Ocugen Inc

NASDAQ: OCGN

$1.69

Closing price April 11, 2024

Wednesday’s top analyst upgrades and downgrades included Baidu, BJ’s Wholesale Club, CrowdStrike, Ocugen, Palo Alto Networks, PayPal, Playtika, Schlumberger, Workday and Zoom Video Communications.

Published:

Stocks were indicated down before the opening bell Monday. A couple of meme stocks were bucking the trend, and one acquisition target was soaring.

Published:

Meme stocks traded well-mixed at midday Thursday. The morning's most surprising turn came from a stock that missed estimates and gave lower guidance but still traded higher.

Published:

U.S. stock markets were having an off-day Tuesday, and the meme stocks were as well -- with the exception of a look-alike to GameStop's position one year ago.

Published:

Trading wa light again Thursday, but one meme stock was making some real noise.

Published:

AMC stock got a big bump on Friday thanks to a new Spider-Man movie, but Monday's downturn was taking back a small piece of the big gain.

Published:

Markets were waiting with bated breath the FOMC announcement. In the meantime, there are always new Elon Musk tweets to ponder.

Published:

Several beaten-down meme stocks were getting some love as investors decided that Tuesday was a good day for taking on risk.

Published:

Reduced concern for the impact of the Omicron variant of the coronavirus lifted stocks higher on Monday. The effect appeared to be continuing in Tuesday's premarket trading.

Published:

Despite Friday's sharp drop in equity prices, there were a couple of winners. Premarket trading indicated a higher open, with crude oil up well over 5%.

Published:

Friday's shortened trading session was dominated by the news of a new coronavirus variant and its impact on investors.

Published:

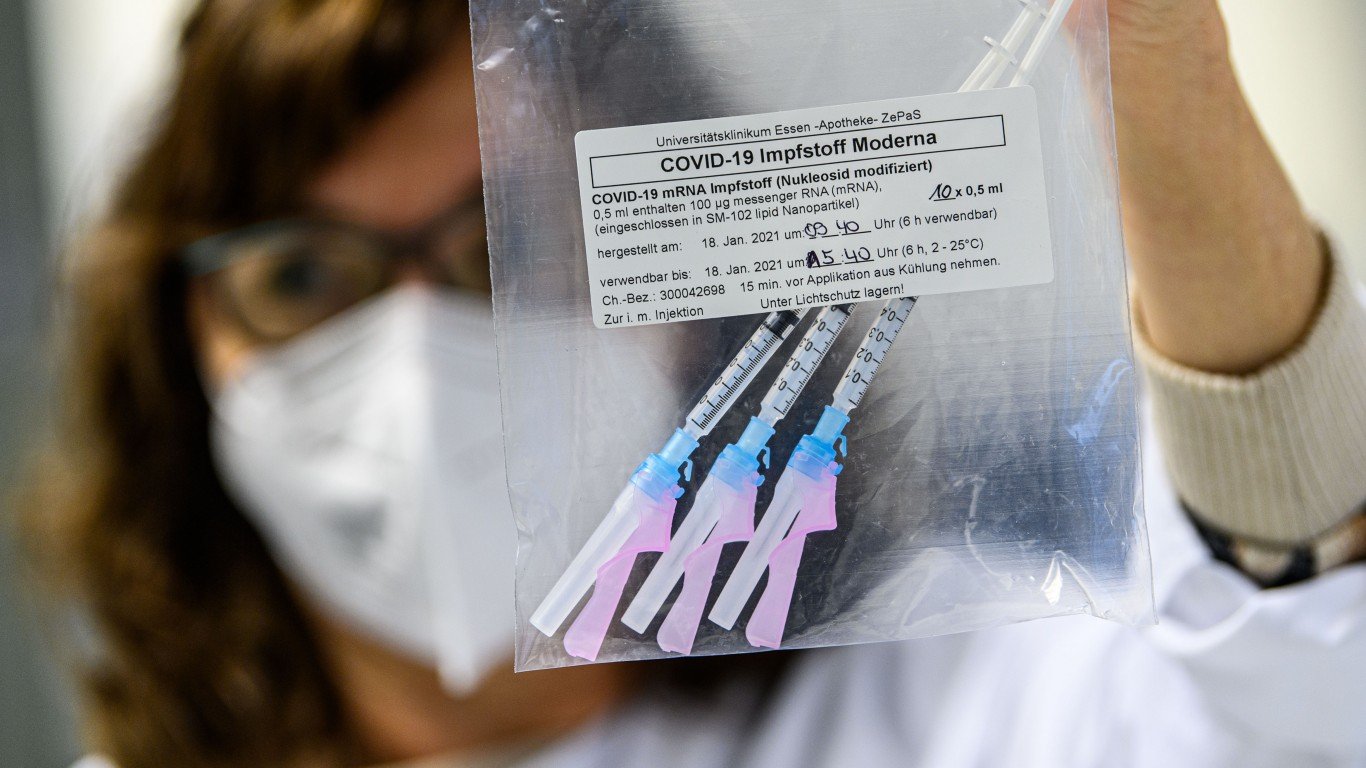

An FDA directive has hammered a coronavirus vaccine maker Friday morning as a new variant of the infection is discovered in South Africa.

Published:

A strong October jobs report lit a fire under traders in Friday's premarket. One of Thursday's big movers added a bit more Friday morning and another was dropping after reporting earnings.

Published:

Why does a coronavirus vaccine maker's stock drop more than 20% after the vaccine is approved for use? It happened Wednesday.

Published: