Source: U.S. Energy Information Administration

The big drop came Friday afternoon on word that the negotiations between Iran and six other nations regarding Iran’s nuclear development program could conclude this week with a settlement that could add another 2 million barrels a day of Iranian crude to the global supply.

Yemen’s proved reserves at the end of 2013 totaled 3 billion barrels, ranking it 31st on the global list. The country produces about 190,000 barrels a day, or about 0.01% of the world’s total daily production. That hardly seems to justify a price spike of $4 a barrel.

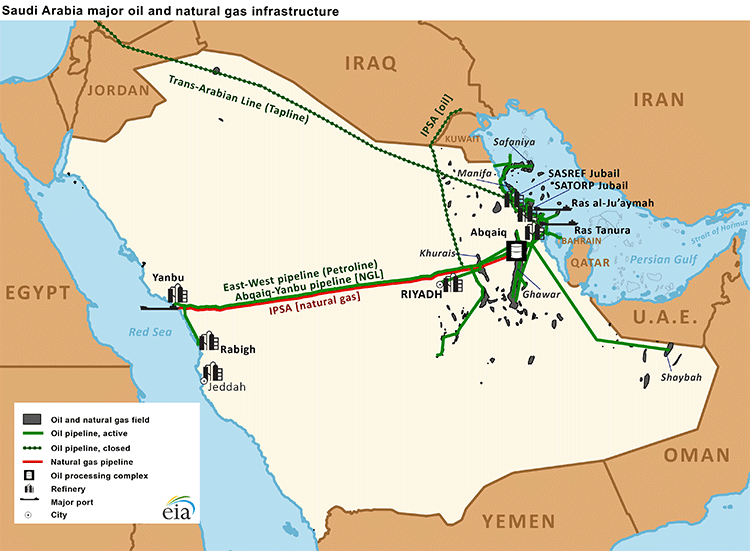

But armed conflict in the Middle East could affect production and, in Yemen’s case, transportation through the Bab-el-Mandeb strait between Yemen and the horn of Africa that connects the Red Sea to the Gulf of Aden. A Saudi Arabian pipeline runs from that country’s massive oil fields across the country to the Red Sea port of Yanbu and about 3.8 million barrels of crude pass through the strait every day, making it the world’s fourth-most important choke point for crude transportation.

ALSO READ: 7 Oil and Gas Stocks Analysts Want You to Buy Now

The Saudis do not particularly fear that Yemen’s Houthis will endanger Saudi oil fields, but they are worried that Iran will gain influence if the Houthis prevail and close the strait. Iran supports the Houthis, at least politically if not also financially, and while Yemen and the Houthis would have little naval capability, Iran could decide to provide the ships to block the strait. Egypt sent four ships to the area on Thursday and navies from the United States, Russia and China are close by.

The counterweight to the conflict and its threat to cut supply and raise prices are the negotiations on the future of Iran’s nuclear development program. If an agreement is reached and sanctions are lifted, some traders worry that up to 2 million barrels a day of Iranian crude will suddenly reach an already oversupplied market.

While anything is possible, such a scenario is unlikely. The United States and the other five nations negotiating with Iran are not going to discard their trump card on nothing more than a promise from Iran not to develop a nuclear weapon. The six countries will offer some relaxation in sanctions and insist that Iran meet certain intermediate goals before sanctions on oil sales are fully lifted. A full return of Iranian oil to the market is very likely months away.

It is instructive to look at the futures prices for Brent. The June contract traded at around $57 on the ICE at around noon London time. The December futures traded at around $61.30 and the March 2016 futures traded around $62.80. When the outcome of the negotiations are announced — currently the talks are scheduled to end on March 31 — the direction of futures prices will signal where traders think the market is headed and how quickly it will get there. We will be paying attention.

ALSO READ: Will India Be the Next Major Driver for Alternative Energy?

Sponsored: Find a Qualified Financial Advisor

Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to 3 fiduciary financial advisors in your area in 5 minutes. Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests. If you’re ready to be matched with local advisors that can help you achieve your financial goals, get started now.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.