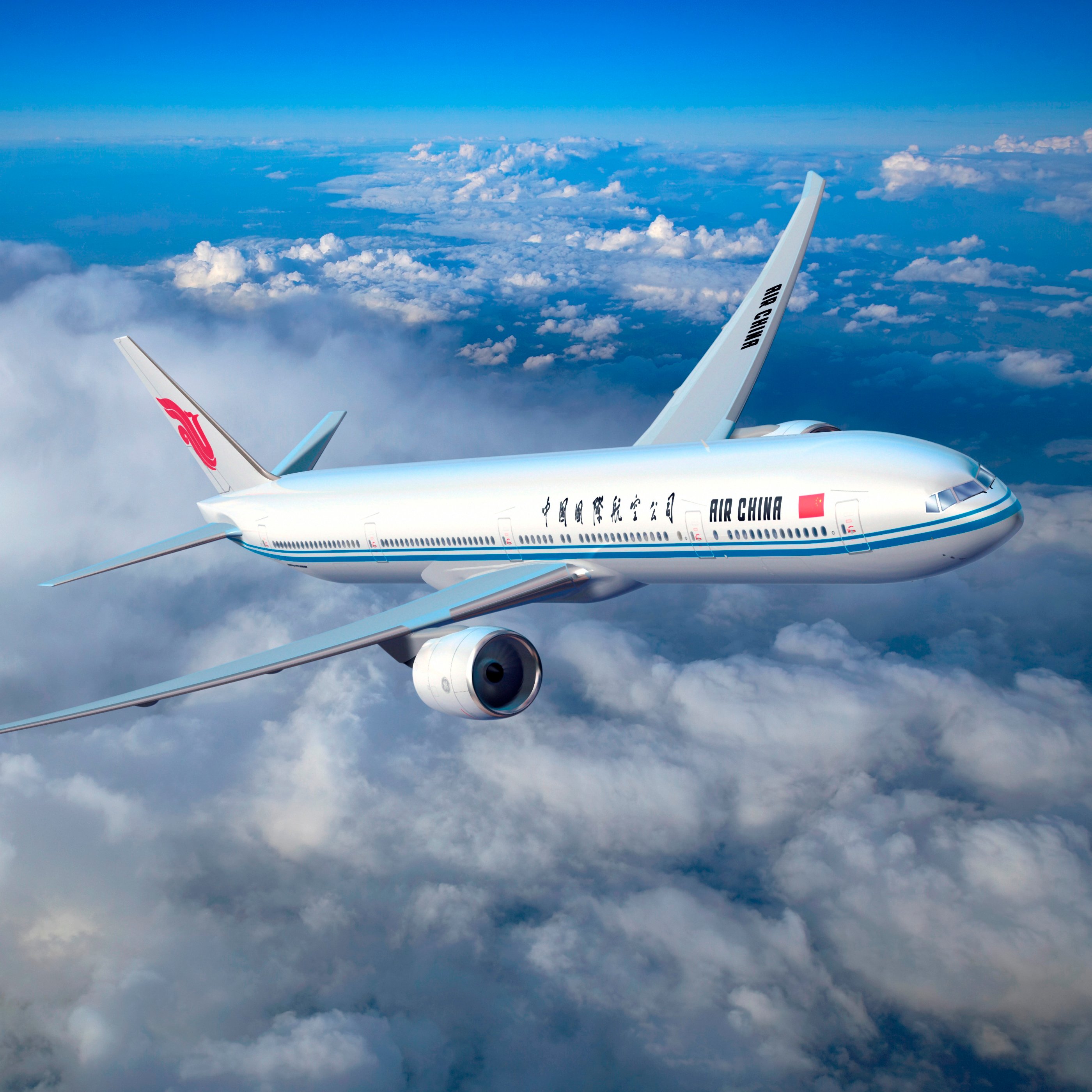

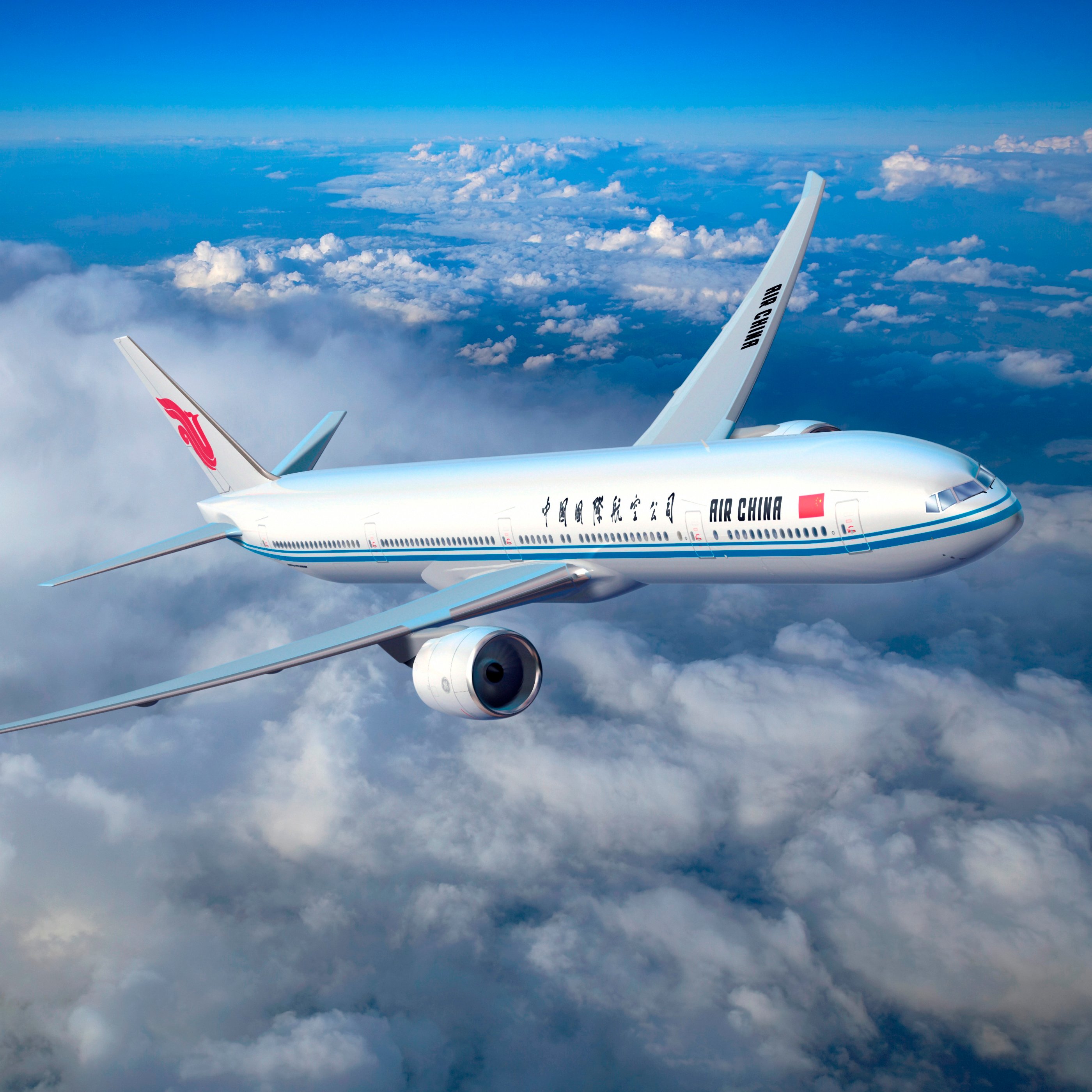

On an uncharacteristically chatty day for Boeing Co. (NYSE: BA), the company announced on Wednesday that it delivered 762 new commercial jets in 2015 (a new record), took 768 net new orders in 2015 and finalized an order for six 777-300ERs with China’s flagship carrier, Air China. This is all good news for Boeing.

At the beginning of 2015, Boeing set a delivery target of 755 new planes for the year and enough orders to maintain a one-to-one book-to-bill ratio. The company delivered on both.

There were a few other targets the company set that are a little more problematic. Most analysts believe that Boeing needs to take an annual total of 40 to 60 net new orders for the current version of its 777 passenger and freighter jets in order for the company to maintain its cash flow. When all was said and done last year, the company managed just 38. Including the new 777X, which is not scheduled to enter service until 2020, Boeing took net new orders for 58 of its 777 family of planes.

While the company has no set specific target for profitability in its 787 program — and some experts have wondered if the program will ever turn a profit — a big plus for Boeing in 2015 would be a decline in its deferred production cost. At the end of the third quarter of 2015, the company’s deferred production costs totaled $28.31 billion, and those costs have risen in every quarter for the past three years. If that number drops, even a tiny bit in the fourth quarter, it means that Boeing has stopped losing money on every 787 it sells. Most analysts agree that the day is coming, but the question is when.

[ims_survey]

The company’s other prominent target for 2015 was to maintain cash flow of $9 billion. We’ll have to wait until January 27, when Boeing reports fourth-quarter and full-year results, to find out how the company did, but this is the least of Boeing’s problems. For the first nine months of 2015, operating cash flow totaled $6.28 billion and free cash flow totaled $4.42 billion. Boeing needs about $2.8 billion in cash flow during the fourth quarter to meet its target, and that number is very likely a slam dunk because the company can ask its customers to bring cash payments forward if it needs to.

Free cash flow is expected to total about $6.7 billion in 2015. Boeing already has repurchased $6 billion in common stock and paid out $1.88 billion dividends in 2015. Boeing’s cash returns to shareholders exceeded its free cash flow in 2014 and will easily do so again in 2015.

Boeing’s stock dropped more than 4% on Thursday to close at $133.01, in a 52-week range of $115.14 to $158.83. In Friday’s premarket, shares were trading up about 2.4% to $136.14.

Sponsored: Find a Qualified Financial Advisor

Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to 3 fiduciary financial advisors in your area in 5 minutes. Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests. If you’re ready to be matched with local advisors that can help you achieve your financial goals, get started now.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.