If any industry was on fire for the past few years it was the semiconductors, and with good reason. Semiconductor use in various products from gaming to automobiles to bitcoin mining has exploded. For one of the first time in recent memory, there is actually a shortage, which many in the industry believe will last until next year. The good news for aggressive growth investors eyeing the industry is the sideways trading since February could be ready to break out to the upside.

[in-text-ad]

In a series of Jefferies research reports, top-notch semiconductor analyst Mark Lipacis remains very positive on four industry leaders, especially with some original equipment manufacturers paying up to four times the normal average selling prices. In addition, he sees upside to gross margin estimates due to the very positive pricing environment.

Four top picks are rated Buy at Jefferies, and all make good sense for aggressive growth investors looking to add exposure to the sector. It is important to remember that no single analyst report should be used as a sole basis for any buying or selling decision.

Analog Devices

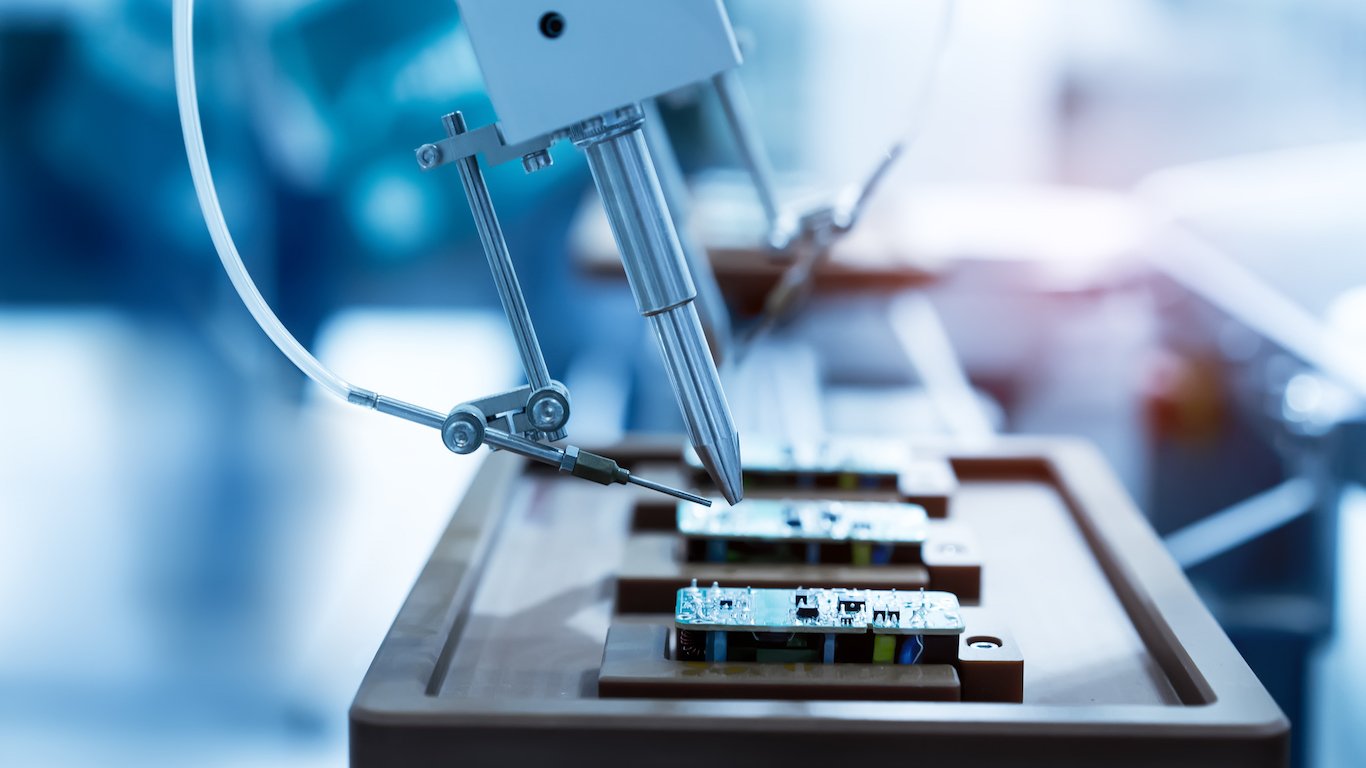

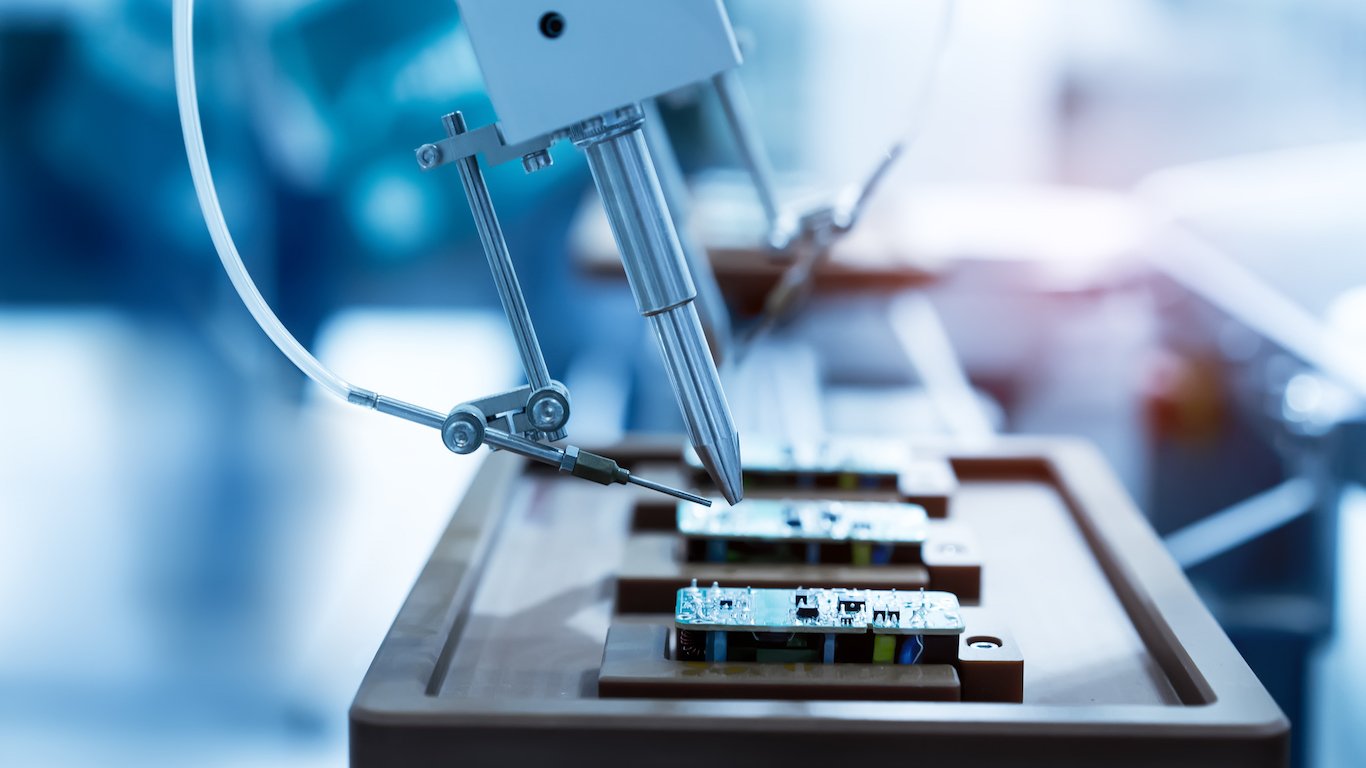

This stock could very well continue to benefit from the increase in information technology and 5G spending. Analog Devices Inc. (NASDAQ: ADI) is a leader in the design, manufacture and marketing of analog, mixed-signal and digital signal-processing integrated circuits for use in industrial, automotive, consumer and communication markets worldwide.

The company offers signal-processing products that convert, condition and process real-world phenomena, such as temperature, pressure, sound, light, speed and motion, into electrical signals.

Analog Devices has among the best end-market exposure, with high communications and aerospace/defense market exposure, in addition to offering investors a powerful 5G content growth story. Plus, acquisitions over the past few years like Linear Technology and Hittite Microwave should provide revenue and additional cost synergies that are still coming.

Investors in Analog Devices stock receive a 1.67% dividend. The Jefferies price target for the shares is $188, and the Wall Street consensus price target is $183.35. Shares closed on Tuesday at $164.91 apiece.

Marvell Technology

This top company also is a favored mid-cap pick at Jefferies. Marvell Technology Group Ltd. (NASDAQ: MRVL) is a fabless supplier of mixed-signal and analog semiconductor products to a number of storage, computing and communication applications, including hard disk drives, personal computers, servers, Ethernet switches, printers and connectivity markets.

The company has a unique positioning in markets that could rebound fastest in the second half of the year and into 2022. Top analysts are expecting enterprise and global 5G infrastructure deployments. In addition, multiple product cycles across the cloud, 5G and autos, which collectively are 25% of sales, as well as design internet protocol across processors, storage and computing.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.

24/7 Wall St.

24/7 Wall St.