Madrigal Pharmaceuticals Inc. (NASDAQ: MDGL) has seen more than its share of volatility over the past year. With a market cap of only about $1.3 billion, many investors will have either never heard of the company or they may have forgotten about it. The clinical-stage company has been public since 2007 and is targeting therapeutic candidates for the treatment of cardiovascular, metabolic and liver diseases.

The stock has been very volatile, with its shares being above $140 a year ago and down at $81.75 as of Wednesday’s close. It has also accumulated negative earnings of −$195.5 million over its life, as of the September 2019 quarter. Now a positive research call indicates that Madrigal shares could deliver more than 100% upside to investors over the coming year or so.

Canaccord Genuity’s Edward Nash initiated coverage of Madrigal’s shares with a Buy rating and a whopping $198 target price. Even after close to a 5% gain so far on Thursday morning, that represents an implied gain of more than 100% from the current prices, if the basis for the research pans out.

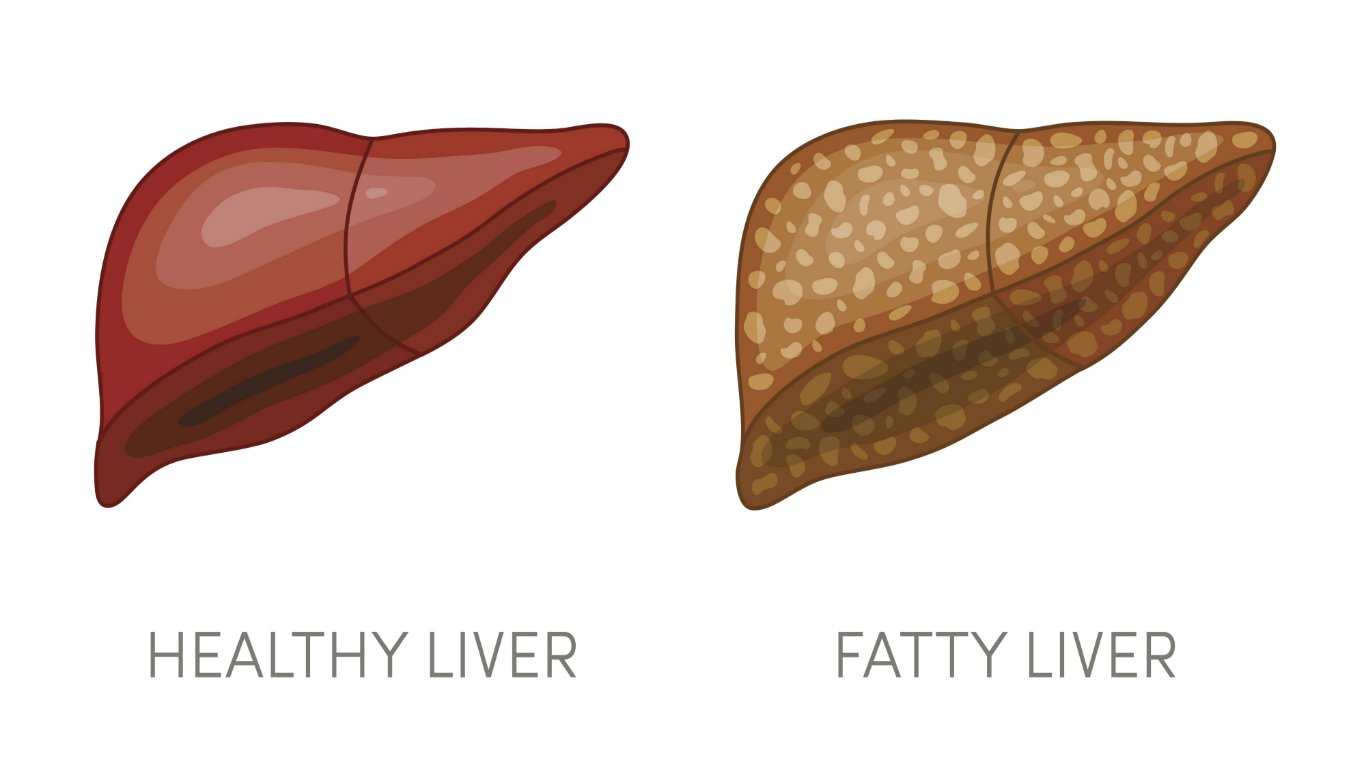

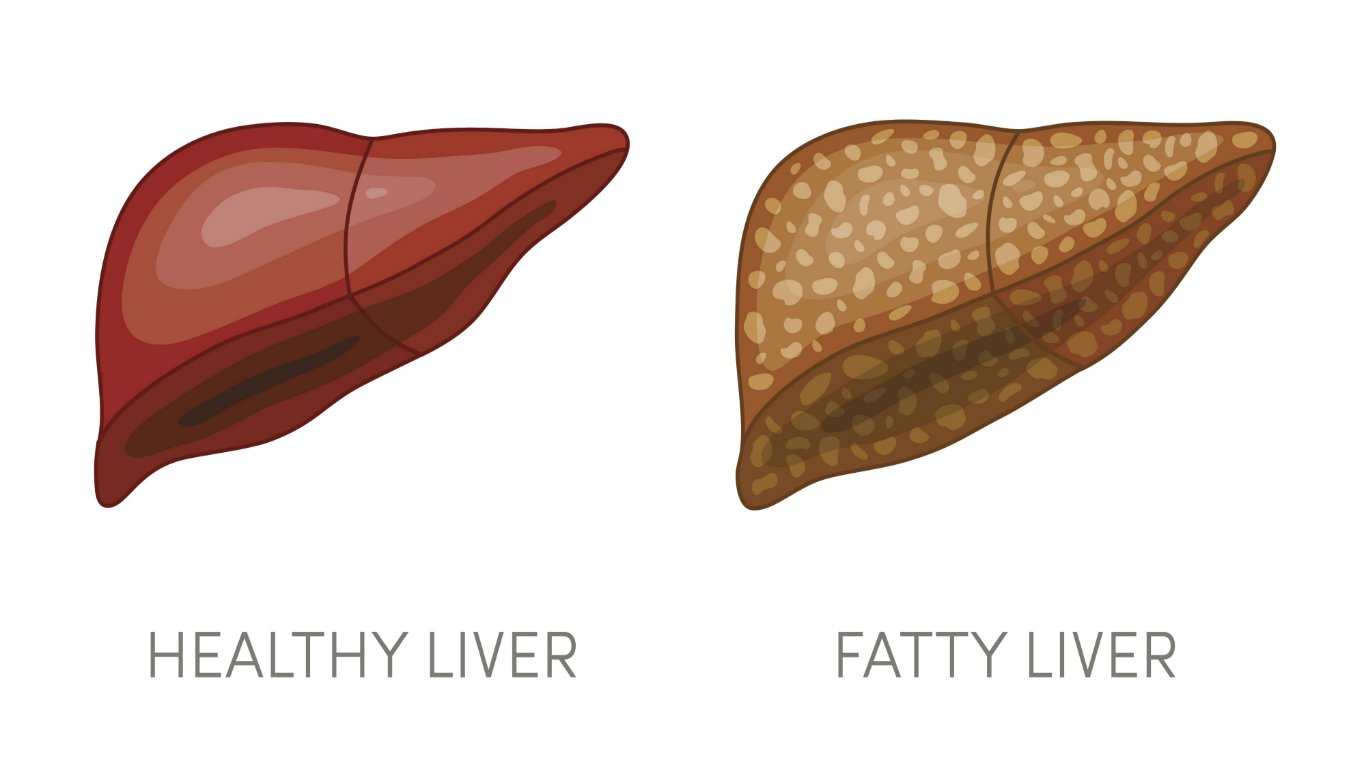

The report cites upside from two ongoing Phase 3 trials in nonalcoholic steatohepatitis (NASH) and nonalcoholic fatty liver disease (NAFLD), with many opportunities in the NASH space. NASH is the most severe form of NAFLD. No medication currently available can fully reverse the buildup of fat in the liver.

The analyst sees resmetirom’s specificity having a strong safety profile, and Madrigal’s past capital raise offers it a strong balance sheet with a clean capital structure.

After looking at the last quarterly balance sheet, Madrigal had roughly $453 million in cash and short-term investments, and its total liabilities were just under $16 million. Madrigal also has kept a burn rate of around $10 million per quarter, so it has a long runway to fund its operations and studies.

Canaccord Genuity noted that the prevalence of NASH is about 3% in the United States alone, roughly 8 million people. Even with one-third diagnosed and half treated, the 1.3 million population target market would be worth about $7.3 billion in 2020. The report shows that Madrigal’s resmetirom candidate has a high likelihood of showing a statistically significant outcome in liver fat reduction and also lowering the NASH score in its ongoing Phase 3 trials based on what was seen in the Phase 2b trial without worsening fibrosis.

