Investors have historically had a hard time getting used to a new Federal Reserve chair. After all, you have to transition from years of the same sort of actions under one chair that become more easy to interpret and predict to a climate in which you have to rely on many past, present and unknown factors.

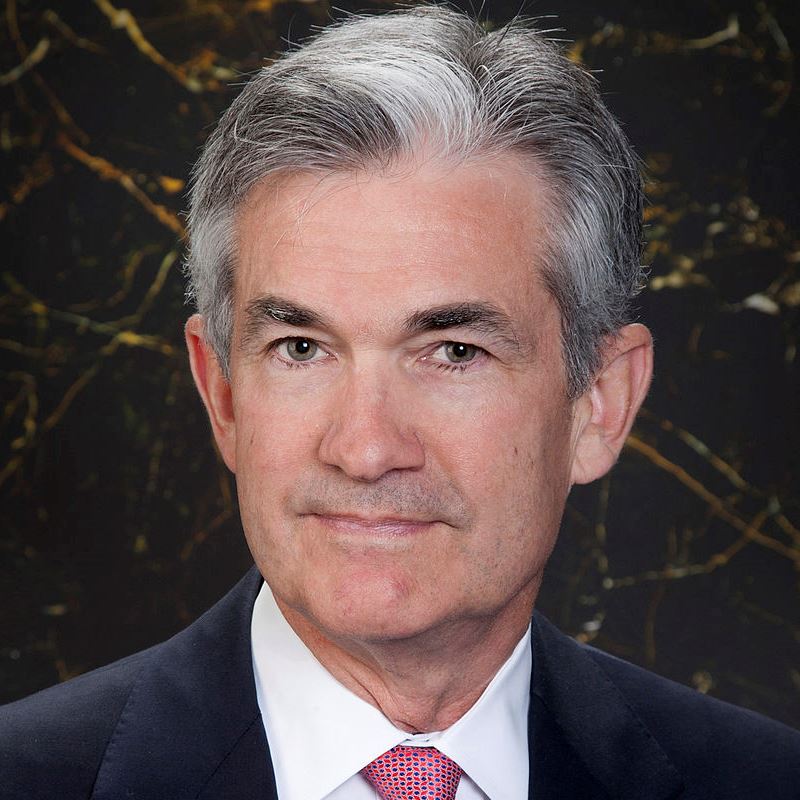

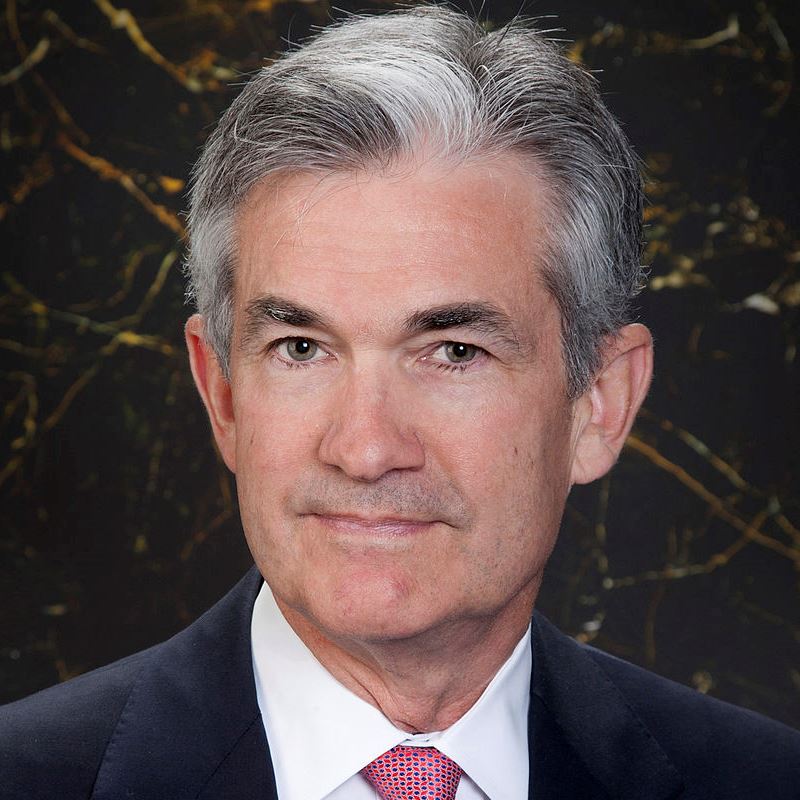

Now that Janet Yellen’s tenure as Fed chair has ended, Jerome Powell has taken up the reins. Tuesday marked Powell’s first testimony to the Congress.

Please note: At the time this was written, the question and answer session of Powell’s testimony was not concluded. If additional comments in the Q&A session act as game-changing events, this post will be updated. Update — in the Q&A session Powell had indicated that the Fed is willing to keep raising interest rates to fight inflation if needed.

The first takeaway is that Powell’s testimony is not, or at least did not initially appear to be, a game-changing policy regime change. The commentary ahead of time should not have spooked the financial markets, even if the questions and answers were really where the highlights took. Yellen and Powell also worked together to ensure a smooth leadership transition and provide for continuity in monetary policy. That being said, this is usually the case.

There are nine more takeaways that the investment community should take away from Powell’s testimony. This included some of the questions and answers session as the introductory comments were not that long.

A second point, which also has continued to remain under Fed transitionary periods, is that the dual mandates of maximum employment and price stability remain. Powell also added “transparency about the Federal Reserve’s policies and programs” as a tool by saying: “I am committed to clearly explaining what we are doing and why we are doing it.”

On the continued weakness in the labor force participation rate remaining roughly unchanged while unemployment has continued lower, as a third point, Powell noted that retiring baby boomers are putting downward pressure on the participation rate.

A fourth point is undefined higher growth ahead. On top of higher growth in the second half of last year, the growth in business investment should support higher productivity growth in time, and the stronger demand for U.S. exports has provided considerable support to the U.S. manufacturing industry.

A fifth point is that Powell is just not yet worried about inflation, even with the recent uptick seen. UPDATE — in Powell’s Q&A he did indicate the Fed would continue raising rates. He noted that inflation has been low and stable, and it has continued to run below the 2% rate that the Federal Open Market Committee (FOMC) judges to be most consistent over the longer run with its congressional mandate. With inflation running under 2%, Powell noted:

We continue to view some of the shortfall in inflation last year as likely reflecting transitory influences that we do not expect will repeat; consistent with this view, the monthly readings were a little higher toward the end of the year than in earlier months… In this environment, we anticipate that inflation on a 12-month basis will move up this year and stabilize around the FOMC’s 2 percent objective over the medium term.

A sixth issue is on the stated economic outlook and the outlook for jobs. Powell said that outlook remains strong and the robust job market should continue to support growth in household incomes and consumer spending. Upbeat business sentiment and strong sales growth likely will continue to boost business investment.

A seventh issue on the fiscal policy is that it is becoming more stimulative, and the Fed views the near-term risks to the economic outlook as roughly balanced (but it will continue to monitor inflation developments closely). Despite the recent volatility, Powell believes that the financial conditions remain accommodative.

An eighth issue is regarding balance sheet normalization of the Fed’s $4.5 trillion balance sheet under monetary policy. Powell sees this as having proceeded smoothly, and that gradually reducing monetary policy accommodation will sustain a strong labor market while fostering a return of inflation to 2%.

A ninth issue is how Powell sees rate hikes ahead and whether the Fed will still be considered as “data-dependent” in its views. This is generally considered a continuation of three rate hikes in 2018 and likely three more hikes in 2019. Powell noted that further gradual increases in the federal funds rate will best promote attainment of both of the Fed’s primary objectives, but he also added in wiggle room by noting that the path of monetary policy will depend on the economic outlook as informed by incoming data.

A tenth point would be that Powell is leaving more wiggle room and variables around just the two mandates of price stability and maximum employment. The Fed has in the past been deemed to be seeking market support as well, but that obviously ties into the mandates. Powell said:

The FOMC routinely consults monetary policy rules that connect prescriptions for the policy rate with variables associated with our mandated objectives. Personally, I find these rule prescriptions helpful. Careful judgments are required about the measurement of the variables used, as well as about the implications of the many issues these rules do not take into account.

Essential Tips for Investing: Sponsored

A financial advisor can help you understand the advantages and disadvantages of investment properties. Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

Investing in real estate can diversify your portfolio. But expanding your horizons may add additional costs. If you’re an investor looking to minimize expenses, consider checking out online brokerages. They often offer low investment fees, helping you maximize your profit.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.