We have noted recently here at 24/7 Wall St. the incredible outperformance of the PHLX Semiconductor Sector (SOX) index, which tracks the semiconductors. It is up an astonishing 35% so far this year, versus the 16% gain in the S&P 500, and just in April, up 9% versus the 1% rise in the venerable index. Given the huge move, many on Wall Street are nervous ahead of earnings as the group’s run comes in spite of street expectations that companies deliver a third and possibly final round of below-consensus guidance.

The semiconductor team at SunTrust Robinson Humphrey is one on Wall Street that feels that indeed this may be the final quarter of guidance that comes in below expectations, and while they are pumping the brakes like many, they do have three top companies that they like going into the first-quarter earnings reports. All three are rated Buy.

[in-text-ad]

Analog Devices

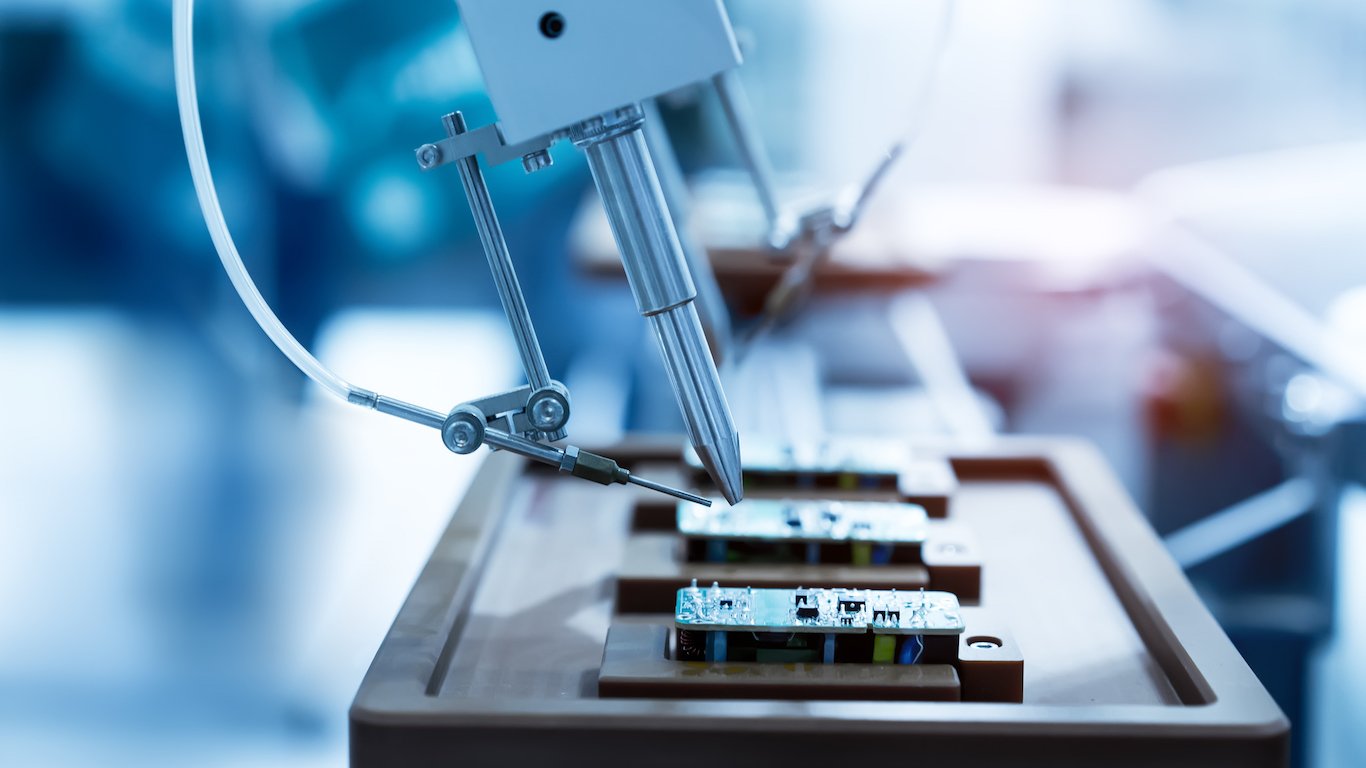

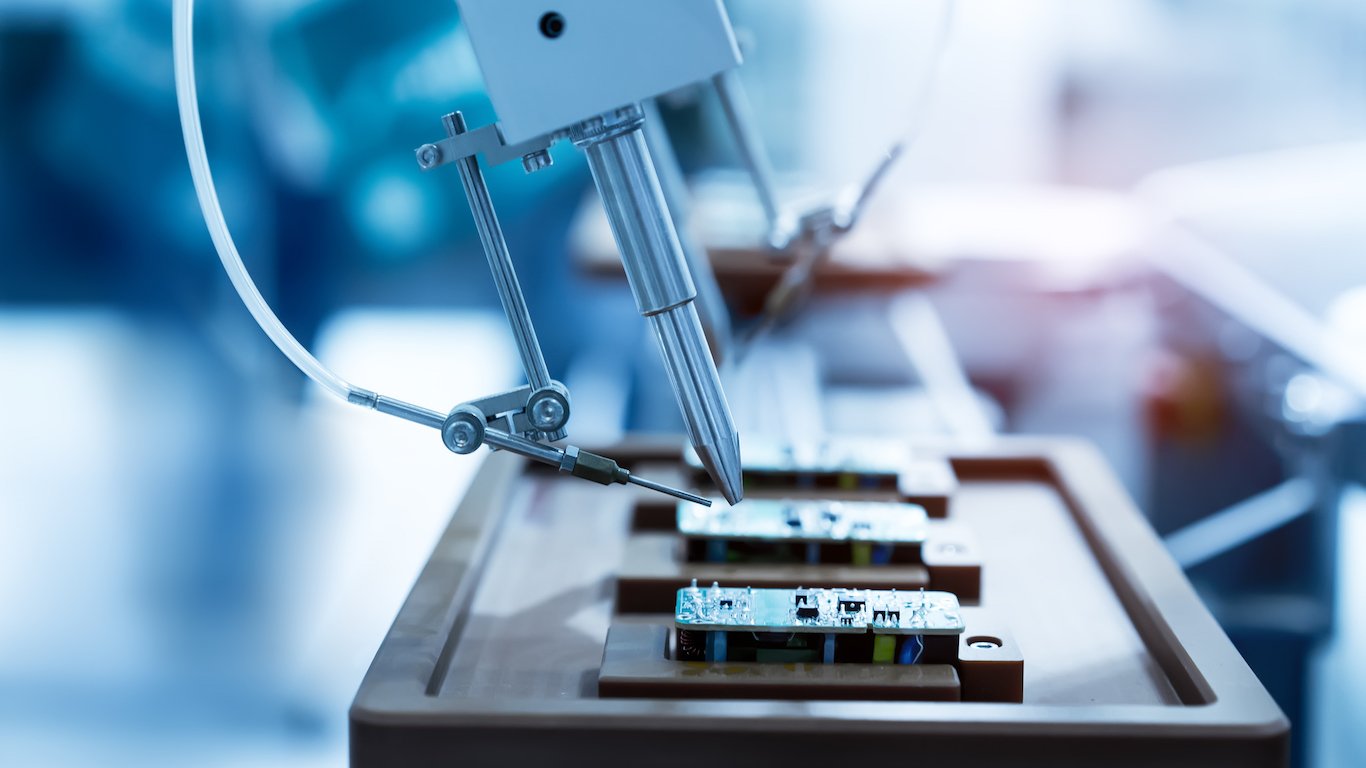

This stock could very well continue to benefit from an increase in information technology and upcoming 5G spending. Analog Devices Inc. (NASDAQ: ADI) is a leader in the design, manufacture and marketing of analog, mixed-signal and digital signal processing integrated circuits for use in industrial, automotive, consumer and communication markets worldwide. It offers signal processing products that convert, condition and process real-world phenomena, such as temperature, pressure, sound, light, speed and motion, into electrical signals.

