As reports continue to show strong labor markets and a return to GDP growth, many investors and economic watchers have to be wondering what the future growth story looks like from here. The Federal Reserve is expected to begin rate hikes in 2015 and bond yields have yet to skyrocket. Reports even have surfaced that some businesses are willing to increase capital spending and make investments again. Source: Thinkstock

Source: Thinkstock

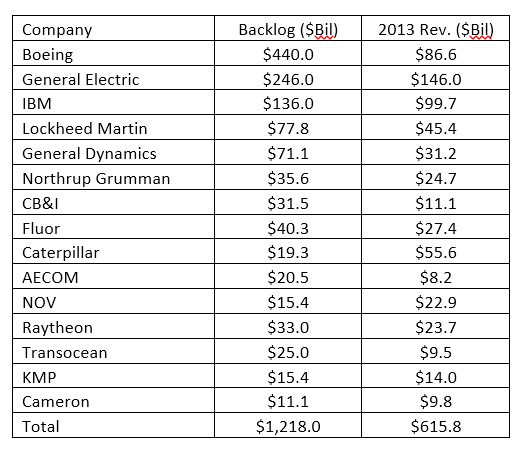

24/7 Wall St. reviews the so-called backlog of service and product orders from companies to see what the future looks like. Quite simply, these are future revenues on the books via orders, but they generally have yet to be paid for entirely or they have yet to be fulfilled. It turns out that some companies actually have a backlog that is close to a year or more worth of revenues.

Now that earnings season is over and 2015 is coming closer, we wanted to see just what is happening with future revenues. We screened the large technology services, infrastructure other services and defense companies to come up with a broad list. Many other companies may have an impressive backlog as well, and some may even be higher than the companies we have presented. Most of these companies have formally referred to their backlog amounts with specific dollars in their earnings reports this summer or in subsequent SEC filings and documents. We then created a small table to show the total backlog and compared this to the last year’s total revenue (2013 in most cases).

READ ALSO: 10 Fresh Higher Dividends and Buybacks That Should Not Be Overlooked

Boeing Co. (NYSE: BA) likely has an even larger backlog now from the recent airshow and follow-on plane orders, but with earnings in July it gave a commercial jet backlog of 5,200 commercial jets worth some $377 billion — yet the company’s total backlog in all segments was listed as $440 billion in July. This is up from $410 billion at the end of the second quarter of 2013.

General Electric Co. (NYSE: GE) has seen its stock gyrate up and down in 2014, and the company is in the process of reorganizing via the spin-off of Synchrony and the sale or divestment of its appliances unit. GE showed with earnings in July that its total backlog was $246 billion. This was up $23 billion from a year earlier. This backlog is in all the heavy equipment, industrial, infrastructure and oil and gas sectors under GE.

International Business Machines Corp. (NYSE: IBM) is always proud to report its backlog with each earnings report. While the total backlog number had not changed much, if you adjust for its divested customer care outsourcing business, its backlog was down 1% to $136 billion.

These three top companies now have a combined backlog of a whopping $822 billion, up from about $785 billion for the same companies in late 2013.

Then there are the defense companies, which also have order backlogs in civilian services and infrastructure as well.

Lockheed Martin Corp. (NYSE: LMT) represented in July that its backlog was $77.8 billion, down almost $5 billion from at the end of 2013.

General Dynamics Corp. (NYSE: GD) reported that its total backlog in July was $71.1 billion, up 27% from just the previous sequential quarter.

Northrop Grumman Corp. (NYSE: NOC) showed that its total backlog was $35.56 billion (rounded up to $35.6 billion in the chart) versus roughly $37.5 billion a year earlier.

Many other companies have a backlog well into the billions, and the following have made additional and significant backlog references during this most recent earnings season:

Fluor Corp. (NYSE: FLR) showed that its consolidated backlog at the end of the quarter was $40.3 billion, up about 9% from the $37.0 billion a year ago.

Chicago Bridge & Iron Co. (NYSE: CBI) said that its backlog was now higher at $31.5 billion, after adding $4.2 billion in orders during the second quarter.

Caterpillar Inc. (NYSE: CAT) showed that its backlog at the end of the second quarter was $19.3 billion, largely unchanged from a year earlier.

AECOM Technology Corp.‘s (NYSE: ACM) total backlog was at $8.2 billion as of Sept. 30, 2013, but grew to $20.5 billion.

National Oilwell Varco Inc. (NYSE: NOV) showed in July that its backlog for capital equipment orders in the rig technology segment was at a record level of $15.4 billion.

READ ALSO: Apple Now Worth $100 Billion More Than GE and Walmart Combined

What we would point out is that these are the same companies we evaluated in late 2013. The backlog tally then was $1.0615 trillion for the same 11 companies later in 2013, but the new backlog is over $1.13 trillion (see table below). Several other companies have discussed backlogs and unfilled orders of late as well, including the following:

Raytheon Co. (NYSE: RTN) represented backlog as $33 billion at the end of June, with a funded backlog of almost $23.6 billion.

Transocean Ltd. (NYSE: RIG) has inverted and moved its corporate domicile to Switzerland, but as of July 16, 2014, the contract backlog for continuing operations was $25.0 billion, versus $26.1 billion as of April 17, 2014.

Kinder Morgan Inc. (NYSE: KMI) is in a serious consolidation among its units. The press releases from earnings showed that its KMP unit had a total of $15.4 billion backlog at the end of June. The reality is that this number under a combined KMI basis could be vastly larger than the skimming of backlog in the press releases showed.

Cameron International Corp. (NYSE: CAM) said that its backlog at the end of the second quarter was $11.1 billion, down slightly from its historical high of $11.4 billion at the end of 2013.

Cerner Corp. (NASDAQ: CERN) showed a backlog of $9.69 billion at the quarter’s end — let’s round to $9.7 billion.

Salesforce.com Inc. (NYSE: CRM) said its deferred revenue was up 31% to $2.35 billion, while its unbilled deferred revenue was up about 32% at approximately $5.0 billion.

Babcock & Wilcox Co. (NYSE: BWC) showed a total backlog of $4.999 billion as of June 30 — let’s just say $5 billion.

READ ALSO: 10 States Where Manufacturing Still Matters

Our table below only includes companies with a backlog of $10 billion or higher.

Take This Retirement Quiz To Get Matched With An Advisor Now (Sponsored)

Are you ready for retirement? Planning for retirement can be overwhelming, that’s why it could be a good idea to speak to a fiduciary financial advisor about your goals today.

Start by taking this retirement quiz right here from SmartAsset that will match you with up to 3 financial advisors that serve your area and beyond in 5 minutes. Smart Asset is now matching over 50,000 people a month.

Click here now to get started.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.