The U.S. steel industry is getting a push from more sources than just the recently proposed infrastructure bill proposed by President Joe Biden. According to a new research report on the industry from Goldman Sachs analysts Emily Chieng and Abigail Chernila, the highly cyclical steel industry is “currently enjoying the benefits of metal prices at all-time highs, underpinned by strong pent-up demand, lagging supply, and a low starting point for inventories.”

The Goldman analysts are initiating coverage on seven steel-related firms with three of the companies rated as Buy, three at Neutral and one at Sell. While steel prices are expected to moderate in the second half of this year, they could establish a “new normal” mark above their historical levels.

[in-text-ad]

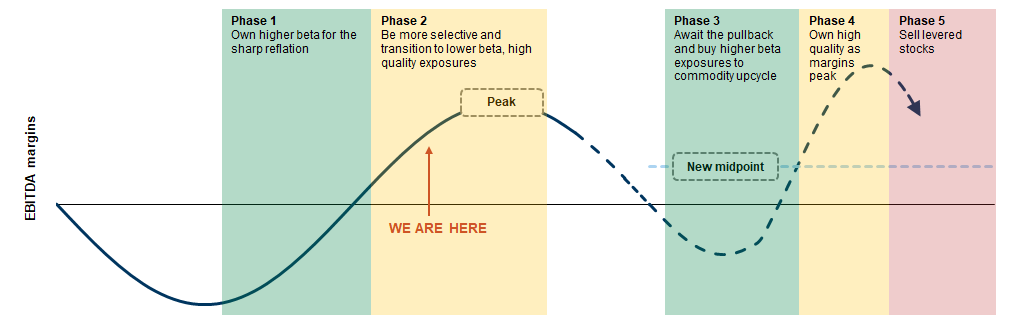

The analysts also believe that the industry will reach “peak EBITDA margins in coming quarters” and recommend that “investors stay selective and look for quality and those names that can drive margin expansion.” The Goldman Sachs report includes the following graphic that illustrates the industry’s EBITDA margins as a percentage of sales.

Chieng and Chernila base their evaluations of the seven companies on four key points:

- Exposure to end markets with positive near-term demand trends

- Positioned to benefit from margin expansion opportunities

- Strength on the balance sheet to support growth and capital returns

- Leader in low-carbon processes

The first three companies here meet all four of those key points.

Nucor

Besides being the country’s largest steelmaker, Nucor Corp. (NYSE: NUE) is a recycler with a capacity of 27 million tons and 25 scrap-based steel mills. Nucor expects to continue its diversification, shifting its product mix more heavily into value-added goods. Over the past 12 months, the share price has increased by about 120% with most of the gain coming since late January.

Goldman rates Nucor a Buy and puts a 12-month price target of $86 on the stock, working out to upside potential of 8% based on Wednesday’s closing price. Nucor’s dividend yield is 2.1%, the highest of any of these stocks and its enterprise value-to-EBITDA ratio (EV/EBITDA) is 5.0 times for 2021, 8.4 times for 2022 and 8.2 times for 2023.

Goldman’s analysts believe the key issues for Nucor include “(1) delivery of projects to drive margin expansion, (2) increasing share in the automotive segment, and (3) building and maintaining the financial strength to drive further growth and capital returns.”

The stock closed at $79.81 on Thursday and traded up fractionally to $80.04 midday Friday. The stock’s 52-week range is $34.72 to $82.76, and the consensus price target is $65.60.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.