By David Callaway, Callaway Climate Insights

The corporate pledges are lining up for Earth Day. Cisco (CSCO), PepsiCo (PEP), Visa (V), State Street (STT). Even Taco Bell. The European Union passed its climate law to cut emissions by 55%. A new study reports more than 2,000 companies are now pricing carbon or plan to.

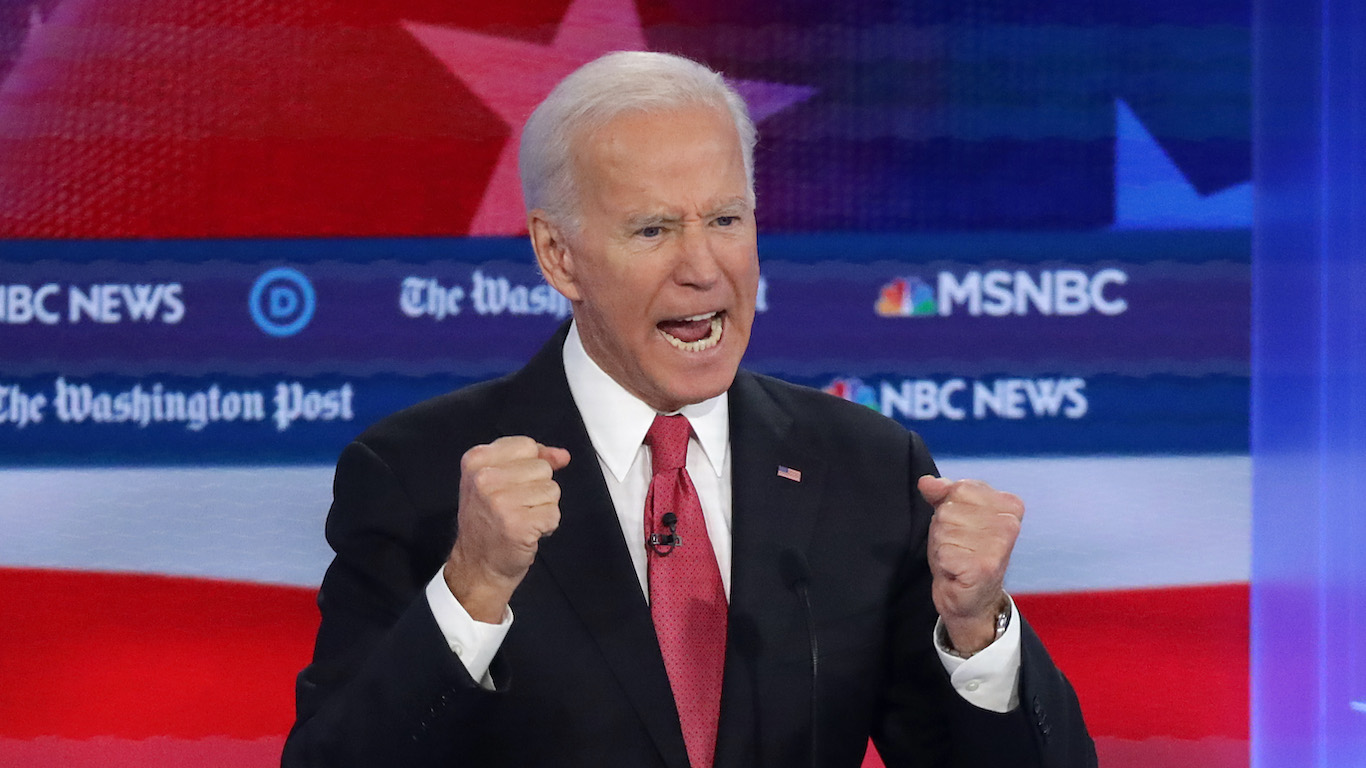

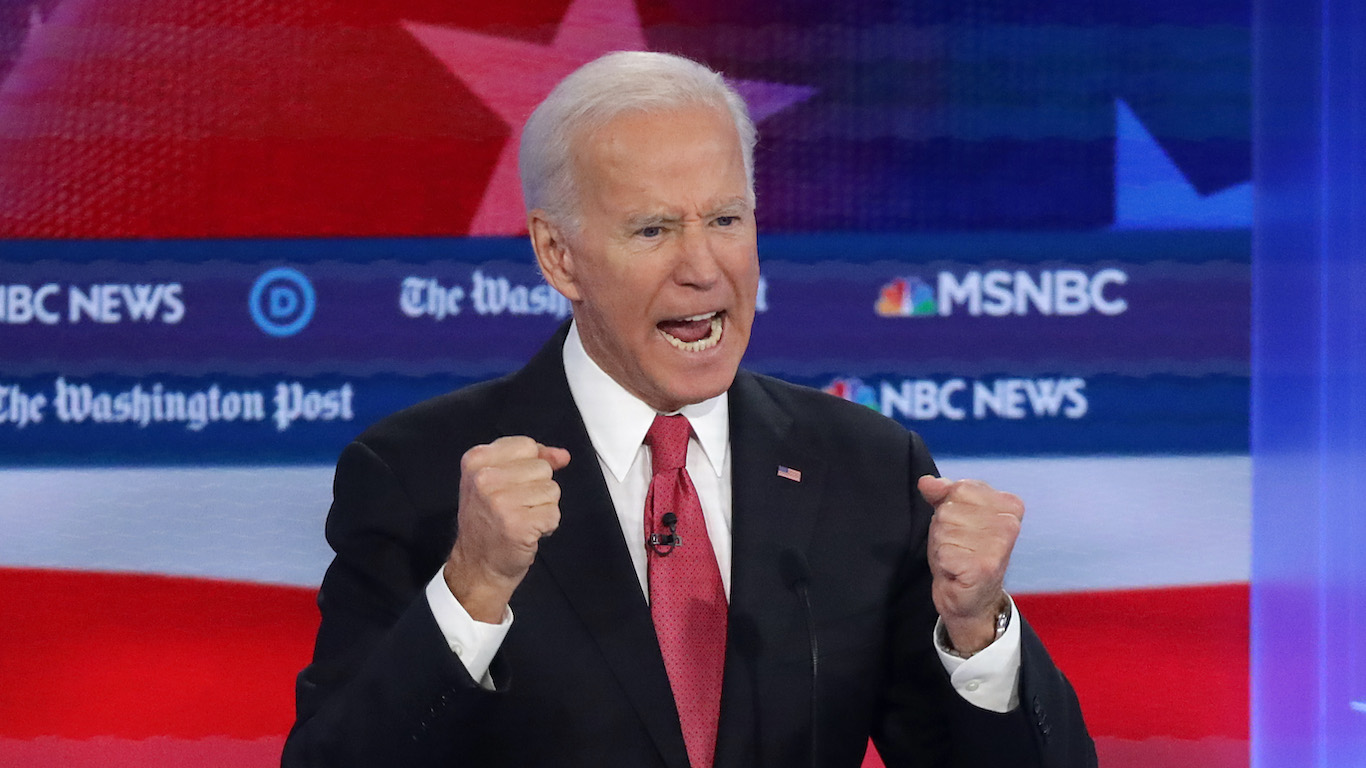

And the Biden Administration is expected to fulfill demands by progressives as well as the business community to promise to slash U.S. emissions by 50% by 2030 — less than 10 years.

Everything that can be done to manage the success of the U.S. re-entry into the global warming battle has been achieved. Even China’s Xi Jinping is on board to join Joe Biden’s 40 global leaders summit Thursday and Friday.

It’s a political gamble of the highest order. Against a backdrop of surging carbon emissions as the world emerges from the pandemic, a rebound in oil prices, and emerging protectionism in renewable technologies, the odds of the summit succeeding in kicking off six months of real action ahead of the COP26 global conference in Scotland in November are slim.

Things are almost certainly going to be worse by the time we get to Glasgow.

Yet there are a few things we will be looking for in the two-day summit this week that could surprise to the upside.

— The potential for China, Russia, or Brazil to try to one-up Biden with an unscripted climate pledge. It’s the perfect opportunity, particularly for China, to seize the reins. And test the U.S.’s willingness to move faster.

— The emergence of a corporate standard bearer beyond Bill Gates or Jeff Bezos, who could come in with a plan to help emerging markets fight global warming that might trigger an international funding wave.

— The elevation of the carbon pricing debate to the point where the U.S. can no longer ignore where the rest of the world is going.

— The appointment of a finance-industry leadership, perhaps under former Bank of England chief Mark Carney and his new Glasgow Financial Alliance for Net Zero, which would rapidly bring global banks into a uniform herd, and speed the fossil fuel transition and corporate disclosures.

— A show-stealing performance from the leader of a smaller country who can ignite a new wave of climate understanding in her or his region and around the world.

Or it can be a virtual talkfest, with missing invitees, technical difficulties and speeches so long and boring that we’ll all be searching for the snooze button. Give Biden credit for risking so much political capital so early in his term, though. While the upside may be limited, the downside is unthinkable.

More insights below. . . .

Clean energy industry readies for Biden emissions pledge

. . . . President Biden’s ambitious targets for cutting greenhouse gas emissions by 50% are just the beginning, as far as Heather Zichal, CEO of the newly formed American Clean Power Association (ACP), is concerned. The head of the trade group, which represents the entire renewable energy sphere in the U.S., tells George Barker in Boston that the key will be the funding and the tools the administration can push through Congress to reach these stretch goals, which many doubt.

“I think they view their plans as the things they are going to use in the international community to defend this new more ambitious target,” said Zichal. . . .

We have a deal on the Climate Law!

5:05am pic.twitter.com/jGt4QWFTTW

— Frans Timmermans (@TimmermansEU) April 21, 2021

EU Climate Chief Frans Timmermans tweeted this morning, “This is a landmark moment for the EU and a strong signal to the world: Our commitment to #ClimateNeutralEU will guide our policies the next 30 years. And positive news to share before #EarthDay. This is a good day for people and planet.”

Wednesday’s subscriber insights: What we’re following for members

. . . . Clean energy jobs in the U.S. are growing again now that the country is emerging from the Covid pandemic, but future growth depends on the messy political business of approving legislation and more subsidies. The offshore wind industry may be a blueprint. Read more here. . . .

. . . . Both the European Union and the U.S. have plans to slash greenhouse gas emissions by 50% or more in coming years, but they intend to deploy them in completely different ways. Place your bets. Read more here. . . .

. . . . Climate czar John Kerry weighed into the dirty shipping emissions waters this week, pledging new tools and policies for cleaning up a business that produces about 3% of the earth’s CO₂. The debate now is whether the answer is methanol or carbon? Read more here. . . .

. . . . And finally, a shoutout to Bloomberg Green for this awesome heat map of London’s climate change challenge from the ground up, showing where the city is succeeding and failing at saving power. Must see!

Data driven: 28 years, 253 days, 9 hours

28 years, 253 days, 9 hours = Time left until the estimated collapse of Earth’s support systems

. . . . Hot, crowded, and running out of fuel is basically how the Organization for Economic Co-operation and Development (OECD) describes the world by 2050. The world will require about 80% more energy and most of this will be generated by burning more fossil fuels — especially coal, according to The World Counts. The non-profit research group notes that without major changes, global warming will continue and temperatures will rise as much as 6°C. (about 10.8°F.) by the end of the century, according to the OECD. Also, air pollution will become the primary cause of premature death. . . .

Free Callaway Climate Insights Newsletter

Take This Retirement Quiz To Get Matched With A Financial Advisor (Sponsored)

Take the quiz below to get matched with a financial advisor today.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

Here’s how it works:

1. Answer SmartAsset advisor match quiz

2. Review your pre-screened matches at your leisure. Check out the

advisors’ profiles.

3. Speak with advisors at no cost to you. Have an introductory call on the phone or introduction in person and choose whom to work with in the future

Take the retirement quiz right here.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.