Share of income typically spent on rent: 27.0% (Arizona: 29.0%)

> Rental occupied housing units: 30.9% (Arizona: 34.7%)

> Median home value: $150,100 (Arizona: $242,000)

> No. of metros considered in ranking: 7

Arkansas: Fort Smith

> Median monthly rental price: $701 (Arkansas: $760)

> Share of income typically spent on rent: 27.1% (Arkansas: 27.2%)

> Rental occupied housing units: 33.8% (Arkansas: 34.2%)

> Median home value: $119,500 (Arkansas: $133,600)

> No. of metros considered in ranking: 6

[in-text-ad-2]

California: El Centro

> Median monthly rental price: $847 (California: $1,586)

> Share of income typically spent on rent: 32.1% (California: 32.2%)

> Rental occupied housing units: 41.9% (California: 44.7%)

> Median home value: $206,700 (California: $538,500)

> No. of metros considered in ranking: 26

Colorado: Pueblo

> Median monthly rental price: $853 (Colorado: $1,335)

> Share of income typically spent on rent: 31.3% (Colorado: 30.6%)

> Rental occupied housing units: 34.9% (Colorado: 33.8%)

> Median home value: $172,500 (Colorado: $369,900)

> No. of metros considered in ranking: 7

[in-text-ad]

Connecticut: Hartford-East Hartford-Middletown

> Median monthly rental price: $1,140 (Connecticut: $1,201)

> Share of income typically spent on rent: 30.3% (Connecticut: 30.8%)

> Rental occupied housing units: 33.6% (Connecticut: 33.9%)

> Median home value: $252,500 (Connecticut: $279,700)

> No. of metros considered in ranking: 4

Delaware: Dover*

> Median monthly rental price: $1,110 (Delaware: $1,150)

> Share of income typically spent on rent: 32.0% (Delaware: 29.7%)

> Rental occupied housing units: 31.2% (Delaware: 28.6%)

> Median home value: $226,600 (Delaware: $258,300)

> No. of metros considered in ranking: 1

*Because Dover is the only eligible metro in Delaware, it is the metro with the lowest rent by default.

Florida: Sebring-Avon Park

> Median monthly rental price: $801 (Florida: $1,218)

> Share of income typically spent on rent: 29.9% (Florida: 33.3%)

> Rental occupied housing units: 23.0% (Florida: 33.8%)

> Median home value: $120,500 (Florida: $232,000)

> No. of metros considered in ranking: 22

[in-text-ad-2]

Georgia: Dalton

> Median monthly rental price: $721 (Georgia: $1,042)

> Share of income typically spent on rent: 24.7% (Georgia: 29.6%)

> Rental occupied housing units: 32.8% (Georgia: 36.0%)

> Median home value: $136,800 (Georgia: $190,200)

> No. of metros considered in ranking: 14

Hawaii: Kahului-Wailuku-Lahaina

> Median monthly rental price: $1,543 (Hawaii: $1,651)

> Share of income typically spent on rent: 30.6% (Hawaii: 32.5%)

> Rental occupied housing units: 37.5% (Hawaii: 39.7%)

> Median home value: $657,400 (Hawaii: $636,400)

> No. of metros considered in ranking: 2

[in-text-ad]

Idaho: Pocatello

> Median monthly rental price: $702 (Idaho: $887)

> Share of income typically spent on rent: 26.8% (Idaho: 27.9%)

> Rental occupied housing units: 31.7% (Idaho: 29.2%)

> Median home value: $165,800 (Idaho: $235,600)

> No. of metros considered in ranking: 6

Illinois: Danville

> Median monthly rental price: $683 (Illinois: $1,038)

> Share of income typically spent on rent: 27.0% (Illinois: 28.7%)

> Rental occupied housing units: 29.2% (Illinois: 33.7%)

> Median home value: $80,900 (Illinois: $202,100)

> No. of metros considered in ranking: 10

Indiana: Muncie

> Median monthly rental price: $725 (Indiana: $844)

> Share of income typically spent on rent: 32.3% (Indiana: 28.3%)

> Rental occupied housing units: 35.5% (Indiana: 30.5%)

> Median home value: $96,600 (Indiana: $148,900)

> No. of metros considered in ranking: 12

[in-text-ad-2]

Iowa: Cedar Rapids

> Median monthly rental price: $768 (Iowa: $806)

> Share of income typically spent on rent: 26.8% (Iowa: 26.7%)

> Rental occupied housing units: 24.7% (Iowa: 28.8%)

> Median home value: $159,800 (Iowa: $153,900)

