Morgan Stanley

NYSE: MS

$86.19

Closing price April 12, 2024

These four BofA Securities value stock picks are rated Buy, pay solid and dependable dividends, and had the lowest 12-month P/E ratios. They look like outstanding ideas now, in a very pricey market...

Published:

Streaming video powerhouse Netflix reports quarterly and annual results after markets close Tuesday, and three other investor favorites are on the calendar for Wednesday morning.

Published:

Goldman Sachs is very positive on four leading financial companies for 2021. Investors looking to add financials to portfolios can feel very comfortable adding these banking giants as they pay solid...

Published:

Tuesday afternoon’s analyst upgrades and downgrades included Citigroup, Goldman Sachs, JPMorgan and Tesla.

Published:

Although the markets may be falling, 24/7 Wall St. is taking a look at some big analyst calls that we have seen so far on Monday.

Published:

One solid way to increase the chances for investment success with stocks is to combine solid fundamental research with outstanding technical patterns. These four stocks should whet the appetite of...

Published:

Morgan Stanley, one of the nation's five largest banks, has agreed to pay $7 billion in cash and stock for investment management firm Eaton Vance.

Published:

It’s been years since value investing was in style, but that trend may be coming to an end. These five analyst picks look like great ideas for growth investors looking to steer away from the...

Published:

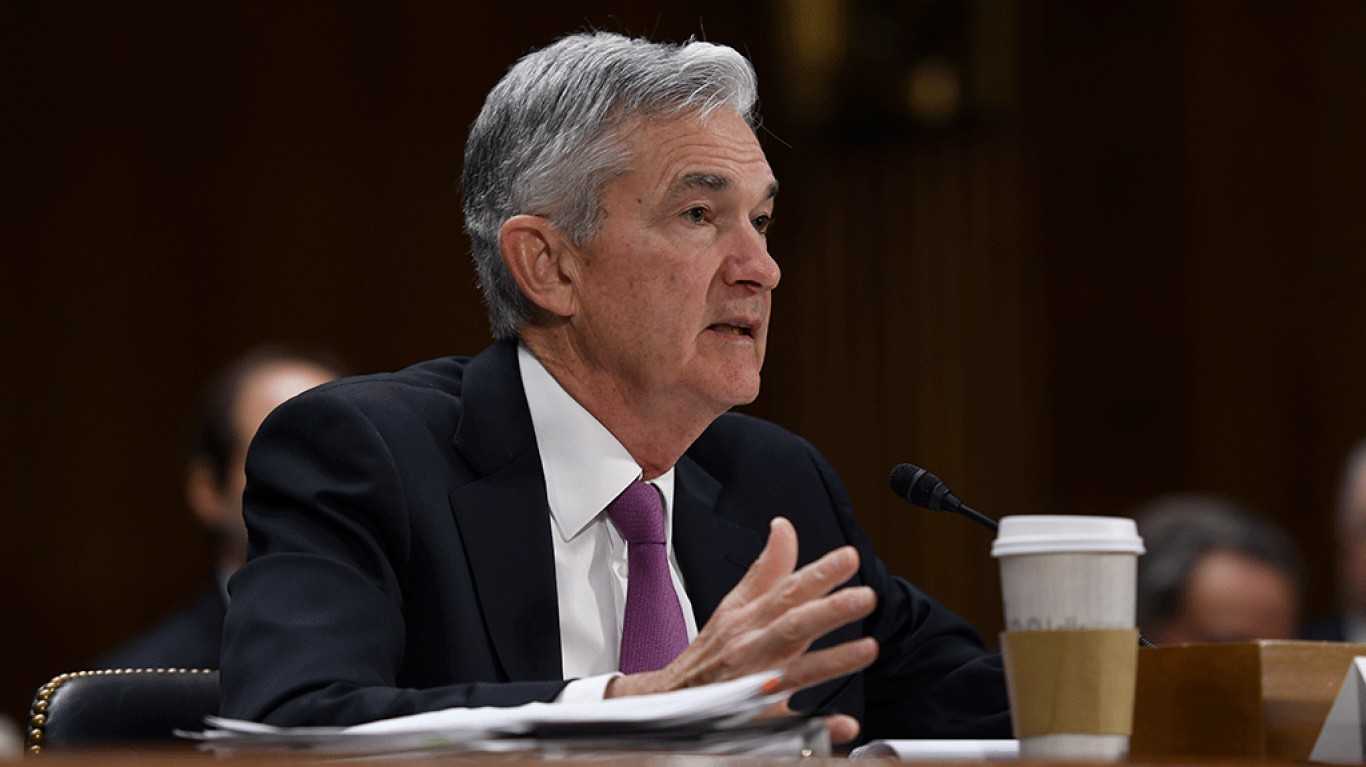

The Federal Reserve on Monday announced the capital requirements for the nation's 34 largest banks. Eleven of the banks are required to maintain at least 10% of total assets as an emergency fund.

Published:

Monday's top analyst upgrades and downgrades included Albermarle, Biogen, Dun & Bradstreet, eBay, First Solar, Lemonade, Morgan Stanley, Procter & Gamble, Schlumberger and Verizon Communications.

Published:

Morgan Stanley released better than expected second-quarter earnings report before the opening bell on Thursday, due in part to strong Sales and Trading revenues.

Published:

24/7 Wall St. has put together a preview of Bank of America, Citigroup and some of the other major financial companies kicking off the new earnings reporting season.

Published:

Wednesday's top analyst upgrades and downgrades included Altria, Apple, Caterpillar, Citigroup, JPMorgan, Nikola, Nokia, Novavax, Transocean, Valero Energy, Walt Disney and Wells Fargo.

Published:

The Federal Reserve has created a formula to determine whether a bank can pay third-quarter dividends. Of the nation's eight largest banks, seven have said they will pay their dividends.

Published:

The Federal Reserve Bank on Thursday released the results of its required stress tests on the nation's biggest banks.

Published: