Media

Is the Social Media Backlash Taking Hold? Facebook, LinkedIn, Twitter Have to Care

Published:

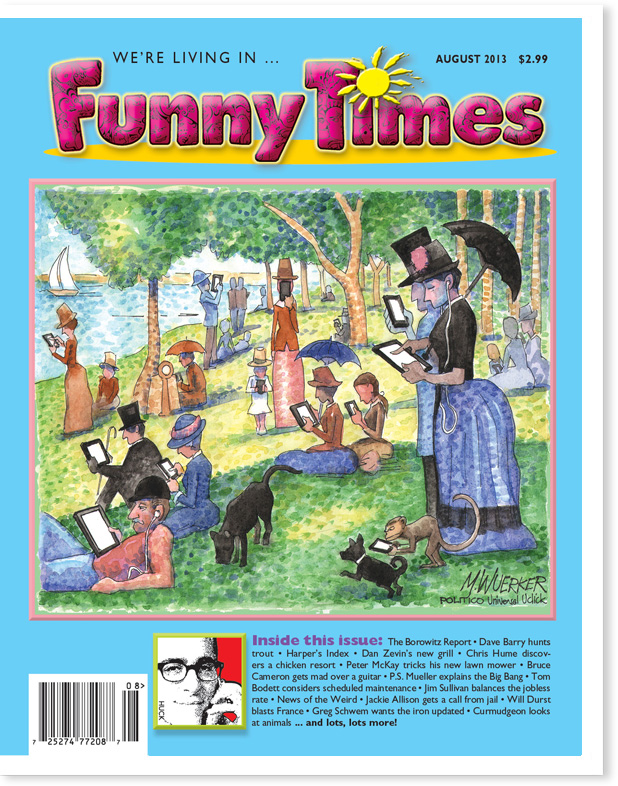

Social media is not dead, but the problems that many social media users have experienced may be starting to drive out the fringe users. This could spell big trouble for some of the growth rates for companies like Facebook Inc. (NASDAQ: FB) and LinkedIn Corp. (NYSE: LNKD), and even for the upcoming Twitter initial public offering (IPO). Source: FunnyTimes.com

Source: FunnyTimes.com

Before you panic, keep in mind that these companies are all expected to double their revenues in the coming years. A recent report Wall Street analyst from Cantor Fitzgerald even had these leaders as still being the leaders of the Internet media sector in the years ahead.

Facebook Inc. (NASDAQ: FB) has grown up beyond the woes of its disastrous 2012 IPO. The problem is that so many things have changed in its operating and functionality, and at the same time more and more people are becoming concerned about aspects of their privacy.

On Monday, Bloomberg ran a video showing reasons that users are quitting Facebook, with privacy concerns being a serious issue. Another trend seen was males more as quitters, and in their young 30s. Some cited it as a waste of time, as well as having too many annoying friends. It may be true that no one really cares what your hamburger looked like at lunch and again at dinner.

LinkedIn Corp. (NYSE: LNKD) is the social networking outfit for professionals. Unfortunately, it also is used as a “professional endless update” tool by many LinkedIn users. Did you notice that LinkedIn recently raised $1 billion? Did you also notice that LinkedIn recently started directing its efforts to younger users who may aspire to become professionals?

Also, a recent lawsuit was filed against LinkedIn by customers claiming that it may have hacked into external email accounts to access the email contact lists. One personal complaint about LinkedIn is that when going in to accept invitations, the default is set to more easily accept rather than for you to personally screen and accept people on your own.

Twitter has filed its paperwork to come public. It has hired a chief revenue officer, and it now is reportedly seeking a credit line that would be for up to $1 billion ahead of that IPO. Twitter is a truly phenomenal service, but there is just one problem. Twitter actually may hurt the traditional media outlets more than it helps them.

To commit to writing endlessly about topics in 140 characters or less does truly make an audience more informed and gives them faster and better access to a topic around breaking news. Sadly, that may hurt revenues from big media houses that actually create much of the content. If you can read 10 little blurbs without ads and without the “yada-yada” filler, how do the big traditional media houses get to make money?

The reality is that social media does have flaws. Social media also has changed how and when people communicate and how and when they consume media. We would not predict that social is dying by any stretch of the imagination. Thomson Reuters predicts that LinkedIn’s sales of $972 million in 2012 will be above $2.1 billion in 2014, and also that Facebook’s almost $5.1 billion in 2012 sales will be $9.7 billion in 2014. These are massive growth rates, even if some blips and trends may be starting to surface.

And to close with a joke, and in some people’s cases a truth, about social media:

MySpace was where you talked about what you would do when you grew up. LinkedIn helped you get your first big job. Your comments and actions on Facebook was how you lost your job.

A financial advisor can help you understand the advantages and disadvantages of investment properties. Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

Investing in real estate can diversify your portfolio. But expanding your horizons may add additional costs. If you’re an investor looking to minimize expenses, consider checking out online brokerages. They often offer low investment fees, helping you maximize your profit.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.