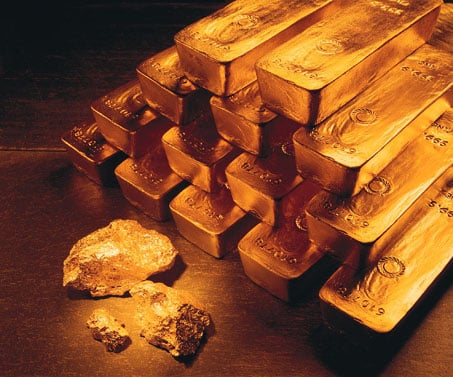

Dillon Gage Metals is calling for higher gold prices in 2013. Not just a little higher, but $2,000 per ounce. With gold around $1,670 per ounce, that translates to about 20% expected price appreciation. With as much money being printed in the world as there is right now, this may not be a huge surprise. Source: Thinkstock

Source: Thinkstock

Note that Dillon Gage Metals is in the business of offering bullion and rare coin trading, online trading of physical metals, jewelry liquidation, refining services and estate liquidations. We point that out because it would not be in the best interest of the company to publicly call for the price of gold to go lower.

The metals group has noted that gold is set up for it eleventh straight year of gains in 2012. Executive Vice President Roy Friedman said:

As I look forward to 2013 and beyond, I see signs that gold and the entire precious metals complex will remain key components in portfolios of small and large investors alike. Rising volume and open interest on the futures exchanges, ETF markets and over the counter physical market continue to indicate that investment demand for precious metals has never been greater … it’s possible that the next four years will look very much like the last four.

Reasons to support the $2,000 call are tied to the demand from the U.S. Mint, demand for physical gold from central banks, possible issues in the Middle East or Korean hostilities, and more.

What is interesting about the $2,000 call is that it is even given upside. Friedman said that $2,200 per ounce would not be that surprising.

See the FULL REPORT.

JON C. OGG

Sponsored: Attention Savvy Investors: Speak to 3 Financial Experts – FREE

Ever wanted an extra set of eyes on an investment you’re considering? Now you can speak with up to 3 financial experts in your area for FREE. By simply

clicking here you can begin to match with financial professionals who can help guide you through the financial decisions you’re making. And the best part? The first conversation with them is free.

Click here to match with up to 3 financial pros who would be excited to help you make financial decisions.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.