By David Callaway, Callaway Climate Insights

SAN FRANCISCO (Callaway Climate Insights) — The calls to world leaders have been made. The plans to introduce climate mandates across the federal government leaked. The rally in renewable energy stocks ignited. Without support from the right, it still won’t be enough.

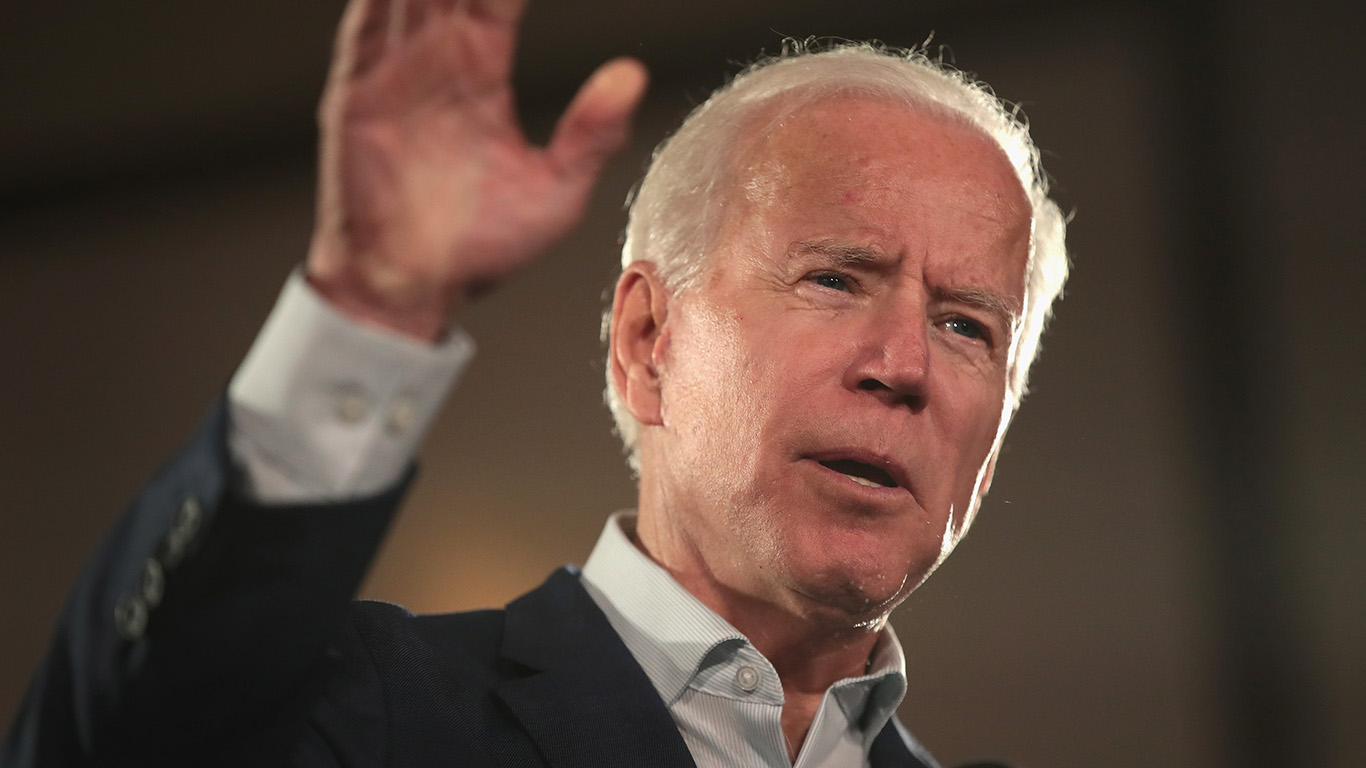

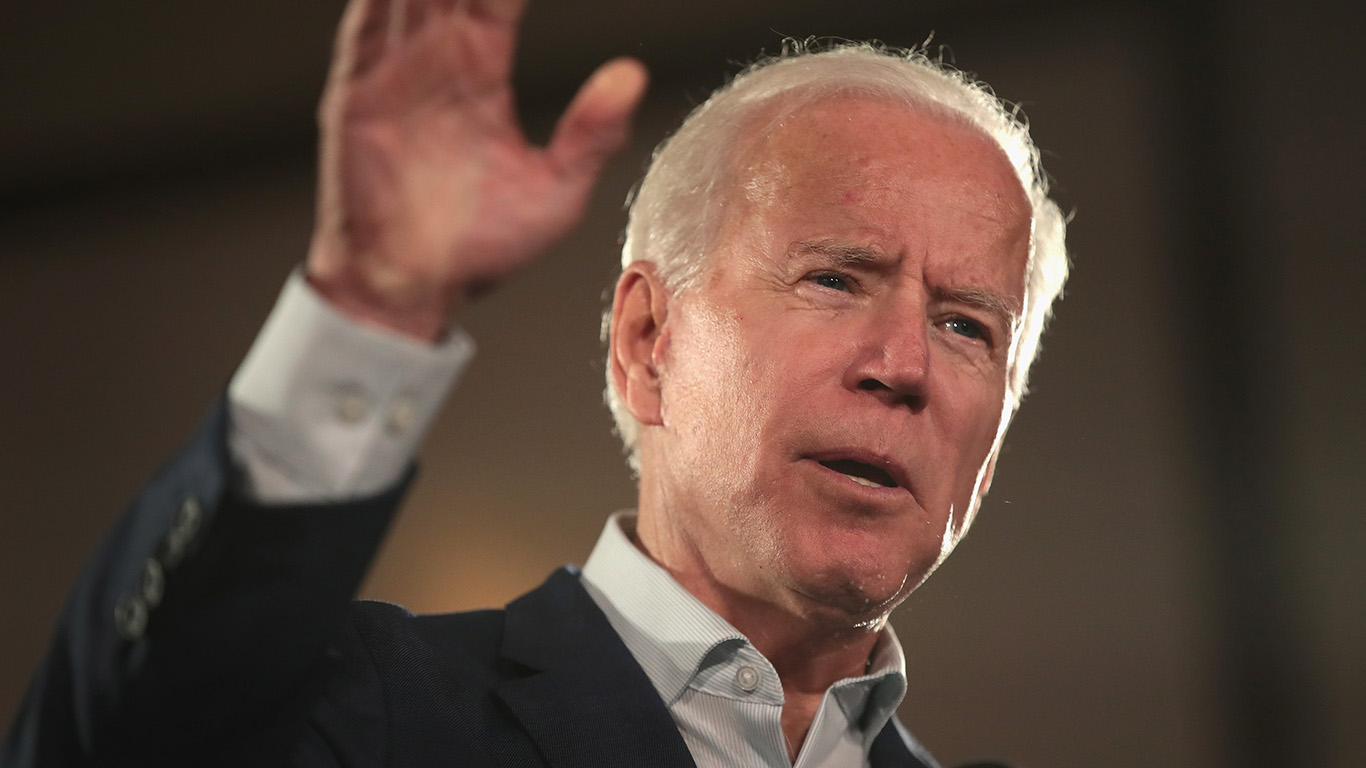

President-elect Joe Biden has a $2 trillion arsenal of regulatory, legislative and unilateral actions at his disposal to turn the U.S. climate battleship back from the edge of Trump’s global warming waterfall. The question is whether there is still time.

Global climate watchers are optimistic.

“This could be an historic tipping point: With Biden’s election China, the U.S., EU, Japan, and South Korea — two-thirds of the world economy and over 50% of global GHG emissions — would have net-zero greenhouse gas emissions by mid-century commitments,” said Bill Hare of Climate Analytics, in a statement last week.

“These commitments are very close, if not within, 1.5°C.-consistent pathways for this set of countries and for the first time ever puts the Paris Agreement’s 1.5°C. limit within striking distance.”

But just jumping back into the Paris Agreement doesn’t change anything. Under that agreement, the U.S. committed to reducing its emissions about 28% below 2005 levels by 2025 — in five years. Emissions have fallen from those levels already, but it will still be a heavy lift, even with full support.

Institutional investors and policy experts agree Biden will start overturning as many of the 70 or so Trump regulatory orders against former President Obama’s climate regulations as possible. Clean car standards, power plants, methane emissions, and oil and gas institutions all fall into this category. Stopping fossil fuel drilling on federal lands is another piece of low-hanging fruit.

Then, many expect him to expand regulations through executive order.

“My guess is that the Biden Administration will move into regulating other sources of energy; cement plants, refineries, and other classes of industrial facilities,” said Richard Revesz, director of the American Law Institute and a professor at the NYU School of Law. “The regulatory work will be done. You don’t need Congress for that.”

If the Republicans keep the Senate, however, big ticket items like a carbon tax will be harder to come by. But some think Biden’s experience in crossing the aisles and his friendship with Senate Majority Leader Mitch McConnell may make a green infrastructure play possible, especially if it is wrapped in Covid-recovery legislation.

“I think we’ll get a $1 trillion infrastructure bill out,” said Jeff Gitterman, co-founder of Gitterman Wealth Management, a fund manager with more than $530 million in assets under management, which specializes in environmental, social and governance (ESG) investments. “It will appeal to (Democratic) progressives and will be hard to fight in the Senate.”

Gitterman says enthusiasm for an infrastructure deal is part of what’s driving climate stocks higher in the week since the election, pointing out the shares of Hannon Armstrong Sustainable Infrastructure Capital (HASI), which bills itself as the first U.S. public company committed to climate change solutions.

Read David Callaway’s profile of Hannon Armstrong CEO Jeff Eckel, the public CEO driving profits from cutting carbon

HASI shares were trading above $50 Wednesday, up more than 17% since Election Day and tripling from their low in March when the pandemic hit.

Indeed, one important ally will be the Business Roundtable, a trade association of some of the largest companies in the U.S., which in September endorsed a “market-based mechanism” to help reduce greenhouse gas emissions. That’s a nod toward a cap-and-trade program, which would establish a market in emissions and reward polluters for cutting emissions. A similar proposal passed the House in 2009, but was killed off in the Senate.

This time, however, Wall Street is weighing in with support from the Federal Reserve and the Commodity Futures Trading Commission for some sort of carbon price; banks and other financial companies are falling more into line behind a pricing mechanism. Perhaps not a tax, but a price of some sort.

In the end, it might be Covid itself that helps bring the two sides together. News of progress on vaccines is encouraging, but the market rallies in the past week are also looking out to how global economies are rebuilt next year. Regulatory moves are needed and welcome, but a bitter, divided government with lawsuits flying for the next four years will limit the ability of the U.S. to hit its important targets.

While Biden is celebrated as a safe pair of hands in the White House who probably will only serve one term, from the climate perspective, his 47 years of working on Capitol Hill could position him to be the most important president of the modern age at the most critical time in our nation’s history. If he can bring both sides together.

To paraphrase Churchill, cometh the hour, cometh the man.

Free Callaway Climate Insights Newsletter

Essential Tips for Investing: Sponsored

A financial advisor can help you understand the advantages and disadvantages of investment properties. Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

Investing in real estate can diversify your portfolio. But expanding your horizons may add additional costs. If you’re an investor looking to minimize expenses, consider checking out online brokerages. They often offer low investment fees, helping you maximize your profit.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.