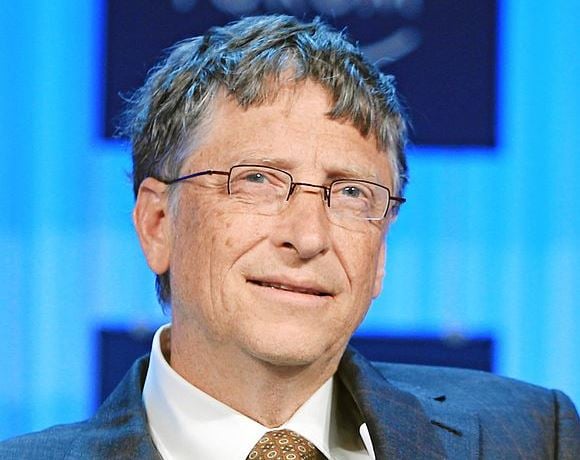

Combine the biggest IPO ever with stock indexes hitting record highs, and you had all the ingredients for one of the most exciting weeks on Wall Street this century. With almost late 1990s excitement, attention was drawn back to stocks and high-profile deals. This didn’t stop insiders from continuing to add to positions. Source: By World Economic Forum (Flickr) CC-BY-2.0, via Wikimedia Commons

Source: By World Economic Forum (Flickr) CC-BY-2.0, via Wikimedia Commons

Each and every week at 24/7 Wall St., we track insider activity so our readers have an idea of what top executives and 10% holders are doing. This week was no exception, as regular buyers returned and some executives took advantage of a price dive to load up on company stock.

Republic Services Inc. (NYSE: RSG) takes up its usual pole position in this week’s edition of insider buying. The private investment office for billionaire Microsoft founder Bill Gates, Cascade Investments, bought an additional 375,531 shares of the waste management company at $39.04 to $39.11, for a total purchase of $14.7 million. The stock was trading at $39.23 on Friday’s close.

American Assets Trust Inc. (NYSE: AAT) saw the executive chairman, who is also a 10% owner of the company, come in for a very large purchase. He bought a tidy 400,000 shares of the stock at $33.80, for a total purchase price of $13.5 million. The company owns, operates, acquires and develops retail, office, multifamily and mixed-use properties primarily in California and Hawaii. Shares closed Friday at $33.55.

READ ALSO: Insider Selling Mounts as Markets Hit All-Time Highs

China Recycling Energy (NASDAQ: CREG) saw a massive buy at the top. The CEO bought 13,829,074 shares of the stock at a price of $1.37. The total purchase came to a whopping $18.9 million, a very bullish sign. The stock was trading at $1.18 at Friday’s close.

Heartware International Inc. (NASDAQ: HTWR) saw a 10% owner of the company make a significant purchase of the shares. Adage Capital Partners bought 100,000 shares at prices ranging from $76.74 to $77.07. The total purchase came to $7.7 million. Heartware is a medical device company engaged in developing and manufacturing miniaturized implantable heart pumps or ventricular assist devices for the treatment of advanced heart failure in the United States and internationally. Shares hit an intraday high of $84.31 on Friday, so the purchase looks very well timed.

ULTA Salon, Cosmetics & Fragrance Inc. (NASDAQ: ULTA) has been absolutely on fire, but that did not stop the CEO and a director of the firm from buying company stock. They bought a combined 20,000 shares of the hot retail company at $118.90 to $119.70, for a total purchase price of $2.4 million. This was after the stock had already gapped up huge, and it is incredibly bullish for shareholders. The stock ended the week at $120.38.

Prospect Capital Corp. (NASDAQ: PSEC) is a high-yield business development company that has seen shares trade all over the place this year. A downdraft in the stock was all the CEO needed to make a large personal purchase. He bought 105,000 shares at prices between $10.10 and $10.17, for a total purchase of $1.1 million. This is the second time this year the CEO has bought stock on a big dip, and it is bullish for shareholders. Shares were trading late Friday at $10.10.

READ ALSO: 10 Stocks Trading Under $10 With Huge Upside Potential

Other top companies that saw insider buying this week included: Leidos Holdings Inc. (NASDAQ: LDOS), Miller Energy Resources Inc. (NYSE: MILL), Energy Transfer Equity L.P. (NYSE: ETE), PolyOne Corp. (NYSE: POL) and Cousins Properties Inc. (NYSE: CUZ).

Sponsored: Find a Qualified Financial Advisor

Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to 3 fiduciary financial advisors in your area in 5 minutes. Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests. If you’re ready to be matched with local advisors that can help you achieve your financial goals, get started now.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.