This time last year, the price of oil was plummeting as concerns about the COVID-19 pandemic were rising. Travel came to a near halt, and there was a sense of paralysis in the country due to the lockdowns and restrictions. In fact, April 20, 2020, was the first day in history in which oil recorded negative prices. U.S. oil benchmark West Texas Intermediate (WTI) fell from $17.85 a barrel at the start of the trading day to negative $37.63 by the close. Storage was full, and those stuck with futures contracts were crushed.

[in-text-ad]

What a difference a year makes. With April here and spring-like weather arriving across the country, WTI has rebounded to over $60 a barrel, while Brent crude is trading near $65. Despite the oil price rebound, energy shares have sold off some over the past month, and the analysts at Goldman Sachs had this to say after speaking with accounts and investors:

Many investors we have spoken to have felt that the stocks going into mid-March were discounting something close to these levels and therefore, despite the potential for a summer rally, were willing to monetize outperformers. After the pullback in the past month the energy select sector SPDR fund (NYSE: XLE from $53 to $48), we have received increased interest in stories that are perceived as attractively valued on mid-cycle levels on long-term estimates.

Four top stocks were highlighted, and while they are rated Buy at Goldman Sachs, it is important to remember that no single analyst report should be used as a sole basis for any buying or selling decision.

ConocoPhillips

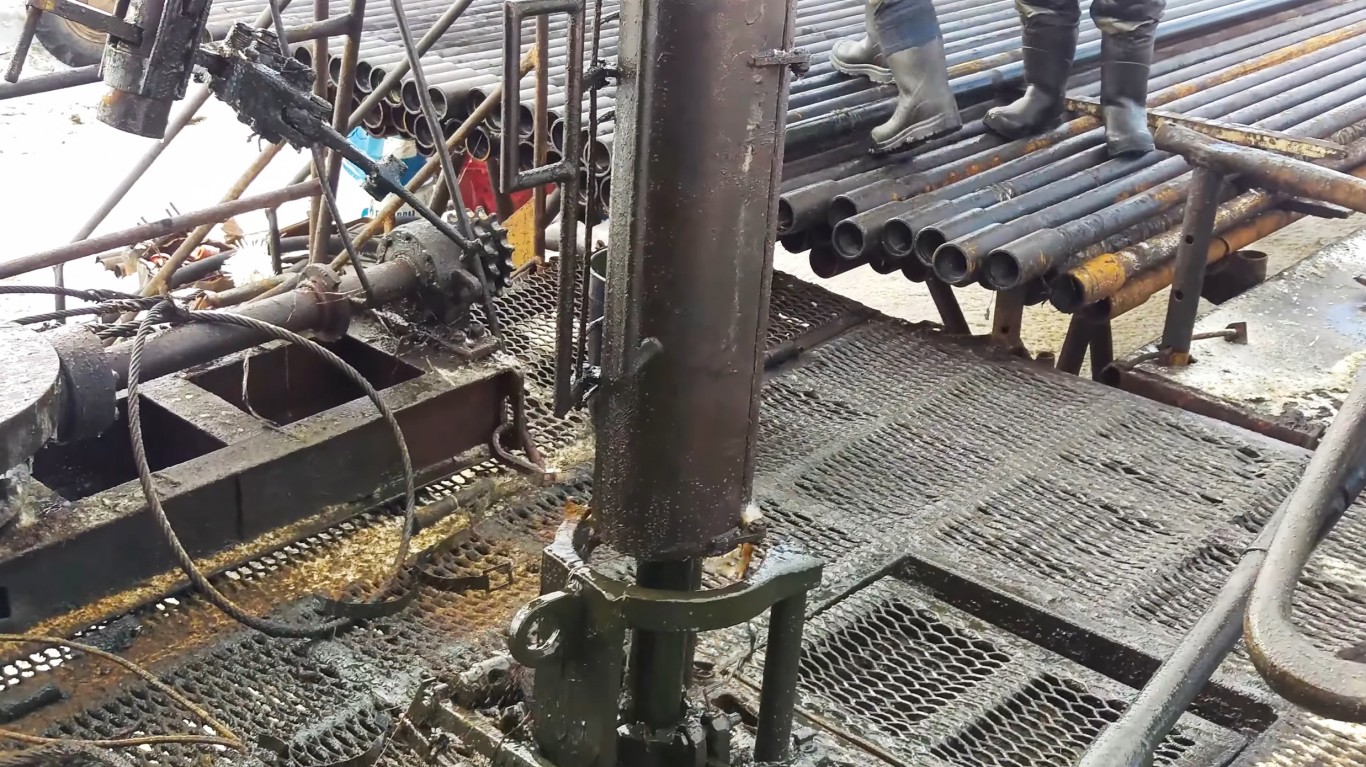

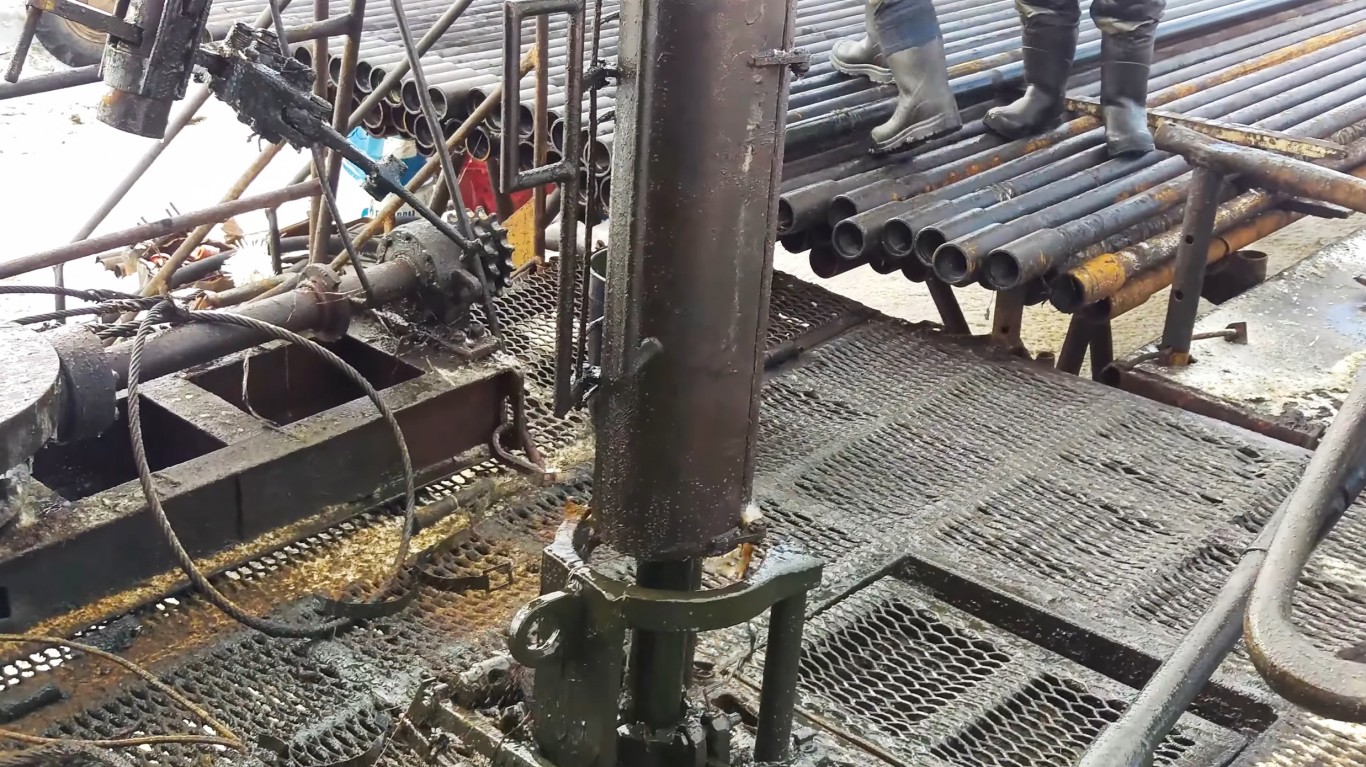

Shares of this large-cap company offer strong value for investors. ConocoPhillips (NYSE: COP) explores for, produces, transports and markets crude oil, bitumen, natural gas, liquefied natural gas and natural gas liquids (NGLs) worldwide.

Conoco’s portfolio includes resource-rich North American tight oil and oil sands assets; lower-risk legacy assets in North America, Europe, Asia and Australia; various international developments; and an inventory of conventional and unconventional exploration prospects.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.

24/7 Wall St.

24/7 Wall St.