Emerging markets have spent years in the shadow of U.S. large caps, but the tide turned in 2025. The iShares Emerging Markets Dividend ETF (NYSEARCA:DVYE) combines dividend income with capital appreciation potential, and BlackRock’s 2026 equity outlook suggests emerging markets may have more room to run, citing “promising prospects” in regions beyond the AI-driven U.S. market.

The Dividend-Focused Emerging Markets Play

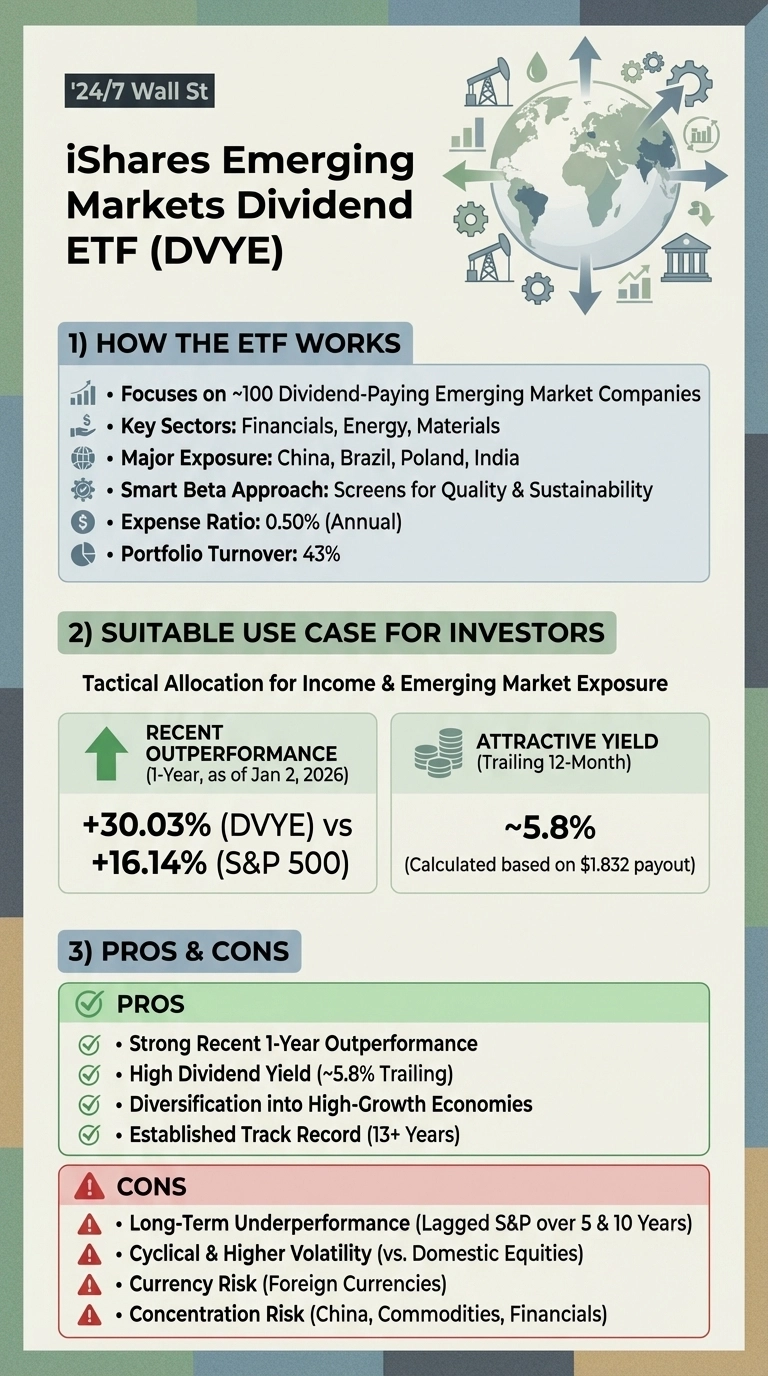

DVYE targets 100 dividend-paying companies across emerging markets, with heavy exposure to financials, energy, and materials in countries like China, Brazil, Poland, and India. The fund’s return engine operates on two cylinders: dividend income from established companies in developing economies, and capital appreciation when those markets outperform. The current dividend yield sits around 5.8%, reflecting the fund’s focus on income generation alongside growth potential.

This isn’t a passive broad market fund. DVYE uses a smart beta approach, screening for dividend sustainability and company quality rather than buying everything in sight. The 0.50% expense ratio reflects that active selection process, and the portfolio turns over at 43% annually as holdings are adjusted.

Performance Meets Income, But Timing Matters

The fund has delivered on its dual mandate during favorable periods. Recent performance has shown strength, with substantial dividend payments providing consistent income. But zoom out to longer time horizons and the picture reveals cyclicality. Emerging markets are cyclical, and DVYE’s performance follows the broader patterns of developing market equities.

That cyclicality is the core tradeoff. You accept higher volatility, currency risk, and concentrated exposure to commodity-sensitive sectors in exchange for periods of outperformance and above-average income. The fund’s top holdings include Vale (NYSE:VALE) (Brazilian mining), ORLEN (NYSE:PKN) (Polish energy), and China Construction Bank. When commodities rally and emerging market currencies strengthen, DVYE thrives. When the dollar surges and global growth slows, it suffers.

Who Should Avoid This Fund

Investors seeking stable, predictable returns should look elsewhere. DVYE has experienced significant volatility during market downturns, demonstrating the downside of emerging market concentration. Retirees who need reliable income without significant principal volatility would find the fund’s price swings uncomfortable, even with the dividend cushion.

Investors who want pure emerging markets exposure without the dividend tilt may prefer broader alternatives. DVYE’s focus on dividend payers skews the portfolio toward older economy sectors like financials and energy, missing some technology and consumer growth stories in markets like India and Southeast Asia.

Consider IEMG for Lower Costs and Broader Exposure

The iShares Core MSCI Emerging Markets ETF (NYSEARCA:IEMG) offers a compelling alternative with a 0.07% expense ratio, about one-seventh the cost of DVYE. IEMG’s 2.8% dividend yield is roughly half of DVYE’s current payout, but it provides broader sector exposure. With $117 billion in assets compared to DVYE’s $1 billion, IEMG provides significantly better liquidity and tighter bid-ask spreads. The tradeoff is less income and broader sector exposure that includes more growth-oriented companies alongside dividend payers.

DVYE works best as a tactical allocation for investors who believe emerging markets will continue outperforming and want to maximize income, but the concentration risk and expense ratio demand careful position sizing.