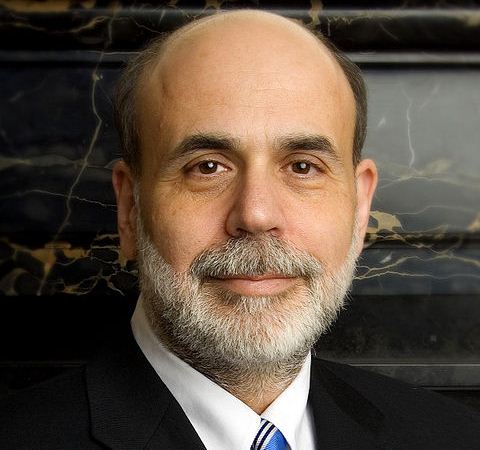

Source: courtesy U.S. Federal Reserve

As has been the case for several announcements, the lone dissenting vote came from Kansas City Fed President Esther George who continues to worry that the “high level of monetary accommodation [increases] the risks of future economic and financial imbalances, and, over time, could cause an increase in long-term inflation expectations.” Nine FOMC members, including chairwoman-designate Janet Yellen, voted to maintain the asset buying program at its present level.

The FOMC also agreed to maintain its target range for the federal funds rate at 0 to 0.25% and said that it expects this “exceptionally low rate” to be appropriate as long as the unemployment rate remains above 6.5%. The FOMC believes that inflation expectations for the next one to two years suggest inflation will rise no more than half a percentage point above the Fed’s 2% long-run goal, keeping longer-term inflation expectations “well-anchored.”

The markets reacted by first sending share prices up, then down, then up again to pre-FOMC announcement levels.

The language of the announcement formally gives the Federal Reserve ammo to maintain its $85 billion in monthly bond buying stimulus, while still having an out to begin tapering if things get better.

Essential Tips for Investing: Sponsored

A financial advisor can help you understand the advantages and disadvantages of investment properties. Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

Investing in real estate can diversify your portfolio. But expanding your horizons may add additional costs. If you’re an investor looking to minimize expenses, consider checking out online brokerages. They often offer low investment fees, helping you maximize your profit.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.