The Strive 500 ETF (NYSEARCA:STRV) has delivered 12.6% returns over the past year, outpacing the SPDR S&P 500 ETF Trust (NYSEARCA:SPY), which gained 11.8% over the same period. This outperformance demonstrates how the fund’s low-cost structure and strategic positioning have captured the market’s growth trajectory, with the fund nearly doubling in value since its September 2022 launch.

Recent performance has been choppy, with the fund down 1.6% over the past month, mirroring broader market softness. This volatility reflects the fund’s concentration in technology stocks, which tend to experience sharper swings during periods of market uncertainty.

STRV positions itself as an ultra-low-cost alternative with a 0.05% expense ratio and $1 billion in assets. Beyond cost efficiency, the fund’s activist shareholder engagement approach creates a differentiated value proposition that sets it apart from passive index clones.

The Rate Environment Matters Most

Long-term interest rates will determine whether STRV’s technology-heavy portfolio continues compounding or faces valuation pressure. The 10-year Treasury yield currently sits at 4.09%, down from 4.29% just two weeks ago. This decline supports higher equity valuations because lower discount rates make future earnings more valuable in present-value terms, particularly benefiting the growth-oriented companies that dominate STRV’s holdings.

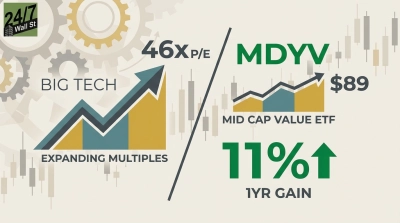

STRV behaves more like a growth fund than a balanced tracker, with information technology representing 32.9% of the portfolio. The concentration in mega-cap names like NVIDIA Corp (NASDAQ:NVDA | NVDA Price Prediction), Apple Inc (NASDAQ:AAPL), and Microsoft Corp (NASDAQ:MSFT)—which together account for 19.3% of assets—creates a performance profile that amplifies market movements compared to more evenly weighted alternatives.

When rates fall, these mega-cap tech names benefit from cheaper borrowing costs and improved relative value versus fixed income alternatives. Investors should monitor the Federal Reserve’s quarterly Summary of Economic Projections and monthly FOMC statements for signals about the pace of rate cuts. If the 10-year yield continues drifting toward the 3.97% low reached in October 2025, STRV’s tech concentration becomes a tailwind rather than a risk.

Concentration Risk in the Magnificent Seven

STRV’s fate hinges on whether its largest holdings can sustain premium valuations. The portfolio includes meaningful exposure to Amazon.com Inc (NASDAQ:AMZN), Alphabet Inc (NASDAQ:GOOGL), and Meta Platforms Inc (NASDAQ:META), creating a portfolio where roughly one-third of assets depend on the continued dominance of a handful of technology companies that have driven market returns but also introduce correlated downside risk if sentiment shifts.

The fund’s 2% annual portfolio turnover means STRV operates as a buy-and-hold vehicle with minimal rebalancing, reducing trading costs and tax drag during bull markets while maintaining consistent exposure to its core holdings. Investors should review quarterly holdings reports to track whether concentration risk is expanding or contracting relative to the broader S&P 500.

The rate environment and mega-cap tech performance will determine whether STRV continues outpacing traditional index funds over the next year.