The report also points out that the drug test demonstrated no cardiotoxicity that could be observed when targeting the alpha isoform of THR. Patients also were shown to have seen a significant decrease in low-density lipoprotein (LDL) and triglyceride levels when compared to the placebo group.

Before thinking these multibillion levels are going to be seen soon, note that Nash’s report projects a top-line resmetirom revenue model for the United States and European Union of $1.44 billion out in 2029. The firm assigned $171 worth of the $198 target price to the drug and the rest from cash on hand.

Investors also should consider that the coming wave of potential NASH treatments could be a very crowded field. Canaccord Genuity showed that Intercept Pharma, Allergan, Genfit, Galmed Pharma, Galectin Therapeutics, Astrazeneca and Cirius Therapeutics all have Phase 3 developments underway that target NASH.

While Madrigal is thinly traded, and while its shares were smashed lower from about $120 to under $90 in December alone, Canaccord Genuity is not the only firm with a large upside target here. UBS raised its rating to Buy and assigned a $127 target price back on January 9, and H.C. Wainwright reaffirmed a Buy rating while lowering its target price to $215 from $225 in early November.

Madrigal Pharmaceuticals stock traded up about 4% to $84.75 on Thursday, in a 52-week trading range of $74.05 to $148.18.

Sponsored: Attention Savvy Investors: Speak to 3 Financial Experts – FREE

Ever wanted an extra set of eyes on an investment you’re considering? Now you can speak with up to 3 financial experts in your area for FREE. By simply

clicking here you can begin to match with financial professionals who can help guide you through the financial decisions you’re making. And the best part? The first conversation with them is free.

Click here to match with up to 3 financial pros who would be excited to help you make financial decisions.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.