Industrials

Full 360-Degree GE Earnings Preview (GE, BRK-A, MMM, UTX, HON)

Published:

Last Updated:

General Electric Company (NYSE: GE) is due to report earnings early on Friday morning in the pre-market hours. Thomson Reuters has estimates for the DJIA component and conglomerate of $0.32 EPS and $34.86 billion in revenues; next quarter estimates are $0.40 EPS and $39.54 billion in revenue.

General Electric Company (NYSE: GE) is due to report earnings early on Friday morning in the pre-market hours. Thomson Reuters has estimates for the DJIA component and conglomerate of $0.32 EPS and $34.86 billion in revenues; next quarter estimates are $0.40 EPS and $39.54 billion in revenue.

Shares are trading around $16.75, its 52-week trading range is $14.02 to $21.65 and analysts have a consensus price target that has slid further to $20.93. Keep in mind that GE shares have recovered more than $2.50 per shares as recently as the lows of October 4.

General Electric has also noted that it is paying back Berkshire Hathaway Inc. (NYSE: BRK-A) from Warren Buffett’s late-2008 investment in the 10% preferred shares. While we have already seen some conglomerates report their earnings, we would expect that GE’s report will set the tone much more firmly for how 3M Co. (NYSE: MMM) and United Technologies Corporation (NYSE: UTX) trade in the week ahead.

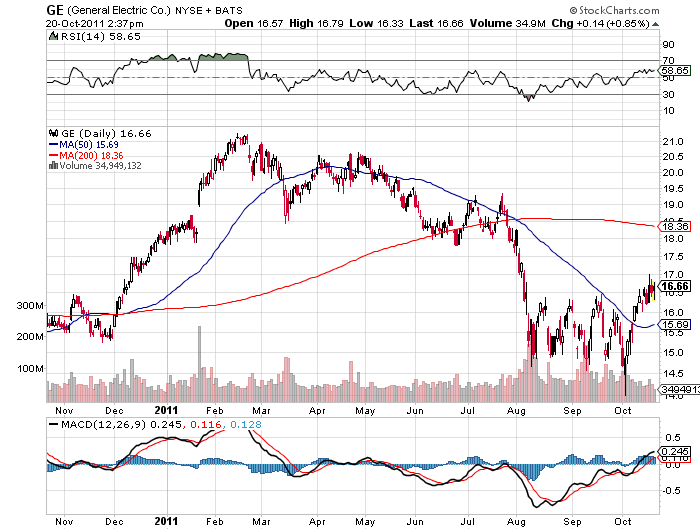

The chart is a bit of a conundrum here if you look at the stockcharts.com chart below. Since GE recovered so much it became a bit overbought on a near-term basis this week. Simultaneously, the stock also cleared a very obvious triple-top after bouncing off the lows. If the company manages to show strong reports there is really nothing but dead space between today’s price and somewhere around $17.90 to $18.00.

The 50-day moving average is $15.69 and the 200-day moving average is $18.36.

Options traders appear to be pricing in only a move of up to $0.35 or so in either direction. That is only just about 2%, but we would note that options expiration date is tomorrow as well.

We would note that Jeff Immelt has said in recent months that he is happier with the GE portfolio than he has ever been. We’ll have to see if he stocks by that in the conference call. Another expectation we expect to hear clarification or direction on is just how much business is suffering in Europe after so many companies have said that business in Europe is suffering. Also, look for Jeff Immelt’s comments on the overall business environment in China.

Another conglomerate’s earnings are due as well on Friday morning. Honeywell International Inc. (NYSE: HON) will report and Thomson Reuters has estimates of $1.00 EPS and $9.26 billion in revenues; next quarter estimates are $1.08 EPS and $9.64 billion in revenue.

JON C. OGG

If you want your portfolio to pay you cash like clockwork, it’s time to stop blindly following conventional wisdom like relying on Dividend Aristocrats. There’s a better option, and we want to show you. We’re offering a brand-new report on 2 stocks we believe offer the rare combination of a high dividend yield and significant stock appreciation upside. If you’re tired of feeling one step behind in this market, this free report is a must-read for you.

Click here to download your FREE copy of “2 Dividend Legends to Hold Forever” and start improving your portfolio today.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.