> No. of metros considered in ranking: 8

Kansas: Topeka

> Median monthly rental price: $808 (Kansas: $863)

> Share of income typically spent on rent: 27.1% (Kansas: 27.0%)

> Rental occupied housing units: 30.6% (Kansas: 33.8%)

> Median home value: $137,900 (Kansas: $157,600)

> No. of metros considered in ranking: 4

[in-text-ad]

Kentucky: Owensboro

> Median monthly rental price: $795 (Kentucky: $783)

> Share of income typically spent on rent: 26.4% (Kentucky: 27.1%)

> Rental occupied housing units: 31.5% (Kentucky: 32.4%)

> Median home value: $139,300 (Kentucky: $147,100)

> No. of metros considered in ranking: 5

Louisiana: Monroe

> Median monthly rental price: $739 (Louisiana: $876)

> Share of income typically spent on rent: 33.6% (Louisiana: 32.3%)

> Rental occupied housing units: 36.8% (Louisiana: 33.4%)

> Median home value: $134,500 (Louisiana: $168,100)

> No. of metros considered in ranking: 9

Maine: Lewiston-Auburn

> Median monthly rental price: $771 (Maine: $873)

> Share of income typically spent on rent: 28.1% (Maine: 28.6%)

> Rental occupied housing units: 35.1% (Maine: 27.1%)

> Median home value: $166,600 (Maine: $198,000)

> No. of metros considered in ranking: 3

[in-text-ad-2]

Maryland: Cumberland

> Median monthly rental price: $708 (Maryland: $1,415)

> Share of income typically spent on rent: 29.0% (Maryland: 29.7%)

> Rental occupied housing units: 28.3% (Maryland: 32.9%)

> Median home value: $131,300 (Maryland: $325,400)

> No. of metros considered in ranking: 5

Massachusetts: Pittsfield

> Median monthly rental price: $894 (Massachusetts: $1,336)

> Share of income typically spent on rent: 29.9% (Massachusetts: 29.6%)

> Rental occupied housing units: 30.0% (Massachusetts: 37.5%)

> Median home value: $221,000 (Massachusetts: $398,800)

> No. of metros considered in ranking: 5

[in-text-ad]

Michigan: Bay City

> Median monthly rental price: $679 (Michigan: $892)

> Share of income typically spent on rent: 27.8% (Michigan: 29.3%)

> Rental occupied housing units: 23.9% (Michigan: 28.3%)

> Median home value: $106,400 (Michigan: $162,600)

> No. of metros considered in ranking: 14

Minnesota: Duluth

> Median monthly rental price: $794 (Minnesota: $1,010)

> Share of income typically spent on rent: 29.2% (Minnesota: 28.2%)

> Rental occupied housing units: 27.7% (Minnesota: 28.1%)

> Median home value: $162,700 (Minnesota: $235,700)

> No. of metros considered in ranking: 5

Mississippi: Hattiesburg

> Median monthly rental price: $815 (Mississippi: $789)

> Share of income typically spent on rent: 31.2% (Mississippi: 29.6%)

> Rental occupied housing units: 34.9% (Mississippi: 31.2%)

> Median home value: $135,600 (Mississippi: $125,500)

> No. of metros considered in ranking: 3

[in-text-ad-2]

Missouri: Jefferson City

> Median monthly rental price: $686 (Missouri: $843)

> Share of income typically spent on rent: 23.5% (Missouri: 27.6%)

> Rental occupied housing units: 28.3% (Missouri: 32.9%)

> Median home value: $162,100 (Missouri: $163,600)

> No. of metros considered in ranking: 8

Montana: Great Falls

> Median monthly rental price: $778 (Montana: $836)

> Share of income typically spent on rent: 28.6% (Montana: 27.7%)

> Rental occupied housing units: 33.4% (Montana: 31.5%)

> Median home value: $184,400 (Montana: $244,900)

> No. of metros considered in ranking: 3

[in-text-ad]

Nebraska: Grand Island

> Median monthly rental price: $766 (Nebraska: $857)

> Share of income typically spent on rent: 26.0% (Nebraska: 26.3%)

> Rental occupied housing units: 35.1% (Nebraska: 33.8%)

> Median home value: $150,600 (Nebraska: $164,000)

> No. of metros considered in ranking: 3

Nevada: Carson City

> Median monthly rental price: $982 (Nevada: $1,159)

> Share of income typically spent on rent: 27.6% (Nevada: 30.0%)

> Rental occupied housing units: 41.8% (Nevada: 42.9%)

> Median home value: $299,900 (Nevada: $290,200)

> No. of metros considered in ranking: 3

New Hampshire: Manchester-Nashua*

> Median monthly rental price: $1,217 (New Hampshire: $1,145)

> Share of income typically spent on rent: 29.2% (New Hampshire: 28.6%)

> Rental occupied housing units: 34.3% (New Hampshire: 28.8%)

> Median home value: $287,900 (New Hampshire: $272,300)

> No. of metros considered in ranking: 1

*Because Manchester-Nashua is the only eligible metro in New Hampshire, it is the metro with the lowest rent by default.