In 2017, the company introduced a highly integrated polyphase analog front end with power quality analysis designed to help extend the health and life of industrial equipment while saving developers significant time and cost over custom solutions. Achieving extremely accurate, high-performance power quality monitoring typically requires customized development, which can be expensive and time-consuming.

The SunTrust team said this in its report:

Despite the company having performed about inline with the SOX year-to-date, and valuation doesn’t look remarkably cheap, we still believe the stock is set up well into first quarter earnings because (a) consensus models below-seasonal growth for the remainder of 2019, (b) Analog Devices has among the best end market exposure (high communications & aerospace/defense exposure) with a powerful 5G content growth story, and (c) Linear Technology and Hittite Microwave revenue & cost synergies are still coming.

Analog Devices investors are paid a 2.05% dividend. The SunTrust price target for the stock is $126, and the Wall Street consensus target is lower at $114.53. The stock closed trading most recently at $114.79 per share.

Microchip Technology

Shares of this huge Internet of Things benefactor and have been very strong recently. Microchip Technology Inc. (NASDAQ: MCHP) is a leading provider of microcontroller, mixed-signal, analog and flash-IP solutions, providing low-risk product development, lower total system cost and faster time to market for thousands of diverse customer applications worldwide.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.

24/7 Wall St.

24/7 Wall St.