Avnet Inc

NASDAQ: AVT

$48.47

Closing price April 23, 2024

Wells Fargo takes a look at a few stocks with potentially huge upside and where they could go in light of a possible recession.

Published:

Thursday's top analyst upgrades and downgrades included Affirm, Bloom Energy, Carlyle, Dutch Bros, Fiserv, Hanesbrands, LyondellBasell Industries, Microsoft, Rigel Pharmaceutical, Target, Tesla and...

Published:

Last Updated:

Wednesday's top analyst upgrades and downgrades included Altria, Apple, Bath & Body Works, BorgWarner, Chevron, Exxon Mobil, FedEx, Occidental Petroleum, Peabody Energy, Plug Power, Rio Tinto,...

Published:

These four Raymond James analyst favorite technology stock picks have substantial upside potential to the price targets. At current price levels, they all make good portfolio additions for growth...

Published:

Friday's top analyst upgrades and downgrades included Alteryx, Booking, CarGurus, Datadog, FedEx, First Solar, Uber Technologies, Vonage, Yeti and Zillow.

Published:

The top analyst upgrades, downgrades and other research calls from Friday include Alphabet, Boeing, CyberArk, Eiger BioPharma, Hewlett Packard Enterprise, Snap, Ulta Beauty and Walmart.

Published:

Last Updated:

Another week in which insider buying dominated the insider selling. This remains incredibly positive for stock investors after an eight-year bull market.

Published:

Last Updated:

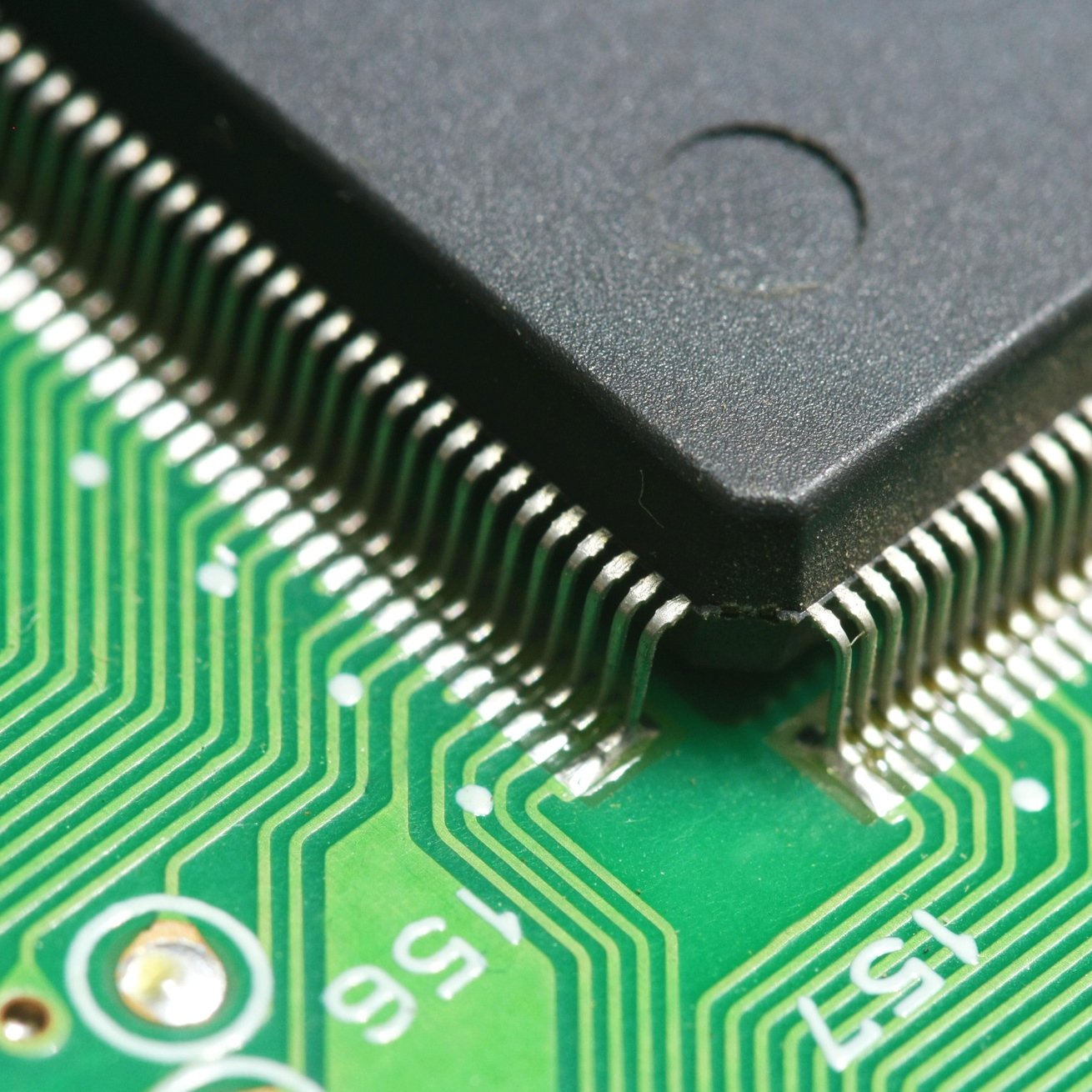

In addition to highlighting four top semiconductor stock picks, SunTrust Robinson Humphrey also lists five reasons to remain positive on selected stocks.

Published:

Last Updated:

What are semiconductor investors to do now? One good idea is to be very selective and, most importantly, stay with the companies that are in the right markets for their products.

Published:

Last Updated:

The top analyst upgrades, downgrades and initiations seen on Tuesday morning include American Electric Power, Broadcom, Ford, General Motors, JD.com, Sarepta Therapeutics and Valeant Pharmaceuticals.

Published:

Last Updated:

Electronics distributor Tech Data announced Monday that it has agreed to acquire the Technology Solutions business of Avnet in a deal worth more than $2 billion.

Published:

Last Updated:

The top analyst upgrades, downgrades and initiations seen on Tuesday morning include First Data, General Electric, Sarepta Therapeutics, Western Digital, Walgreens Boots Alliance and Zillow.

Published:

Last Updated:

The bull market is now more than six years old, which may have some investors perhaps wondering if they should return to value stocks rather than chasing the growth stocks that have risen so much.

Published:

Source: ThinkstockInvestors love to see insiders at high corporate levels purchasing their own companies’ stock. That is particularly true if the stock has performed well and has traded to higher...

Published:

Source: ThinkstockTechnology stocks continue to severely underperform the overall market this year. Through the end of last week, the sector was down 3.28 year to date, and it was the only S&P 500...

Published: