Last Friday was indeed a Black Friday for U.S. equities. All three major U.S. stock indexes closed down by at least 2%. All 11 sectors traded lower, primarily due to worries that the Omicron variant of the coronavirus would drag on the global economic recovery. Those fears appear to be somewhat allayed in Monday’s premarket trading, with the major indexes all trading higher by nearly 1%.

Crude oil closed at just over $68 on Friday, but it surged by more than 5% Monday morning to trade near $72 a barrel. Bitcoin sank below $54,000 on Friday but traded just above $57,000 early Monday. Yields on 10-year Treasury notes also jumped Monday morning, up by about seven basis points to 1.55%.

The stocks on our meme stock watch list also cratered Friday, and some were making a comeback of sorts in Monday’s premarket. Ocugen Inc. (NASDAQ: OCGN) has recovered more than half its 90% Friday loss to trade up more than 5% at $6.79. The company on Friday announced an FDA-imposed hold on its new drug application for a COVID-19 vaccine.

E-commerce retailer Newegg Commerce Inc. (NASDAQ: NEGG) defied Friday’s downturn, adding nearly 8% to its share price. The stock traded up more than 5% in Monday’s premarket at $20.88. Earlier in the morning, the company reaffirmed its financial forecasts for fiscal 2021, including $2.4 billion in net sales and net income in a range of $36.3 million and $40.3 million.

Newegg also placed third in this week’s list of companies most likely to face a short squeeze. According to Fintel: “… short interest jumped 102% in the first week of November, from 1.04M shares to 2.1M shares, an increase of 102%. The cost to borrow shares is currently 84%.” The company’s affirmation of its guidance may only add fuel for the short squeezers.

OG meme stock GameStop Corp. (NYSE: GME) dropped 5.7% on Friday but recovered 2% in early trading Monday morning to around $203. It was also the most talked-about stock Monday morning on social media, including this comment on WallStreetBets from ResidentBat4:

Bulltrap activated. Dow goes up Monday and Tuesday. [Omicron] spreads globally and everyone freaks out Wed/Thursday/Friday. Mother of all market crash happens Friday. Dow goes to 20,000 and people start freaking out. GME goes to $10,000 a share. Dogecoin is the new global currency. Use of cars other than Tesla is made punishable by death. Memes replace sporting events.

You might not want to bet the ranch on these predictions.

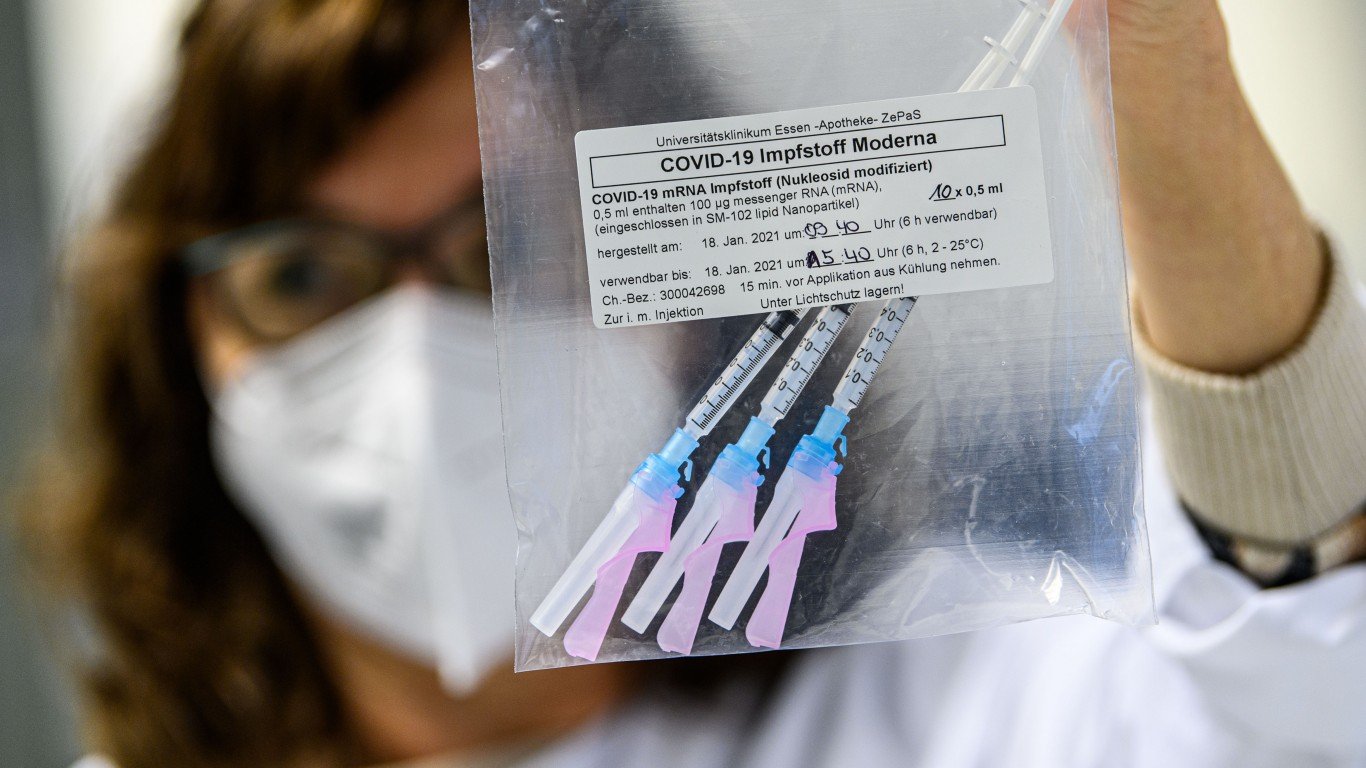

COVID-19 vaccine maker Moderna Inc. (NASDAQ: MRNA) gets a lot of social media attention. The stock’s average daily trading volume is around 13 million, and the stock jumped more than 20% on Friday. Shares traded up another 10% in Friday’s premarket session at about $363.

Moderna’s chief medical officer told the BBC on Sunday that the company is working on a higher-dose booster to deal with the Omicron variant and that, if it is needed, a completely new vaccine could be ready early in 2022.

Sponsored: Attention Savvy Investors: Speak to 3 Financial Experts – FREE

Ever wanted an extra set of eyes on an investment you’re considering? Now you can speak with up to 3 financial experts in your area for FREE. By simply

clicking here you can begin to match with financial professionals who can help guide you through the financial decisions you’re making. And the best part? The first conversation with them is free.

Click here to match with up to 3 financial pros who would be excited to help you make financial decisions.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.

24/7 Wall St.

24/7 Wall St.