[in-text-ad-2]

New Jersey: Vineland-Bridgeton

> Median monthly rental price: $1,082 (New Jersey: $1,368)

> Share of income typically spent on rent: 37.4% (New Jersey: 30.3%)

> Rental occupied housing units: 33.7% (New Jersey: 36.0%)

> Median home value: $166,400 (New Jersey: $343,500)

> No. of metros considered in ranking: 4

New Mexico: Las Cruces

> Median monthly rental price: $765 (New Mexico: $857)

> Share of income typically spent on rent: 33.3% (New Mexico: 29.3%)

> Rental occupied housing units: 35.4% (New Mexico: 32.0%)

> Median home value: $153,600 (New Mexico: $175,700)

> No. of metros considered in ranking: 4

[in-text-ad]

New York: Utica-Rome

> Median monthly rental price: $760 (New York: $1,315)

> Share of income typically spent on rent: 26.9% (New York: 30.8%)

> Rental occupied housing units: 30.1% (New York: 45.9%)

> Median home value: $127,000 (New York: $325,000)

> No. of metros considered in ranking: 13

North Carolina: Hickory-Lenoir-Morganton

> Median monthly rental price: $708 (North Carolina: $932)

> Share of income typically spent on rent: 24.7% (North Carolina: 28.6%)

> Rental occupied housing units: 26.6% (North Carolina: 34.3%)

> Median home value: $139,100 (North Carolina: $182,100)

> No. of metros considered in ranking: 15

North Dakota: Grand Forks

> Median monthly rental price: $804 (North Dakota: $828)

> Share of income typically spent on rent: 28.2% (North Dakota: 24.4%)

> Rental occupied housing units: 44.8% (North Dakota: 37.5%)

> Median home value: $195,500 (North Dakota: $199,900)

> No. of metros considered in ranking: 3

[in-text-ad-2]

Ohio: Mansfield

> Median monthly rental price: $677 (Ohio: $825)

> Share of income typically spent on rent: 27.6% (Ohio: 27.5%)

> Rental occupied housing units: 33.1% (Ohio: 33.7%)

> Median home value: $115,100 (Ohio: $151,400)

> No. of metros considered in ranking: 11

Oklahoma: Lawton

> Median monthly rental price: $810 (Oklahoma: $818)

> Share of income typically spent on rent: 27.1% (Oklahoma: 27.2%)

> Rental occupied housing units: 45.6% (Oklahoma: 33.9%)

> Median home value: $121,500 (Oklahoma: $142,400)

> No. of metros considered in ranking: 4

[in-text-ad]

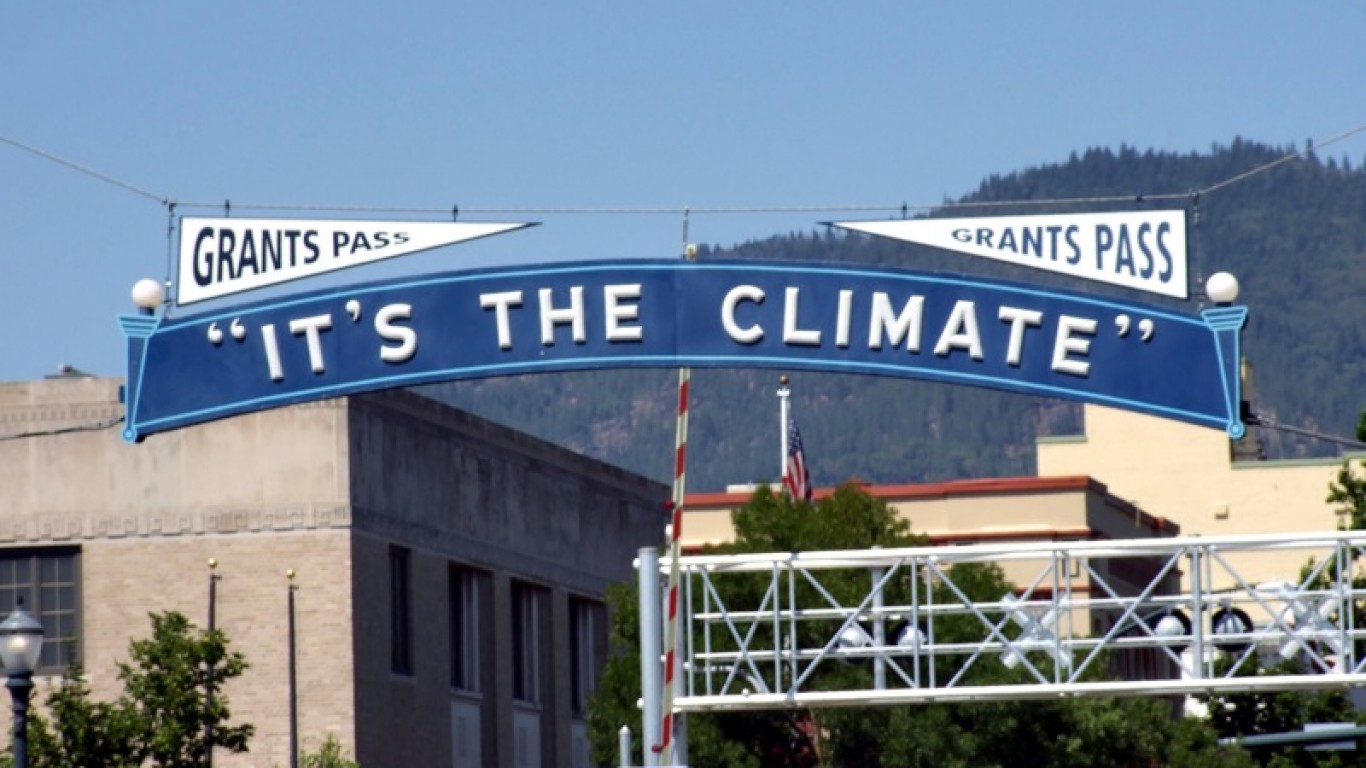

Oregon: Grants Pass

> Median monthly rental price: $930 (Oregon: $1,173)

> Share of income typically spent on rent: 34.2% (Oregon: 30.3%)

> Rental occupied housing units: 31.2% (Oregon: 37.2%)

> Median home value: $281,500 (Oregon: $336,700)

> No. of metros considered in ranking: 8

Pennsylvania: Johnstown

> Median monthly rental price: $635 (Pennsylvania: $958)

> Share of income typically spent on rent: 27.5% (Pennsylvania: 28.6%)

> Rental occupied housing units: 25.3% (Pennsylvania: 31.0%)

> Median home value: $94,900 (Pennsylvania: $187,500)

> No. of metros considered in ranking: 18

Rhode Island: Providence-Warwick*

> Median monthly rental price: $993 (Rhode Island: $1,031)

> Share of income typically spent on rent: 28.9% (Rhode Island: 29.0%)

> Rental occupied housing units: 38.0% (Rhode Island: 38.4%)

> Median home value: $290,500 (Rhode Island: $276,600)

> No. of metros considered in ranking: 1

*Because Providence-Warwick is the only eligible metro in Rhode Island, it is the metro with the lowest rent by default.

[in-text-ad-2]

South Carolina: Florence

> Median monthly rental price: $754 (South Carolina: $918)

> Share of income typically spent on rent: 28.4% (South Carolina: 29.7%)

> Rental occupied housing units: 33.0% (South Carolina: 29.9%)

> Median home value: $125,100 (South Carolina: $170,100)

> No. of metros considered in ranking: 8

South Dakota: Sioux Falls

> Median monthly rental price: $836 (South Dakota: $761)

> Share of income typically spent on rent: 25.5% (South Dakota: 25.2%)

> Rental occupied housing units: 33.8% (South Dakota: 32.0%)

> Median home value: $208,400 (South Dakota: $174,600)

> No. of metros considered in ranking: 2

[in-text-ad]

Tennessee: Kingsport-Bristol

> Median monthly rental price: $678 (Tennessee: $897)

> Share of income typically spent on rent: 26.6% (Tennessee: 28.8%)

> Rental occupied housing units: 26.5% (Tennessee: 33.5%)

> Median home value: $140,800 (Tennessee: $177,600)

> No. of metros considered in ranking: 10

Texas: Brownsville-Harlingen

> Median monthly rental price: $746 (Texas: $1,082)

> Share of income typically spent on rent: 30.8% (Texas: 29.1%)

> Rental occupied housing units: 33.8% (Texas: 37.7%)

> Median home value: $89,700 (Texas: $187,200)

> No. of metros considered in ranking: 25

Utah: Logan

> Median monthly rental price: $839 (Utah: $1,090)

> Share of income typically spent on rent: 28.7% (Utah: 27.8%)

> Rental occupied housing units: 35.3% (Utah: 29.5%)

> Median home value: $252,800 (Utah: $305,400)

> No. of metros considered in ranking: 5

[in-text-ad-2]

Vermont: Burlington-South Burlington*

> Median monthly rental price: $1,248 (Vermont: $999)

> Share of income typically spent on rent: 31.7% (Vermont: 29.8%)

> Rental occupied housing units: 33.2% (Vermont: 28.7%)

> Median home value: $285,200 (Vermont: $230,900)

> No. of metros considered in ranking: 1

*Because Burlington-South Burlington is the only eligible metro in Vermont, it is the metro with the lowest rent by default.

Virginia: Lynchburg

> Median monthly rental price: $815 (Virginia: $1,257)

> Share of income typically spent on rent: 27.6% (Virginia: 28.8%)

> Rental occupied housing units: 29.2% (Virginia: 33.3%)

> Median home value: $173,900 (Virginia: $282,800)

> No. of metros considered in ranking: 9

[in-text-ad]

Washington: Yakima

> Median monthly rental price: $868 (Washington: $1,337)

> Share of income typically spent on rent: 27.8% (Washington: 29.1%)

> Rental occupied housing units: 37.7% (Washington: 36.7%)

> Median home value: $191,400 (Washington: $366,800)

> No. of metros considered in ranking: 11

West Virginia: Weirton-Steubenville

> Median monthly rental price: $650 (West Virginia: $732)

> Share of income typically spent on rent: 25.4% (West Virginia: 28.9%)

> Rental occupied housing units: 29.0% (West Virginia: 26.3%)

> Median home value: $95,400 (West Virginia: $123,200)

> No. of metros considered in ranking: 7

Wisconsin: Sheboygan

> Median monthly rental price: $744 (Wisconsin: $872)

> Share of income typically spent on rent: 23.6% (Wisconsin: 27.0%)

> Rental occupied housing units: 29.7% (Wisconsin: 32.9%)

> Median home value: $165,400 (Wisconsin: $189,200)

> No. of metros considered in ranking: 12

[in-text-ad-2]

Wyoming: Casper

> Median monthly rental price: $846 (Wyoming: $853)

> Share of income typically spent on rent: 28.0% (Wyoming: 26.3%)

> Rental occupied housing units: 29.4% (Wyoming: 29.0%)

> Median home value: $215,400 (Wyoming: $228,000)

> No. of metros considered in ranking: 2

Methodology

To determine the metro with the lowest rent in every state, 24/7 Wall St. reviewed five-year estimates of median gross rent from the U.S. Census Bureau’s 2020 American Community Survey.

We used the 384 metropolitan statistical areas as delineated by the United States Office of Management and Budget and used by the Census Bureau as our definition of metros.

Metros were excluded if median gross rent was not available in the 2020 ACS, if there were fewer than 500 renter-occupied housing units, or if the sampling error associated with a metro’s data was deemed too high.

The sampling error was defined as too high if the coefficient of variation — a statistical assessment of how reliable an estimate is — for a metro’s median gross rent was above 15% and greater than two standard deviations above the mean CV for all metros’ median gross rents. We similarly excluded metros that had a sampling error too high for their population, using the same definition.

Metros were ranked based on the median gross rent. To break ties, we used the median gross rent as a share of household income.

Additional information on median gross rent as a share of household income, share of households occupied by renters, and median home value are also five-year estimates from the 2020 ACS. Because the Census Bureau didn’t release one-year estimates for 2020 due to data collection issues caused by the COVID-19 pandemic, all ACS data are five-year estimates.

Take This Retirement Quiz To Get Matched With An Advisor Now (Sponsored)

Are you ready for retirement? Planning for retirement can be overwhelming, that’s why it could be a good idea to speak to a fiduciary financial advisor about your goals today.

Start by taking this retirement quiz right here from SmartAsset that will match you with up to 3 financial advisors that serve your area and beyond in 5 minutes. Smart Asset is now matching over 50,000 people a month.

Click here now to get started.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.

24/7 Wall St.

24/7 Wall St. 24/7 Wall St.

24/7 Wall St.

24/7 Wall St.

24/7 Wall St.